While every financial cycle is distinct, historical patterns consistently reveal a common dynamic: the economic value of groundbreaking general-purpose technologies (GPTs), ones that can affect the whole economy, tend to shift from producers to consumers as adoption rates peak. Examining this trend offers critical insights into the evolution of financial cycles and excesses, providing a framework for understanding today’s AI investment boom.

The paradox of GPTs

After a recent business trip in the Middle East, my 14-hour flight home felt long — but a century ago, it would have taken 14 weeks. The air travel industry has shrunk distances, accelerated the delivery speed and volume of goods and expanded human connectivity, effectively integrating the global economy. Through that lens, few would argue that flying — as a GPT — hasn’t been wildly beneficial to society; yet the airline industry’s profit margins across cycles are lower than average.

This pattern repeats across other historical GPTs. Like airlines, the automobile also brings people and goods together faster, and unsurprisingly, the industry’s profit margins are similarly lower than the market average. This pattern was repeated later with radio and television and again in the late 1980s, as computers were rapidly placed on office desktops, delivering massive productivity gains. Today, however, PC makers (at least those not focused on handset devices) often deliver lower-than-market returns on capital.

This leads to a predictable cycle, which can be broken down into these phases:

- New technology with far-reaching demand is supply-constrained and drives high profit expectations.

- Prospects for outsized returns draw entrepreneurs and capital which increases product supply and elevates stock prices.

- While adoption rates are rising, excess competition and supply exceeds demand and dilutes industry margins.

- Elevated asset prices collapse, and the industry consolidates.

- Depending on how leveraged the economy and financial markets were to the investment boom, it dictates the severity of the ensuing recession and market drawdown.

The paradox doesn’t stem from a failure of the technology itself; in fact, the products continue to advance. Computers are more powerful and faster, televisions are lighter with better pictures, automobiles are more fuel efficient and last longer, flying times are shorter, etc. This is the core of the GPT paradox: the adoption of technology is inversely proportional to its commercial value for its producers and shareholders.

This dynamic often precipitates economic and financial market excesses and corrections, as entrepreneurs and investors fail to properly account for the powerful forces of capitalism and free markets. Investors who allow the awe of scientific advancement to obscure this transfer of commercial value from producers to society are often taught a painful lesson in economics and financial markets.

How can this help us think about AI and this cycle?

An algorithm is a feedback loop that predicts the future based on the past, making AI, at its core, a powerful prediction machine with computational power far beyond human capacity. It is an amazing feat of human engineering that advances daily.

However, like other historical GPTs, this reality possesses dualities. If the profit margin prospects are as high as market hype implies, how can we not expect the past to repeat itself through massive AI supply growth, as we saw with the release of DeepSeek earlier this year?

At the same time, much of the data available for AI models to learn from has already been consumed. This means highly capital-intense AI models may face more than new competitors but also find it increasingly difficult and expensive to outcompete existing models when they are all scraping from the same database: the web. The less differentiated a product is, the less its pricing power and commercial value.

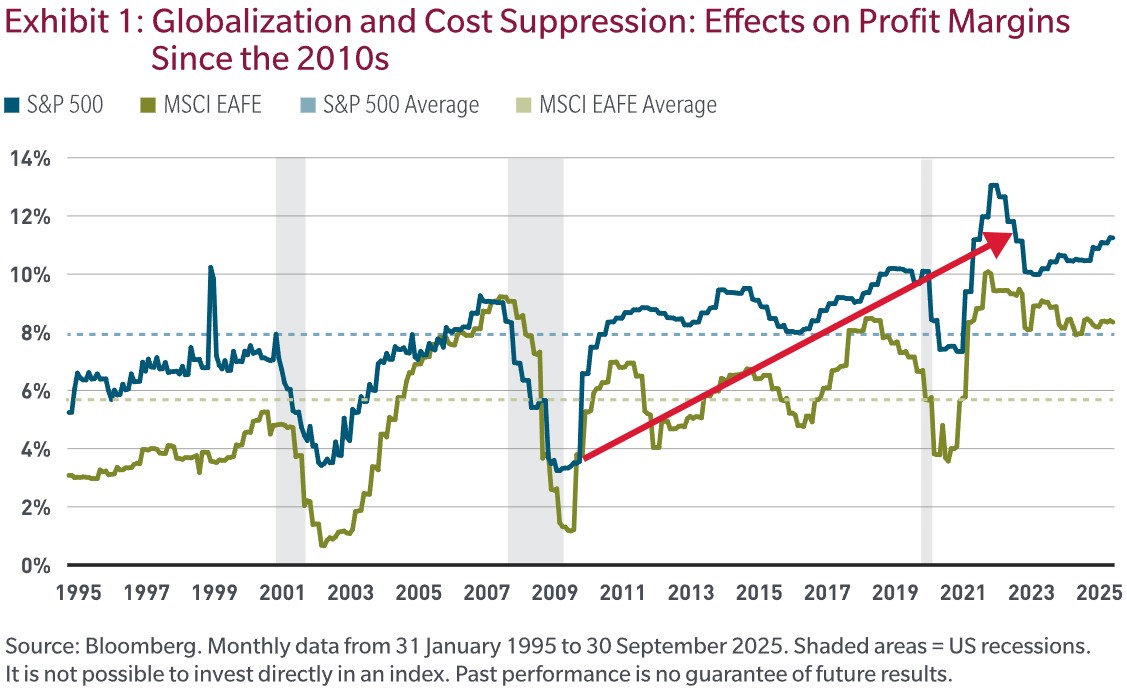

The accompanying chart displaying S&P 500 and MSCI EAFE profit margins shows the excesses that began in the 2010s after a long period of artificially suppressed interest rates, cost suppression and divestment via globalization. If AI, like other GPTs, follows a path of increased competition and commoditization, it will likely drive a slowdown in AI-related capital spending and flow-through to the broader economy. This could expose vulnerabilities in profit margins currently being obfuscated by the halo around AI.

Conclusion

Much like other technologies, I don’t believe you need to be a coder or programmer to assess the commercial aspects of artificial intelligence. Instead, the skilled investor needs to assess the future demand for AI against supply created by the capital cycle, as that is what will ultimately determine profit margins and stock performance.

For long term asset allocators, we feel the investment opportunity lies in avoiding businesses exposed to high commoditization risk, whether directly or indirectly related to AI. Capital should instead be allocated toward enterprises with hard-to-replicate advantages, which includes AI enablers such as certain hyperscalers. We see opportunity in vertical software companies with non-replicable domain expertise, while being wary of certain horizontal software businesses (those that create applications for a broad range of industries, such as accounting or customer relationship management vendors) which may face market share challenges as enterprises adopt AI.

But commoditisation and profit margin deflation extend beyond technology. AI brings instant agency to consumers of all sorts, eliminating the profit advantages of mediocre products whose only economic moat was brands built by large advertising budgets. Companies with middling products and services will likely find past returns difficult to achieve as competition grows, while being forced to starve advertising budgets to feed long-overdue innovation. Elevated margins, as shown in Exhibit 1, will be difficult for many to sustain.

Overall, we believe selectivity will be key to driving better-than-market returns in what promises to be an evolving and volatile future, delivering a new paradigm of differentiated performance between active and passive managers.

Robert M. Almeida is a Global Investment Strategist and Portfolio Manager at MFS Investment Management. This article is for general informational purposes only and should not be considered investment advice or a recommendation to invest in any security or to adopt any investment strategy. It has been prepared without taking into account any personal objectives, financial situation or needs of any specific person. Comments, opinions and analysis are rendered as of the date given and may change without notice due to market conditions and other factors. This article is issued in Australia by MFS International Australia Pty Ltd (ABN 68 607 579 537, AFSL 485343), a sponsor of Firstlinks.

For more articles and papers from MFS, please click here.

Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries.