What makes one business the envy of others? Every investor will have their answer but ours is a company’s ability to sustainably pay and raise its dividend quickly over a long and healthful lifetime. If a company can achieve that – moreover, if an investor can identify that – this dividend trajectory will eventually be reflected in its share price, the former pulling the latter upwards like a magnet. This lockstep relationship, though historically proven, has seldom been seized as it demands patience, discernment and laser focus on the behaviour of the dividend above other enticements, or else investors risk becoming imperilled by distractions. For those who correctly identify a company of this profile, investors will gradually become attuned to the propulsive rhythm of a dividend grower, steeled by every increase, each a psychological keel. Our conviction in this approach is so absolute that, were we stranded on an island save for this annual information on our dividend-raising companies, that would be enough.

The hidden power of growing dividends

Even experienced investors often fail to exploit the underlying potential of dividends. Why? Their focus typically diverts to high current yields. However, underlying these yields are companies which the market expects will either pay out almost everything they earn, leaving little to reinvest for growth, or who do a poor job reinvesting their earnings. The dividends of these high-yielders typically stagnate or even shrink, providing minimal dividend growth propulsive power for the share price to follow suit, or worse, pulling their share price downwards if the dividend is cut. Conversely, companies which reinvest the bulk of their earnings at very high rates of return, and can do so for a very long time, tend to offer low initial dividend yields. However, over time, as their dividend grows rapidly, the dollars received, and yield on cost, will not only catch up to their high-yielding counterparts but eventually eclipse them, while simultaneously driving their share prices upwards at a much faster rate.

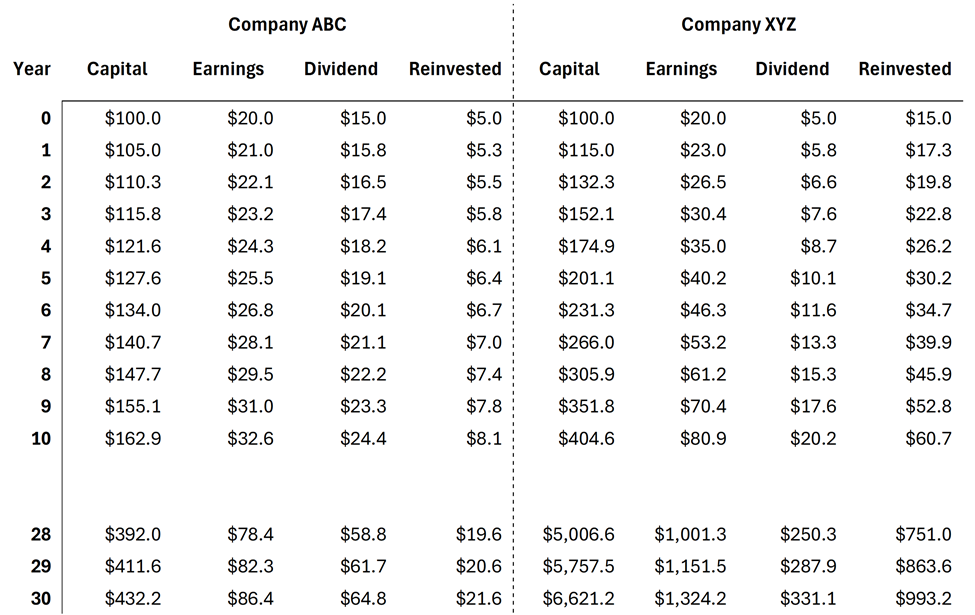

Consider companies ABC and XYZ. Both companies begin with $100 of capital on which each earns 20%, $20 this year. ABC is a typical high-yielder with little dividend growth. It pays out 75% of its earnings as dividends, with little to reinvest in growth, while XYZ only pays out 25% of its earnings, reinvesting the rest. Put otherwise, ABC compounds its capital at 5% per year (25% of 20%), while XYZ compounds its capital at 15% per year (75% of 20%). Assuming both companies rinse and repeat each year, which is the more compelling investment?

Source: DivGro

Data shows that companies able to sustainably grow their dividends quickly (albeit from smaller initial bases), ultimately prove superior propositions. Yet most investors overlook the inherent value of such companies. Chasing initially higher dividend yields and immediate income, ABC investors ultimately settle for lower total returns, punctuated by slower dividend growth and its attendant psychological repercussions. Conversely, XYZ investors, who sacrificed the ‘allure’ of an initially higher dividend yield and delayed ‘immediate’ gratification, experienced a multiplicative effect. Their dividend continued to ascend quickly, ultimately surpassing the yield of the supposed high-yielder, while their share price ascended at a correspondingly faster clip. ABC investors did not exploit the open secret of sustained high rates of dividend growth: where the dividend goes, the share price follows.

Gordon Growth Model

Our roadmap for excellent dividend growth began at MIT. There, the Gordon Growth Model, developed in the 1950s, laid the groundwork for what we do. Three key findings were established: 1) dividend behaviour is the most reliable predictor of future company performance; 2) dividend-paying companies, especially those who can consistently raise their dividends at faster rates, outperform; and 3) the expected total annual rate of return equals the sum of a company’s current dividend yield plus the expected sustained rate of growth of that dividend.

This model has been rigorously tested over many decades. Within our own methodology, we have unspooled a significant psychological unlock that makes a singular focus on dividend growers much more effective than traditional approaches. Picture that remote island again, where the only information we receive is our dividend receipts, rising each year at double-digit percentage increases compared to the same payment in the year prior. This single number, more so than any other, illuminates the trajectory of our company, showcasing that its business, and our investment, are on track. This easeful trackability of dividend growth – and the concomitant positive reinforcement it engenders – provides a superior anchor to buoy investors in a volatile environment. It is our opinion that the magic of dividend growth is underused because its effect on investor psychology is too readily dismissed. The success of this approach rests on the investor’s capacity to remain permanently focused on the dividend behaviour, rather than becoming sidetracked.

The makings of superb dividend growers

Rapid dividend growers are shielded by special features, and those detailed here should be treated as appetisers – with a caveat. These features are non-exhaustive and should be considered alongside the emotional armament of collecting growing dividend receipts. They may include but are not limited to: a proven dividend growth track record; an unequal playing field; low to moderate payout ratios; a privileged business model; little or no debt; high returns on capital; and a long, sheltered reinvestment runway. (Certainly, companies who can grow their dividends at high rates over the short-term but reach a reinvestment ceiling or are subject to significant cyclical forces beyond their control, exist but don’t make the cut).

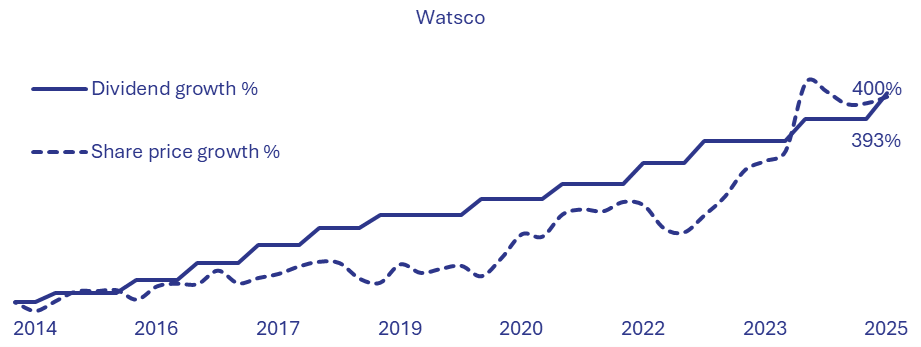

What does? Take Watsco (NYSE: WSO) – whose dividend has grown more than 100x since 2000, catalysing a similarly remarkable magnification of its share price. As North America’s dominant HVAC distributor, Watsco benefits from its vital role in a time-sensitive supply chain: OEMs supply distributors, who accordingly supply technicians servicing urgent needs, especially in humid markets like Florida. With the broadest inventory, lowest prices, and fastest fulfilment, Watsco is the go-to partner for technicians for whom winning the job heavily depends on the speed and product availability of their distributor. With 120+ million HVAC systems in the North America’s installed base requiring frequent and urgent repair, and with significant share still to capture, Watsco’s dividend growth future is extremely promising.

Source: DivGro, company filings

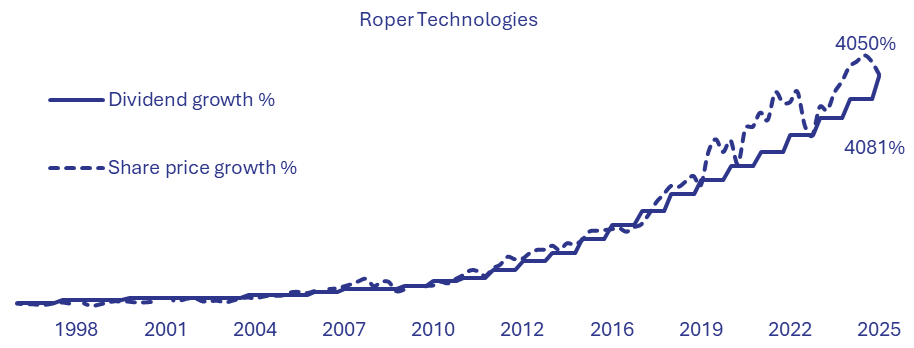

Roper Technologies (NASDAQ: ROP) has always understood that dominating a niche could be more valuable than the absolute size or growth rate of that niche. Roper pivoted from industrial machinery to medical equipment, then software and most recently, high-margin software networks. Each shift boosted its EBITDA margins from ~30% to over 50%. Its playbook? Roper acquires the leader in a narrow but critical niche, improves that business and acquires complementary capabilities, and over time upscales its margins and profitability. Since 1993, Roper’s dividend has grown more than 15% per annum compounded, with its share price escalating accordingly.

Source: DivGro, company filings

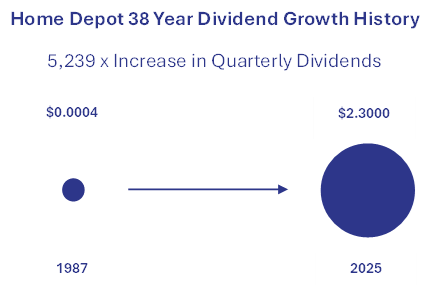

Finally, consider home repairs behemoth Home Depot (NYSE: HD). Together with Lowe’s (NYSE: LOW), it operates a powerful duopoly that commands more than 30% of the one trillion dollars spent annually on US home repairs and maintenance. Their size provides all the attendant scale advantages, principally the ability to price products well below fragmented competitors, taking market share in every environment. As the average age of North American homes exceeds 40 years (a critical inflection point for repair and maintenance), Home Depot and Lowe’s are poised to continue benefitting from price leadership, market growth, and market share gains.

Source: DivGro, company filings

The ability to identify and focus on long-term rapid dividend growth is both a strategic edge and psychological anchor. For those disciplined enough to execute effectively, the potential rewards – compounding returns, rising income, and enduring peace of mind – can be profound.

Josh Veltman and Jen Nurick work across Investor Relations and Communications at DivGro.