The data centre industry is a critical backbone of the global digital economy, enabling the storage, processing, and dissemination of data across businesses, governments, and individuals. The sector has experienced rapid growth over the past decade, driven by technological advancements, the proliferation of cloud computing, and the increasing importance of data-driven decision-making across industries.

Key demand drivers include:

- Cloud Computing and SaaS: Cloud computing adoption continues to soar, with enterprises migrating workloads to the cloud for scalability and cost-efficiency. Platforms offering Software-as-a-Service (SaaS), such as Microsoft 365 and Salesforce, rely heavily on data centres.

- 5G and IoT: The rollout of 5G and the growth of Internet of Things (IoT) devices generate unprecedented data volumes, necessitating scalable and reliable data storage solutions.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML require significant computational power, leading to increased demand for high-performance data centres equipped with GPUs and specialised hardware.

- Digital Transformation: Businesses across all sectors are investing in digital tools and platforms, further boosting the need for robust data infrastructure. On a conference call in December 2024 with US based Digital Realty, the company described demand growth “greater than anything we’ve ever seen before” and went on to explain how they’ve moved from addressing the need for “growth in the cloud” to “enterprise digital transformation” to a current situation where Artificial Intelligence is accounting for approximately 50% of new bookings.

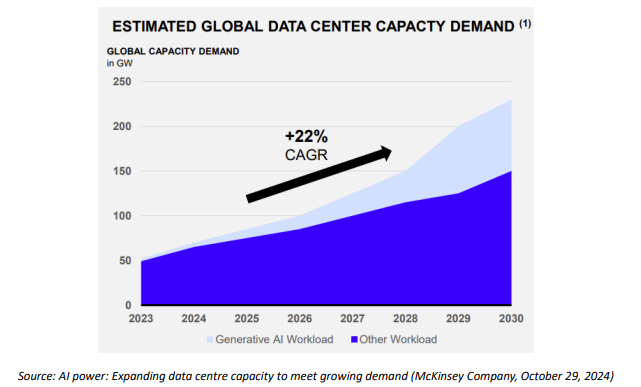

While all forecasts in this space need to be considered carefully, the chart below provides an indication of potential growth.

Supply is being added rapidly, albeit, the physical requirements of land, buildings, IT infrastructure and power can sometimes lag demand. In broad terms, the supply landscape comprises:

- Hyperscalers: Technology giants such as Amazon (AWS), Microsoft (Azure), and Google (GCP) dominate the hyperscale market. These companies continue to invest heavily in expanding their global network of data centres.

- Colocation Services: Colocation providers, such as Equinix and Digital Realty, are also experiencing high demand as enterprises seek hybrid solutions that combine on-premises and cloud storage.

- Enterprise Data Centres: Large organisations such as banks and government, may own and operate their own data centres, specifically tailored to their needs.

- Edge Centres: For certain uses, it is important that data centres are close to end users, helping latency. Edge centres are closely located to end users, but tend to be smaller in scale.

What is DigiCo REIT?

Digico (ASX: DGT) is a newly established, ASX-listed Real Estate Investment Trust that seeks to own, operate and develop data centres. Initially focused on Australia and the USA. The trust has a global mandate and an equally broad strategic focus, looking for exposure across stabilised assets, value-add, and development opportunities.

Unlike traditional real estate metrics, where the focus is on gross or net lettable area, with data centres, it’s all about power, so the metrics turn to megawatts (MW) and gigawatts (GW) as the key attribute of a facility. In that context, DGT’s initial portfolio has installed capacity of 76MW, with the vehicle looking to materially expand this to 238MW via additions and greenfield opportunities already identified.

Externally managed by HMC Capital Limited, DGT benefits from a recently acquired operating platform of staff that brings the IT capability alongside the funds management, accounting, tax and risk management skills of the HMC Capital platform.

DGT is tapping into one of the mega-trends identified by its external manager.

What’s not to like?

Data centre assets are more difficult to value than traditional real estate. Traditionally, as a real estate investor, we have been a provider of land and buildings with the tenants responsible for power, and everything that sits within the buildings. This type of real estate is reasonably easier to value, particularly where long leases provide certainty of income. Once we move further up the risk spectrum, by providing a powered shell, and potentially towards operating the assets ourselves, we benefit from much higher returns but are also more exposed to the operating business, and the risks around obsolescence of equipment. As such, valuation metrics become more challenging, as long-term forecasts for cash generation are subject to large estimation error.

DGT is new to this space, and while we believe they have done a solid job of assembling a diversified initial portfolio and management team, they lack a solid public track record. Over time this will dissipate, but in the short term we require an enhanced return expectation to compensate.

The entire portfolio has been recently acquired and a large portion of it is yet to even settle. Given the strong interest in the sector, it would be hard to argue that it is anything other than a sellers’ market which is unlikely to be supportive of cheap acquisitions. Our estimate of the price paid per MW of capacity is around $28m. This includes both the cost and additional capacity of planned projects.

By way of comparison, Goodman Group (GMG), which has been a hugely successful developer, owner and operator of industrial property in Australia and key overseas markets, has also recently pivoted towards the development of data centres. Data Centres are expected to become more than 50% of GMG’s total development pipeline. GMG has a data centre pipeline of ~5GW, albeit this will take more than a decade to roll out. GMG is targeting 80MW facilities with an estimated end value of ~$2bn, implying a market value for a brand new facility of ~$25m per MW. Furthermore, this includes a substantial development margin for GMG. These figures are rough and ready, but do not flatter the DGT valuation.

One of the metrics we use to value property stocks is a “Sum of the Parts”. For externally managed REITs, this involves estimating a market value for each of the assets held, and then making adjustments for the capital structure (debt) and the management fee structure. For DGT, given all assets have been recently acquired, we have a reasonable starting point for valuation. At IPO DGT was priced at a ~4% premium to book value and a bigger premium to our assessed “Sum of the Parts” once the management fee stream is accounted for.

And finally, a word on externally managed trusts, which we have made many times before, but remains very important. There is an inherent conflict between the manager, who is incentivised to grow assets and fees, versus the unitholders of the trust who may be better served with a more stable portfolio. This misalignment is made worse when there are fees attached to acquisitions and dispositions. Sadly, DGT is encumbered with such fees, albeit the manager does have a substantial co-investment stake offsetting this concern to some extent.

Conclusion

The data centre space is an amazing one. It represents a substantial opportunity, and we expect DGT to grow strongly as it develops out its current pipeline and makes acquisitions. However, each opportunity needs to compete for the same dollar of capital. Right now, we see some compelling opportunities in related areas, such as Centuria Industrial REIT (CIP), which trades at a material discount to its book value and also has some growth options.

Stuart Cartledge is Managing Director of Phoenix Portfolios, a boutique investment manager partly owned by staff and partly owned by ASX-listed Cromwell Property Group. Cromwell Funds Management is a sponsor of Firstlinks. This article is not intended to provide investment or financial advice or to act as any sort of offer or disclosure document. It has been prepared without taking into account any investor’s objectives, financial situation or needs. Any potential investor should make their own independent enquiries, and talk to their professional advisers, before making investment decisions.

For more articles and papers from Cromwell, please click here.