The Mark Twain quotation that "The report of my death has been grossly exaggerated" has become embellished over many years, but let's run with it as an analogy for SMSFs. The headlines react to small variations in SMSF establishments, only for the sector to recover the next year.

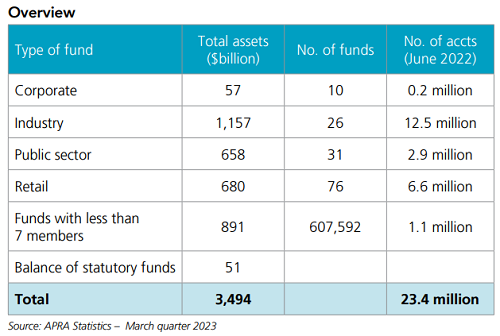

Superannuation in Australia is a multi-trillion-dollar arms race. Not only has the total amount in super reached $3.5 trillion, but each year, new contributions are over $150 billion into large super funds. While over time, withdrawals will increase as more people reach pension age, the two big winners in recent years are industry funds, now at $1.1 trillion, and SMSFs, at $891 billion. Both have overwhelmed retail funds. SMSFs are called 'Funds with less than 7 members' in the ASFA table below.

While recent headlines suggest SMSFs are declining in importance, in the March 2023 quarter alone, net rollovers from large funds into SMSFs were $1.2 billion, suggesting many people still want the control and flexibility that personal funds deliver, even transferring money from industry funds.

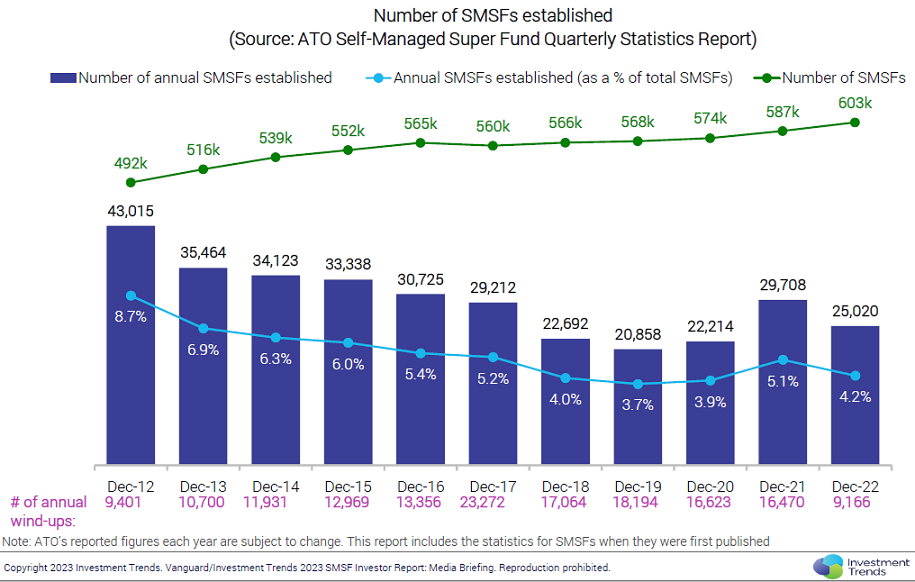

As recently as February 2023, The Australian Financial Review reported the expected ‘plunge’ in SMSF accounts, and how brokers were seeing the number of SMSF accounts ‘plummet’. It was argued that SMSF establishments were brought forward in 2020 and 2021 as new investors engaged with their own investments during the pandemic, but this boost is over. The latest statistics indicate otherwise.

SMSFs are thriving

While large funds continue to evolve and give investors much of what they need, more SMSFs were established in the 12 months to December 2022 than in the calendar years of 2018, 2019 and 2020, as shown below. Yes, 2021 was exceptional, driven by the freedom to acquire new assets such as Bitcoin which are not offered in managed funds, but the total number of SMSFs is now over 600,000 for the first time. Indeed, the data below drawn by Investment Trends from ATO sources shows a significant fall in wind-ups, although this is a notoriously volatile series subject to updating.

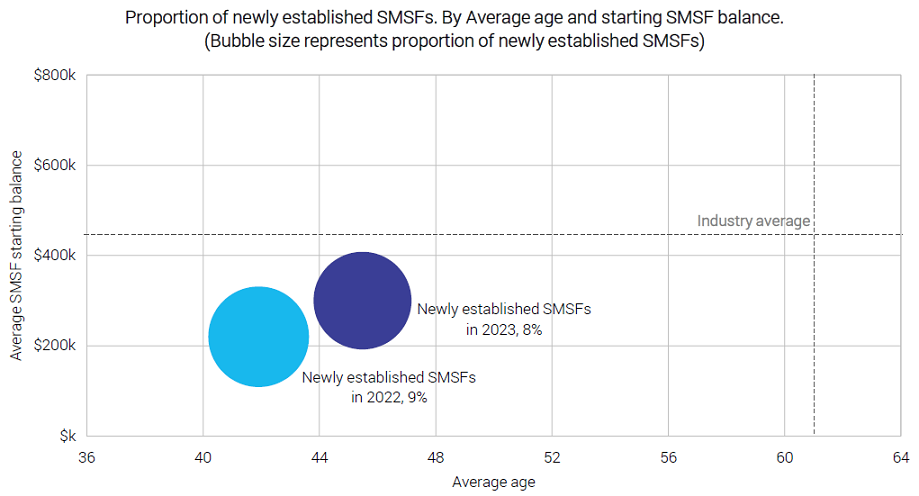

It's also popularly believed that the age of new SMSF trustees is falling, but recent data shows the reverse. In the chart below, where ‘newly established’ means set up in the preceding two years, the average age has increased by a couple of years and average set up balance risen from $220,000 to $300,000. This tends to support the claim that younger people set up SMSFs in 2021 to participate in pandemic fads which have since faded.

Source: ATO and Investment Trends

Why do people set up an SMSF?

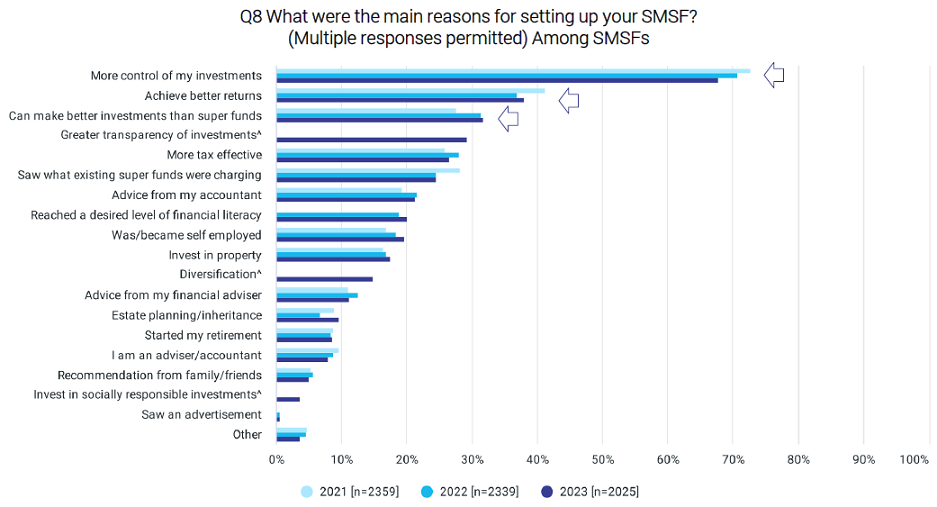

The dominant reason for establishing an SMSF remains ‘control’, given the flexibility to invest in almost anything. But it is common for new trustees to think they can perform better than professional investors, with ‘achieve better returns’, ‘can make better investments than super funds’ and ‘saw what existing super funds were charging’ high on the list. A recommendation from accountants and advisers to set up an SMSF still makes up a healthy 30%.

This confidence in personal expertise is confirmed in the reasons most SMSFs do not use a financial adviser, where ‘can manage my own financial affairs’ is the top reason, followed by cost, lack of confidence in advisers and difficulty finding an adviser.

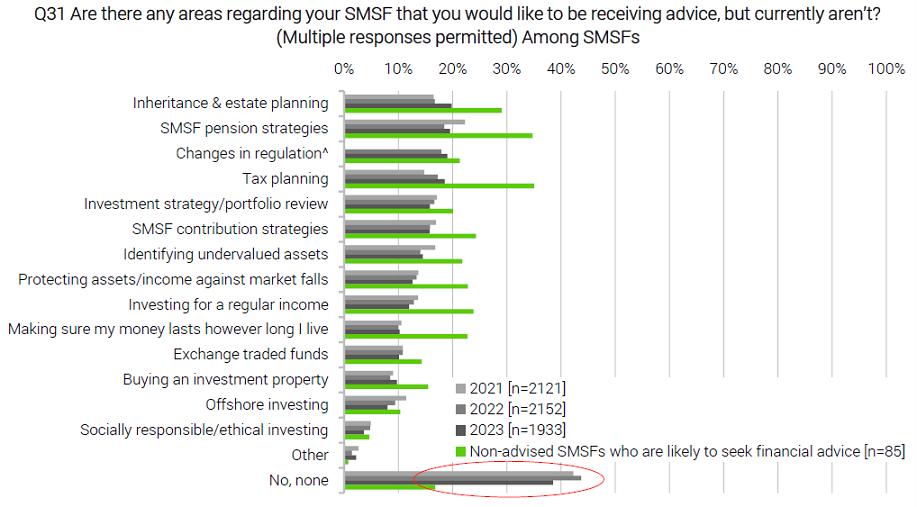

However, SMSF trustees do nominate areas where they need assistance, and the most popular are not the advice on investment selections traditionally thought of as the role of an adviser. Rather, inheritance and estate planning, pensions strategies, tax planning, impact of regulations and contribution strategies are vital parts of the advice experience.

Investment Trends concludes from looking at the data on financial advice:

“SMSFs’ use of financial advisers has stagnated, while unmet advice needs continue to accumulate. Two key segments in particular – female investors and those in Transition To Retirement phase – would be particularly receptive.”

How are SMSFs investing?

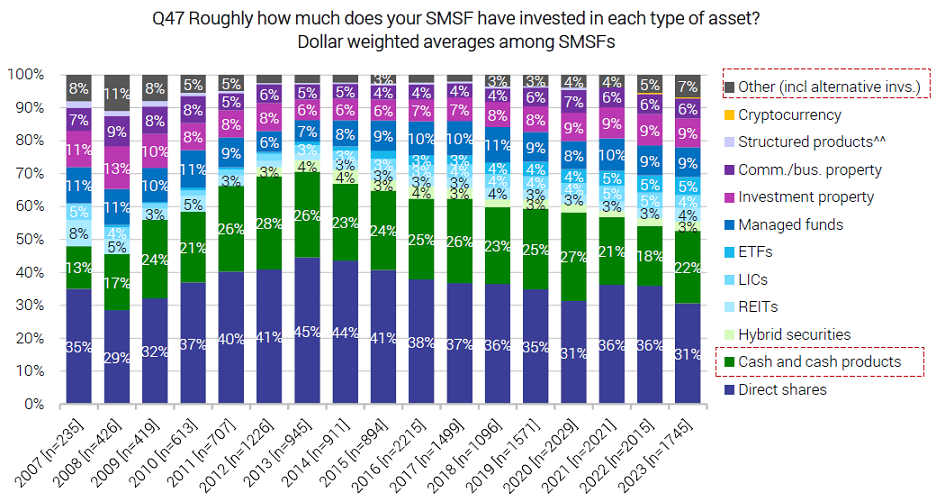

While data is produced by the ATO showing asset allocation by SMSFs, the categories obscure trends by grouping global and Australian equities into one number. The Investment Trends Survey asks trustees directly and generally shows a move back to cash, up to 22%, and a decline in direct shares, down to 31% (but still by far the highest).

This may coincide with caution about the equity markets and better rates on cash, although the latter has always received a surprisingly high allocation among SMSFs. Alternatives also received a decent jump in the last year. ETFs have retained a small but steady allocation of 5%, while managed funds occupy 9%. Property remains popular at 15%.

On the new $3 million super tax, the Survey suggests far more changes to investments are likely in response. Although the Government and Treasury estimate that only 80,000 people will be affected, representing 0.5% of members, it is a significant issue with SMSF trustees, where large balances are usually held. Nearly half, at 46%, of surveyed trustees think the tax is a ‘bad idea’, while only 24% say it’s a ‘good idea’. The rest are neutral or want more detail. Surprisingly, given the $3 million threshold, a high 25% say they are ‘very likely’ to be affected, with a further 22% saying ‘somewhat likely’.

In summary, SMSFs remain a vibrant and growing part of the superannuation landscape, and with decent investment markets, will also push through the $1 trillion barrier in the next few years.

Graham Hand is Editor-At-Large for Firstlinks. This article is general information. All charts are copyright Investment Trends and are sourced with permission from the Vanguard/Investment Trends 2023 SMSF Report.