The immense value of the age pension is often underappreciated when markets are strong, but its worth is never greater than in a crisis.

The government age pension can potentially offset a one-third decline in the value of a wealthy retired couple's investment portfolio, according to our analysis. This revelation will provide some much-needed comfort to investors as the COVID-19 pandemic creates widespread job losses and wipes billions of dollars from retirement balances.

How the age pension makes a difference: a practical example

Theo and Sue are a hypothetical 65-year-old couple who own their home and have $1 million in pension assets.

Their comfortable position means they initially aren’t eligible for the age pension. However, they may well become eligible in future as they draw income from their investments. This can provide them with enormous additional value.

Milliman has modelled thousands of future scenarios for the couple, which demonstrates that the potential future age pension payments they might receive over the next 25 years have a median value of about $180,000 over the course of their retirement.

If Theo and Sue’s assets fall by 30% in a major shock to the market, the value of the age pension increases even more. This is because they are more likely to receive larger age pension payments, as well as benefiting from receiving them earlier into their retirement.

In fact, the median value of their age pension more than doubles, rising to approximately $500,000, essentially offsetting the entire fall in their retirement savings.

(The current level of a full age pension is $37,000 a year or $1,423 a fortnight including supplements for a couple).

What it means for different people

Wealthier retirees often receive the largest financial buffer from the age pension as their private savings decrease, even where they consider themselves to be self-funded retirees.

That’s because retirees with lower retirement savings already receive a full age pension. Those people, most of whom don’t receive financial advice, benefit far less as there is no more age pension to receive either now or in the future.

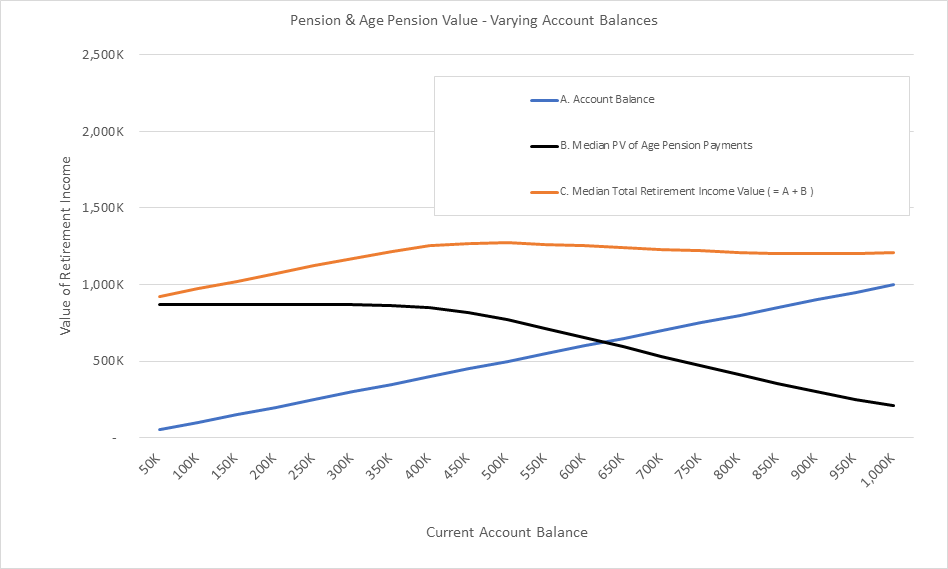

This is demonstrated in the following graph, which shows how the median value of future age pension amounts (the black line) can combine with the value of their private superannuation savings (blue line) to protect the value of their total retirement income (orange line) as retirement savings fall.

As eligibility for the full age pension becomes more likely at around a $400,000 pension balance, the value of future age pension payments levels off, leaving these individuals' retirement incomes more exposed to further market falls.

Source: Milliman analysis

Financial advice in turbulent times

The emotional impact on retirees of seeing huge falls in the value of their retirement savings needs to be appreciated, along with the behavioural biases that come to the fore at times like these. The pain felt by many retirees has been proven to be much greater than that experienced by younger people.

In the current environment of falling investment values, understanding the role of the age pension as part of their retirement plan can provide welcome reassurance.

These complexities underline the value of ongoing advice and analysis to assist retirees in navigating turbulent and volatile environments. Advisers can help retirees better manage this issue in the current climate, by implementing portfolios that provide explicit protection against current and future market falls.

Key assumptions and methodology

Analysis is modelled using the Milliman GBA Platform to model 1,000 random future scenarios. Analysis assumes a couple, both aged 65-years-old who own their own home. The couple’s assets are all invested in a 70/30 Growth/Defensive asset mix within an account-based pension, with no further sources of income or assets (for age pension means-test purposes).

The couple draw down the usual minimum required income each year from their pension account (not the temporary COVID levels). All income (including age pension) is assumed to be spent, with no reinvestment of future income.

Future age pension payments are valued by means testing to determine payment amounts in each modelled scenario, then discounting those payments to today’s dollars using modelled wage inflation in each scenario. Future age pension amounts assume payment rates and thresholds (indexed in line with AWOTE) as at 20 March 2020 with deeming rates based on the announced deeming rates effective from 1 May 2020.

The analysis runs 1,000 stochastic simulations through to age 90 (i.e. over 25 years), assuming both of the couple survive to this time.

Economic models use Milliman’s standard Australian Stochastic ESG calibration and setup as at 31 December 2019. This setup is intended to be used to model the long-term dynamics of a wide range of economic variables, including asset returns, income, inflation and interest rates, and is updated quarterly as part of Milliman’s GBA Platform modelling services.

Wade Matterson is a Principal, Senior Consultant, and leader of Milliman’s Australian Financial Risk Management practice and a fellow of the Institute of Actuaries of Australia. This article is general advice only as it does not take into account the objectives, financial situation or needs of any particular person.