The new Demographia International Housing Affordability report doesn’t pull punches when it comes to housing affordability in Australia and globally.

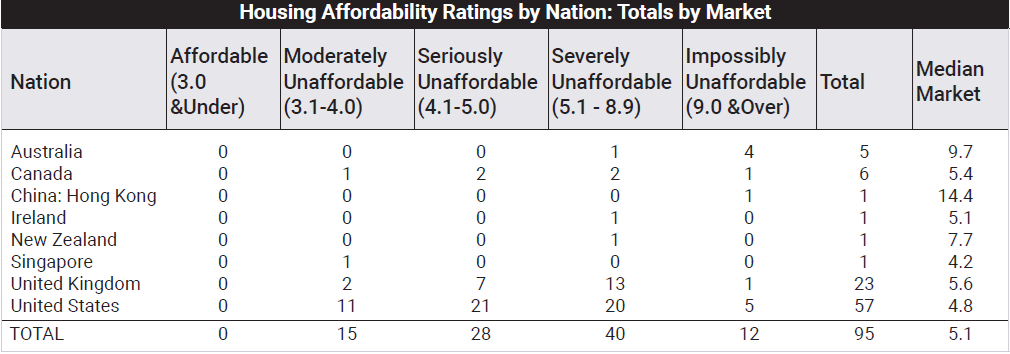

Launched 21 years ago, the report is considered a standard bearer when it comes to the cost of housing in developed markets. When Demographia released its first report, almost every major housing market (it covers 95 markets across eight countries) was deemed affordable. Now, not one of them falls into this category.

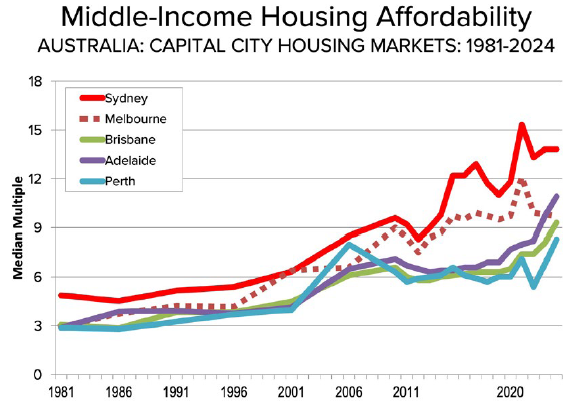

Australia is one of the least affordable for housing. The report says that we have one market, Perth, which falls into the 'severely unaffordable' category with a median house price to median household income ratio (median multiple) between 5.1x and 8.9x. And we have four other major markets – Sydney, Adelaide, Brisbane, and Melbourne – that are ‘impossibly unaffordable’, with median multiples of 9x or more.

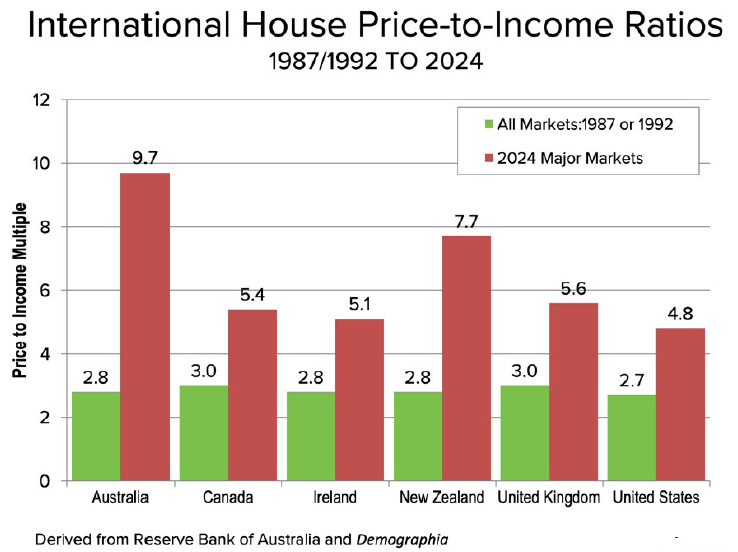

Australia is the second most expensive nation for housing, only behind Hong Kong. Note that our housing is twice as expensive as that in the US, and it’s well above the UK’s multiple of 5.6x.

In 1987, the median multiple for housing in Australia was 2.8x. Since then, that multiple has more than trebled.

All five of our major housing markets have become considerably more expensive over time.

We have become a world leader in expensive housing

We have five cities ranked in the top 14 most expensive housing markets in the world.

Sydney is in second place with a median multiple of 13.8x. It’s likely to take the mantle of the world’s most expensive market by next year. That’s because Hong Kong’s affordability is rapidly improving thanks to a depressed housing market there. In 2021, the median multiple on Hong Kong housing peaked at an astonishing 23.2x. That’s declined to 14.4x today and is expected to fall further over the next 12 months.

Amazingly, Adelaide is ranked as the sixth most expensive housing market in the world. To put this into context, Adelaide housing is more expensive than several of the major global cities, including London, New York, and Chicago.

Meanwhile, Melbourne continues to slip down the rankings as house prices stagnate and affordability improves. Its median multiple peaked at 12.1x in 2021, when it was deemed the world fifth least affordable market. Now at a multiple of 9.7x, it comes in ninth spot.

Brisbane’s housing is becoming more expensive, as is Perth’s. That means both are moving up Demographia’s list of the least affordable markets.

Where can you find cheaper housing?

The US, UK, and Canada have markets with much cheaper housing. Pittsburgh in the US ranks as the most affordable, with a median multiple of 3.2x. It’s followed closely by Cleveland, St Louis, and Rochester in New York. The fifth most affordable market is Edmonton in Canada, which is tied with Middlesbrough and Durham in the UK.

Why are there no ‘affordable’ cities to live in?

Why do none of the 95 markets fall into the ‘affordable’ category with a median multiple of 3x or less? And what’s happened over the past 40 years that’s led to exponential rises in house prices around the world?

Demographia puts the blame squarely on planning policies. It lambasts the so-called urban containment strategies of the developed world. It says planners have built boundaries around cities beyond which housing isn’t being built. Instead, the focus has been on densifying housing within city boundaries. Demographia thinks increasing density limits land supply and this naturally increases both land and house prices.

It says all the severely unaffordable markets follow the same urban containment model. The model was developed from the UK’s Town and Country Planning Act in 1947 and has since spread around the globe.

The report suggests planners should concentrate instead on building new detached homes on the fringes of cities. Only by increased land supply can land prices fall, and house prices with them.

As an interesting aside, the report notes that middle-income households are increasingly leaving expensive markets for more affordable places – a trend especially visible in the US and UK. It says these moves reflect long-term structural problems, and without major reform, this migration seems likely to continue.

Should Australia follow New Zealand’s lead?

The report lauds the housing policies of two countries: Singapore and New Zealand.

With New Zealand, its major city of Auckland has had median multiples drop from 11.2x in 2021 to 7.7x now. The report says the fall is a combination of improved incomes coming out of the Covid period and Government reforms that have started to impact land prices.

The Coalition Government elected in 2023 in New Zealand is opening up a large amount of land for greenfield development, consistent with promises made during the election. The Housing Minister, Chris Bishop, has noted that “our housing crisis is holding New Zealand back socially and economically,” and “we need more houses, and we need more greenfield development.”

The New Zealand Government’s ‘Going for Housing Growth’ program is seeking to ensure abundant development land within and around urban areas.

Demographia says these moves should prevent the artificial scarcity that has driven house prices so high under previous planning strategies.

James Gruber is Editor of Firstlinks.