Valuations in listed infrastructure haven’t yet responded to higher earnings forecasts or the influx of private suitors for high quality assets in the sector. Seeking answers, portfolio manager Jessica Jouning and analyst Sophie Smith from First Sentier Investors’ global listed infrastructure team hit the road.

In a recent research trip to the US, Jouning and Smith touched ground in eight different states and met fifty infrastructure management teams, regulators and customers from the utility, railroad, waste management, energy midstream and data center sectors. One of the team’s biggest takeaways was that utilities are at a significant turning point on the demand front.

Demand for electricity has inflected up

After decades of flat electricity demand for US utilities, the industry is now seeing unprecedented demand as growth in data centers and artificial intelligence (AI), electrification, onshoring and electric vehicles outweighs energy efficiency gains. One utility executive stated: “Seeing all these customers wanting 24/7 load and willing to pay for it – it is every utility’s dream”.

Demand is expected to accelerate as the AI rollout continues. Employees we met at a data center in Atlanta, Georgia, one of the five epicentres of the current data center boom, highlighted that the pace of leasing demand growth is “astounding”.

All capacity currently under construction (425 megawatts / MW) is already sold out to 2027. In terms of how AI is boosting that demand, they said: “An average customer wants power density of 14-17 kilowatt-hours (kWh3). An AI customer now wants 70 kWh”. Effectively, a five-fold increase.

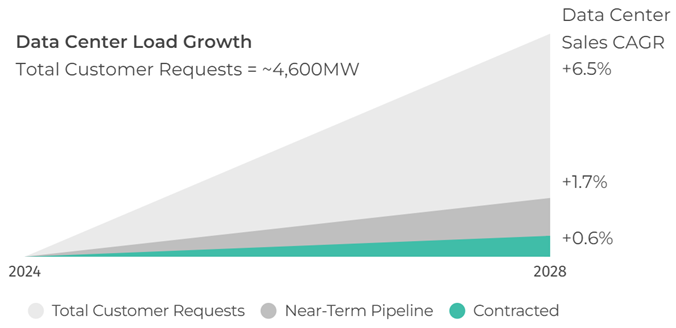

As data centers (and especially AI-focused data centers) expand their footprint throughout the US, upward pressure on utility load forecasts will continue, owing to the amount of power required for processing and cooling. The following chart from Minneapolis-based electric utility Xcel Energy highlights the extent of this load growth.

Xcel Energy's anticipated load growth from data centers

Source: Xcel Energy. Data as of 19 May 2024.

Data centers account for 4% of total US electric load today. Forecasts expect that to increase by 80-120%, to eventually make up between 6% and 10% of total US electric load by 2030 - with risk to the upside.

As this load demand increases, data center priorities have changed. An executive said: "Data centers used to ask for 24/7 power, clean energy and low prices …now they are just asking for 24/7 power".

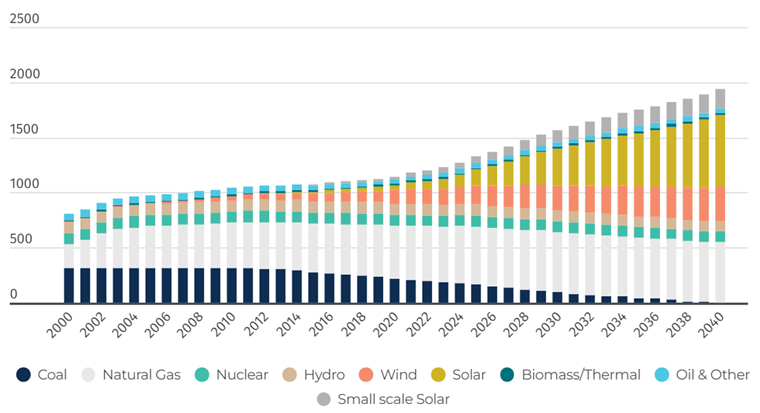

A consistent message among utilities at our attendance of the American Gas Association conference in California was that natural gas will continue to play an important role as more renewables come online, coal plants retire and competition for energy intensifies in the face of increased load.

Natural gas represents a reliable source of backup power, especially with increased extreme weather events leading to power outages. It can also play a crucial role in meeting power needs during periods of peak demand.

US electricity generation capacity (GWs)

Source: First Sentier Investors. Data as of 31 May 2024.

Upside risk to current forecasts

As noted earlier, load growth is putting upward pressure on utility load forecasts. This is being reflected in turn in the Integrated Resource Plans (IRPs) being filed by utilities.

In 2022, Georgia Power, a subsidiary of listed electric utility Southern Company, filed an IRP with forecast load growth of less than 400 MW between 2024 and 2031. In their 2023 IRP filing, the forecast load growth for the same period was 6,600 MW (a 17 times greater increase).

These increases then flow through to utilities’ investment plans, ultimately expanding the regulated asset base upon which each utility is allowed to earn a return.

For example, Pennsylvania-based PPL Corp estimated that every new large data center requesting 1 GW of power would require transmission grid upgrades costing at least US$50-150 million. For PPL, every US$125 million spent in this way equates to an additional 1% of EPS. And the growth isn’t all being driven by new-build data centers.

Southern Company’s CFO stated on the company’s Q1 2024 earnings call that energy sales to data centers increased by 12% compared to the prior year; three quarters of this increase came from existing data centers. As today’s conversations with potential data center customers progress through to tomorrow’s signed deals and construction commencements, utilities will see their rate base and earnings growth profiles trend upwards.

We believe that over the next 12 months we will see material uplifts to existing IRPs because of this. First Sentier Investor’s listed infrastructure portfolios are well positioned to benefit, with exposure to electric utilities including NextEra Energy, Southern Company, Dominion Energy, Duke Energy, Xcel Energy, AES Corp, Alliant Energy and Evergy. Our research trip also yielded insights into the US freight and railroad markets, with recovery expectations pushing into 2025 given an uncertain economic backdrop. You can read the full version of our US field notes here.

Sophie Smith is an Analyst, and Jessica Jouning a Portfolio Manager with the Global Listed Infrastructure team at First Sentier Investors, a sponsor of Firstlinks. This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs.

For more articles and papers from First Sentier Investors, please click here.