Whether for yourself or a family member, it’s never too early to start thinking about aged care. Planning ahead can help manage the transition from one life stage to the next and provide for an appropriate standard of living as well as a contingency for the unexpected.

The Australian Government subsidises a range of aged care services in Australia. One of the first steps in preparing for aged care is to determine if the person is eligible for subsidised care and what services they need. This process takes time so it’s best not to wait until the need is urgent.

After the assessment, if the individual is eligible, they will receive a support plan which outlines what services they can receive. This may include:

- Care at home – allows you to stay at home for as long as possible and maintain independence

- Residential care – provides continuous supported care ranging from help with daily tasks and personal care to 24-hour nursing care.

Changes coming to aged care from 1 November 2025

Between 2024 and 2044, there is expected to be a 68% increase in Australians aged 70 years. This will lead to an increased demand for both residential care and care at home[1].

With an increased reliance on aged care forecasted, the new Aged Care Act, which will be implemented from 1 November 2025, aims to address aged care funding issues and improve the viability and quality of residential care. The legislation focuses on older people accessing safe and high-quality care that meets their needs. The government will continue to heavily subsidise the cost of care, however there may be an increase in contributions for individuals with means above a certain level.

Let’s have a brief look at government subsidised aged care from 1 November 2025.

Care at home

From 1 November 2025, the Support at Home program will replace Home Care. The Support at Home system is designed to help older Australians live longer in their homes.

How much the individual contributes will depend on the services used and their assessable assets and income as determined by Services Australia.

The services available are classified into 3 categories:

- Clinical care, such as nursing and allied health. This will be funded by the government.

- Independence support, such as personal care, transport and social support. Individual contributions will be between 5% and 50%, depending on means.

- Everyday living, which includes services such as cleaning, meals delivery and gardening. Individual contributions will be between 17.5% and 80%, depending on means.

Transitional arrangements apply for Home Care recipients, or those in the queue or approved for a package at 12 September 2024. A no worse off principle will apply, with contributions set to ensure these people do not pay higher contributions than they were paying with Home Care.

Individuals who only need a low level of support to keep living independently may receive the Commonwealth Home Support Program. This program will eventually be merged into Support at Home.

Residential care

It is expected the older person will contribute towards the cost of their residential care if they can afford to do so. However, there are strong protections in place to make sure that care is affordable for everyone. The Australian Government sets the maximum fees for care and daily living expenses, and there are also rules about how much you can be asked to pay for your accommodation.

Contributions for everyday living costs

All residents pay a basic daily care fee, set at 85% of the basic rate single pension or currently $65.55 per day. Residents entering care from 1 November 2025 may also be asked to pay a hoteling contribution of up to $22.15 per day (indexed) which covers services such as catering, cleaning and laundry, depending on their means.

Contributions for non-clinical care

The legislation introduces a means-tested Non-Clinical Care Contribution (NCCC) which covers non-clinical care costs such as bathing, mobility assistance and provision of lifestyle activities. Residents with sufficient means, based on their assets and income, contribute until reaching a lifetime cap ($130,000 in total contributions, or after four years, whichever comes first). Clinical care costs in residential aged care will be fully funded by the Government.

Service providers may also offer access to higher quality services through an additional Higher Everyday Living Fee.

Accommodation costs

Once the cost for accommodation is agreed, the resident chooses how to pay. The choice between paying a lump sum refundable accommodation deposit (RAD) or a daily accommodation payment (DAP), or combination, is unchanged by the new legislation. However, there are some changes which impact RADs and DAPs.

In Australia, the average RAD payable is $470,000 but can be much higher for in demand locations. The RAD has its advantages, being government guaranteed and Centrelink assets test exempt. The balance (less applicable fees) is returned upon leaving the residence. For those entering aged care from 1 November 2025, the facility must retain 2% pa of the RAD, up to 10% over five years. Concessions may apply for a person assessed by the Government to be low-means.

The DAP is like rent or paying interest on a loan. It is calculated by applying the maximum permissible interest rate, set by the Government, to the applicable RAD. For those entering aged care from 1 November 2025, this interest rate is indexed to CPI twice yearly, which could mean an increasing cost.

The new rules don’t apply to everyone

Existing aged care residents in residential care at 31 October 2025 can continue to be assessed under the previous rules.

In addition, individuals who were receiving a Home Care package (or approved, or in the queue) as at 12 September 2024 who move into residential care after 1 November 2025 have their care fees assessed under the previous rules, unless they choose to opt in to the new rules. Their accommodation fees are assessed under the new rules from 1 November 2025.

The value of advice

Depending on your circumstances, there may be real value in seeking comprehensive financial advice when weighing up aged care options. A financial adviser can provide advice, including:

- Outlining the range of fees, determining which apply, and how they are calculated to estimate what you might need to pay

- Evaluating options and strategies for funding the accommodation payment

- Considering strategies to maximise age pension, generate sufficient cash-flow and minimise aged care fees

- Discussing the importance of estate planning.

Example

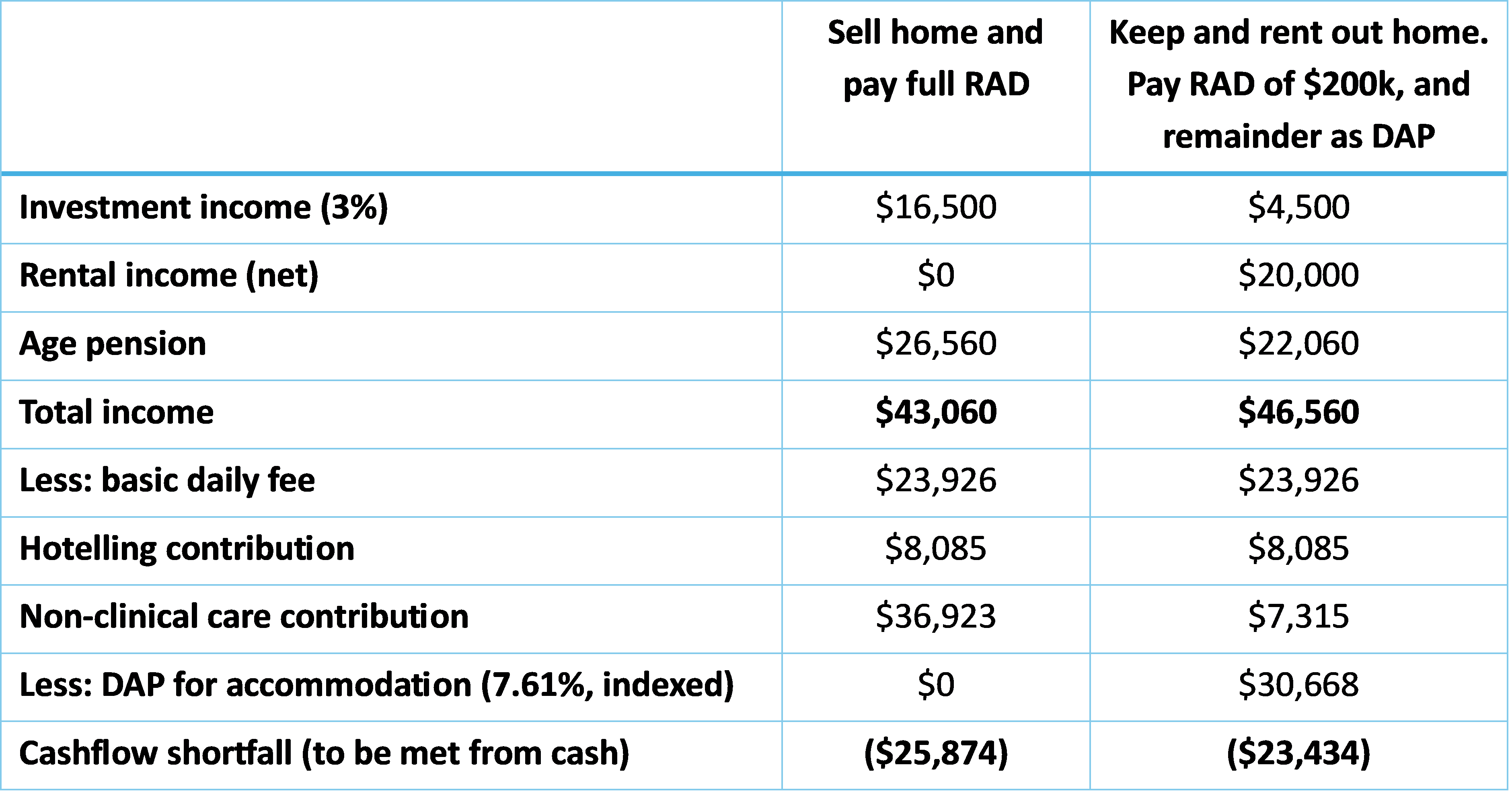

Betty, a widow, is moving into a residential care in November 2025. In addition to her home valued at $800,000, she has home contents ($10,000), $350,000 cash and receives Age Pension of $26,871 per annum.

She has been asked to pay a RAD of $600,000.

The table below compares two potential strategies and the impact on Betty’s fees and cash-flow in the first year:

Based on rates as of 20 September 2025

To determine which option is better, the adviser would need to look beyond one year and consider the knock-on effects of these strategies on Betty’s Age Pension, cash-flow, assets and ongoing fees. For example:

- If she sells her home, Betty’s Age Pension is higher and she doesn’t have to pay a DAP but she pays the full non-clinical care contribution.

- If she retains the home, it becomes assessable for Age Pension after 2 years, which may reduce her benefit. The DAP may also increase from inflation.

- Betty’s goals are important. Does she want to retain her home for emotional reasons? What about her estate planning goals?

Only by considering the full picture and comparing results can a decision be reached.

And don’t forget If Betty was receiving a Home Care package (or approved, or in the queue) as at 12 September 2024, her ongoing fees will be assessed under the previous rules.

Confusion, concern, and complexity are a common thread with aged care, so it is important to consider obtaining professional, financial advice. Planning ahead, including both estate planning and aged care planning, can make a difference.

The content of this article is based on information available as at 22 September 2025, which may be subject to change.

[1] https://www.health.gov.au/sites/default/files/2025-07/financial-report-on-the-australian-aged-care-sector-2023-24.pdf

Brooke Logan is a technical and strategy lead in UniSuper's advice team. UniSuper is a sponsor of Firstlinks. This information is of a general nature and doesn’t consider your personal circumstances. Before making decisions, you should consider whether the information is appropriate for your circumstances otherwise seek financial advice.

UniSuper Advice is operated by UniSuper Management Pty Ltd ABN 91 006 961 799 (USM), which is licensed to provide financial product advice. USM is also the administrator of the fund UniSuper ABN 91 385 943 850 (UniSuper). UniSuper Limited ABN 54 006 027 121 is the trustee of UniSuper.

For more articles and papers from UniSuper, click here.