An equity-based investment fund that aims to deliver dependable income is likely to deviate significantly from the Australian share market index. It requires an active approach to manage a set of different risks.

For a typical return-seeking equity fund aiming to outperform the index, the main risk is ‘relative risk’ due to the portfolio deviating from the index and underperforming this benchmark. But what really matters for income investors is the risk that the fund does not deliver a sustainable and growing income stream.

A different set of risks requires a different approach.

Risks specific to the income investor

Income investors face several unique risks that are often not acknowledged in traditional investment literature:

Income level risk

Typically, income investors aim to generate an income stream that enables them to maintain their standard of living. This is a critical issue for retirees, and to achieve this goal they must tackle income level risk – the danger that income paid by an investment falls in response to interest rate changes and other factors.

For example, in 2010 one of Australia’s leading banks offered its customers a five-year term deposit rate of 8% pa. Today, the market rate is below 3.5% pa and around 2% for a more popular 90-day term. For investors who have relied on short-term cash rates, the steady fall in interest rates over this decade has exposed them to heightened income risk. Of course, living costs continue to rise.

In today’s lower interest rate world, term deposit investors need to invest larger sums of capital to achieve the same dollar return. Additionally, these lower rates impact the returns from other annuity-type products and create significant challenges.

Inflation risk

Inflation risk is the risk that the real value of an income stream declines as the cost of living rises. For investors to maintain their spending power and living standards, they must ensure their income stream grows at least in line with inflation. This is particularly important for people in retirement as they are likely to incur increased costs in areas such as health care and aged care services.

For example, investing in a term deposit at 2% pa when inflation is compounding at 2.5% annually leaves the investor with a real (inflation-adjusted) return of negative 0.5%.

Given retirees usually have a relatively fixed capital base, inflation protection is central to any medium- to long-term income-oriented financial plan.

Income volatility risk

Investors worry about movements in the capital value of their investments but for income investors, we believe it is more important to focus on the volatility of the income stream. What matters most for income investors is that their investments deliver a sustainable and growing income stream, and the main risk they face is that it does not. Reducing the volatility of the income stream in search of reliable income delivery should be a primary consideration.

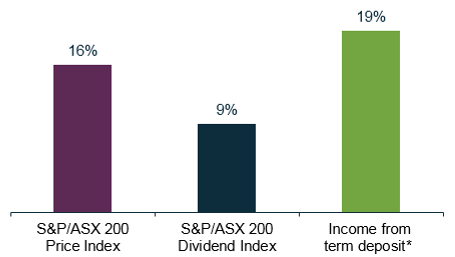

Chart 1: Income volatility over the last 15 years – equities and cash

Past performance is not a guide to future performance.

Source: Martin Currie Australia, Factset; as of 30 June 2018. *Average 'special' rate (all terms).

The chart above compares the volatility of Australian shares (prices and dividends) and term deposit income over the last 15 years. The volatility of the income stream from term deposits is more than double the volatility of the dividend stream from Australian equities, and the income from dividends has been materially higher.

With this understanding, equity income investors are increasingly valuing the more dependable nature of dividend streams especially from higher quality companies and are worrying less about short-term capital volatility associated with share markets.

Asset managers have helped with this process through educating investors on the opportunities and risks of equity-based strategies and by developing specialist funds to enable them to benefit from these attractive income streams.

Longevity risk

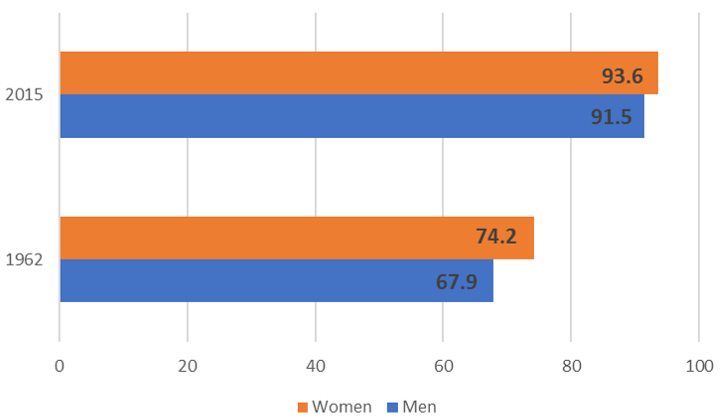

Australians are living longer. As the chart below shows, the average life expectancy of Australian men and women is now over 90 years, having increased by around 20 years since 1960. So the probability (risk) of outliving savings is growing, and this is known as longevity risk.

Chart 2: Australian life expectancy (at birth)

Source: Australian Institute of Health and Welfare, Australian Treasury Intergenerational Report, ABS, March 2018

Over the next 40 years, Australia’s population will experience a major shift. A far greater proportion of the population will be older, and the dominant baby boomer generation will move into retirement. This combination will significantly increase the nation’s pension expenses and upset the balance between retirees and the working age people who are funding the pension system. Currently, for every person aged 65 and over there are 4.5 people of workforce age (15 to 64 years) but this is forecast to decrease to around 2.7 people per retiree by 2055, putting an increased strain on the entire system (see the 2015 Intergenerational Report, Chapter 1, Australian Department of Treasury).

This all points towards continued growth in demand for income-generating investment solutions, particularly given the prevailing ‘lower for longer’ view of interest rates. In this world, equities can carry much of the burden, especially funds that utilise proven active management focused on uncovering the highest quality, most sustainable, dividend streams.

The real risk/return trade-off for income investors

Investors seeking income need solutions that can generate a yield high enough to meet their requirements today, that is sustainable over the long term, that can be expected to grow at least in line with inflation, whilst also protecting their hard-earned capital base. This requires a change in investor behaviour and the need to challenge some traditional investment approaches.

Given these specific risks, what is the true risk/return trade-off that applies to income-focused portfolios?

The traditional approach to investing looks at the potential total return (capital plus income) of an investment and compares it to the expected risk. The aim is to create a portfolio that can deliver the best possible return for a given amount of expected risk. But this only makes sense if your investment objective is focused on total return. If you are an income investor, your objective is to generate a sustainable and growing income stream. Hence a different approach to investing and portfolio construction is required as low risk in this context is defined as income sustainability.

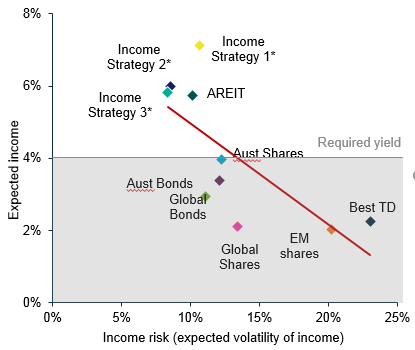

Chart 3: Expected income versus income risk

Source: Martin Currie Australia, ASFA, Factset; as of 30 June 2018. Income is calculated using manager assumptions for each asset class – because of this, the returns quoted are estimated figures and are therefore not guaranteed. *Data calculated for representative Legg Mason Martin Currie Australia Equity Income (1), Real Income (2) and Diversified Income (3) accounts in A$ gross of management fee; gross performance data is presented without deducting investment advisory fees, broker commissions, or other expenses that reduce the return to investors. Assumes zero percent tax rate and full franking benefits realised in tax return.

The risk/return chart above examines how the major asset classes fare when the portfolio construction trade-off is redefined as expected income versus income risk (also known as the expected volatility of the income stream). Term deposits have deeply disappointed as the dramatic drop in interest rates over the past decade means that the volatility of the income offered is high and actually worse than the income volatility from emerging market shares. Australian shares and A-REITs do much better and these can be improved further by dedicated equity income strategies that target the companies that matter most to income investors – those with high dividends that are both sustainable in difficult economic conditions and are expected to increase in value over time.

Andy Sowerby is Managing Director at Legg Mason Australia, a sponsor of Cuffelinks. This article is general information and does not consider the circumstances of any investor. The opinions and views expressed herein are not intended to be relied upon as a prediction or forecast of actual future events or performance, guarantee of future results, recommendations or advice.

For more articles and papers from Legg Mason, please click here.