Interviews with politicians are normally bland affairs though this one was anything but.

In late November last year, as politicians were preparing for a coming election campaign, Dave Marchese of Triple-J’s youth-oriented Hack program interviewed the Housing Minister, Clare O’Neil.

The interview came soon after the government had rolled out policies to try to improve the housing market, especially the supply of homes. The Minister was at pains to emphasise that the main problem was that Australia wasn’t building enough houses.

And then the interview went off script:

Marchese: What is the goal here in terms of these policies – is it to bring down house prices? Is that what the government wants to do?

O’Neil: We want to bring house price growth into something sustainable, so we’re not trying to bring down house prices but we don’t want to see some of the growth that we’ve seen in some parts of the country, where you’re getting double digit increases in house prices year-on-year.

Marchese: Why don’t you want to see house prices drop? Because if you’re looking to get into the market, if you’re a young person looking at what’s ahead of you, you definitely want to see house prices come down.

O’Neil: Well, that may be the view of young people, it’s not the view of our government. We want to see sustainable house growth, we want to see more houses come on line, we want to see the rental vacancy rate go up a bit because that will relieve pressure on renters and we certainly want to see more homeowners and the government has taken action on all of those pieces this week.

Marchese: But Minister, if house prices don’t come down, doesn’t that mean the system is stacked against young people - it’s just not going to work for them?

O’Neil: Sure, Dave, we may have a difference of view about this. I have a strong view; our government’s policies are not going to reduce house prices. We want house prices to grow sustainably. That will, I understand that you can have a different view to me but that is the view of our government. We want to make sure that house prices are growing sustainably, that we’ve got renters who can get into the market and that we’ve got more homeowners in our country.

The Minister knew the interview had gone down a path that she didn’t want to go, and she couldn’t escape it quickly enough.

After, the Triple-J phone lines blew up as younger people expressed their outrage at the comments by the Minister. The government had banged on for months about “affordable housing” and now it was as if a lightbulb had gone off with Triple-J listeners: that by “affordable housing”, the government meant building cheap homes for those on lower incomes, not making existing property prices cheaper.

They lamented that, as Marchese alluded to, the “system is stacked against young people” and the government and Opposition were part of that system.

Months later, these younger people moved away in record numbers from the major political parties to cast their votes with Independents.

The outrage has been a long time coming

What’s surprising is that it’s taken until now for the anger to surface. Because the truth is that the system has been stacked against young people for a long time.

In a recent article, I outlined how economic growth and wages have stagnated while asset prices have boomed since the GFC in 2008. And those who’ve owned assets have benefited while those who haven’t have missed out.

The key reason why this has happened is that both Labor and Liberal governments have been unwilling to address the main drivers for the economic slowdown. Instead, they’ve been happy to pump up assets prices to give the appearance of increasing wealth.

Successive governments have piled on more and more debt to keep asset prices inflated. And any economic downturn that’s threatened ever-rising asset prices has been met with more government stimulus and debt.

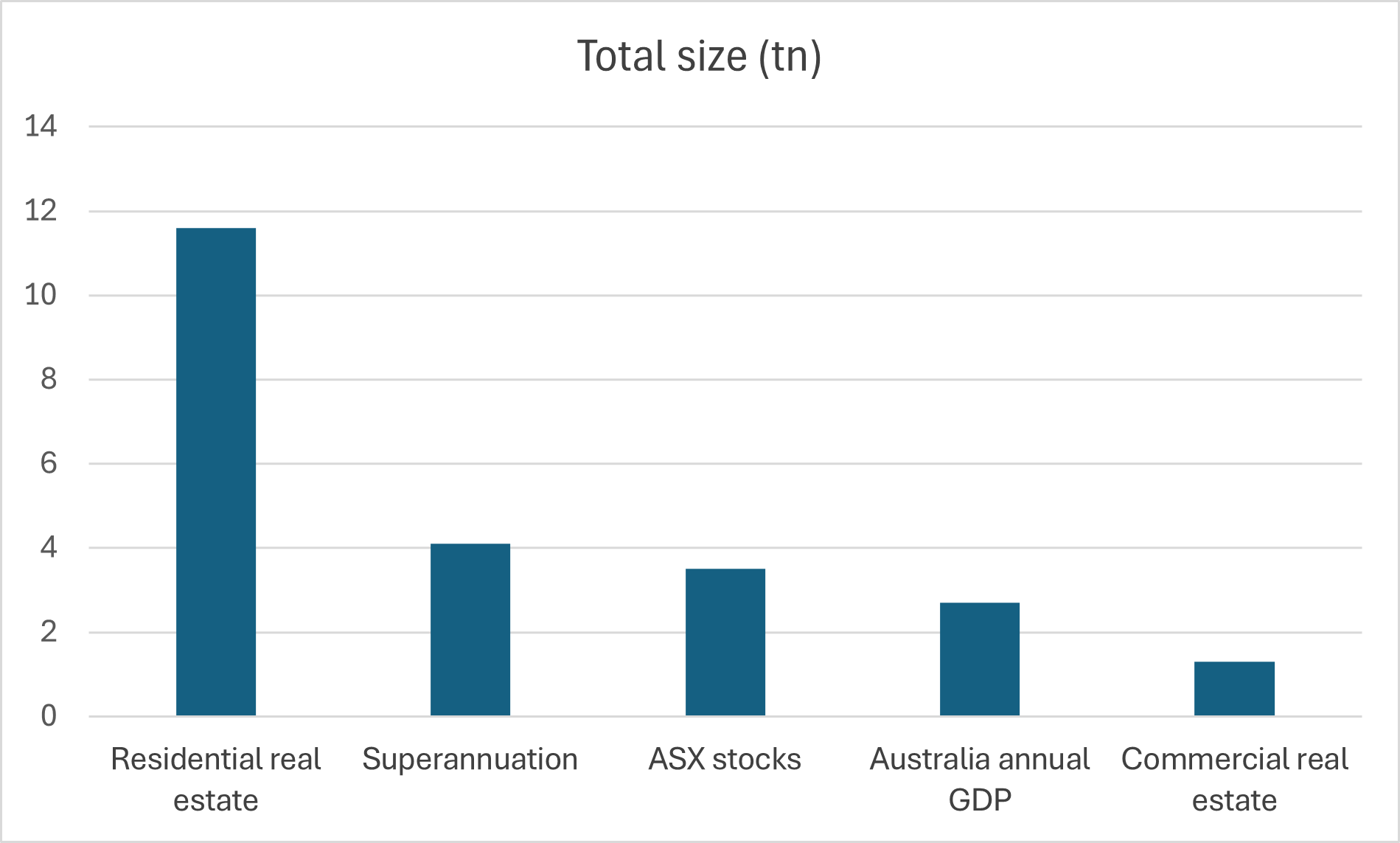

It’s resulted in assets like housing growing to gargantuan proportions versus the size of the economy. That’s impacted our living standards because investment that should have been going into growth areas has been channelled into unproductive assets such as housing.

Source: Cotality, Firstlinks

Young people have been the big losers in all this. Belatedly, they’ve realised the system is stacked against them and they may never be able to buy a house of their own.

The generational clash

Anger from the young has not only been directed at government. Baby Boomers have copped it too. Younger people view Boomers as part of the system that’s working against them. They see Boomers in cahoots with the government to keep house prices high and ignore the hard policies needed to revive the economy.

Is this fair? It seems overdone. Yes, Boomers have been major beneficiaries of the asset boom of the past three decades. And, yes, some members of that generation (Albanese included) have contributed to an expansion of that boom while failing to address key weaknesses in the economy.

However, the anger at Boomers seems a sideshow to the real issue: young people have lost hope in their living standards improving any time soon.

They see an economic pie that isn’t growing and they want a larger piece of that pie. It means increasing pressure on Boomers to share their slice of the pie with younger generations.

We’ve been here before

Clashes between generations aren’t unique.

In the 1960s, there was the countercultural revolution, which rebelled against the mainstream values and social norms of the time, especially traditional authority and conformity.

Today feels more akin to another period, though: the 1930s.

In the late 1800s/early 1900s, we had the Gilded Age which culminated in the roaring 1920s. It was an era of technological breakthroughs (railroads, cars, electricity etc), extravagant wealth and increasing inequality. That was shattered by the Great Depression and World War Two.

It led to an overhaul of systems and societies. Institutions were strengthened. In the US, Franklin Roosevelt’s New Deal policies expanded the role of government to revive economic growth and laid the groundwork for future social security and welfare programs. In Australia, it came later with Ben Chifley’s efforts at post-war reconstruction, which included nationalizing private banks, expanding social welfare benefits, and building mass infrastructure such as the Snowy Mountains Hydro-Electric Scheme.

Today, it seems like another major reset may be coming, though let’s hope it doesn’t entail an economic depression and war to get there.

How the young can respond

The younger generations can get angry about their situation though it’s unlikely to help them.

There are two alternative ways that they can respond:

1. Reform the system.

If they young want the system to change, they need to drive the change. Governments don’t respond to Triple-J; they only yield to sustained pressure. If the younger generations want reform, they need to increase pressure on Labor.

One thing that baffles me a little is the protests about Palestine. I have nothing against these protests, but where are the protests about housing? Why aren’t young people on the streets day and night demanding changes with housing? For example, why aren’t they demanding that the current government pledge to maintain current house prices, or make them fall, over the next decade?

The other way to change the system is from within. To get into positions of power to enact real change. To become the face of change.

2. Accept the system and get on with life.

The other option is for young people to accept the current system and make the best of it. To accept that the government may not be in their corner. To accept that older generations don’t want the system to change. To accept that they may never own a house, for instance.

This last point needs further explanation. The young may need to move past the obsession of previous generations with owning a home. After all, if the goal of most people is to have a happy life, then they should prioritise many other things before home ownership: family, friends, health, spirituality/contentedness, and so on. A realignment of values may be needed.

I suspect the young will respond to their current plight in one of these two ways, or a mix of both. The route they take will shape our country in coming decades.

James Gruber is Editor of Firstlinks.