Equity markets have emerged unscathed from a financial year marked by geopolitical turmoil and uncertainties over US trade policy, with many global indices finishing at or near record highs. But now come the tough decisions.

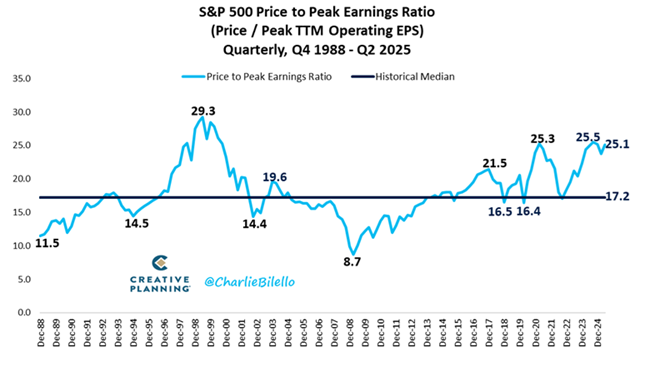

With the Australian market’s total return in 2024/25 at 14% and unhedged global equities returning 19%, some valuations are looking stretched, and uncertainties are increasing. The S&P 500, for instance is trading at historically high multiples.

Compounding investor angst locally has been the concentration in the Aussie market. CBA alone accounted for one-third of the S&P/ASX 200 index total return with a return of 50% in the financial year and a 12% index weight.

So it’s natural for investors to reflect on their portfolios at this time and ask whether they are appropriately positioned for whatever might come next.

Source: Charlie Bilello

For investors paying heed to market commentary, the kneejerk responses to these issues can be confusing. “Should I be repositioning my global equity exposure away from the US? Should I be rotating out of the banks and into the miners?”

While these are legitimate questions, they are more tactical than strategic, and speak to the need for a reflex, emotion-driven response rather than one that is more considered.

The truth is whatever the state of the market cycle, the most important element of portfolio management isn’t picking stocks or tactically shifting your exposures. Instead, it is the discipline and focus brought by a systematic approach.

A risk control mechanism

While the temptation may be to make tactical moves and attempt to second-guess markets, it makes more sense at this time to revisit your portfolio make-up and rebalance it back to its strategic weights.

Rebalancing is first and foremost about risk control, particularly the risk of being overweight equities in rising markets, and the risk of a mismatch between your original portfolio design and its construction today.

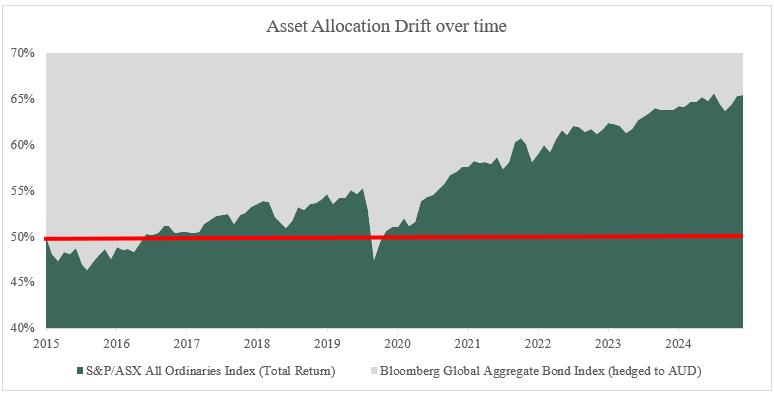

The chart below shows you what can happen without rebalancing. Left untouched, the asset allocation of a simple 50/50 growth/defensive, Australian equities/bond portfolio would have drifted over the past decade to closer to 65/35. Using global equities, which have outperformed over this period, the drift would have been even more dramatic, to 75/25.

Source: Minchin Moore Private Wealth

As my previous article showed, even slight changes in growth/defensive allocations can generate dramatically different outcomes. A 65/35 portfolio, for instance, will show much greater variability of returns than a 50/50 portfolio, post negative annual returns more frequently and have a higher probability of negative returns over extended three-to-five-year periods.

Now, while that might be OK for you, such changes should result from an intentional decision on your part, not a head-in-the-sand, “I-never-look-at-my portfolio” situation.

Ultimately, your portfolio needs to be one you can live with. When you established it, you had an objective, investment parameters and risk tolerance in mind. If those factors still hold true, make sure your portfolio still reflects your intention.

A self-management tool

If investing is as much about managing yourself as managing money, then a compelling reason to rebalance your portfolio is behavioural.

Instead of trying to time markets or tactically allocate at different points in the cycle, systematic rebalancing takes the emotion out of it and realigns your portfolio to its strategic weights.

This doesn’t require any decision-making on your part. You simply follow the rules as stipulated in your investment policy. All you need is the discipline and focus to implement those rules and not be tempted to time markets.

Looked at another way, disciplined and strategic rebalancing forces you to sell high and buy low – without a market-timing decision. You trim the asset classes that have outperformed and invest in those that have underperformed.

Such a framework not only controls for risk but can at times enhance returns, as we’ll see below.

Rebalancing mechanics

One of the arguments against rebalancing is the impact of transaction costs and capital gains tax from the sale of securities. But there are ways to manage this.

Accumulators can use cash or additional contributions to buy underweight portfolio exposures, which will mitigate all or some of those costs (this is one reason to hold some cash - to enable efficient rebalancing).

Those in drawdown often need to sell securities to supplement income harvested from the portfolio, which provides an opportunity to bring the portfolio back into alignment.

As to timing, a common approach is to rebalance twice per year on a set schedule, ideally to align with periods of significant cashflow. Rebalancing when the portfolio drifts outside of tolerance ranges can have merit, but this also introduces a discretionary element and can mean you are rebalancing too often or at time when you don’t have cash to support it.

Rebalancing and performance

Rebalancing not only controls for risk but can deliver excess returns at times, although this can be dependent on idiosyncratic factors and is tough to control.

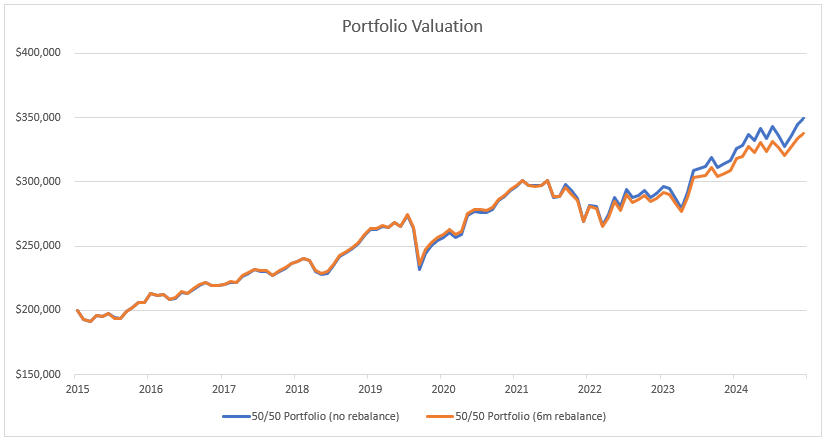

The chart below takes the same 50/50 portfolio in the exhibit above and tracks the performance of a version with no rebalancing versus a version that rebalances twice a year, in January and July.

Source: Minchin Moore Private Wealth

The rebalanced version was marginally ahead for the first six years through 2021, and further ahead on a risk-adjusted basis. This was driven by weakness in equity markets in 2015/2016, and the 2020 COVID shock, and the ability to rebalance into that weakness and top up equity exposure.

Calendar 2022 was an anomaly, with both bonds and equities down in the face of the post-COVID inflation breakout and subsequent central bank interest rate increases. This meant, rebalancing offered little benefit, and both portfolios suffered.

From October 2023, the ASX has powered ahead, albeit with a few blips, which has left the unbalanced version outperforming, as you would expect. More recently, we have seen not only strong upward momentum, but also periods of short, sharp volatility, such as February to June this year amid the tariff mayhem. In this instance, the dip didn’t align with a rebalance date, and you didn’t reap the rebalance benefit of this market weakness.

Summary – the friend you need to ride out whatever happens

After the financial year we’ve seen and the magnitude of ongoing uncertainties, it can be tempting to respond to the urge to make tactical shifts in your portfolio.

But your best approach remains using systematic, disciplined rebalancing as an integral part of your investment policy and program design.

Systematic rebalancing realigns your portfolio back to your original plan on a rules-based schedule, removes emotion from the process, and prompts you to sell high and buy low in a strategic way. What’s more the costs can be managed successfully.

So if your portfolio has been drifting and withstanding the intermittent storms to date, don’t be lulled into a false sense of security. Check your asset allocation and ensure you are comfortable with the settings.

With equity markets looking stretched, geopolitical and policy uncertainty mounting, and returns concentrated in a few stocks, there is bound to be a bigger storm brewing somewhere on the horizon.

Systematic rebalancing is the friend you need to you ride out whatever happens.

Jamie Wickham, CFA is a Partner at Minchin Moore Private Wealth and former managing director, Morningstar Australia.