After crashing hard in April, the US stock market rebounded even harder, recently hitting a new all-time high. This has left many investors feeling nervous about the potential for a fall.

Many others have parked savings in cash, attracted by the high rates on offer. The thought of investing that cash-on-the-sidelines when the stock market is at an all-time high feels uncomfortable. But should it?

The conclusion from our analysis of stock market returns since 1926 is unequivocal: no.

The market is actually at an all-time high more often than you might think. Of the 1,187 months since January 1926, the market was at an all-time high in 363 of them, 31% of the time.

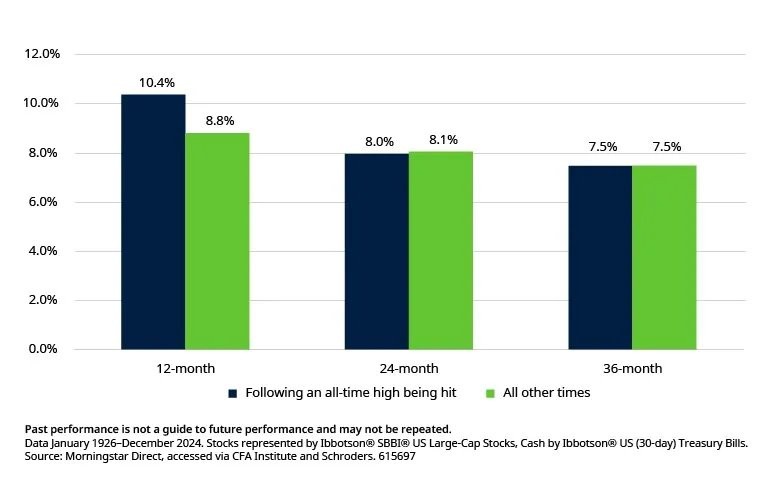

And, on average, 12-month returns following an all-time high being hit have been better than at other times: 10.4% ahead of inflation compared with 8.8% when the market wasn’t at a high. Returns on a two or three-year horizon have been similar regardless of whether the market was at an all-time high or not (see chart below).

Figure 1: Returns have been higher if you invested when the stock market was at an all-time high than when it wasn’t

Average inflation-adjusted returns for US large cap equities, p.a.

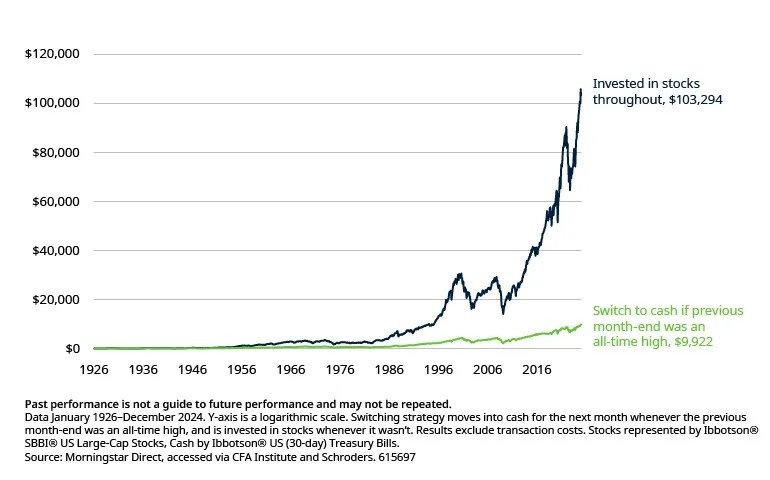

Differences compound over time

$100 invested in the US stock market in January 1926 would be worth $103,294 at the end of 2024 in inflation-adjusted terms, growth of 7.3% a year. In contrast, a strategy which switched out of the market and into cash for the next month whenever the market hit an all-time high (and went back in again whenever it wasn’t at one) would only be worth $9,922 (Figure 2). This is 90% lower! The return on this portfolio would have been 4.8% in inflation-adjusted terms. Over long time horizons, differences in returns can seriously add up.

Figure 2: Selling stocks whenever the market was at an all-time high would have destroyed 90% of your wealth in the very long-run

Growth of $100, inflation-adjusted terms

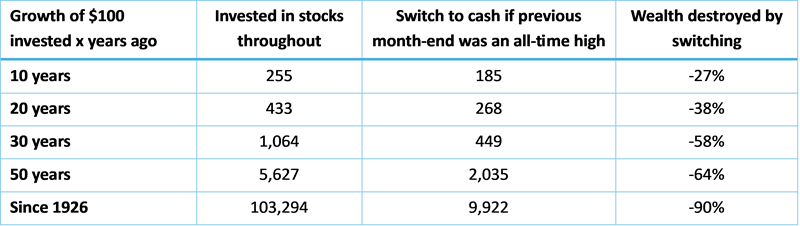

This analysis covers a nearly 100-year time horizon, longer than most people plan for. But, even over shorter horizons, investors would have missed out on a lot of potential wealth if they had taken fright whenever the market was riding high (Figure 3).

Figure 3: Selling stocks whenever the market was at an all-time high would have destroyed 90% of your wealth in the very long-run

Growth of $100, inflation-adjusted terms

Past performance is not a guide to future performance and may not be repeated.

Data January 1926-December 2024. Y-axis is a logarithmic scale. Switching strategy moves into cash for the next month whenever the previous month-end was an all-time high, and is invested in stocks whenever it wasn’t. Results exclude transaction costs. Stocks represented by Ibbotson® SBBI® US Large-Cap Stocks, Cash by Ibbotson® US (30-day) Treasury Bills. Source: Morningstar Direct, accessed via CFA Institute and Schroders.

Conclusion? Don’t fret over all-time highs

It is normal to feel nervous about investing when the stock market is at an all-time high, but history suggests that giving in to that feeling would have been very damaging for your wealth. There may be valid reasons for you to dislike stocks. But the market being at an all-time high should not be one of them.

Duncan Lamont, CFA is Head of Strategic Research at Schroder Investment Management Australia. This material is general information only and does not take into account your objectives, financial situation or needs. Schroders does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this material. Read the full report and important disclaimers here.

For more articles and papers from Schroders, click here.