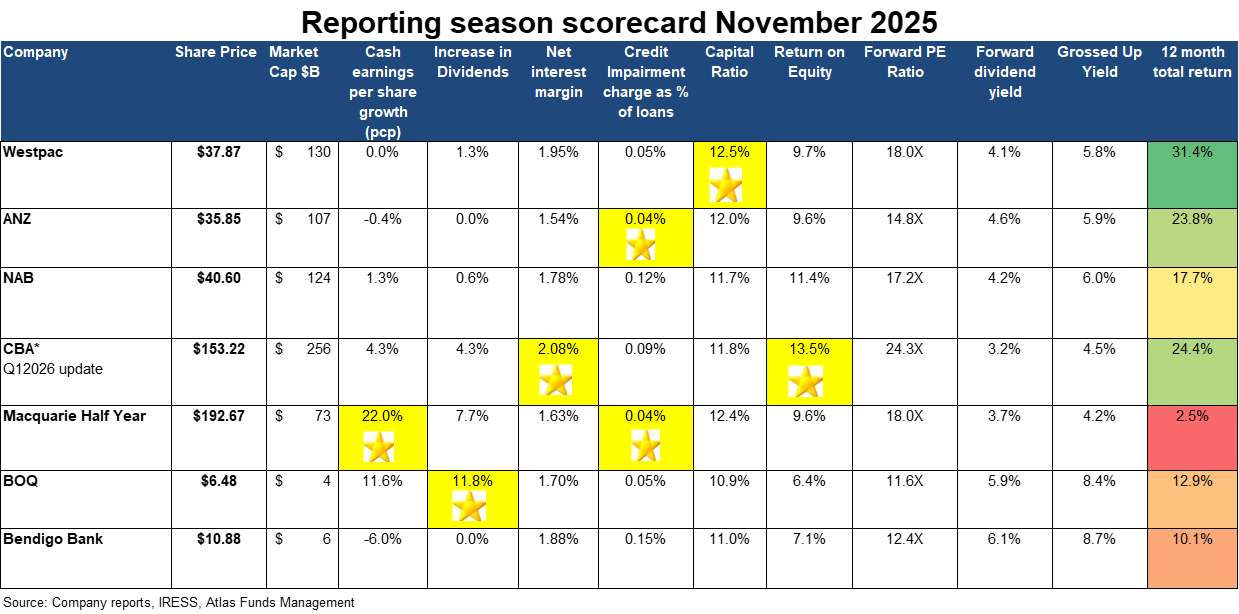

Unlike the past few bank reporting seasons, there was little trepidation from investors going into the November 2025 season. The last few bank reporting seasons had been very consistent, with a similar story of high margins, solid loan growth, strong capital, and minimal bad debts. An excellent position for investors with a large weighting to the banks, but infuriating for professional fund managers who sold down their bank exposures in early 2024 due to concerns about recession, rising bad debts, and valuation concerns, particularly in the case of the Commonwealth Bank.

However, the prophesied (and hoped for by those short the banks) doom and gloom for Australia's banks once again did not eventuate this November, with all banks growing dividends and again revealing minuscule bad debts. Since the start of 2024, the banks have gained by 58%, or 34% ahead of the ASX 200.

In this piece, we examine the major themes that emerged over this latest bank reporting season, as outlined in the over 700 pages of financial results released, including the regional banks, with awards based on their performance over the last six months. Even for investors who don't own the banks, examining their results closely provides a window into the financial health of Australia, which looks to be quite robust.

Bad debts remain extremely low

Bad debts have remained low across 2025, with all banks reporting extremely low loan losses. ANZ and Macquarie reported the lowest bad debts at 0.04% of gross loans, reflecting the continued discipline of banks in not writing loans at any cost. Across the rest of the banks, none reported bad debts exceeding 0.15% of gross loans.

The level of loan losses is important for investors, as high loan losses reduce profits and, consequently, lower dividends due to the resulting lower bank capital base. This reporting season has seen low bad debts translated into better-than-expected profits and, thus, higher dividends.

Bad debts remained low in 2025, with all banks reporting negligible loan losses; Westpac, Macquarie and ANZ reported the lowest level, with loan losses of 0.04%. To put this in context, after the 1992 recession, bank loan losses have averaged around 0.30% of outstanding loans, and banks price loans assuming losses of this magnitude. Similarly, sell-side analysts issue share price targets on the banks, assuming a reversion to losses at this level.

Atlas has observed that two factors have changed for banks, resulting in loan losses remaining at levels below the long-term averages.

Firstly, APRA (Australian Prudential Regulation Authority) implemented standards that increase the cost and reduce the bank's appetite for higher-risk lending, including some types of property development finance, particularly those projects with limited pre-sales. This is accomplished by requiring banks to hold more capital against higher-risk, less-secured loans compared to lower-risk, well-secured loans. While many bank management teams have trumpeted their current low loan losses due to ‘prudent lending’, we see that regulatory constraints have contributed to the current situation.

Secondly, the loans to risky developers, property syndicates, and troubled industrial companies that are currently impaired predominantly sit with non-bank lenders and private credit funds, rather than the big four banks. What we have seen almost weekly in 2025 are signs of stress in private credit funds, with various funds converting non-performing loans into private equity stakes and entering residential property development as loans went sour. While an APRA-regulated bank would have to declare this as a bad debt, private credit funds have been slow to record these as losses, characterising the move as a ‘pivot’ in investment strategy.

Indeed, last week, ANZ announced in its results that it is expecting long-run loss rates of 0.11%, a significant step down from the 0.23% it expected in 2008. While these percentages sound small when spread across loan books between $700 billion and a trillion dollars, this will result in expected bank profits being higher by several hundred million dollars, as expected losses don't eventuate.

Margin resilience

Net interest margins are always a major topic during the banks' reporting season, with most investors going straight to the slide on margin movements in the immense Investor Discussion Packs. Banks earn a net interest margin [(interest received - interest paid) divided by average invested assets] by lending out funds at a higher rate than borrowing these funds from depositors or wholesale money markets. Small changes in a bank's net interest margin can have a material impact on profits when spread across a large loan book. For example, in the case of Westpac, a 0.01% move, or one hundredth of one per cent, equates to an $86 million impact on profits.

Typically, Westpac and Commonwealth Bank enjoy a higher net interest margin than ANZ and NAB, due to their higher weighting in mortgages, compared to the Melbourne-based bank, which focuses on business lending. Generally, lending to homeowners results in a higher net interest margin than lending to businesses, which can often turn to global banks for their borrowing needs.

In November, interest margins remained relatively steady, reflecting a stable interest rate environment and rational pricing among banks for loans and deposits. Both NAB and Westpac saw higher net interest margins in the second half of 2025.

Business banking to drive returns

NAB's results show solid business banking growth, but its banking rivals are circling with their own strategies to chip away at NAB’s SME and business banking dominance. NAB's entrenched business banking position may appear like a fortress at the moment, but it could quickly become a well-fortified cul-de-sac.

Westpac has stepped up its lending to businesses and institutions, with each sector growing by 15% and 17%, respectively. The majority of the lending comes from existing companies. While this growth may appear to be risky lending, Westpac is focusing on lending to industries that have historically had a better track record of repayments, such as health services, professional services, and agriculture. On the other hand, ANZ is focusing more on cross-border transactions, leveraging its presence in the Asia-Pacific region, which benefits businesses with importing or exporting operations. New CEO Nuno Matos highlighted in his first annual report that ANZ has an opportunity to continue growing its position in the institutional market and increase market share. In November, we were pleased to see the growth in Westpac's business lending.

Highly capitalised banks

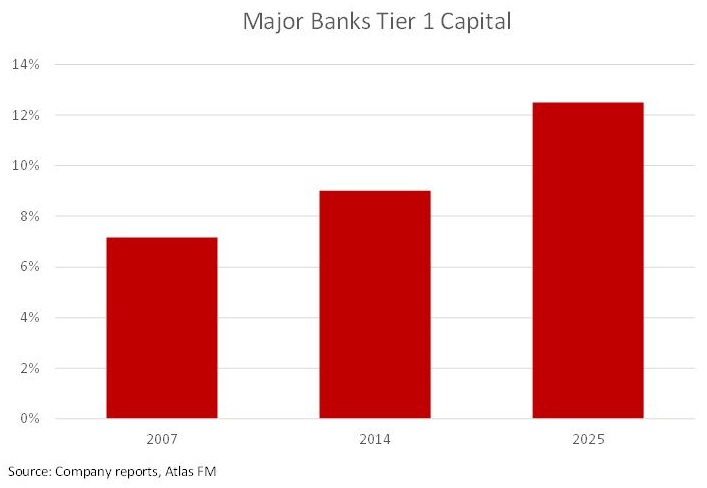

The capital ratio is the minimum capital requirement that financial institutions in Australia must maintain to weather potential loan losses. The bank regulator, APRA, has mandated that banks hold a minimum of 10.5% of capital against their loans, significantly higher than the 5% requirement pre-GFC. Requiring banks to hold high levels of capital is not done to protect bank investors but rather to avoid the spectre of taxpayers having to bail out banks. In 2008, US taxpayers were forced to support Citigroup, Goldman Sachs, and Bank of America, while British taxpayers dipped into their pockets to prevent RBS, Northern Rock, and Lloyds Bank from going under. The Australian banks were better positioned in 2008 and did not require explicit injections of government funds; the optics of bankers in $3,000 Zegna suits asking for taxpayer assistance are not good.

In 2025, the Australian banks are all very well capitalised and have seen their capital build. This enables banks to return capital to shareholders through on-market buybacks and increased dividend payments. While the banks have not been actively buying back their shares recently, the ongoing buybacks serve as a sort of floor in the share price, with the banks stepping back into the market to purchase shares when the share price falls below a certain threshold. Indeed, CBA's $1 billion market buyback last bought back a share on November 15, 2024, at $151.

In December 2024, APRA announced that additional tier 1 capital (bank hybrid notes) would be phased out of bank prudential frameworks. This will not be a large problem for the big banks, with all of them finishing the half with over 12% capital ratio. As many of these hybrids had franking credits attached to their coupon payments, the phasing out of hybrids sees franking credits build on bank balance sheets. Winner in November, the Australian banking oligopoly.

Regional banks

The regional banks received a single star, with the Bank of Queensland (BOQ) being the only recipient, for increasing dividends by 12% for its shareholders. However, this star comes with an asterisk, as BOQ cut the dividend by 11% in 2023 and a further 17% in 2024. Consequently, the regional bank's 2025 dividend remains below what it paid in 2022. This compares unfavorably to the big banks that have consistently maintained or increased their dividends. Over the past decade, the regional banks have not seen many stars awarded to them due to their competitive disadvantage.

In Australia, the big four banks dominate the market with a combined market share of 74%, following ANZ's acquisition of Suncorp Bank. The closest to breaking into the market is Macquarie, with a 6.5% market share, followed by the two regional lenders, BOQ and Bendigo Bank, with a 3% market share each.

As we can see in the bank matrix at the top, the Australian regional banks did not win a single star, minus the dividend increase. This is due to having a higher capital cost than the big banks, as wholesale funders require higher coupons on their bonds to offset the higher risks associated with them. Additionally, the regional banks have limited access to the large pools of corporate transaction account balances that have historically paid minimal interest rates. To remain competitive against lending products from major banks, regional banks must accept a lower net interest margin across their loan book, resulting in lower returns on equity.

Our take

Overall, we are happy with the financial results from the banks. Westpac, ANZ and Macquarie either maintained or increased their dividends, with the market expecting ANZ's new CEO to usher in a rebasing of the dividend lower.

All banks demonstrated solid net interest margins, low non-performing loans, and effective cost control. In 2026, the banks will all have cleaner loan books, more consistent earnings and a greater margin of safety than they have had in the past. In a turbulent world with weekly changes in trade policies, Australia's major banks are likely to continue positively surprising the market, operating in a small oligopolistic market, sheltered from both new competition and global storms. Atlas has been more optimistic towards the banks than most fund managers over the past few years, which has been positive for our investors. However, given current valuations and portfolio construction constraints, we are likely to reduce our holdings.

Hugh Dive is Chief Investment Officer of Atlas Funds Management. This article is for general information only and does not consider the circumstances of any investor.