Megatrends are long-term structural changes that affect the world we live in. Importantly, they shape communities, but they also create investment opportunities and risks.

What we have learned from historical megatrends is:

1) they often solve a problem through innovation;

2) the scope of the megatrend can initially be underestimated;

3) the duration of a megatrend is typically longer than anticipated

There are numerous megatrends likely to influence markets that investors should consider: the shift to the cloud and generative AI, the ageing population, rising geopolitical tensions and so on. Today we highlight just some of the megatrends we are monitoring.

The continued growth in 'winners take all' dynamics

A megatrend that continues to play out is growth in “winner take all” or at least “winner takes most” dynamics in the global economy. Reduced cross-border frictions, the growth in digital goods and distribution channels, and the increasing importance of scale and network effects have allowed companies to scale to a size almost unimaginable in the past.

The rise of the so-called 'magnificent seven', the group of leading US technology companies, is a good example of these forces playing out. This group now accounts for a higher share of global markets than the leading companies of the tech bubble era of the early 2000s. However, unlike that time, their size today has predominantly been fuelled by enormous growth in revenues and profitability, albeit some speculative elements may have played a part more recently.

A key risk for some of these businesses is antitrust. Microsoft, Apple and Alphabet have recently attracted the attention of the antitrust authorities, with increased competition the primary motive. We see a low probability that regulators break-up these businesses meaning the underlying economic forces will continue to allow successful businesses to scale far more quickly and to far larger sizes than historically was the case. This presents a significant opportunity for global investors, as these companies can deliver outsized returns. On the other hand, these trends also increase disruption risks to legacy businesses and industries.

To benefit from the former and guard against the latter, investors should focus on quality companies that have strong and enduring competitive advantages. These advantages typically include scale, pricing power, brand strength, network effects, and intellectual property.

GLP-1s and solving obesity

One of the biggest health issues facing developed countries is obesity. The development of the GLP-1 class of weight loss drugs such as Ozempic promises to transform the treatment of obesity and significantly improve health outcomes for societies. GLP-1s stimulate the brain to reduce hunger and act on the stomach to delay emptying, so you feel fuller for longer, have a lower calorie intake and lose weight.

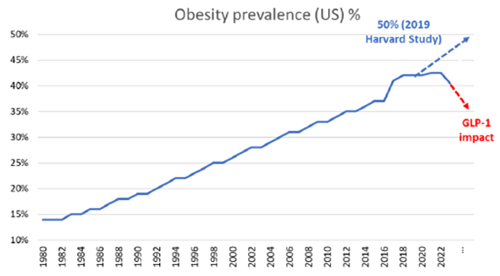

Take-up is likely to be strong over coming years as supply constraints ease and continued innovation delivers a more convenient oral pill and mitigates potential side effects such as nausea. Growing clinical evidence of health benefits, such as lower risk of heart problems, will also encourage governments and insurers to cover the cost of the drugs. These developments have dramatically changed the outlook for obesity, with the US recording its first fall in obesity rates since at least the 1970s, a dramatic turnaround from predictions of just a few years ago.

Source: CDC, OECD, WHO, IHME, Harvard

The development also has some significant investment implications. Most obvious are the potential investment opportunities in the drug manufacturers, although given high expectations we need to carefully monitor scientific developments and the pricing environment. There are also several investment risks to consider, with the potential for lower demand for certain medical device companies, food manufacturers and quick service restaurants.

The unrelenting rise in sovereign debt

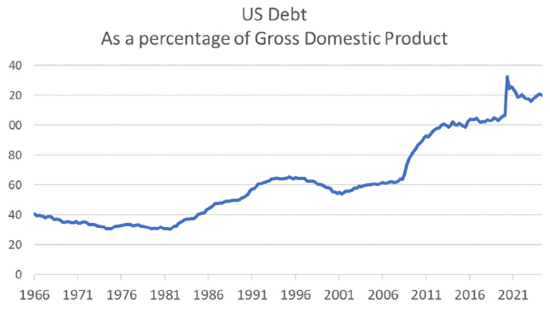

Not all megatrends are positive for investors; one megatrend to be wary of is rising sovereign debt. In many parts of the world fiscal responsibility is no longer a priority as governments focus on more immediate issues and winning elections. In the US, the national debt has been rising since the 1980s. In 2010, following the government’s response to the Global Financial Crisis, it first exceeded 90% as a percentage of GDP – the level identified by academics Reinhart and Rogoff as associated with a worsening in growth outcomes. A further spending binge during the 2020 covid pandemic has resulted in the US national debt rising to more than 120% of GDP.

Source: Federal Reserve Economic Data

With the US Federal budget deficit expected to hit $1.8 trillion in 2024 and the new President promising billions more in spending, debt is likely to continue to build. US national debt has not been a major issue for markets to date, but the risk of a debt crisis, accompanied by rising bond yields and volatile markets, increases as debt levels continue to rise. Many other countries are in a similar position, with debt to GDP exceeding 100% in the UK, France, Spain, Italy and Japan. Australia is relatively well placed with the national debt at 38% of GDP.

What does this mean for investors? Governments have three ways to “solve” excessive national debt: (1) austerity – cutting spending and raising taxes; (2) default; or (3) financial repression – printing money to inflate the problem away. The first is politically unpalatable and appears unlikely, the second would be an outright disaster and can be avoided by countries that issue debt in their own currency such as the US. Thus, the most likely outcome is money printing, or central bank financing of budget deficits in more technical terms, resulting in a period of structurally higher inflation.

While it’s impossible to be precise in terms of the timing of a potential debt crisis, investors can seek to protect themselves by investing in real assets, such as property and equities, with a focus on high-quality companies with pricing power that can protect investors in times of high inflation.

These are just a few of the megatrends shaping markets today and in the future. As investors, a long-term focus and active management are key to both taking advantage of the opportunities these trends provide and avoiding risks that may arise.

Alan Pullen is a Portfolio Manager and Elisa Di Marco is an Investment Director and Portfolio Manager at Magellan Group, a sponsor of Firstlinks. This article has been issued by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 (‘Magellan’) and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs.

For more articles and papers from Magellan, please click here.