“I do this for a living …” I plead in vain when confronted with the confident assertions of my be-suited friends in the big end of town mouthing off about residential property. Just because you are an expert bond trader, management consultant, CEO, banker or lawyer, doesn’t mean you know everything about residential property. I mean – do you live in a house? Yes, in fact you may have bought and sold a few over the years. You went to school too, but that doesn’t make you an education policy expert.

Yet with the same confidence – rightly earned, I don’t doubt – in their professional callings in other disciplines, I hear otherwise sensible people mouthing complete nonsense when it comes to residential property. And no amount of gentle prodding or even quoting clear quantitative evidence by me will shake their unshakeable certainty about their opinion.

So, with the Barmy Army in town, I shall borrow from their vernacular and rather than plead professional expertise, a 7-year veteran data science team, and decades of professional buying advisor experience, I’ll just say “bollocks” to all of that!

Myth 1: We’re in a debt funded bubble headed for another crash!

I’m sorry you must have mistaken Australian housing for some long-lost equities market somewhere. When you say, “another crash”, I want to ask, when was the last one? The GFC? Paul Keating and 17% interest rates? Yes and yes, I am confidently told.

In reality, even since before I was born, Australian house prices have never suffered a greater peak to trough loss than 12% – and that was hardly a “crash”. It happened over a leisurely two-year period from a frothy high to a modest low. The market recovered almost completely in the third year.

So, this frantic “blokes-jumping-from-buildings crash” period? It happened in mid-2017, until Bill Shorten and negative gearing were dispatched by the electorate in May 2019.

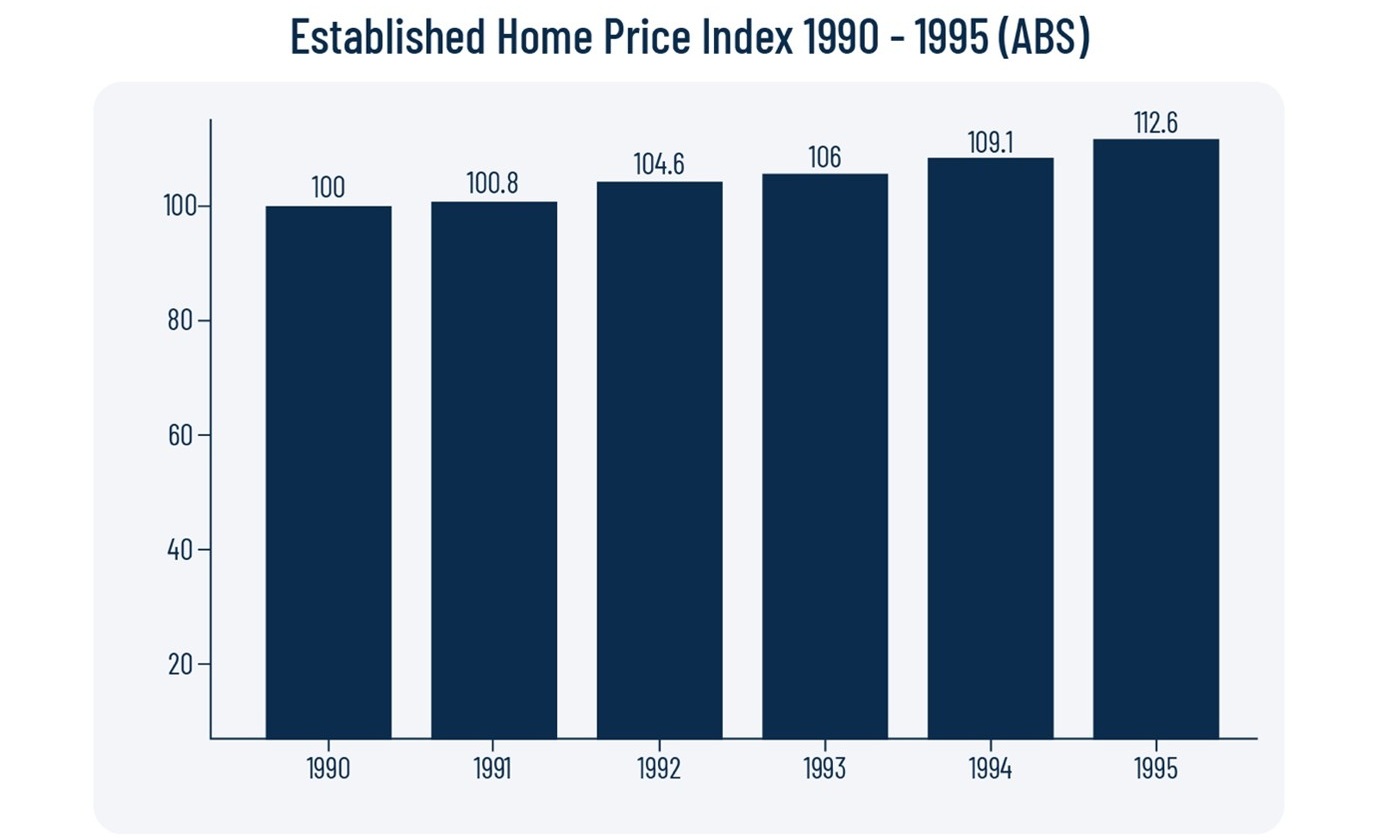

For the record, here’s the recession we had to have’s impact on property prices. See the “crash”?

Source: Australian Bureau of Statistics.

Don’t see it? Nor can I. But even this won’t stop my blow-hard experts telling me otherwise. “I do this for a living” is my plaintive reply.

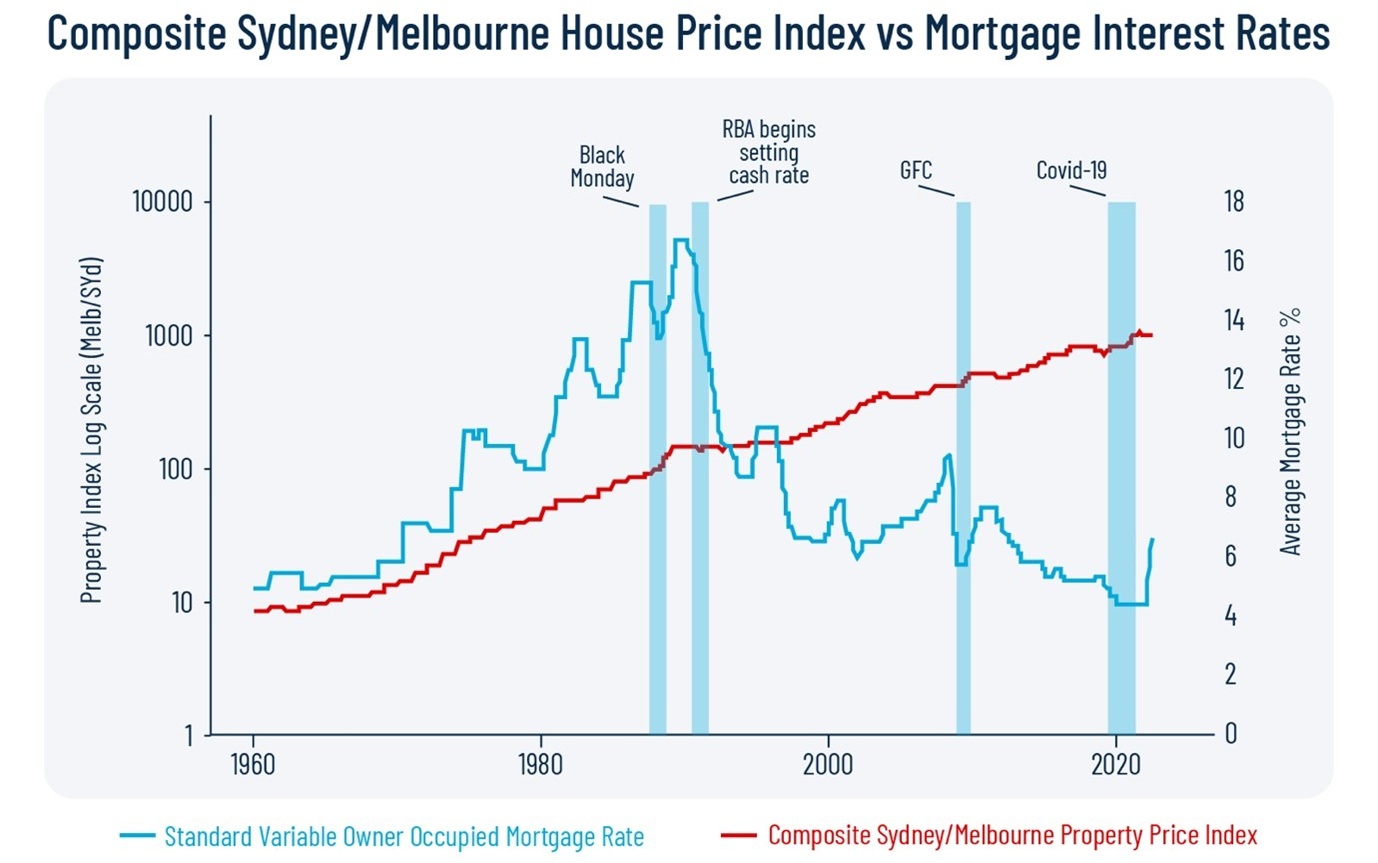

Speaking of “debt-funded bubbles”, in an asset class that is routinely between 21% and 24% geared, this seems unlikely. But that has never stopped the experts – starting with many major bank economists in the country – predicting blood in the streets when rates started to rise in 2023. “Bollocks,” we said. LongView and PEXA published a white paper called “What Drives Australian House Prices?”, which amongst other things included a graph any 12-year-old with Google could have produced in less than a minute:

Source: PEXA LongView White Paper No.1 “What Drives Australian House Prices Over the Long Term?” February 2021.

See the obvious correlation between interest rates and house prices? Nope. I can’t either. I’m not saying interest rates don’t have an impact. They do. But overall, it’s surprisingly modest.

As otherwise erudite rate/bond expert Christopher Joye confidently predicted in the AFR, “a 100 bps rise in interest rates will lead to a 15-25% drop in house prices”.

Umm… Did it?

So much for “debt funded bubbles” and “crashes”.

Myth 2: It’s all the fault of negative gearing

If only those greedy property investors weren’t fleecing the taxpayer, the sunlit uplands of housing affordability would re-appear… Bollocks.

Don’t get me wrong, I could take or leave negative gearing. I’ve seen it’s pernicious influence on unsuspecting buyers of rubbish high rise apartments being swooned into thinking that wasting a dollar to save 50c in tax will make them rich. I’d happily see it gone if only to save Mum and Dad investors from being fleeced by unscrupulous developers yet again.

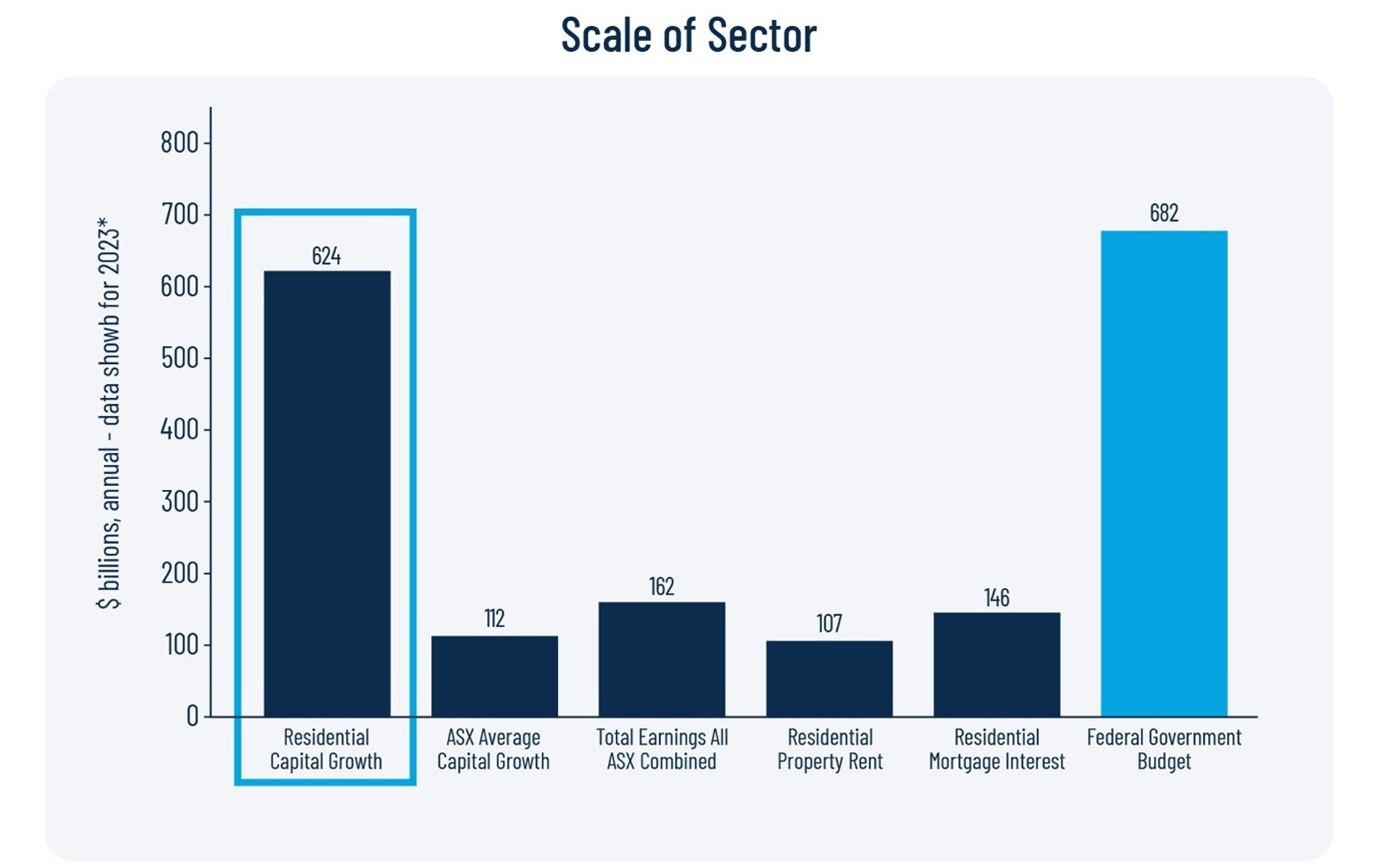

I spent nearly five years at McKinsey but the most important lesson I learnt was in the first two weeks – let’s separate the big numbers from the small.

Take capital growth in residential property: just the growth, not the underlying $12 trillion of asset value. Capital growth, just this year, and most other years, will be bigger than the entire Federal Government budget. Truly. 4-5x the size of all the earnings of every company on the ASX combined.

That is the speed and scale at which Australian housing is getting less affordable. Best part of $800 billion p.a.

Source: ABS; RBA D2 Lending and Credit Aggregates; ASX; Bloomberg; Australian Budget 2023–24. Data reflects a 6.5% interest rate and a median rent of $601. Residential capital growth includes realised and unrealised capital growth for all homes. ASX capital growth source: historical market statistics (asx.com.au). Average ASX capital growth shown for the period 2019–2023.

How on earth can a tax concession drive an $800 billion p.a. growth engine?

As even the modelling done by proponents of eradicating it will show, eliminating negative gearing may have a once-off impact on house prices of maybe 1-3%. They would then continue their generations long climb at 7.2% p.a.

I’m not making a political point. I honestly don’t care if it stays or goes. It’s just mathematically irrelevant. Although not politically irrelevant – if I could make one suggestion “of all the hills to die on, Bill, that one wasn’t worth it” – it would have changed nothing.

Myth 3: It’s the greedy landlords and speculators that are causing the housing crisis

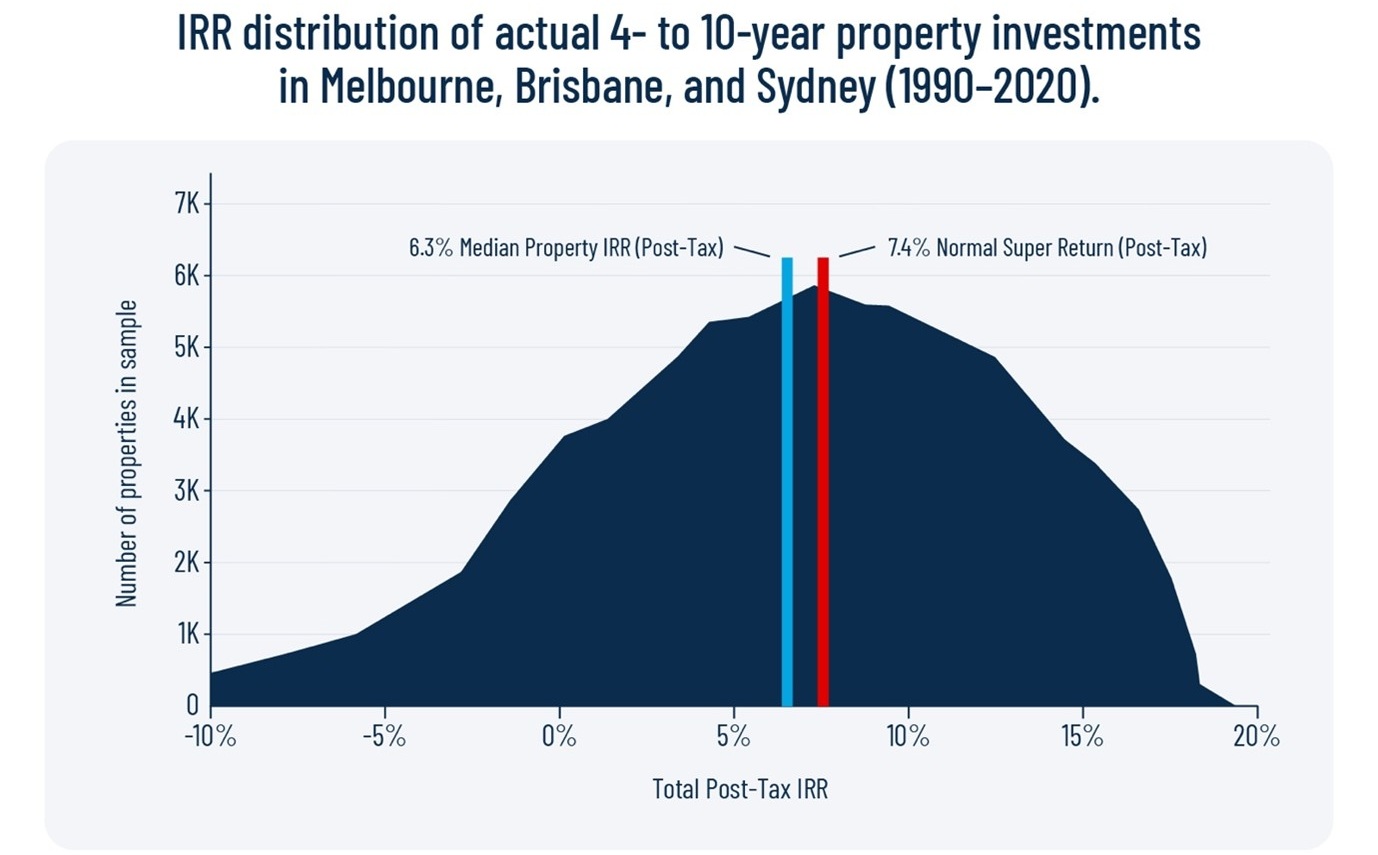

Well if they are, they’re doing a remarkably bad job at making money out of it.

As LongView and PEXA showed in White Paper #2, the average landlord is making an internal rate of return of just 6% p.a. on their money. They would have been better off putting it into a balanced super fund. Half of them made even less than that.

Source: PEXA LongView White Paper No.2 “Private Renting in Australia – a Broken System” March 2023.

So, I’m not saying there aren’t some very successful property investors out there. I’m just saying that, on average, those providing rental housing are doing so on a 6% p.a. return.

Undiversified. With volatile net income flows from maintenance, arrears, vacancy and taxes.

Really, being an individual investor in individual rental properties is generally a lousy way to make money.

Our business, along with its Funds Management arm, manages 4,000 rental properties for landlords. Almost without exception the following statement is true of those landlords: they made a better return on investment on the owner-occupied home they bought for lifestyle reasons than they did on the investment property they thought they were buying to make money. And that’s even before adjusting for tax.

Whenever I say that to a landlord client, it stops them in their tracks. You can see the cogs turning over and they reply, “I think that’s true for me too”.

Better quality assets deliver a better return. Land appreciates, buildings depreciate.

Who knew?

The $2 million family home almost always outperforms the $700K apartment bought down the road as an “investment”.

That’s why at LongView we say we “invest in dirt disguised as houses”. 81% of the value of our portfolio of homes is in the dirt underneath them. We call them RODWELLs – Robust Older Dwellings on Well Located Land. The sort of homes most of us live in.

So, most of the rise in house prices has nothing whatsoever to do with negative gearing or greedy landlords.

It’s to do with scarce urban land with family homes on it going up rapidly in value. Why? Because we have the second highest population growth rate in the world that we try to cram almost into the same big three urban centres.

Hence land values in good locations in those cities have been doubling every 8 years. For 100 years.

As Mark Twain said when counselling investment in land, “They’re not making any more of it.”

Evan Thornley is CEO and Co-Founder of LongView, an integrated residential property business focused on fixing Australia’s broken housing system. Evan is a technology and social entrepreneur who has been a property investor for 30 years in Australia and the US.