Australia sits among the world’s wealthiest nations on a median# household basis. However, much of that wealth is in residential property, now nearing $12 trillion in aggregate, almost three times the size of current total superannuation system assets.

That concentration of illiquid non-financial wealth is creating its own complications as retirement approaches, particularly for those still indebted.

In our new white paper 'The Growing Debt Burden of Retiring Australians: Challenges, Solutions and Opportunities' we unpack what this growth in housing debt means for retirement. We then suggest some measures to help ameliorate this expanding retirement cashflow imbalance.

Home is where the wealth (and debt) is

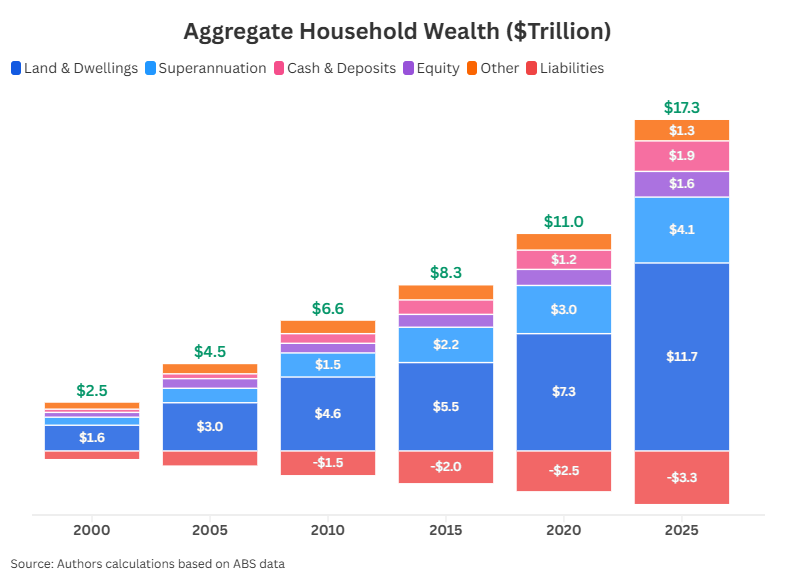

ABS data shows total household assets now exceed $20 trillion, dominated by housing (land and dwellings) at almost $12 trillion and superannuation at just over $4 trillion.

Against these stands one key liability: some $2.5 trillion of property debt, comprising some $1.7 trillion in owner-occupier loans outstanding and about $800 billion in investment property debt.

The growth in aggregate household net wealth, from $2.5 trillion in 2000 to today’s $17 trillion is shown below. Through every intervening point, residential housing has dominated the household balance sheet.

Larger housing loans carried later into life

More Australians are approaching retirement with larger mortgages than any previous cohort. Today, effectively one in every two homeowners aged 55 to 64 has outstanding housing debt versus fewer than one in six in 1990.

For those aged 65-plus, 15% of households now still have housing debt, more than double the rate from 1990. For the 55 to 64 pre-retiree cohort, the latest ABS Survey of Income and Housing data suggests the average housing debt balance now exceeds $230,000.

With the 7-capital city average property price (excluding Darwin) around $43,000 in 1980, $120,000 in 1990 and $176,000 in 2000, current debt levels for those who first purchased 20 or 30 years ago are concerning from a retirement security perspective.

What has driven this? Our research points to house prices outpacing real income growth, increased refinancing and use of redraw facilities, and a rise in later-life relationship breakdowns.

The 2020 Retirement Income Review noted that mortgage debt-to-income ratio for borrowers aged 55 to 64 rose from 72% to 138% between 1990 and 2020 and the median age of loan extinguishment drifted from 52 in 1981 to 62 in 2016. These trends have not reversed.

Dealing with housing debt as retirement approaches

Indebted pre-retirees have three broad strategies to dealing with housing debt:

- delay retirement until the debt is (ideally) extinguished;

- retire and continue to service the loan; or

- seek a source of capital to reduce or extinguish it.

The average age of actual retirement has risen from 57.4 years in 2004-05 to 61.4 years in 2022-23, according to the ABS, which also finds the intended age of retirement today to be between 65 and 66. While people may be delaying retirement to match the Age Pension qualifying age of 67, servicing home loan debt may now also be a contributing factor to defering retirement.

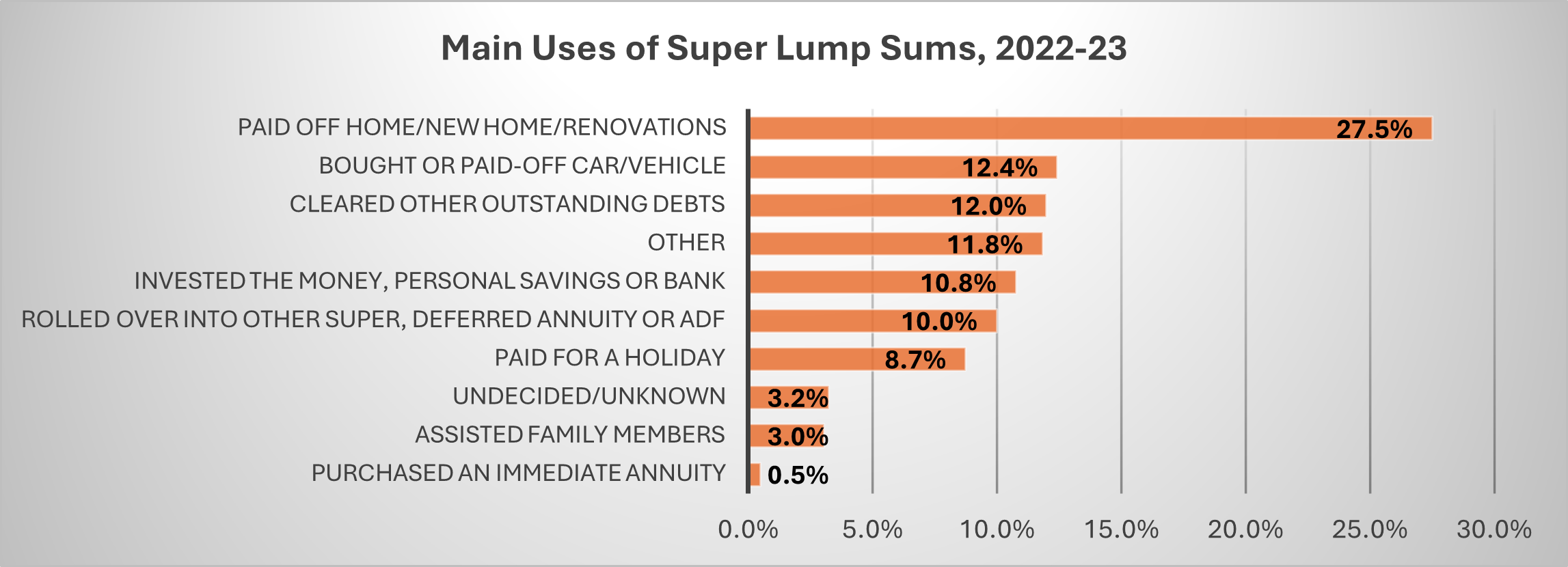

Evidence also suggests many retirees withdraw superannuation lump sums to pay down debt.

The ABS Survey of Retirement and Retirement Intentions below shows property-related expenditure accounting for more than one in every four super dollars withdrawn in 2022-23.

Source: Author’s calculations from ABS Cat 6238.0 (Retirement and Retirement Intentions, 2022-23)

This would thereafter clearly reduce the income generating capacity of the remaining superannuation, this residual component we term one’s ‘Net Pension-Generating Super’.

Reframing housing’s role in retirement

The most current data suggests the median Australian home-owning couple today is approaching retirement with a property valued at around $850,000, and with some $400,000 in combined superannuation. Against this may be a home loan balance of some $200,000.

To the extent that some are choosing to partially withdraw their super to extinguish housing debt, the result is that many retirees are entering retirement ‘asset rich but cash poor’ and heavily reliant on the full Age Pension (now around $46,200 for a homeowning couple).

Given households over 65 are estimated to hold some $3 trillion in housing wealth, our research suggests that accessing some amount of housing equity, instead of using super to extinguish housing debt, could (depending on a couple’s circumstances) result in improved retirement outcomes for those prepared to consider a home equity release solution.

The home equity release market has developed significantly in the last decade and is now estimated at more than $4 billion across the Government’s Home Equity Access Scheme (HEAS) and commercial providers (broadly reverse mortgage and debt-free equity release solutions).

Importantly, commercial providers have made significant strides in improving consumer protection measures in recent years including the No Negative Equity Guarantee (for reverse mortgages), the encouragement for prospective customers to seek legal and/or financial advice prior to contract finalisation, and the possibility of early termination rebates (in the case of debt-free equity release).

Retirement horses for courses

Australia’s retirement income system is still a work in progress, some 33 years on from the start of the Superannuation Guarantee.

It must cater for some 18 million individuals of varying incomes, savings capacity, investment risk appetite and retirement income preferences.

Of those, roughly 1 million are in SMSFs, with a median near-retiree couple balance closer to $2 million than the $400,000 currently for APRA-regulated members.

It is thus less likely that SMSF members will approach retirement with material debt outstanding on their principal residence, and it is more likely that that they will be fully self-funded in retirement (typically until their early eighties).

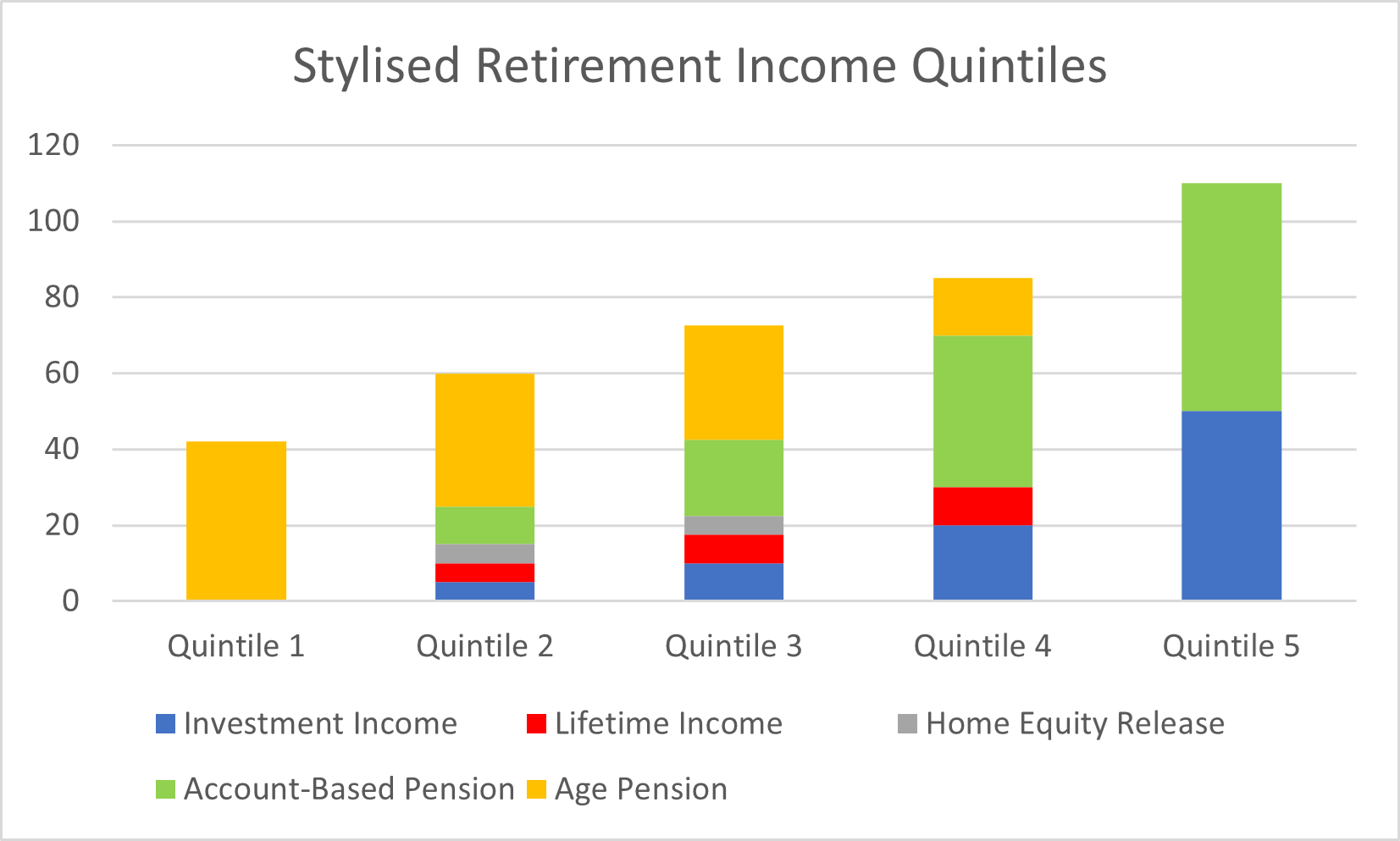

Australia’s retirement income system should therefore cater to this diversity by acknowledging all five (non-employment related) potential sources of retirement cashflow, including:

- The Age Pension;

- Account-based Pensions;

- Home Equity Release;

- Lifetime Income Streams; and

- Non-super Investment Income

Conceptually, these five cashflow sources might be relevant to different cohorts across the wealth spectrum as depicted in the diagram below.

Source: Author’s submission to Treasury (Retirement phase of super, 2024)

For a nation where the combined capitals median dwelling value is rapidly approaching $1 million, it is perhaps time that the humble Aussie house helps with smoothing consumption for today’s 4 million-odd retirees, and the estimated 2.5 million who’ll transition from the accumulation phase into retirement during this decade.

As Treasury’s 2020 Retirement Income Review stated:

“The existence of many ‘asset rich income poor’ retirees on the Age Pension suggests home equity release has significant potential to help support retirement incomes.”

Our research concurs with that position.

Harry Chemay is a Principal at Credere Consulting Services and a Co-Founder of Lumisara. He has almost three decades of experience across financial advice, wealth management and institutional consulting. Lumisara assists wealth management entities and APRA-regulated super funds to develop retirement solutions through next-generation product, guidance, advice and service delivery models.

# The median is that value where half of observations are greater than it and half less than. It thus is considered a better measure of the ‘middle ground’ compared to the average (mean) which can be disproportionately influenced by a few large observations at either end of the distribution.