The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Being a teenager in the early 1990s, I remember watching the budget movie that became a cult classic, Dazed and Confused. It followed a bunch of teenagers on their last day of high school, and how they were uncertain about their own identities and about the world. There was a lot of partying, and pot. Several of the young actors went on to bigger things, including Matthew McConaughey.

I was reminded of the movie after reading a new study by Macquarie University on how Australians’ views on housing influenced their voting patterns during the 2025 election. The study shows that almost everyone agrees that there is a housing crisis, yet no one can agree on the best ways to fix it.

Perhaps it shouldn’t come as a surprise that we’re so dazed and confused about the housing problem. After all, there’s a lack of genuine leadership on the issue, and enough vested interests to block any progress towards a national housing consensus.

But let’s dig into the study, which offers many fascinating findings.

Houston, we have a problem

The study is based on a survey of more than 1,000 voters and their attitudes to housing around the time of the 2025 election.

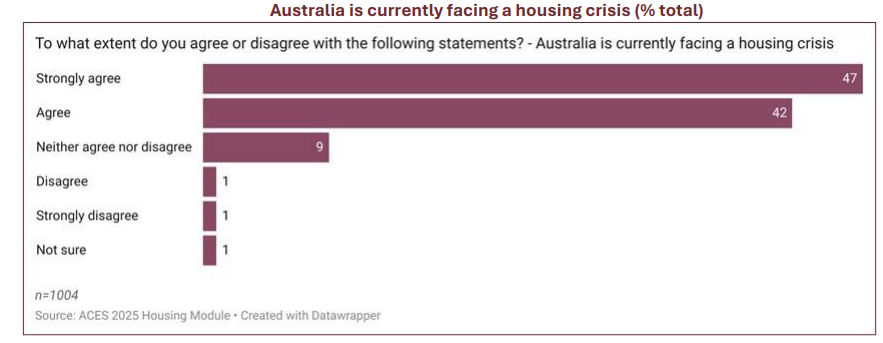

It found that there is almost universal agreement that Australia is facing a housing crisis. 89% of respondents agreed or strongly agreed that we currently have a crisis. That agreement went across all age groups, though it was strongest among renters and those under 35 years of age.

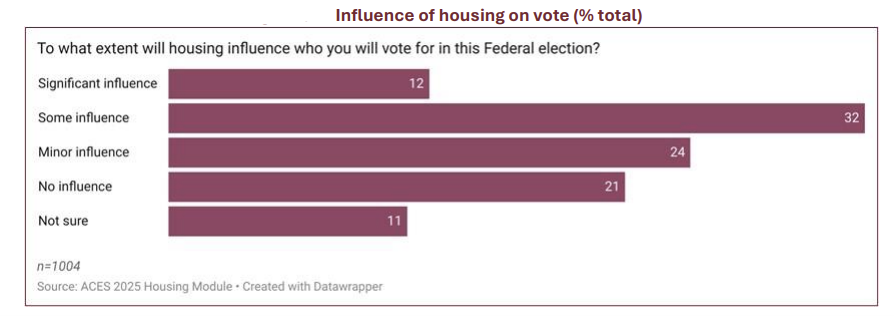

As to whether housing influenced their vote in the election, it was split between those who said it had some or a significant influence, and those who said it had a minor influence or no influence at all.

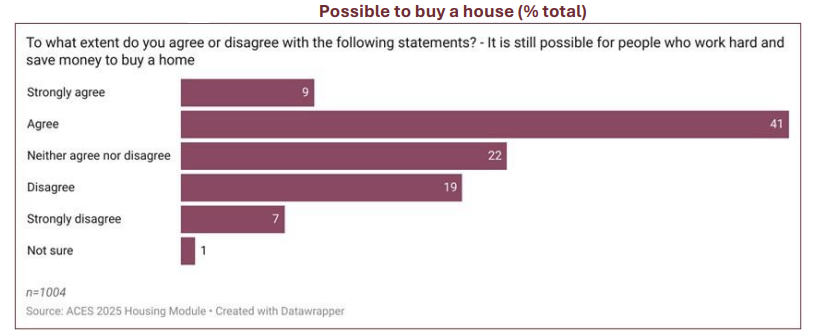

Interestingly, despite largely agreeing that there is a crisis, most respondents still believe that homeownership is possible if people worked hard and saved money. 50% of those surveyed agreed strongly with this notion and around a quarter disagreed. The support was strongest among those +65 years old, and Coalition voters; less so among the young and renters.

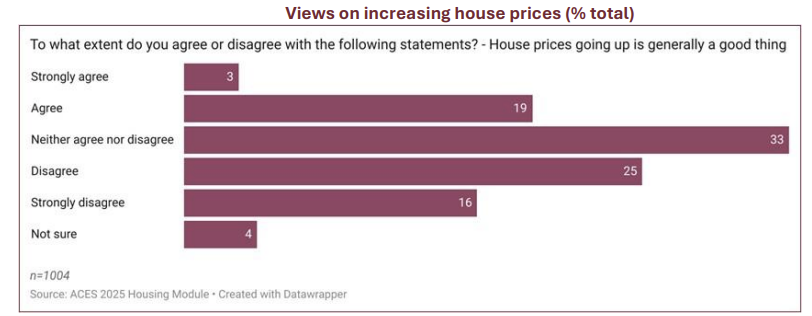

For a long time, conventional wisdom has been that rising house prices are a good thing – a broad market of achievement in an aspirational society. Yet, the study shows attitudes are changing.

Only 22% of respondents viewed rising house prices positively, while 41% frowned upon it.

The study indicates that there’s deep unease about high property prices, even among homeowners.

Causes for the crisis

So, what’s behind the housing crisis?

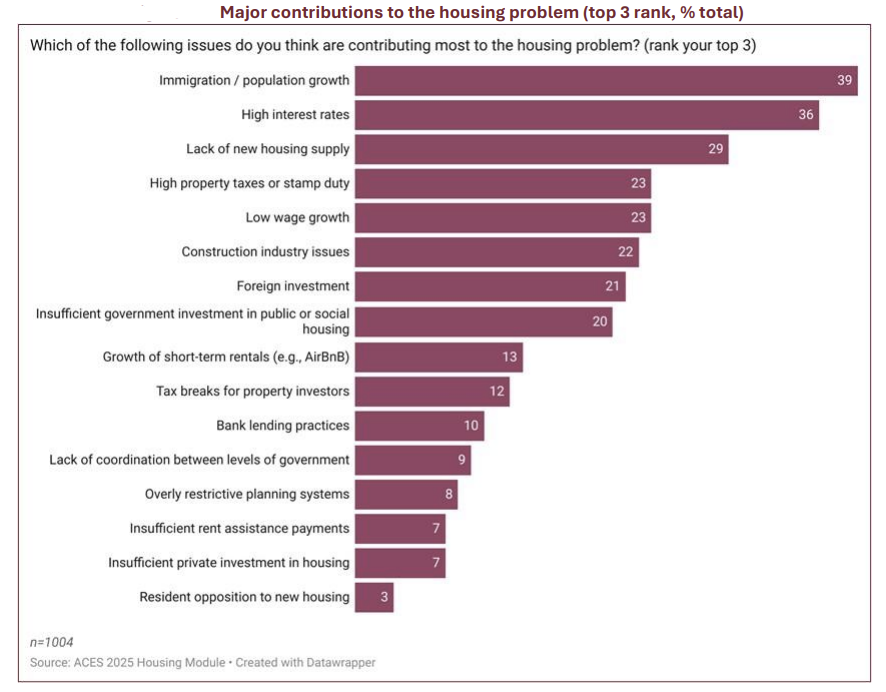

The survey participants were asked to rank their top three housing problems from a list of 16 options.

According to the respondents, the leading contributors to housing problems are immigration/population growth (39%), high interest rates (36%), lack of new housing supply (29%), and high property taxes or stamp duty (23%).

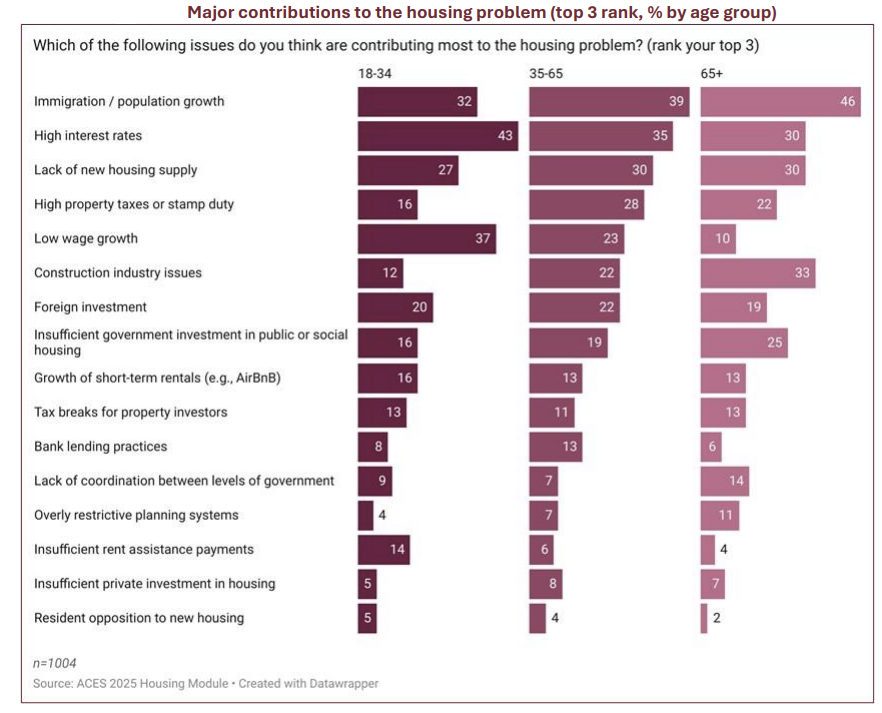

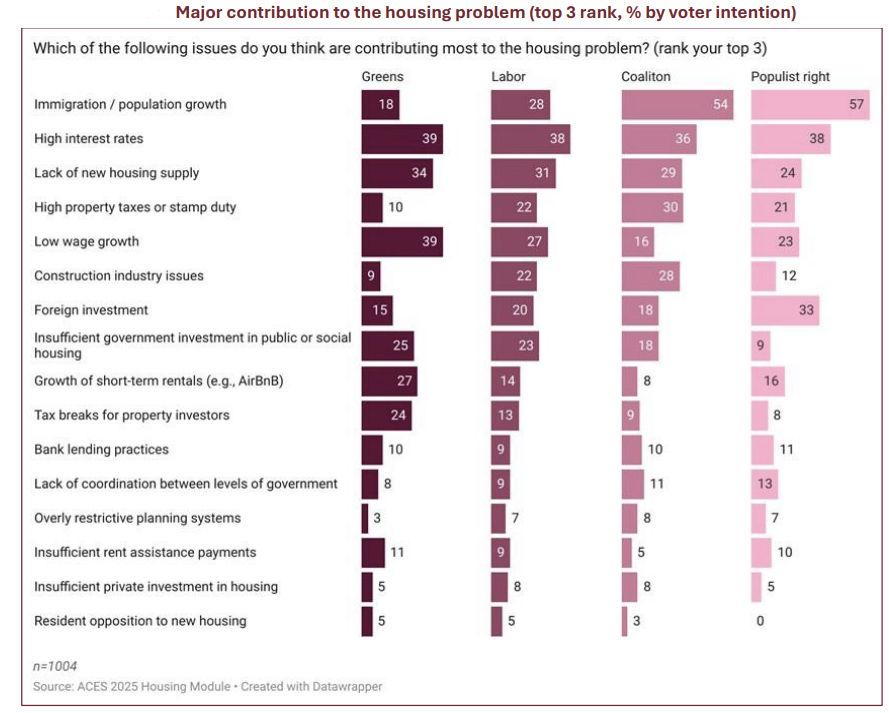

Yet answers were divided along generational and ideological lines. Younger Australians and progressives nominated high interest rates and low wage growth as key contributors to housing issues. Meanwhile, conservatives and populist right voters blamed immigration.

It’s curious that high interest rates are so highly ranked as a cause of housing problems. Rates aren’t high now – especially versus history. What it shows is that interest rates moving from near zero in early 2022 to a recent peak of 4.35% took a toll – not only for those who borrowed a lot to buy a house but also for those looking to break into the market.

The other curiosity is that planning restrictions aren’t higher on the list. Perhaps it shows that while Labor thinks it should be the priority, voters aren’t as convinced.

Solutions to the housing problem

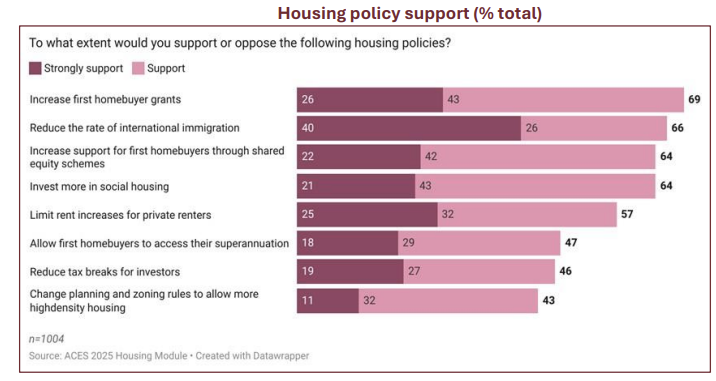

The study shows Australians support the following housing policies most:

- Increasing first homebuyer grants.

- Cutting international immigration.

- More support for first homebuyers through shared equity schemes.

These favoured policies are odd. It should be obvious by now that homebuyer grants just push up demand and increase property prices. From a selfish viewpoint, it makes sense to want more grants, though it makes zero sense as a broader solution.

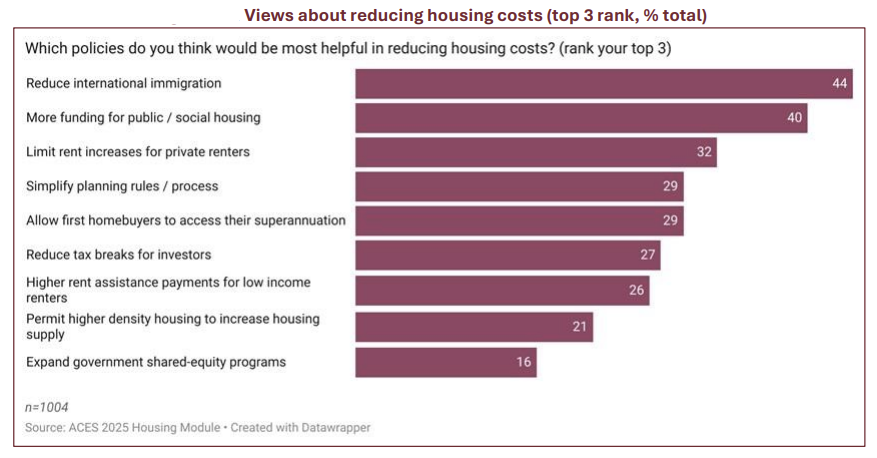

Asked about which policies would be most helpful in reducing house costs, the answers were different. Lower migration (44%), more funding for public/social housing (40%), and limiting rental increases (32%) topped the list.

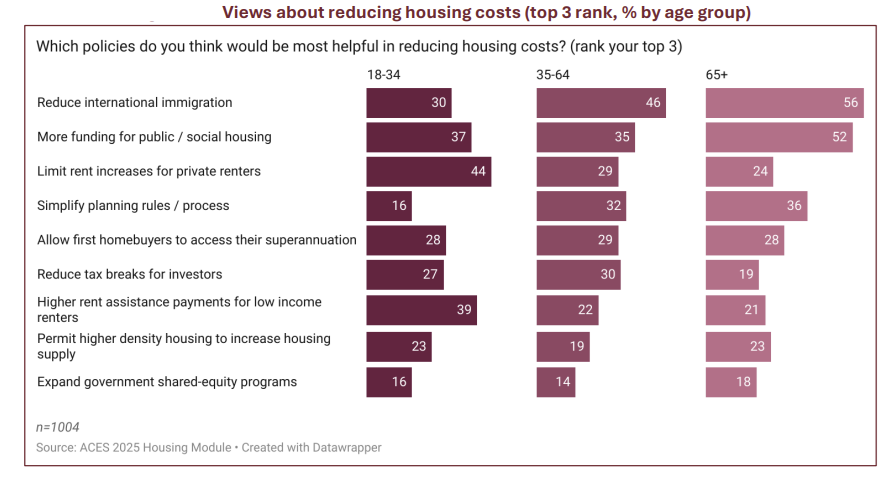

The young favour limiting rental increases and increasing rent assistance payments for low income renters, while cutting migration and more funding for public housing are the top choices for those aged 35+.

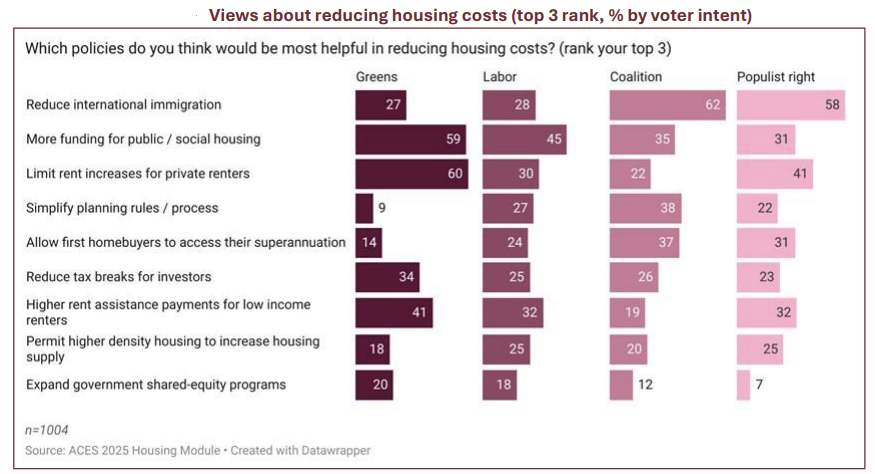

There’s also an ideological divide among Australians on the best solutions to lower housing costs.

Left leaning voters think more public housing and rental concessions are the answer, while they’re less of a priority for Coalition voters who want lower immigration and fewer planning barriers.

The biggest area of agreement across age groups and political affiliations is that we need more public housing.

How Labor won over voters

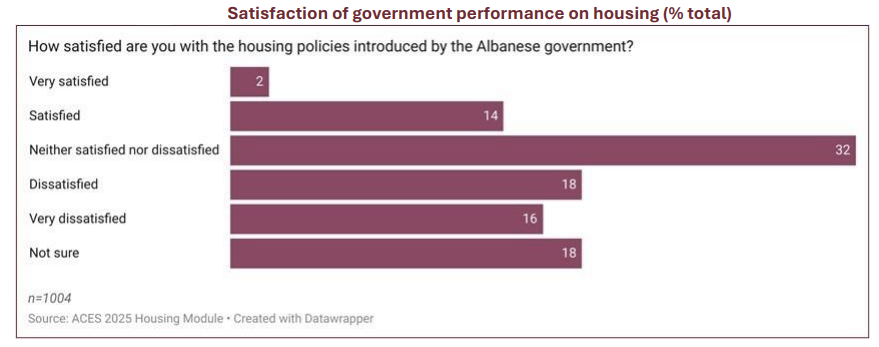

Almost everyone thinks there’s a housing crisis, and most aren’t happy with Labor’s policies to fix it. So, how did Labor score a landslide election victory?

The study says the Albanese government won because it put forward a platform that was modest and offended few:

“Labor may not have voters showering them with praise, but they have retained reasonable support across broad sections of society.”

The Coalition got obliterated partly because its policy to allow first home buyers to tap their superannuation gained little traction. And their voter base is now skewed away from those experiencing a growing housing crisis.

Final thoughts

The study concludes that if home ownership rates continue to fall, housing may emerge as an even more important electoral issue, driving more radical demands for policy change.

It suggests voters are still forming their views on housing. Most are open to arguments about supply, although not especially enthused. Many people across the political spectrum want more help for those trying to buy a home, and younger voters are keen for more assistance for renters.

My take is that this survey highlights widespread confusion among voters about the causes of the housing crisis and potential solutions to fix it. A lack of leadership has led to this confusion and divisions among the electorate.

Genuine leadership requires a genuine conversation about the role we want housing to play in our society and economy. It requires gaining a broad consensus on the best ways to solve the problem. And most of all, it requires courage from politicians to think big and be unafraid to take on vested property interests.

Recently, I wrote about some possible solutions to deal with the housing crisis.

****

In my article this week, I look at 13 legal ways to reduce your tax bill.

James Gruber

Also in this week's edition...

Australians are entering retirement wealthier than ever, but they’re also receiving more government support than ever before. This raises serious questions about fairness and sustainability in Australia’s tax and welfare system, according to Robert Breunig.

Despite many articles in Firstlinks on franking credits over the years, the topic continues to divide and confuse people. Jon Kalkman is our resident expert on franking credits and here he explains how they work, and how they impact both companies and shareholders.

Vanguard founder John Bogle taught investors that costs matter when building wealth - a lot. Yet, have we become too focused on costs, especially amid the relentless ETF fee war? Macro Torque thinks so, suggesting index design itself - not cost - may be the most powerful driver of returns.

As stock markets march upward, some investors worry about a possible correction or even a crash. Fidelity International's Tom Stevenson says that history shows the real question isn’t timing the top, but whether you have the time and liquidity to ride out inevitable downturns.

Australia is proud of its superannuation system yet our ranking in Mercer's global pension index continues to fall. What gives? Tim Jenkins and David Knox explain our shortcomings and what can be done about them.

Australia’s wine regions reveal a surprising truth: prestige doesn’t always equal property performance. Vanessa Rader says economic fundamentals like production volume, exports, and infrastructure often drive stronger growth in regional housing prices than reputation alone.

Two extra articles from Morningstar this weekend. Nathan Zaia looks at Westpac's ho-hum earnings result, and Johannes Faul examines whether Woollies offers investors a better long-term opportunity than Coles.

In this week's whitepaper, Neuberger Berman outlines its outlook for global fixed income and how it's pivoting to new opporunities in non-US markets.

***

Weekend market update

Reports of progress towards a deal to reopen the federal government helped stocks rebound back above unchanged on the S&P 500 from a 1.2% mid-day drop on Friday. Meanwhile Treasurys saw some modest curve steepening with muted outright moves. WTI crude marked time just south of US$60 a barrel, gold popped back above US$4,000 an ounce, bitcoin rebounded above US$103,000 and the VIX settled at 19 after topping 22 in late morning.

From AAP:

Australia's share market notched its lowest weekly close since in more than three months, with interest rate-sensitive stocks under pressure from an increasingly grim rates outlook. The S&P/ASX200 fell 0.66% to 8,769.7 on Friday.

An afternoon tumble in financials stocks wiped out an early lift for the bourse, with three of the big four banks in the red by the close, and investment giant Macquarie Group weighing heavily with a 5.7% drop after an earnings miss.

Westpac led the big four's losses, followed by CBA, which lost 1.5% to $175.91, while NAB was alone in bouncing higher after tanking 3.3% following disappointing financial results on Thursday.

Other rate-sensitive and highly leveraged sectors were under pressure, with IT stocks plummeting 2.3%, consumer discretionaries down 1.1% and industrials fading 0.9%.

Raw materials slipped lower, despite a long-awaited rebound for rare earths, as large cap miners tumbled in step with iron ore futures, which dipped below $US103 a tonne for the first time since September.

Weaker prices came amid softening demand from China's steelmakers, and with fresh concerns for the world's second-largest economy as exports unexpectedly fell in October after months of front-loading by US importers trying to get ahead of President Trump's tariffs.

Goldminers were mixed, with Evolution and Northern Star fading more than 0.5% while Newmont, Perseus and Ramelius notched gains.

Energy stocks grinded 0.5% higher with steady gains for fossil fuel producers but uranium plays still fall out of favour with investors.

The broad-based IT stock slump followed a tech-led sell-off on Wall Street overnight, so it was only fitting the dual-listed fintech Block Inc was the top-200's weakest performer, tanking more than 15% after an earnings miss.

Closer to home, IT stocks such as Xero, WiseTech, Technology One fell between 1.8% and 2.7%, while California-headquartered tracking software company Life360 slumped more than 3.5% to $46.64.

In company news, Qantas shares dropped 6.6% to $9.51 after leaning into the lower end of guidance for projected domestic revenue growth.

Nine Entertainment shares lost 1.8% to $1.12 after flagging advertising revenue was expected to remain soft heading into Christmas.

Looking ahead, Coles, Goodman Group, Downer, TPG Telecom and Domino's will hold annual meeting's next week, while ANZ, Orica, Aristocrat, Zero, GrainCorp and Infratil are among companies providing earnings updates.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

Monthly Investment Podcast by UniSuper

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website