AI has been the story of the past few years in markets. It’s an AI rush, and like the gold rush that occurred in the 19th century, those who are winning are not who you would expect.

In the mid-19th century, California was home to the gold rush. People from all over the world made their way to Northern California and the Sierra Nevada Mountains in search of their fortune. History has shown that the financial winners of the gold rush were not necessarily those who discovered deposits on their plot, but rather those savvy entrepreneurs who sold the equipment, such as picks and shovels, to a massive, growing market.

There is a new ‘’rush” in California: AI. And many of those companies making their fortunes are not AI companies, but rather those that supply what the AI companies demand: Electricity. For investors, this may be an opportunity.

But first, let’s have a quick look at what happened in California in the 1800s.

The old 49ers

San Francisco’s NFL team is called the 49ers. The name harks back to the mid-1800s gold rush. The ‘49ers’ was the nickname given to the prospectors from around the world who flooded California in search of gold in 1849. The team's original logo depicted a gold miner.

Exhibit 1: San Fransico 49ers logo 1946 to 1968

Before the gold rush, California’s population was estimated to be around 160,000 people. Between the time of the 1848 discovery of gold at Sutter’s Mill (about 80 miles east of Sacramento) and 1855, 300,000 additional people arrived in California.

San Francisco, which had a population of around 1,000 before the gold rush, grew to 50,000 by 1856.

One of the interesting outcomes of the rush was that many of those who made fortunes because of the discovery of gold in California were not miners; rather, they were retailers. Samuel Brannan, the wealthiest man in California during the early years of the rush, is an example of this. His business model was simple - he opened stores around the gold fields and sold supplies, such as picks and shovels, to miners at a hefty premium.

The new 49ers

Today, Silicon Valley, near San Francisco, is home to many technology companies involved in the current AI boom. We think it’s not only the companies involved in AI that will benefit from the AI rush, but also those companies that provide the ‘picks and shovels’ supporting AI.

Electricity is one such need AI companies have, and surprisingly, nuclear energy is stepping in.

Last year, Bloomberg reported that Microsoft had agreed with Constellation Energy to restart a nuclear reactor at Three Mile Island, which has been inactive since 2019. This is a good example of the potential ‘picks and shovels’ that the energy sector can provide to the AI rush.

Constellation Energy will invest US$1.6 billion to revive the shuttered Three Mile Island nuclear plant in Pennsylvania, with the agreement to sell all the output to Microsoft as the tech titan seeks carbon-free electricity for data centres to power the AI boom.

The decision is representative of the surging interest in uranium as power demand for AI soars, we think. More than a dozen reactors were deactivated over the past decade as competition from cheaper natural gas and renewable energy heated up.

However, uranium and nuclear energy are now being reconsidered because of the increasing electricity demands fuelled by AI and the global push towards net-zero emissions.

Nuclear is considered a reliable, low-carbon option, and stronger regulatory support has sparked a renewed interest in nuclear energy.

Key forces powering the nuclear renaissance - demand

Firstly, the rising electricity demand to support the vast energy needs of the AI boom has been a significant factor in the revival of nuclear energy. According to a report by the International Energy Agency in late 2024, global electricity demand is projected to surge through 2025 and beyond, led by emerging economies such as China and India. This increase is fuelled by trends such as AI, electric vehicles, cryptocurrency, and the growing impact of heatwaves.

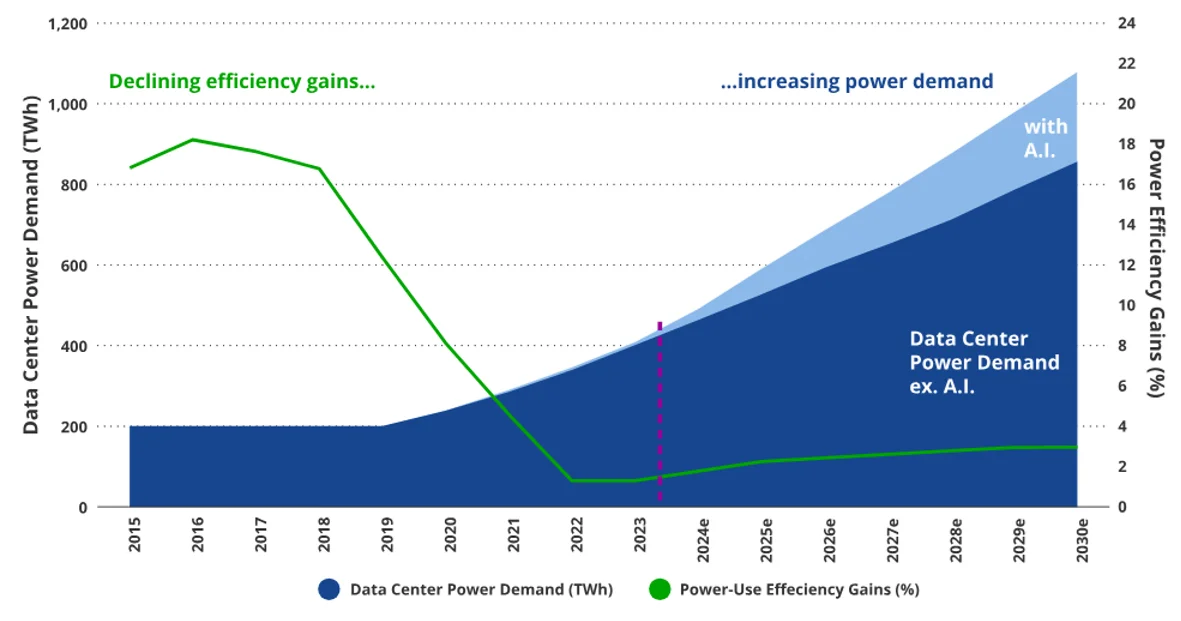

Exhibit 2: Increasing data centre power demand with decreasing efficiency gains

Source: Goldman Sachs; (via Masanet et. al, 2020, IEA, Cisco and Goldman Sachs Global Investment Research), 2024. For illustrative purposes only.

Key forces powering the nuclear renaissance – low carbon output

In addition, nuclear energy is known to be a reliable, clean energy source. Global efforts to reduce greenhouse gas emissions by building out renewable energy capacity have, by many accounts, fallen behind schedule. This has raised the profile of existing nuclear facilities and new construction as important components of the global energy transition.

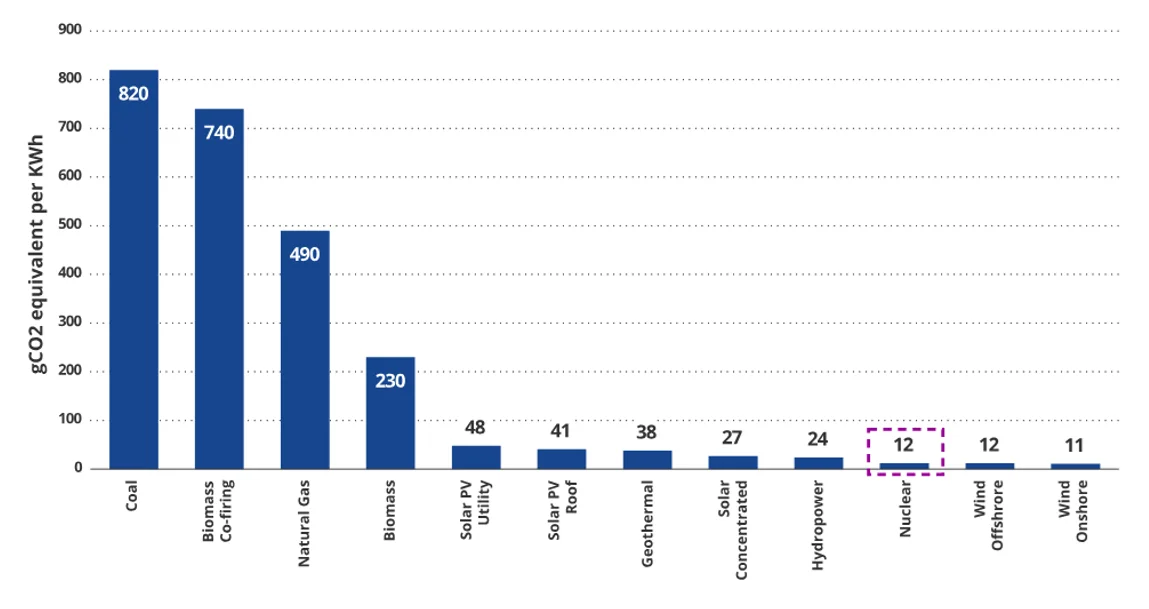

Uranium-powered nuclear energy has lower emissions compared to some renewable energy sources, and there are no limits on when nuclear facilities can generate power. Unlike wind and solar energy, which face the hurdles of calm winds and dark skies, nuclear can provide consistent and reliable power.

Exhibit 3: Nuclear emits less carbon during its life cycle compared to many renewable energies

Source: World Nuclear Association, Intergovernmental Panel on Climate Change. For illustrative purposes only. Based on total lifecycle emissions, June 2025. For illustrative purposes only.

Key forces powering the uranium renaissance - regulatory

Uranium-powered nuclear energy used to be shunned by governments and environmentalists. The fear of nuclear accidents was a key deterrent to countries exploring this source of energy. Additionally, operating a nuclear plant is expensive without government subsidies.

However, in recent times, there has been increased regulatory support from many governments. Many have reversed their stance or affirmed their commitment, recognising the critical importance of nuclear energy in the power mix.

For example, the US has reversed course by choosing to extend the life of several nuclear power plants that were set to be decommissioned. Recently, the US Nuclear Regulatory Commission renewed the operating licenses at the North Anna Power Plant in Virginia, extending their operating lifetime by 20 years to nearly 2060. This trend is evident in many regions of the US.

More surprisingly, in the US, in the run-up to last year’s Presidential election, both nominees ran pro-nuclear campaigns. Notably, the Biden Administration released a roadmap to deploy 200 additional gigawatts of nuclear energy capacity by 2050.

Since winning, President Trump has issued a series of executive orders aimed at quadrupling US nuclear capacity to 400 GW by 2050 from approximately 100 GW today. His executive orders also focused on expediting nuclear licensing by placing time limits on the Nuclear Regulatory Commission’s licensing review process. His orders also seek to address America’s lack of domestic uranium enrichment and processing capability. The US and much of the world have become dependent on a select few countries, namely Russia, for enriched uranium.

These executive orders supported the nuclear energy ecosystem, providing investor confidence across the supply chain and raising the prospects of increased investment in nuclear capacity across the board.

In Japan, despite the Fukushima disaster being fresh in their collective memory, Japanese leaders have begun taking steps toward expanding nuclear capacity. In late August, Prime Minister Fumio Kishida announced plans to hold a ministerial meeting to discuss measures needed to restart existing reactors at a Tokyo Electric Power Company facility.

Other countries that have begun to show support include China, Switzerland, India and Norway.

We think this is an opportunity for investors.

Brad Livingstone-Foggo is Head of Marketing – Australia at VanEck, a sponsor of Firstlinks. VanEck recently launched its Uranium and Energy Innovation ETF on the ASX (URAN). This is general information only and does not take into account any person’s financial objectives, situation or needs. Any views expressed are opinions of the author at the time of writing and is not a recommendation to act.

For more articles and papers from VanEck, please click here.