In 1991, the House of Representatives Standing Committee on Finance and Public Administration conducted an inquiry into print media, and billionaire Kerry Packer appeared before it. The committee pressed Packer on how little tax his companies paid, to which he replied:

“I am not evading tax in any way, shape or form. Now of course I am minimising my tax and if anybody in this country doesn’t minimise their tax, they want their heads read because as a government I can tell you you’re not spending it that well that we should be donating extra.”

The remarks went viral – or at least as viral as they could go back in those days. And love him or hate him, Packer had a point.

So, how can people legally minimize their tax?

Recently, I came upon a book by Dr Adrian Raftery, 101 ways to save money on your tax – legally! 2025-26. It offers helpful tips and strategies to reduce your tax bill.

Out of the 101 ways to save money on tax, I’ve chosen 13 that I think are most relevant to Firstlinks’ readers:

1. Family Trusts

The book suggests trusts are a great way to manage and preserve family wealth.

There are two main types of trusts used by families:

- Discretionary trusts: These are often set up either to hold property and investments on behalf of family members or to operate a business.

- Testamentary trusts: These are created via a clause in the ‘testament’ or will of an individual, but don’t get established until after the individual dies.

Trusts have the following benefits:

- Asset protection: Family assets may be protected from ‘creditors and predators’ in the event of bankruptcy and insolvency.

- Australia-wide: Can be operated in every state and territory.

- Flexibility: Can cater to a variety of beneficiary classes and investments, and different types of income can be directed to different beneficiaries.

- Don’t have same reporting requirements as company structures.

- Tax minimization: Income can be directed to family members on lower taxes.

While offering these benefits, it’s also worth noting that the cost of establishing and maintaining a trust can be high, especially if the assets involved are not worth much.

2. Negative gearing

Australians love to negatively gear investment properties (where expenses exceed rent received) though Dr Raftery isn’t a fan of the strategy. He says most people become asset rich and cash poor using negative gearing. And he says the tax benefit is usually only a small percentage of the loss incurred.

The only time that negatively gearing a property makes sense is when the capital growth of a property is greater than the negative cash outlay. And there are no guarantees that this is going to happen.

He suggests that when making an investment decision, you should follow the ‘ABC motto’ – Absolute Bloody Cashflow.

3. Co-ownership of your investment property

I include this as it’s relevant for many people though doesn’t get much attention.

Co-owners who aren’t running a rental property business are regarded as investors and must divide income and expenses for rental property in line with their legal interest in the property.

If they own the property as joint tenants then they each hold an equal interest in the property.

However, if you are carrying on a rental property business in partnership with others, then you must divide the net rental income or loss in line with your partnership agreement. One tip is that if it’s a partnership carrying a business, you may be eligible for generous small business concessions.

4. Dividends

I won’t go through the ins and outs of franked versus unfranked dividends. There are a few things to note about dividends and tax:

- Franked dividends paid to non-residents are exempt from Australian income tax, but they are not entitled to any franking tax offset for franked dividends.

- The timing of dividend payments can cause confusion. If a final dividend is paid in July or August yet the dividend statement says it is in respect of the year ending 30 June, the dividend should be declared in the following tax year.

- You may not be eligible for the franking tax offset unless you continuously hold shares ‘at risk’ for at least 45 days around, and including, the ex-dividend date.

- For dividend reinvestment plans, all dividends paid, in cash or shares, must be included in your tax return.

- If you receive bonus shares, they aren’t taxable on receipt but if you sell any received after 19 September 1985 you may have to pay tax on any capital gain and average out the cost base of your existing shares in the company.

5. Borrowing to buy shares

The book rightly points out that borrowing is a sound strategy in a rising market though it can multiply any losses in a falling market.

That said, by borrowing money to buy shares, you can claim a tax deduction for the loan interest, provided it’s reasonable to expect that dividends or capital gains will be derived from the share investment.

The benefit of the strategy is that, “interest expense should offset any dividend income received, resulting in franking credits that can be offset against other taxable income. Hopefully the shares increase in value under this strategy and any capital gains are only realised in a later year when the taxpayer is on a lower tax rate, for example, in retirement.”

One tip is that if you expect to earn lower income next year, you can prepay interest on your margin loan 12 months in advance before year end to maximise your tax deduction based on the higher marginal tax rate.

6. Other share deductions

- Travel expenses when visiting a stockbroker or AGM are fully tax deductible.

- Journals and publications: Payments for sharemarket information to help you manage your stock portfolio can be claimed against your investment income.

- Internet access: If you use the internet to manage your portfolio, the cost for that usage (not for other usage) will be deductible.

7. Inheriting share portfolios

If you get shares from a deceased estate, future dividends received are treated as normal income. The only exception is if a child under 18 gets income through a testamentary trust. Then, it’s taxed at adult rates instead of the high rates imposed on minors.

Normal capital gains tax rules apply, although there are some exceptions based on when the shares are inherited and when they were originally bought by the deceased.

The book offers helpful advice on tax planning before someone dies:

- “Use any capital losses that are accumulated or unrealised prior to death, as these cannot be passed on to beneficiaries.

- Bequeath share portfolios to beneficiaries on lower taxable incomes so that the tax paid on income and capital gains in the future are minimal and the capital is preserved for as long as possible.

- Of the estate is substantial and there are children under age 18 who are potentially beneficiaries, consider establishing a testamentary trust so they can access the favourable adult marginal tax rates.”

8. Employee share schemes

It seems more companies are giving employees the chance to participate in employee share schemes (ESS) by offering shares, rights or options at a discount.

If taxed upfront, the discount you get is assessable in the financial year you receive the ESS interests. You’re also eligible for a $1,000 reduction if your taxable income after adjustments is less than $180,000.

If tax deferred, and you get less than $5,000 of shares via salary sacrifice or there is a risk of forfeiture, the tax on any discount is deferred for a maximum of 15 years after you acquire the share/right.

Finally, options issued to employees of start-up companies after 30 June 2015 are taxed when they are converted to shares.

9. Self-Managed Super Funds (SMSFs)

SMSFs have many benefits. They can give you the freedom to decide how and where to invest your super funds.

They also have tax benefits. The maximum tax payable on contributions is 30% and only 15% for earnings. CGT on assets held more than a year is just 10%.

Earnings in the pension phase are not taxable, subject to transfer balance caps.

SMSFs aren’t suitable for everyone though. Administrative obligations can be onerous and annual fees for administration and accounting can range from $2,000 to $6,000 for an average sized fund.

Property is becoming increasingly popular in super funds and Dr Raftery says it makes a lot of sense. After all, why buy an investment property based on post-tax dollars, at as much as 47%, when you can buy based on 15%? Also, it’s better to pay 10% or even no tax on any capital gains rather than 23.5%.

Things to consider if you’re looking to own investment property in an SMSF:

- Home ownership: You can’t live in a property owned by your SMSF for private purposes.

- Related business leases: Commercial properties can be leased to a related business entity but only if there is a written lease in place.

- Costs. These will increase with having a property.

There are also benefits to holding shares in an SMSF. In the accumulation stage, an SMSF pays tax at a 15% rate. Any capital gains held for more than 12 months are taxed at just 10%. And once a pension is started, provided the balance is under $2 million as at 1 July 2025, a fund pays no tax at all on its income or its capital gains.

10. Transition to retirement

If you were over 60 years of age on 1 July 2024 you can begin a transition to retirement (TtR) pension and access up to 10% of your super each year tax-free to supplement your income. For those under 65 who are not retired, the earnings on the amount supporting the income stream will be taxed at 15%.

You can continue to work full-time if you wish while accessing up to 10% of your super each year.

If you’re 65 or over and you begin a TtR, you can salary sacrifice any surplus income back into super. This can save tax along the way and help accumulate more benefits for your retirement nest egg.

11. Account-based pensions

There is no requirement to withdraw all your super just because you turn a certain age. Some elect to convert up to $2 million of their super from the accumulation phase to the pension phase and start an income stream such as an account-based pension.

The bonus is that income streams receive favourable tax treatment.

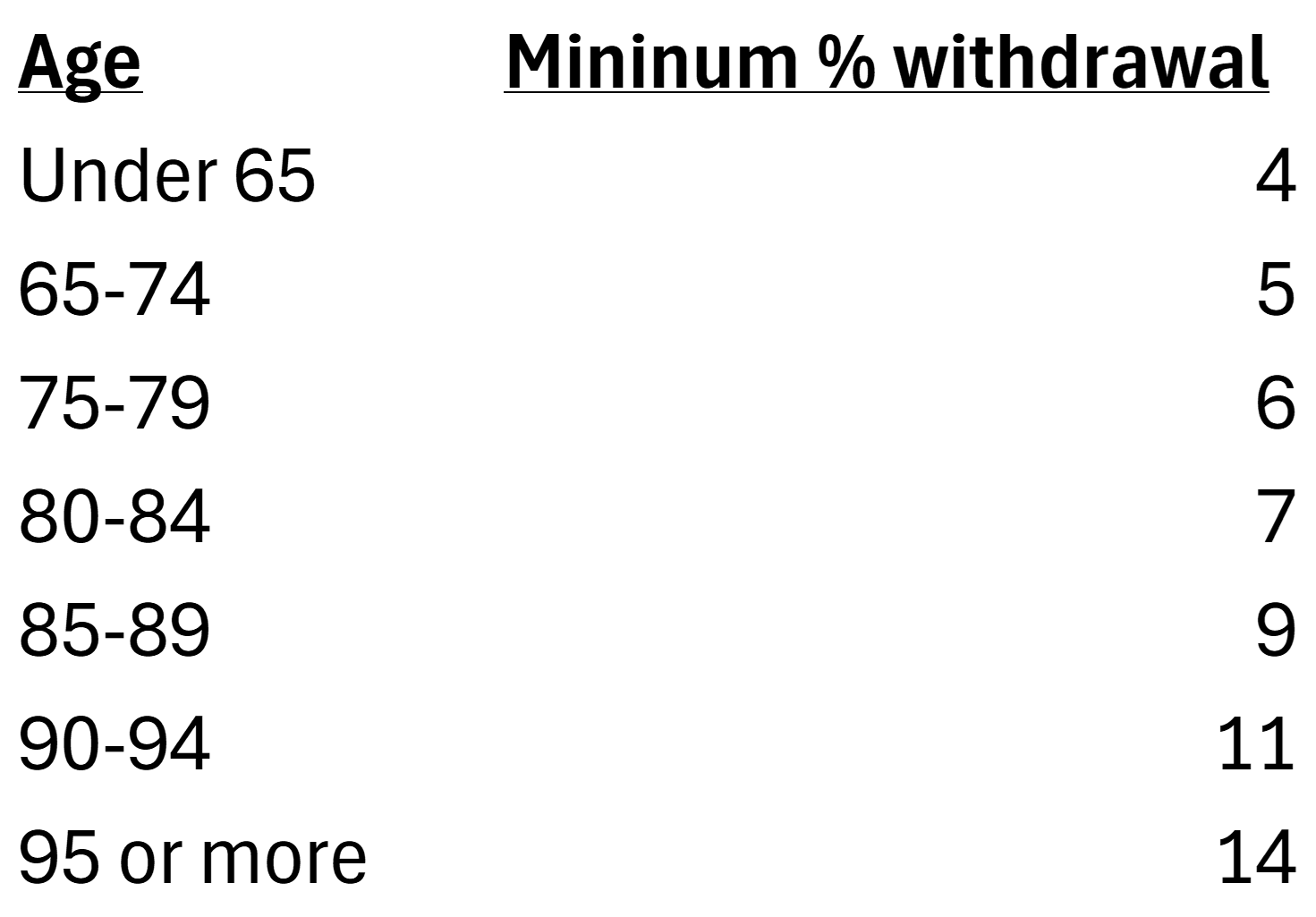

Once you start a pension or annuity, a minimum amount, based on your age, is required to be paid to you each year.

Minimum percentage age factors, 2025-26

Source: ATO, Dr Adrian Raftery

12. Death benefits

“… there are three things in life that are certain: taxes, death… and taxes on death!”

Premature death may mean a large payment to family members, particularly when life insurance is attached to the fund.

Super doesn’t form part of your estate. If you don’t put a binding nomination in place, the super fund trustee has discretion to distribute super benefits to anyone they wish.

If a death benefit is going to a dependant, like a spouse or minor children, then it can be paid as an income stream or as a lump-sum payment. Lump-sum payments to dependants are tax-free. But lump-sum payments to non-dependants are taxed at 17% on the taxed element and at a maximum rate of 32% for the untaxed element.

Unlike with many overseas countries, there is no inheritance tax in Australia.

13. Estate planning

Dr Raftery rightly points out the importance of having a valid will that is regularly updated. It’s not a set and forget process.

Dying without a will in place can potentially lead to an inequality in the distribution of an estate due to the higher rates of tax payable by some beneficiaries.

While death can be sudden, it is possible to do some planning before you die:

- “Use any capital losses that are accumulated or unrealised prior to death, as these cannot be passed on to beneficiaries.

- Bequeath share portfolios to beneficiaries on lower taxable incomes so that tax paid on income and capital gains in the future are minimal and the capital is preserved for as long as possible.

- If the estate is substantial and there are children under age 18 who are potential beneficiaries, consider establishing a testamentary trust so they can access favourable adult marginal tax rates.”

Super isn’t an estate asset and on death it doesn’t automatically go to the estate of the deceased. That’s why, as mentioned earlier, getting a binding death benefit nomination is vital. The nomination will be valid for three years. You can also get non-lapsing binding nominations that last indefinitely.

If you become the executor of a deceased estate, you need to do several things including notifying the ATO that you have been appointed executor, lodging a final date of death return plus any outstanding prior year returns for the deceased and lodging any subsequent trust tax returns for the deceased estate.

Final notes

I’ve only touched the surface of the many ways to minimize your tax. For more detail, I’d recommend reading Dr Raftery’s book. I’d also suggest Noel Whittaker’s book, Wills, death and taxes made simple.

If you need further advice, go see an adviser.

James Gruber is Editor of Firstlinks.