Summer’s nearly over and it’s almost time to relegate the swimwear and shorts to the back of the cupboard. Items on the ‘to do’ list include mentally preparing for a physical return to the office and restarting an exercise regime. Regardless of which life stage you’re at, it is also good to put a review of your investment portfolio on your list and consider whether a rebalance is necessary.

The value of rebalancing

Does the allocation of your portfolio to shares, fixed income, property and cash look right? If your portfolio allocations have shifted, such as due to the recent falls in many share prices, take this opportunity to retune your asset allocation for the eventual rebound in the stockmarket.

Or if recent market falls felt more like a downhill run than momentary ups and downs in the road, now may be a good time to reconsider your risk tolerance as it is likely that your risk appetite and asset allocation are not in sync.

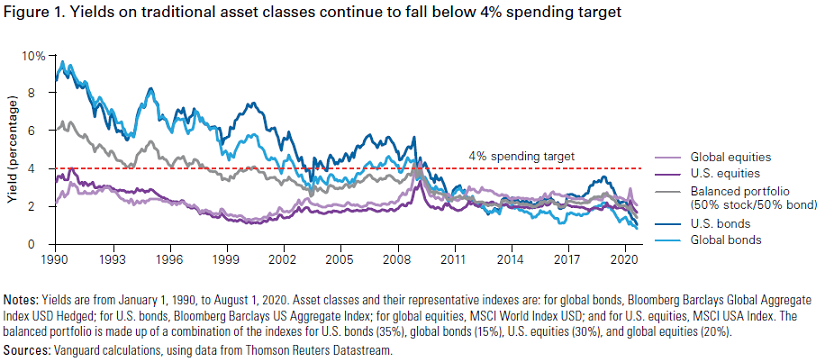

The low-yield environment poses a challenge to income-focused investors who hope to use portfolio income to support spending. In the past, as illustrated in Figure 1, a broadly-diversified portfolio of equity and fixed income could generate a ‘natural yield’ (that is, the return of the portfolio in the form of dividends and interest) equal to 4% or 5% of the portfolio’s value, consistent with conventional guidelines for spending from a portfolio. Today, that is no longer the case.

Unless investors are willing or able to make radical cuts in spending, there are two broad options to address the shortcoming of portfolio yields in meeting spending goals:

- Alter the portfolio asset allocation in search of higher yielding and potentially riskier assets, or

- Spend from capital in addition to the portfolio income yield.

For retirees or those approaching retirement, it could be tempting to increase your portfolio’s allocation to equities in the hopes of making up for the shortfall caused by capital losses. But this could mean taking added risk at the most conservative phase of your investment journey and is likely not in your longer-term best interest. If you take on more risk than you can tolerate, then losing your nerve and selling out of your strategy at the worst possible time can be damaging both emotionally and also to your hip pocket.

Higher rates should eventually lead to better fixed income returns

Vanguard expects that rising interest rates will likely reduce rising inflation and create a higher real interest rate environment that could potentially provide a boost for fixed income returns. The transition to higher rates is likely to curtail the most speculative parts of the financial markets at the edges but is unlikely to upend bond markets.

There are a few ways that you can rebalance your portfolio, but ultimately, you must decide how far you are willing to let your portfolio drift from its target asset allocation while also considering how much you are willing to pay in rebalancing costs.

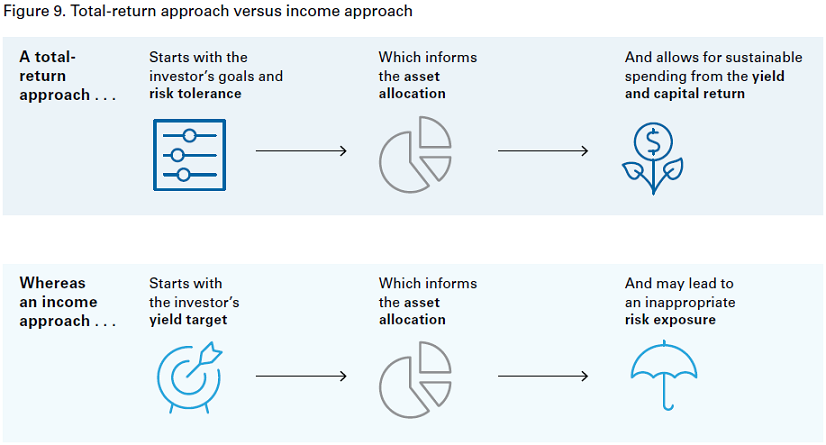

The other element to consider is how you construct your portfolio. Some portfolios are designed with an income-oriented strategy in mind, with the goal of spending from interest and dividends while preserving capital. But Vanguard research has found that adopting a total return approach provides a better alternative to most investors.

The total return approach

So what is a total return approach? Instead of targeting a desired level of income, it begins with your goals and risk tolerance and then matches the asset allocation to your risk-return profile. It takes into account all sources of return from your portfolio, both income and capital (hence the term 'total return'), while controlling risks by using diversification, minimising costs and remaining disciplined over time. Then you set a prudent spending rule that sustainably supports your spending needs.

Source: Vanguard

As yields on traditional bond and balanced portfolios have fallen over the past 20 years, some investors opted to chase additional yield by overweighting higher income producing assets, taking on more equity or credit risk and introducing unintended factor or sector tilts.

The total return approach ensures that portfolio risk is aligned to the investor’s risk tolerance, it also allows investors to control the size and timing of withdrawals, using the capital returns when necessary.

With a total return approach, the capital gains of the portfolio are spent to make up shortfalls in periods where the income yield of the portfolio is less than your spending needs or goals. This approach helps smooth out spending over time, as long as the total return drawn from the portfolio doesn’t exceed the sustainable spending rate over the long term.

It also requires you to be disciplined to reinvest a portion of income yield during times when the income generated by the portfolio is higher than the sustainable spending rate. Since capital returns can be volatile, taking a long-term view is paramount.

The ongoing volatility and market turbulence can be worrying over the short term, but history has proven that those who build their portfolios in line with their goals and risk tolerance and who remain disciplined by rebalancing their portfolios back to their target asset allocation are rewarded over time.

Inna Zorina is a Senior Investment Strategist at Vanguard Australia, a sponsor of Firstlinks. This article is for general information and does not consider the circumstances of any individual.

For articles and papers from Vanguard, please click here.