People reading Firstlinks fall into two camps: they want to make money or they want to hold onto it.

Yet getting rich and staying rich require different approaches. Why is that?

There are two primary reasons. First is the attitude to risk. If you have little money and want to become wealthy, you’re more willing to take greater risks with the money you have because you have less to lose. Conversely, when you’re wealthy, you have a lot to lose and that reduces your appetite for risk.

Second is the attitude to time. People who want to make money are generally in a hurry. That might be because they see those who are wealthy and want to be like them, or perhaps subconsciously they’d rather enjoy the fruits of their wealth in their 30s or 40s rather than when aged in their 80s. On the other hand, people who have wealth have all the time in the world and they can allocate their money accordingly.

Let’s first dig into the main reason that people are here: to make money. How do you go about doing this? There are five ways:

1. Luck

You can get lucky and become rich. Examples include winning the lottery or pokies, inheriting a bunch of money, or marrying into wealth.

When I look around, I see a lot of people hoping that luck will come their way and deliver them riches.

For evidence, look no further than Australia’s love affair with gambling. Each year, we spend almost $200 billion on gambling. That’s about $7,500 per person. Most of the money is spent on lotteries, casinos and poker machines, though sports betting is rising in popularity.

Why do people gamble? Some of it is for fun. For a smaller group of people, it’s an addiction. Mostly, though, it’s about making money.

Another way you can get lucky is by inheriting a lot of money. This is becoming more commonplace with an estimated $5.4 trillion wealth transfer in Australia over the next 20 years. It’s principally property that has made the Baby Boomer generation wealthy, and this property wealth will be passed on to other generations.

The history of those who’ve inherited fortunes paints a mixed picture. Lists of the world’s richest people are full of those who’ve inherited a heap of money but gone on to build even greater wealth. Think Elon Musk in the US, or Gina Rinehart and Anthony Pratt in Australia.

There are plenty of cautionary tales too. When Cornelius Vanderbilt died as the richest American in 1877, his heirs inherited today’s equivalent of US$400 billion. Within three generations, all that wealth had disappeared, thanks to poor financial management and lavish spending.

Another way to get lucky is by marrying into wealth. I won’t say more about this lest I get into trouble.

Summing up, the odds of getting lucky – through gambling, marriage, inheritance, or other means - are small and most people can’t rely on it to become wealthy.

2. Work

This is the commonplace strategy to gain wealth. However, it’s difficult to become filthy rich through this approach.

There are three things to note about work and wealth. First is that it takes time. Think about doctors. They do 12 years of schooling, before eight or more years of university. Then they do an internship for one year before prevocational training for another year or more. From there, they become a specialist and that’s where the money starts rolling in. Yet, most will have hefty HECS debts to pay off. It’s only in their 40s that doctors become well off or significantly wealthy.

Second, the amount of money that can be earned through work is capped. Even for doctors and lawyers, their income is limited by their personal output. If they don’t work, they don’t get paid.

Third, it’s tough to become very rich through work. Yes, you can become a CEO or a cardiologist, though the odds are against you. Also, high taxes on personal income in Australia don’t help. It’s why many of our best and brightest head to places where taxes are lower, such as Asia or Dubai.

All up, work is the safest of all the strategies though the amount of wealth it can bring is limited.

3. Owning a business

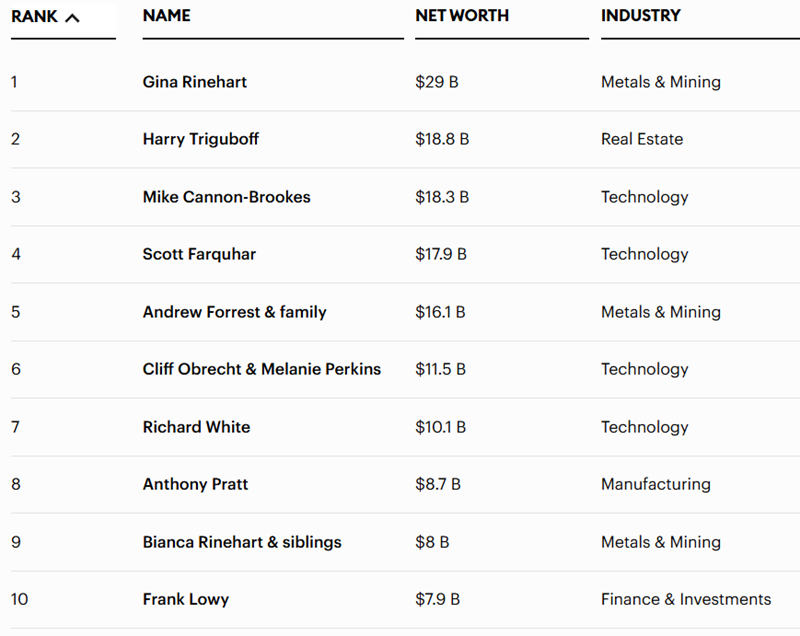

Have a look at this list of the top 10 wealthiest Australians.

Source: Forbes

What do you notice? All of them bar one own businesses. Even the outlier, Bianca Rinehart and siblings, are the beneficiaries of a business.

So, being an entrepreneur or businessperson is the principal way to reach these rich lists.

Yet, it entails significant risks. Surveys suggest that 20% of businesses in Australia fail within their first year, and 60% are gone by year three. And around 43% of small businesses fail to make a profit and 75% of small business owners take home less than the average wage.

There are ways to reduce the risks of owning a business. Buying a franchise is an option. Buying a well-established brand with standardised procedures and protocols has many benefits. Be aware though that the franchisor owns the franchisee and has all the power in the relationship.

Personally, I’ve started businesses from scratch and bought one. In my experience, buying a business is far less risky than starting one from scratch.

And if you do choose to build a start-up, it might be best to find a partner or partners to share the load and who have different skillsets. Flying solo with a startup business is hard yards.

4. Investing

Here’s a secret that no business or investing publication will say out loud: investing alone won’t make you rich. And by rich, I mean rich enough that you don’t have to think about money.

There are exceptions, of course. If you can plough money into investments and earn 20% a year over 40 years, yes, you can become very wealthy. But most people aren’t Warren Buffett.

And, yes, there are fund managers that have plenty of wealth. I would argue it’s more about owning a business than through investing itself.

Finally, there are a selected few who have made life-changing investments. Perhaps by being an early investor in Microsoft, Amazon, or Pro Medicus.

The truth is that investing can do wonders for your wealth, but it alone won’t put you on a rich list any time soon.

5. A combination, with leverage to boot

A lucrative approach can be to combine two or more of the above approaches. Having a good paying job and regularly investing savings in the share market. Or having a business where excess profits are invested. Or, for the ambitious, to work and have a side business, while investing any savings.

People who want to get on the fast-track to wealth often use leverage and a lot of it. That’s worked well in recent decades with falling interest rates. The important thing to note is that debt increases the upside on an investment, though it also increases the downside too.

There are many stories about the potential perils of using leverage. In markets, one of the more famous ones is Jesse Livermore, a trader who used a huge amount of leverage to short the US market and profit from short positions during the Great Depression, making the equivalent of billions of dollars. Only to lose it all in the following years.

Or the case of Long-Term Capital Management (LTCM), a hedge fund founded by Nobel laureates and Wall Street veterans in the 1990s. The fund managers used quantitative models and massive leverage to produce stunning returns in the initial years. That emboldened them to take greater risk, though it unravelled when the Asian financial crisis triggered a cascade of market events, resulting in $4.6 billion in losses and threatening the stability of the global financial system.

Staying wealthy

Ok, so you’ve made your money. What then? The problem that a number of wealthy people have is that the strategies they use to make money aren’t the best ones when trying to preserve money.

There are cautionary tales about those who’ve blown their riches, like the Vanderbilts mentioned above.

Other examples come from the 2000s commodities boom and bust.

In 2012, Elke Batista was Brazil’s richest man with wealth then totalling US$35 billion. Two years later, he was bankrupt. How did it happen? Batista made his money through oil and other commodities and used a lot of debt to do so. When the commodities boom turned to bust in 2012, his leveraged empire went with it, and in 2014, he reportedly had a net worth of negative US$1.2 billion.

Another example comes from closer to home. Nathan Tinkler went from nothing to coal baron in 2000s. In 2012, he was named by BRW as Australia’s youngest billionaire. He splashed out with purchases of the Newcastle Jets soccer club and the Newcastle Knights rugby team.

When coal prices tanked, his empire crumbled. In 2016, Tinkler was declared bankrupt.

What did Batista and Tinkler do wrong? They principally bet on commodities, with leverage, and eventually lost. Their error was in concentrating their wealth in one sector and not sufficiently spreading their bets elsewhere.

The lesson is that though concentration can be the friend of those who want to get rich, it’s the enemy of those who wish to stay rich.

The question is: how best to diversify? All assets have risk attached. Cash in a bank or under a mattress can be risky in the event of hyperinflation – just ask the Germans who still have it seared in their memories more than a hundred years later. Bonds similarly have lost all their value – in Germany, it happened three times in the first half of last century.

Property has risks – though don’t tell that to the millions of property boosters in Australia. Think of Japan, where property has never really recovered after the 1990 crash.

Equities have risks too. The finance industry loves to quote US market history, which has shown that markets always recover relatively quickly from downturns. Less mentioned is that Japan’s market only reclaimed its 1990 highs early last year - 34 years later.

There are two rules when trying to preserve wealth:

- Higher returns generally entail higher risk. Equities have higher returns and greater volatility. Cash is the least volatile asset class, though it has the lowest returns.

- Diversification is your friend. It will minimize your upside though reduce your downside too. But it will give you peace of mind that your wealth can withstand whatever is thrown at it in future.

James Gruber is Editor at Firstlinks.