The performance of the Australian equities market this year has highlighted, once again, a persistent conundrum facing investors – how to approach a heavily concentrated index reliant on two sectors and a handful of stocks.

The biggest driver of the S&P/ASX 200 on the way up to the record high on October 21, and the retracement since, has been the performance of some of the biggest companies in the index. These are the cornerstones of many portfolios – the likes of CBA, Westpac, ANZ, NAB, CSL, Telstra and Wesfarmers.

As these household names are all terrific businesses admired for delivering for investors over a long period, many people are content to leave them in the bottom drawer – particularly the banks, as a source of much-loved fully-franked dividends.

In the meantime, however, share prices for these mature businesses can run well beyond their fundamental values (see my previous article on the importance of systematic rebalancing). CBA is one of the most expensive banks in the world. It doesn’t take much bad news for performance to turn around and for the portfolio to go with it. Those with overweight positions in CBA and CSL can attest to this phenomenon in the last few months.

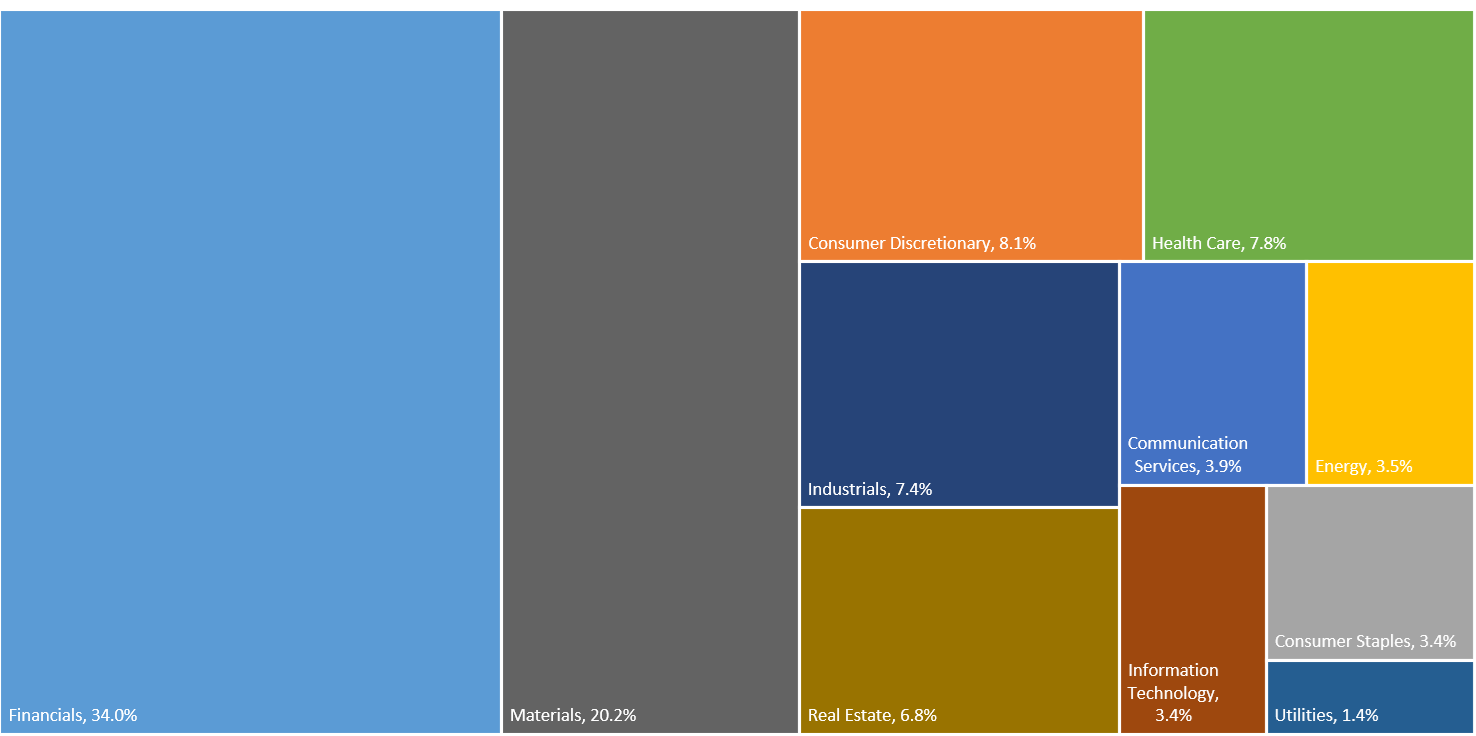

Equally, those taking a passive, market index approach are experiencing a similar conundrum. Of the S&P/ASX 200 index, 54% is made up of banks and miners. The recent strong performance of the banks has lifted the financials weighting to more than a third. Just 10 companies account for almost half of the index value. And CBA alone accounts for almost 10% of the index.

Composition of the S&P/ASX 200 by industry sector weight as at 30 September 2025

Source: Minchin Moore Private Wealth.

Looking to the future

Saying these household name companies have delivered up till now is all very well, but investing is about the future. And in a market so top-heavy, it is worth asking whether such mature businesses - with potential headwinds in excessive valuations, cyclicality and slowing relative growth in earnings - will continue to do so.

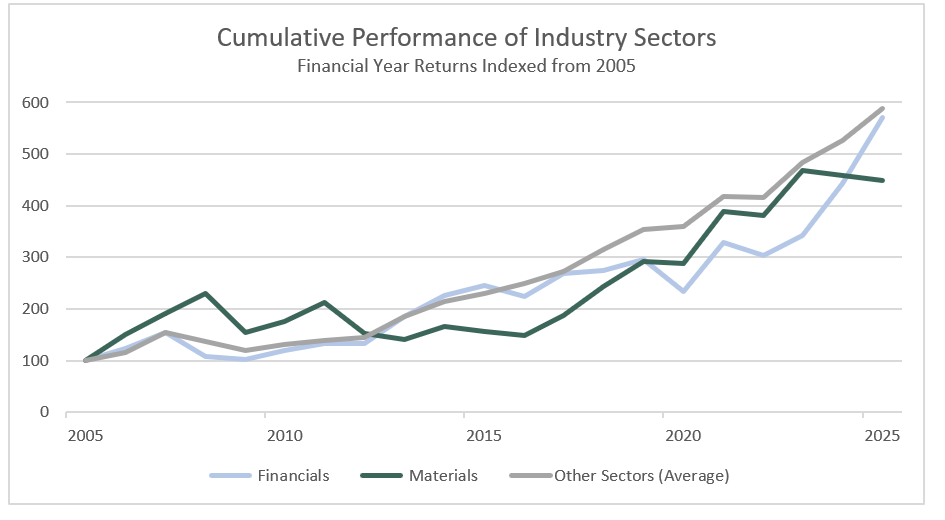

Indeed, the chart below shows that both Materials and Financials over the last 20 years have underperformed relative to other sectors in the Australian market. Furthermore, those two sectors have been more volatile, and each have had long periods of underperformance.

Source: Minchin Moore Private Wealth.

What’s more, we know that the make-up of the local market is as challenging for professional investors as it is for the self-directed investor.

For instance, evidence shows most actively managed 'stock picking' managers in Australian large caps underperform the benchmark after costs over the medium to longer term.

So the question becomes if the index is too reliant on two sectors and active stock-picking has proven to be so difficult, how do we address these challenges?

Rethinking the core portfolio

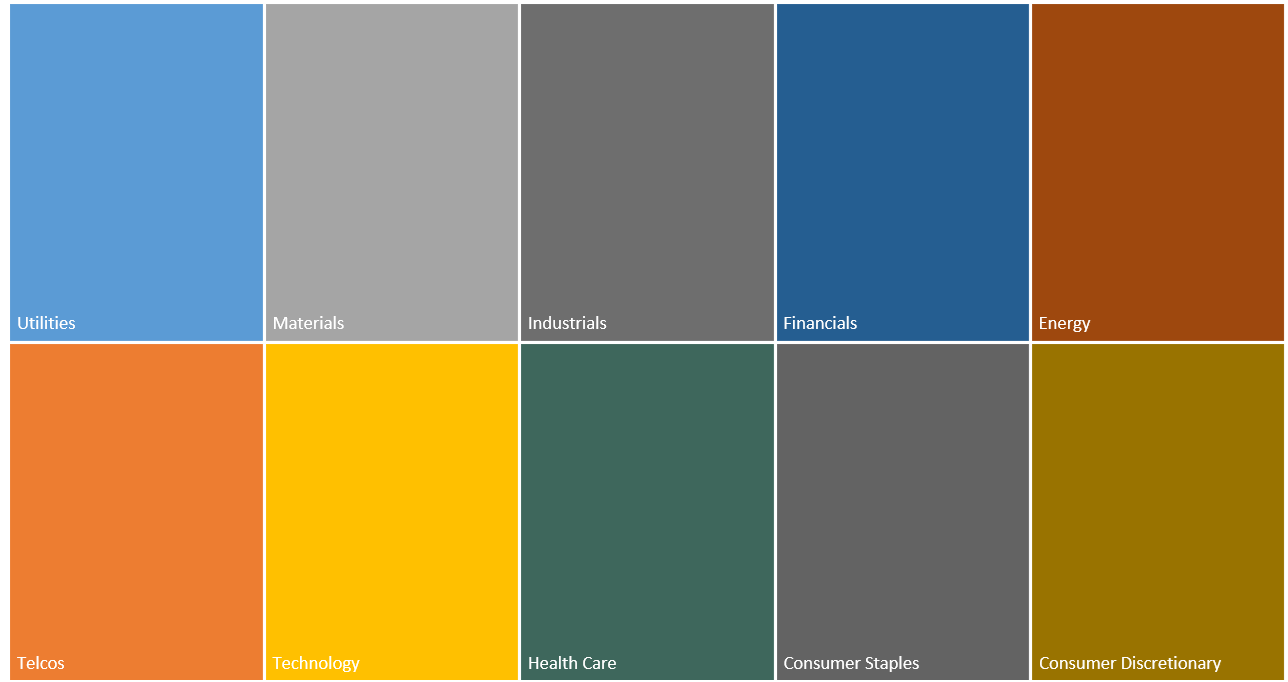

One idea is to take a more diversified approach to large cap equities by equally weighting exposure to industry sectors – 10% in each of the 10 industry sectors (excluding property given it is treated as a discrete asset class).

This can be implemented in a systematic, rules-based approach coupled with periodic rebalancing. Not required here is active stock picking, forecasting, valuation models, or second-guessing constituents. Instead, we can stick to an index-style mandate and a set of rules regardless of market sentiment.

Equal-weight investing has consistently shown evidence of enhanced long-term returns and diversification benefits compared with traditional cap-weighted approaches. Academic and practitioner studies have found that equal-weight portfolios tend to outperform over time due to a systematic “rebalancing premium”. This contrarian effect captures mean reversion and maintains balanced exposure across all constituents rather than concentrating exposures in the largest companies and sectors. Evidence suggests equal weighting reduces concentration risk, improving portfolio resilience when dominant mega-cap stocks and sectors underperform.

Source: Minchin Moore Private Wealth.

There are not only substantial diversification benefits from holding a higher exposure to the often-neglected smaller industry sectors, but also return opportunities across the cycle.

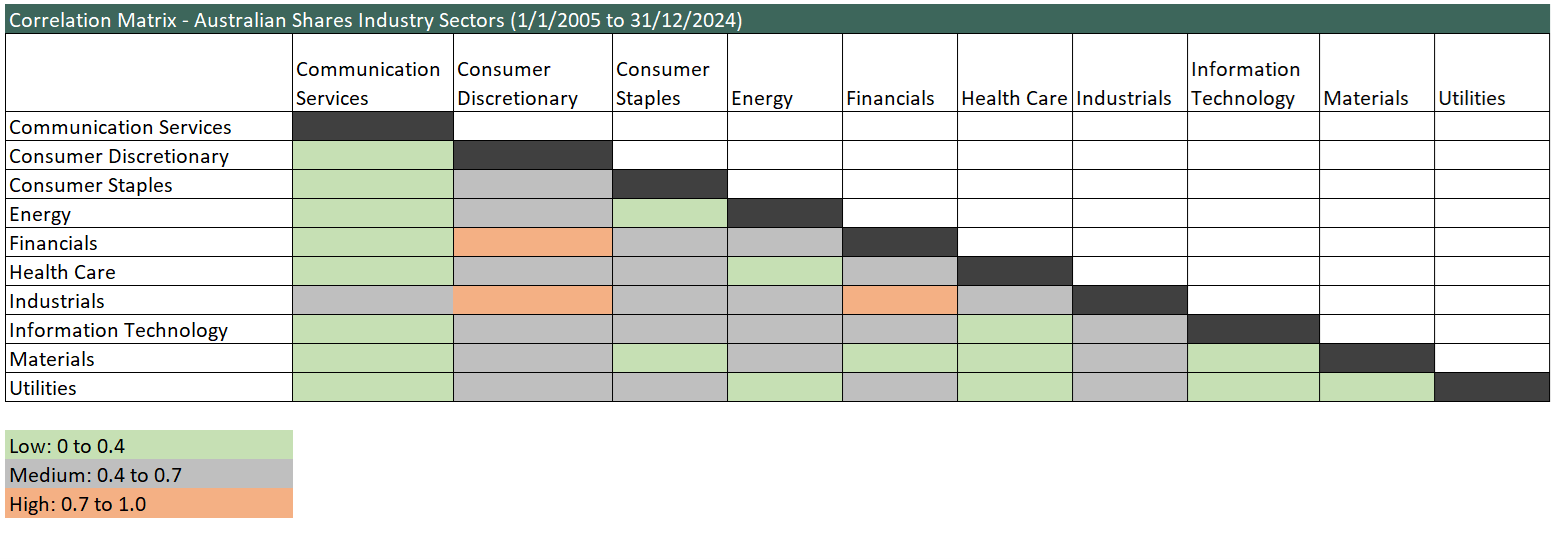

On the diversification front, the matrix below highlights the low correlation between sectors, which can optimise the risk/return characteristics of the portfolio.

Source: Minchin Moore Private Wealth.

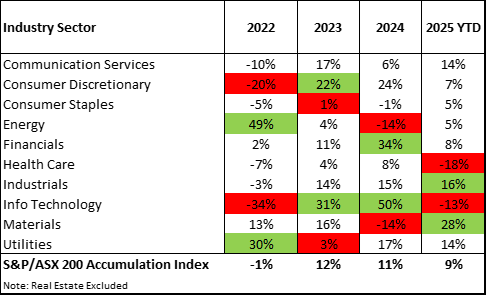

From the performance perspective, sector leaders and laggards often rotate from year to year as market and economic conditions support or detract from the performance.

A good example is 2022. The Ukraine war had broken out, oil prices spiked and energy stocks outperformed. At the same time, the surge in inflation and subsequent increase in interest rates after COVID impacted adversely on long-duration, technology stocks. In the subsequent years, however, the relative performance of these two sectors reversed.

This is the benefit of a systematic approach of rebalancing back to sector and stock weights. Positions in outperformers are trimmed to reinvest in the laggards. But this is done in a disciplined way that effectively means selling high and buying low, thus enhancing portfolio returns.

Source: Minchin Moore Private Wealth. Calendar year returns and 2025 year to date to 30 November

The outcome of this approach is a core Australian equity portfolio which over the long-term has:

- Lower volatility than the market index

- A higher Sharpe ratio than the index

- Significant active sector positioning

- Higher exposure to smaller companies than the market-weighted portfolio

- And an increased “growth” bias than the index.

Adding another layer

In addition to rethinking the construction of the core, large cap portfolio, the Australian equity sleeve can be optimised further by introducing value and size “factors”, for which there is strong academic evidence of a long-term premium.

Value captures the positive link between stocks that have low prices relative to fundamental values. Size captures the excess returns of smaller firms (by market capitalisation) relative to their larger counterparts, even after adjusting for betas and other factors like value, momentum, and liquidity.

Combining these factor exposures with the core large companies holding leads to a well-diversified aggregate Australian equity exposure consisting of:

- Large Companies (for broad market exposure),

- Value Companies (those with cheaper relative valuations), and

- Mid/Small Companies (expected to deliver higher returns over time).

Each of these constituents behave differently across time, and each plays a role in contributing to performance and risk management.

Through the investment cycle we expect each to experience different sequencing of return, leading to opportunities to top up the underperforming components and take profits from the components that are performing well.

Solving the conundrum

The Australian market, as we have seen, is concentrated in a couple of sectors and a handful of names, posting thorny challenges for both self-directed and professional investors.

One answer, as we have shown here, is to set up a durable portfolio and process that is not overly reliant on one or two sectors or a bunch of household names.

Over time, structure and discipline will prove to be more reliable features of your investing toolkit than research-based forecasts or poring over the daily financial news.

By attending to diversification, disciplined rebalancing and long-term value and size factors, we can build a sustainable and methodical portfolio that focuses on variables within our control and gives us the best chance of meeting our objectives.

Jamie Wickham, CFA is a Partner at Minchin Moore Private Wealth and former managing director, Morningstar Australia.