The Productivity Commission’s 571-page ‘Report into Superannuation’ provides some well-researched findings on institutional funds, but it fails to hit the mark on SMSF performance. This is not a reflection on the quality of the Commission’s work, but it is a stark reminder of the inherent differences between how the Australian Prudential Regulation Authority (APRA) and the Australian Tax Office (ATO) report fund performance. We need to highlight and fill in some critical 'SMSF gaps' identified in the Commission’s draft Report.

The disparities in performance reporting result from:

- The ATO includes contributions tax and insurance costs in net earnings while APRA does not.

- Given these extra costs, the ATO performance measure will always be worse than APRA’s.

- The smaller the SMSF balance, the higher the impact of those extra costs.

We have analysed publicly-available contribution tax and insurance data from the ATO to restate SMSF performance so it can be directly compared to institutional fund returns.

For the 10-year period the Commission’s Report covers, SMSFs outperformed APRA funds on a like-for-like basis.

- In a technical supplement to the Report, the Commission noted that if APRA fund performance is calculated using the ATO method, then SMSFs outperform institutional funds (SMSFs 5.59% compared to 4.98%)

- The Class submission shows that when SMSF performance is restated using the APRA approach, the amount by which SMSFs outperform institutional funds is even higher (SMSFs 6.71% compared to 5.58%).

The discrepancy around 10-year performance reporting

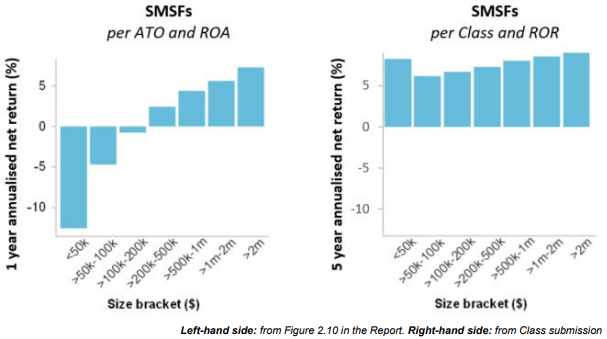

The Report highlights how institutional funds of different sizes performed over the 10 years from 2006 to 2015. In parallel, the Report should also show how SMSFs starting with different balances (e.g. $1,000 - $50,000 and $51,000 - $100,000) performed over the same period. Instead, they provide a mash-up of one-year performances across the 10 years.

The Commission noted in the Report:

“It is unclear to what extent the presence of small SMSFs in the system is necessarily a problem. It may be that many of these SMSFs will move into higher balance categories over time (or as the upfront capital costs are paid off), although this is difficult to discern given the lack of publicly-available panel data.”

This is highly concerning, given that super is all about saving over the long term, and the industry should be able to compare data on a like-for-like basis.

Class analysis of SMSF performance across five years shows that although funds with smaller balances do generate lower returns, the variance is considerably less than the exaggerated results provided in the draft Report.

The analysis in the right-hand chart used APRA’s rate of return (ROR) method (as against the ATO’s return on assets (ROA) method) and looked at SMSF performance over the five years from 2013 to 2017. Funds were grouped by their starting balance in 2013.

Long-term fund analysis published by the ATO in the infographic SMSFs first lodged in 2012 FY: where are they five years on? did not include performance data. The ATO should provide a 10-year version of this document and it should include performance for all SMSFs, grouped by their start of year balance in 2006.

A call for collaboration between APRA and the ATO

It appears that the advice the Commission received from the regulators was that it is ‘too hard’ to compare the performance of APRA funds against SMSFs. This is disappointing, given the dual regulators are responsible for an industry worth over $2.5 trillion. The competing approaches deliver significant performance reporting differences.

It’s time that the two industry regulators collaborated to deliver accurate insights into like-for-like fund performance.

A full copy of the Class submission can be downloaded here.

Kevin Bungard is CEO of Class Limited, a provider of SMSF administration software.