Investment legend Ray Dalio has a historian’s eye and quantitative bent that gives him a unique perspective on markets. A recent post of his reflecting on 2025 and looking at what’s ahead is a case in point.

.jpg)

Photo by Kimberly White/Getty Images for TechCrunch, CC BY 2.0, via Wikimedia Commons.

Tanking currencies

While everyone’s fixated on US stocks and AI, Dalio suggests that they’re missing the bigger picture. That’s because last year’s largest gains went to those betting on a collapse in the value of money and a shift away from US assets into international ones.

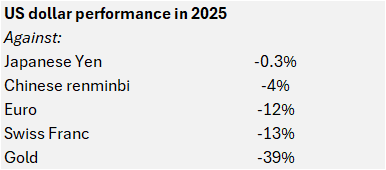

On the value of money, he says the US dollar fell 0.3% against the Japanese yen, 4% against the Chinese renminbi, 12% against the euro, 13% against the Swiss franc, and 39% against gold (he considers gold a currency and the second largest reserve currency behind the USD). Against gold, all the major currencies fell, but the weakest ones fell most while the strongest held up better, Dalio says. Reading between the lines, it means he considers the US and Japan among the weaker currencies and the Swiss among the stronger ones.

Source: Ray Dalio, Firstlinks

Due to the fall in the value of money, the best major investment of 2025 was gold, returning 65% in US dollar terms, and outperforming the S&P 500 index by 47% (the index returned 18%).

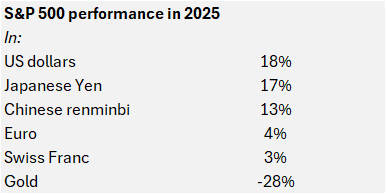

Because of America’s weaker currency, it made the S&P’s returns look better than they were, Dalio believes. The S&P returned 18% for a dollar-based investor, 17% for a yen-based investor, 13% for a renminbi-based investor, but only 4% for a euro-based investor, 3% for a Swiss franc-based investor, and for a gold-based investor, it returned -28%.

Source: Ray Dalio, Firstlinks

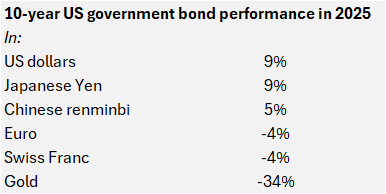

The picture for US bonds wasn’t much better. That’s because “when the value of money goes down, their real worth is lowered even as their nominal prices rise.” In 2025, 10-year US Treasury bonds returned 9% (roughly half from yield and half from price) in dollar terms, 9% in yen terms, 5% In renminbi terms, -4% in euro terms, -4% in Swiss franc terms, and -34% in gold terms. Cash in US dollars did even worse.

Source: Ray Dalio, Firstlinks

Moves away from US assets

Dalio says the other big theme from last year was investors’ moving their money out of US stocks into other markets. More specifically, in US dollar terms, European stocks outperformed American stocks by 23%, Chinese stocks outperformed by 21%, Japanese stocks outperformed by 10%, and emerging market stocks outperformed by a whopping 34%.

Meanwhile, emerging market dollar debt returned 14% and emerging market local currency debt in dollar terms returned 18%.

“Clearly, investors would have much rather been in non-US stocks than in US stocks, just as they would have preferred to be in non-US bonds than in US bonds and US cash,” Dalio says.

Drilling down on US stocks

Dalio says the strong returns from US shares, at least in US dollar terms, came from both earnings growth and an expansion in valuations on those earnings (price to earnings expansion). Breaking down the 18% total returns, earnings growth was up 12%, the P/E rose 5%, while the dividend yield contributed about 1%.

The Magnificent Seven stocks had earnings growth of 22% in 2025. Contrary to many media reports, profits from the remaining 493 companies in the S&P 500 were also healthy, up 9% year-on-year.

Revenue growth of 7% contributed the majority of the 12% in earnings growth. The rest came from a jump in profit margins.

Dalio says that means companies captured most of the earnings improvement at the expense of workers – and that’s something to keep an eye on.

What’s next for markets?

Dalio sums up 2025 as a year where just about everything went up in US dollar terms thanks largely to American policies to boost its economy, including higher government spending and lower interest rates.

He sees much of the same in 2026 though returns may be harder to come by as many assets are expensive now.

Dalio doesn’t like the prospects for US stocks or bonds. He says valuations for shares are stretched, with high P/E multiples and low credit spreads (the difference in yields on riskier bonds versus risk-free bonds). If these spreads start to rise, it would be negative for shares. So would any rise in interest rates.

Dalio’s long-term expected return for the S&P 500 is 4.7% per annum, which is low compared to the expected return from long-term government bonds of close to 5%.

But Dalio isn’t a fan of US bonds either:

“Thus far, the bond supply/demand imbalance has not been a serious problem, but a large amount of debt (nearly $10tn) will need to be rolled going forward. At the same time, it appears likely the Fed will be inclined to ease to push real interest rates down. For these reasons, debt assets look unappealing, especially at the long end of the curve, and a further steepening of the yield curve seems probable, though it seems questionable to me that the Fed’s easing will be as much as is discounted in the current pricing.”

Without saying so explicitly, Dalio strongly hints that he prefers international assets outside of the US, including equities, bonds and currencies. In his view, these assets offer a hedge against a continuing decline in the US dollar.

He also continues to like gold as a diversifier in portfolios even though he acknowledges that it may be fully priced. He’s previously said that gold doesn’t carry someone else’s liability, which makes it a strong store of value.

He’s also previously highlighted inflation-protected bonds as useful for investors seeking protection against inflation and real loss of purchasing power.

Lastly, Dalio isn’t a big fan of private assets. He says it’s notable that stimulatory moves from the US Government and central bank didn’t help venture capital and private equity in 2025:

“If one believes the stated valuations in VC and PE (which most people don't), liquidity premiums are now very low; I think it's obvious that they are likely to rise a lot as the debt these entities took on has to be financed at higher interest rates and the pressures to raise liquidity build, which would make illiquid investments fall relative to liquid ones.”

The US mid-term election risk

Last year, Trump had control of both the House of Representatives and Senate and that meant he could do what he liked. And what he did was fashion a government-directed style of capitalism that stimulated the economy and was market-friendly.

Dalio predicts that Trump will lose control of the House of Representatives at the mid-term elections in November this year. If right, that would make Trump a lame duck President and give him limited power to enact further market-friendly policies.

This is a risk that markets aren’t pricing in now but may start too as we move closer to the elections.

The long-term picture

Those familiar with Dalio will know that he views current events in the context of long-term historical cycles. He’s mapped out the last 500 years of history and quantified key factors in long-term debt cycles and, more broadly, the rise and fall of major powers.

He believes long-term debt cycles last 50-100 years, and are characterized by:

- Short-term debt cycles of 5-10 years driven by credit expansion and contraction.

- Over decades, each short-term cycle adds more debt.

- Interest rates gradually fall toward zero.

- Eventually, rates can’t be lowered further ? debt saturation.

- Central banks turn to money printing (QE).

- This often leads to:

- Currency debasement

- Asset inflation

- Rising inequality

- The cycle ends with a major reset (restructuring, inflation, or default).

Dalio thinks the last major debt reset happened in the 1930s and that period has echoes to what is happening today.

It all sounds gloomy, though Dalio would call himself a realist. If he’s correct, we’re heading down a treacherous path that will bring both opportunities (think real assets) and rising risks (think the US dollar and bonds).

James Gruber is editor of Firstlinks.