Discombobulation has a meaning that sounds like the word’s pronunciation: volatility and unpredictability. Every decade brings surprises, good and bad, but discombobulating ones are more rare - being the 1910s, 1930s, 1940s and 1970s in the last century.

In the early part of one of those decades, the 1970s, a one-time US Vice-President said at the midst of his problems and an investigation by the District Attorney, ‘if you’re not schizophrenic these days, then you’re just not thinking clearly’. This statement could be used again as an excuse these days by a lot of aberrant leaders.

That was half a century ago, but the 1970s were the last truly discombobulating decade. The United States were defeated in Vietnam and their president, Richard Nixon, was impeached and subsequently resigned. Australia elected a Labor government for the first time in 23 years which was controversially, some would say unlawfully, sacked by John Kerr our then Governor General in 1975. A huge stock market crash occurred in the late seventies. We had runaway inflation that took decades to bring under control and unprecedented oil price rises. These were some of the standout events that punctuated the decade.

We are just into the 2020s, but it already looks like another volatile decade with issues such as:

- a pandemic

- warmongering (Russia into Ukraine, and others thinking of equivalent incursions)

- fascist dictators-cum-kleptocrats by the handfuls

- democracy now falling to less than half the world’s eight billion citizens

- a stock market correction, perhaps ‘crash’, in some countries

- rising inflation and interest rates, off a very low base

- scary climate changes with inadequate responses by too many nations, and

- the rise of populism based on fiction and lies instead of rationality.

And they are only the ones we know about. What else lies in store?

We all want to know what trends are taking place. Firstly, on a positive note, it is more than likely that Australians will be better off, with longer lives, better health and higher household incomes by the end of this decade. That’s been true for each decade for well over a century.

But change is constant, and we humans have been in an exponential rate of change since the Industrial Revolution started in the 1760s in the United Kingdom. Since that time we've seen rapid population growth, technological change, economic output and socio-political ideologies and protocols.

Australia has gone along with these changes, some of which it created. So, short summaries of some of these key changes, hopefully create a picture of our emerging world.

Jobs

With a quarter of the year behind us, we are back to ‘full employment’ (being under 5% unemployed) and the total hours of work by all 13.4 million employed, has finally overtaken the December 2019 level.

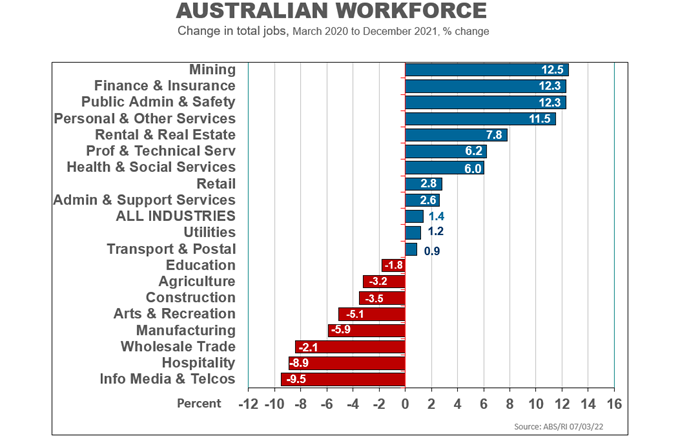

The following chart shows the disproportionate impacts on the nation’s 19 industry divisions over nearly two years, using the seasonally adjusted change in total jobs. Some growing very fast, but many of our industries have some way to go to restore their equanimity.

One trend before the pandemic, was the gradual increase of working from home. In early 2020, around 30% of our 13 million workforce was working part-time or full-time from home. This jumped to 69% at a peak during the pandemic, but is now down to 45% (25% FT and 20% PT). It may settle nearer to 35% before resuming its long-term trend growth upwards, particularly the part-time trend.

So, working from home was already a pre-existing trend, as said, aided by technology and boosted with the advent of the Digital Era in 2007, and will continue as one of the important changes in this decade.

Technology

Technology and innovation played a transforming role in the Agrarian Age, mainly with transport.

But technology has played a bigger, if sometimes subliminal role in our lives since the birth of the Industrial Revolution in that age of goods-dominance in the economy. Then, a ubiquitous new utility emerged in the form of power that came in two eras. The first era was waterwheel, wind, and steam power; and the second era came in the form of electricity. We can also add telegraphy to those power changes.

This phenomenon of a new utility for a new age is yet again a vital feature of the current Infotronics Age of service industries growth over more than five decades since the mid-1960s with its new information communication and technology (ICT) utility. It too has come in two eras. The first was computers and software; and the second era - since 2007 – came with the advent of the digital era of fast broadband, artificial intelligence, big-data and analytics.

In the 2020s, this new utility is changing our living, working and leisure patterns at a fast and often seemingly giddy pace.

In some cases, the impact of this new utility on Australia’s economic growth has been more disruptive than growth generating. Evidenced by our continued slide in GDP growth over the past 5-6 decades, from 5-6% per annum to 2.25% per annum in the 2020s. We are seeing - since the 2007 stage two of the ICT utility - traditional industries using hi-tech and other success factors to make a break from the old methods. This is especially true in the United States, where some visible or spectacular examples can be seen in the following:

- Tesla is a car manufacturer, creating a new third lifecycle with batteries instead of ICE, using robots, and dispensing with dealer networks, service outlets and petrol stations;

- Amazon is a huge global online department store and bookseller;

- Alibaba is also an online department store;

- Alphabet (mainly Google) is a new generation online encyclopedia;

- Spotify and Netflix are online music stores and cinemas, termed streaming;

- Apple iconized and miniaturized computers and took telephones to online multi-dimensional devices; and

- Uber and Uber Eats are new-generation taxi operators and express couriers.

So hi-tech is not a new industry, it’s a must-use utility to be incorporated in all industries. And there are more than 500 classes of industry in the United States and Australia, over and above the examples cited, that will transition or metamorphose over time to a greater or lesser extent. This is part of the discombobulation of the 2020s.

And of course, the Digital Era technology is having transformational impacts on our working protocols and lives as we will return to shortly.

Households and lifestyles

Like all developed economies, spending on goods in Australia has shrunk from the majority of spending (62%) when we federated in 1901, to around 21% at the outbreak of COVID-19 in early 2020.

However, the pandemic saw a temporary reversal of this trend as households spent more money on home durables – especially electrical and electronic goods – as they made their enforced incarceration more communicable, entertaining and livable. Home delivered fast foods boomed, as restaurants were closed.

Entertainment and hospitality shrank, transport shrank both domestically and (especially) internationally, and savings ballooned as there was far less opportunity to spend incomes.

In 2021, we then saw the biggest rise in housing prices - over 20% – supported by record-low nominal mortgage interest rates.

Of course, our transport and communication activities have been through an astonishing transformation via teleconferencing (Zoom, Teams etc.) and social media (Facebook, TikTok et al). But online shopping for both goods and services has been equally spectacular and contributed to the decimation of high street retailing, and the topping-out of the growth of shopping-centers.

All in all, profound changes in spending and lifestyles. And by the middle of this decade, most of the pre-pandemic changes - favouring spending on services, will resume - especially travel and hospitality, curtailed so heavily as they have been during the pandemic.

Finance and stock markets

Where to invest is an important challenge right now. For businesses, the answer is easy: on intellectual property (IP) and digitization (fast broadband, data, AI and analytics), not hard assets; these should be leased.

For households, it is a case of playing safe through the first half of this decade with shares, property and interest rates all gyrating if not collapsing in the case of shares and homes. Superannuation is probably the safest, having - as it does - a mixed portfolio of shares, property, infrastructure, and interest-earning assets.

It is worth touching briefly on international shares as they now form a major part of the shares segment in superfunds with local shares now being a minority, due to under-performance compared with our American and European cousins, and the sheer size of superfunds (over $3 trillion) with limited availability of local equity stocks.

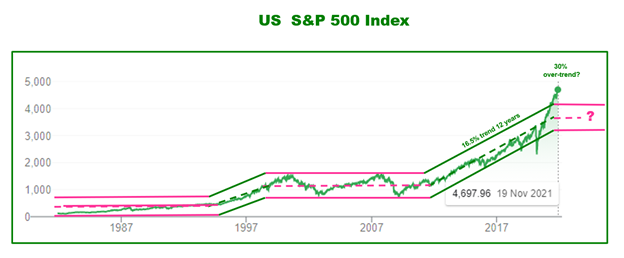

The two charts below show the impact of the internet, then the Digital Era that underpinned the rise in Indexes such as the S&P 500, and new innovative stocks such as Alphabet, in creating upward share price trends in the United States.

Corrections if not crashes will occur in both indexes and stocks, but good new-age stocks will recover.

Politics

We will finish this insight with a brief look at politics.

Unlike the Industrial Age when major parties who stuck resolutely to one or the other ideology, the parties in our new age have not been so committed. The Labor party has had stints of rationality and reform as well as emotionalism and populism. Ditto the Coalition of the Liberal and National parties.

The inadequacy of the major parties has enabled splinter and minority special-interest parties to increase their power since the 1980s, and they now have veto power in the undemocratically elected upper house (the Senate). They are generally more ‘emotionalist’ than ‘rationalist’ and are making it harder to effect overdue reforms.

Sadly, populism has been the winning ideology in the social, political and media arenas for some 15 years - and well and truly through the pandemic and into 2022 - with negligible reforms, very little long-term vision, and old-style cronyism at the expense of talent. As a human race, we live with both ideologies, but need more rationality than emotionality to progress our standard of living.

Hopefully the balance will favour more rationality by the end of this decade. But as said, expect it to be a turbulent and discombobulated decade indeed.

Phil Ruthven AO is Founder of the Ruthven Institute and Founder of IBISWorld. The Ruthven Institute was created to help any business that wants to emulate world best performance and profitability using the Golden Rules of Success, based on over 45 years of corporate and industry analyses and strategy work.