Airports have seen phenomenal traffic growth as people prioritise travel and experiences in the face of cost-of-living pressures.

The rate of growth in the near-term is seemingly not a demand story, but rather a question of whether airlines and aircraft manufacturers can keep pace with an insatiable demand to travel.

In the medium-term we expect demand from baby boomers, millennials and Asia’s emerging middle class will continue to drive strong global traffic growth. We explore what this means for listed airport companies.

The state of flight

We have observed a three-stage recovery of airline capacity since 2022. All of which have been acutely felt by travellers, both in terms of their patience and their hip pocket.

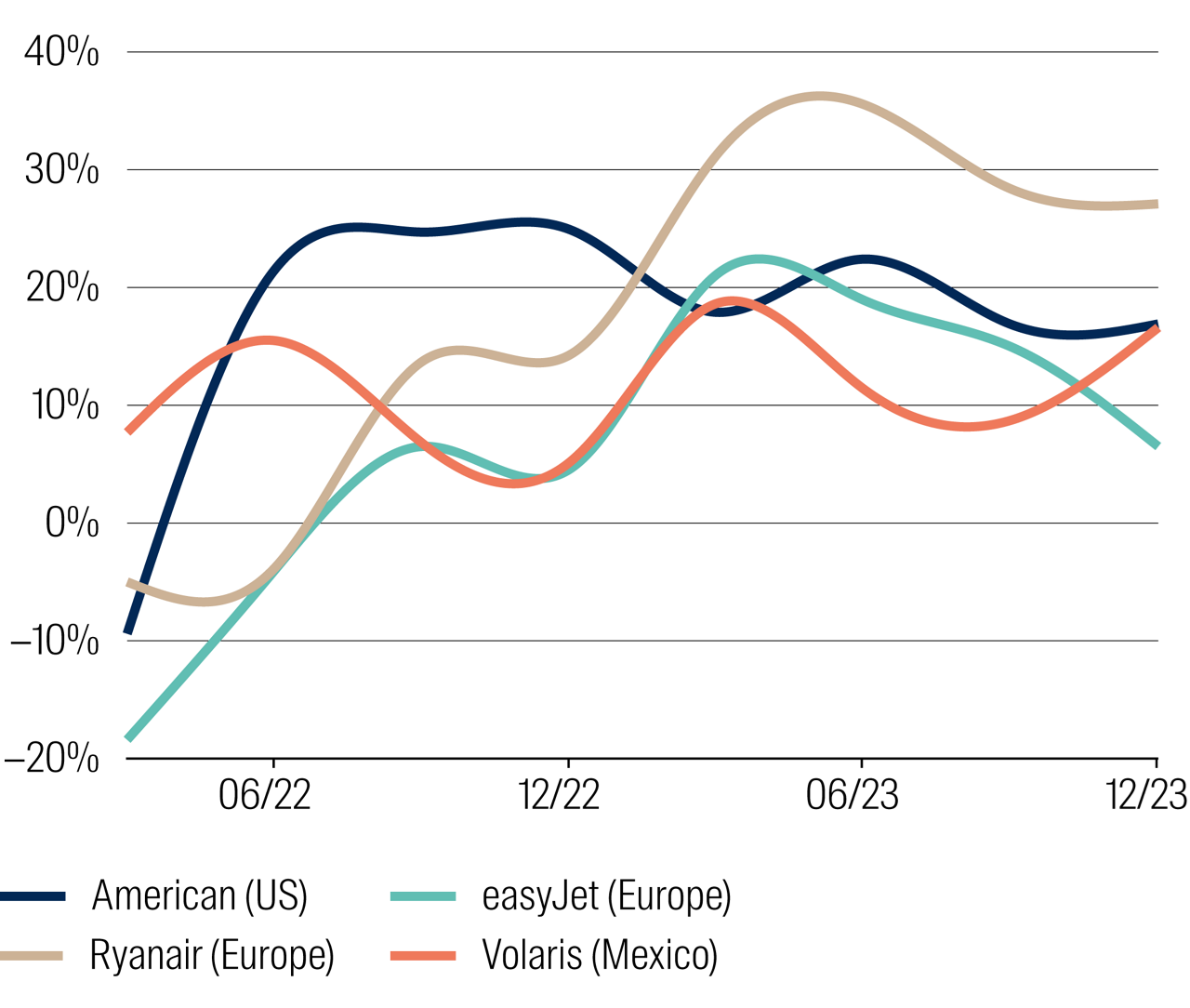

The first stage in 2022 and 2023 – by far the most challenging for travellers – was characterised by low levels of operational readiness for most airlines and airports. This led to low levels of flight availability, delays, cancellations and a poor overall travel experience. Airlines took advantage of the demand-supply mismatch, with ticket prices hitting levels 20–40% higher than 2019.1

Then during late 2023 and 2024 we saw improvements in seat capacity as more planes returned to the skies and operational readiness improved. We saw low-cost carrier (LCCs) such as Ryanair in Europe and Volaris in Mexico perform particularly well, with their operating agility and healthy balance sheets allowing them to move more quickly to capitalise on strong traveller demand. Unfortunately for travellers whilst the experience started to improve, ticket prices remained elevated. Strong traveller demand resulted in any additional capacity being quickly absorbed, allowing airlines to largely sustain the pricing gains they’d made.

Airfares vs 2019

Airfares based on revenue per available seat mile

Source: Company data.

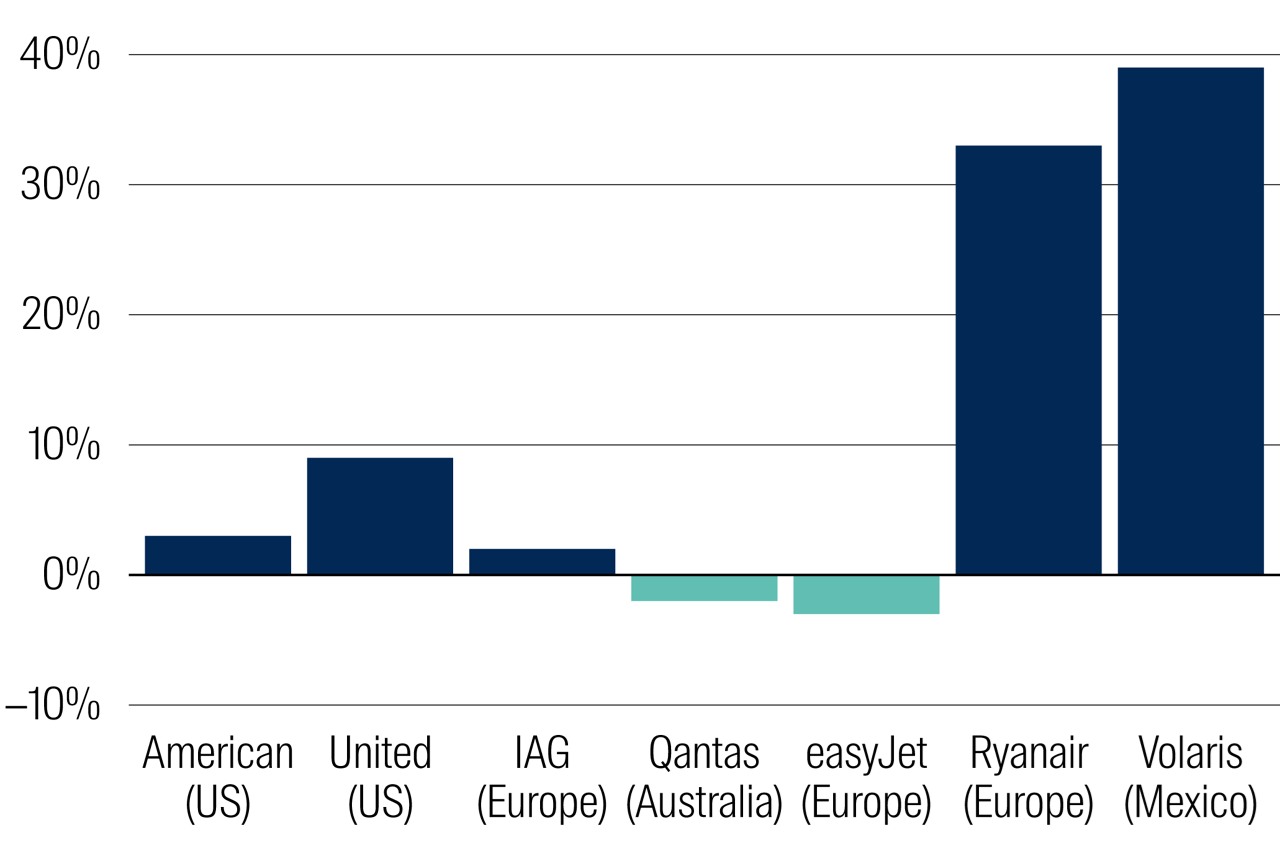

More recently, capacity and pricing growth have somewhat normalised. Pricing has even gone backwards in some regions. For example, the US has seen pricing declines of between 5% and 10% in periods through 2024 and 2025, driven in large part by overcapacity on leisure-orientated routes. In Europe demand has continued to be robust and capacity additions have been modest, leading to strong pricing trends particularly during holiday travel periods.

2024 capacity vs 2019

Capacity = Available seat miles/available seat kilometres

Source: Company reports.

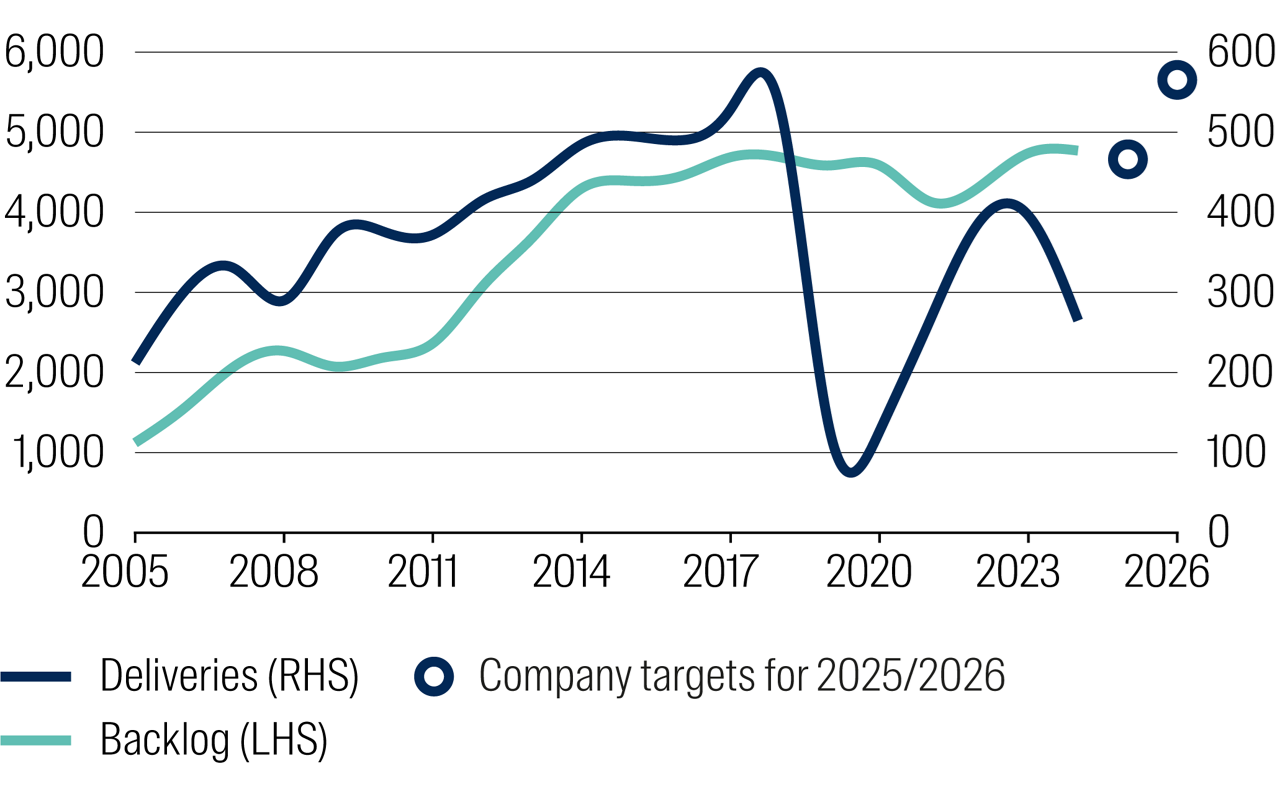

Stuck in a holding pattern

The key constraint we see to further upside to traffic growth in the near-term is the lack of new aircraft becoming available to continue to satisfy demand growth. The world’s two dominant aircraft manufacturers, Boeing and Airbus, remain nowhere near their previous rates of aircraft production. Total industry output is still running 30% below the highs seen in 2018. This hasn’t stopped them from taking orders for new planes though, with outstanding orders for new planes reaching a record high of over 17,000.2

Boeing’s 737-Max, the aircraft responsible for much of the world’s short-haul traffic growth, has over 4,500 outstanding orders alone. Even if Boeing were to lift their production rates from the currently capped 38 aircraft deliveries per month to the targeted 47 deliveries per month, their order book would still take more than seven years to clear.

Aircraft demand outpacing supply capacity

Boeing 737 order backlog and deliveries

Source: Boeing. Data as at 30 September 2025.

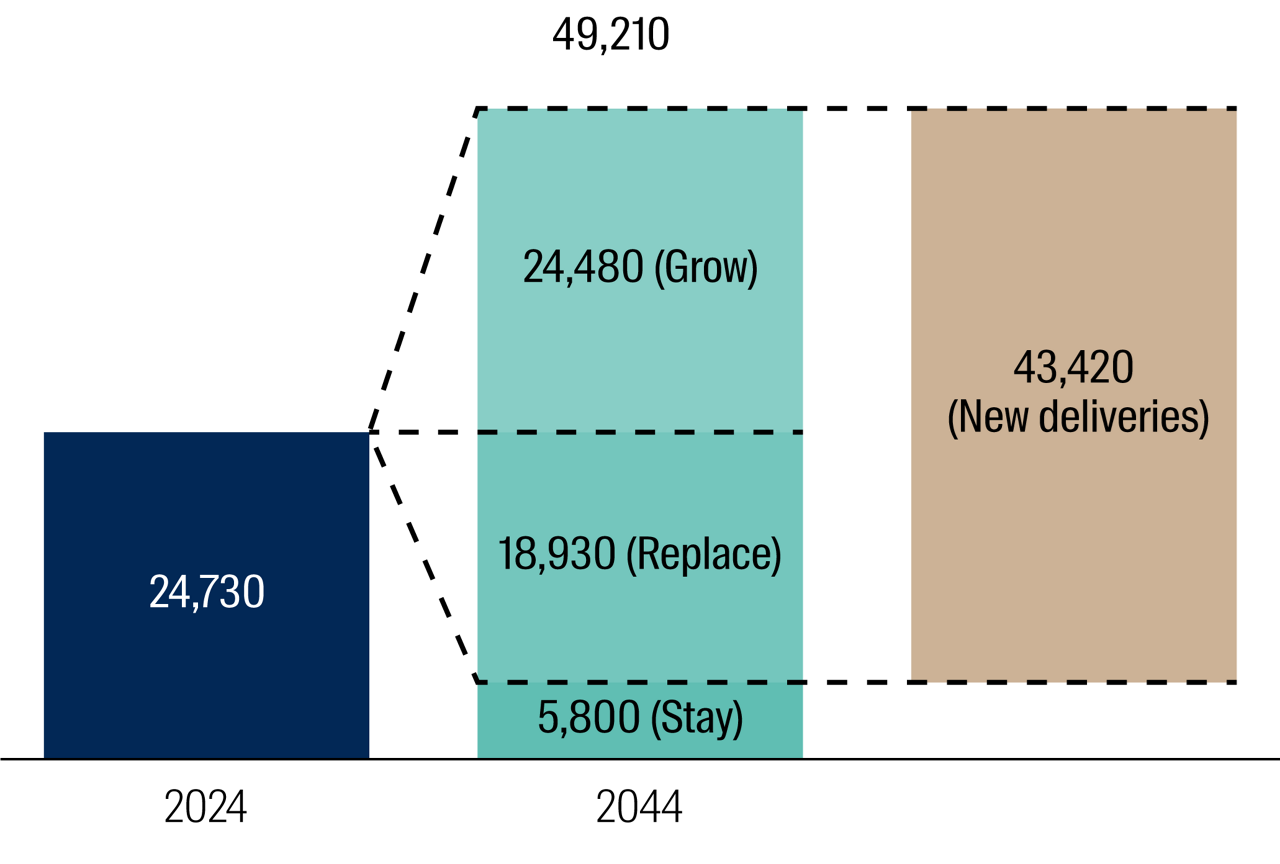

We expect these capacity growth headwinds to ease in 2027 as aircraft production rates improve, allowing airlines to receive new aircraft and put them to work. This should see downward pressure on ticket pricing, with the additional capacity leading to a more competitive market for airlines. Both of which bode well for traffic growth.

As a result, we are positioning the portfolio towards those airports where earnings growth is not predicated on significant capacity additions in 2026. We find this in Zurich Airport and in Groupe ADP’s Charles De Gaulle and Orly airports in Paris. We believe the market has suitably conservative expectations on traffic growth for both companies, and we see earnings upside potential from other areas of their businesses such as retail and their international operations.

Airbus forecast of demand growth

Fleet in service (# aircraft)

Source: Airbus GMF 2025, Cirium May 2025.

SKI season

As we see these supply-side constraints ease our expectation is that strong demand growth will continue. The trends of baby boomers ‘spending the kid’s inheritance’ (SKI) and millennial/ Gen-Z ‘fear-of-missing-out’ (FOMO) travel should continue to fuel growth.

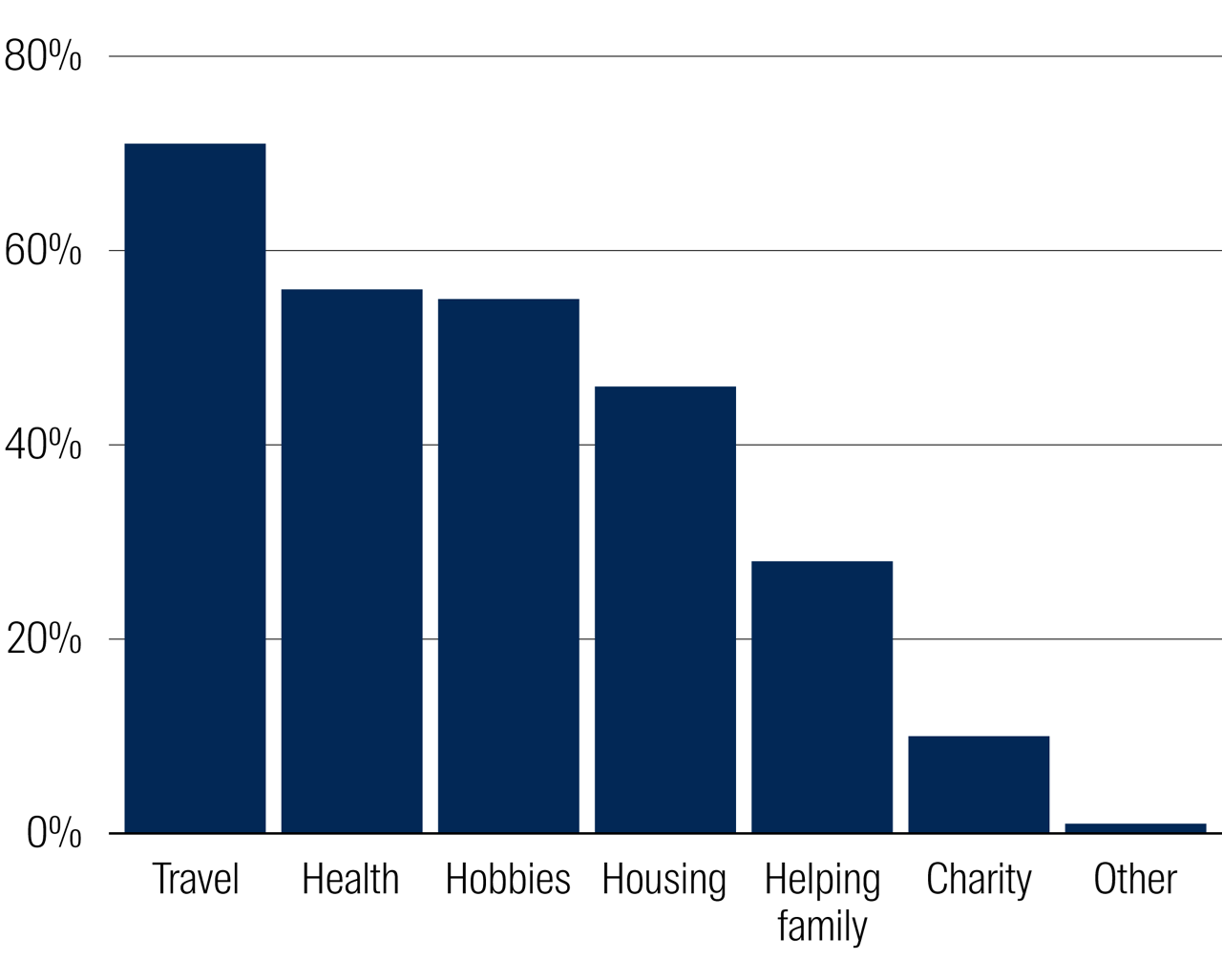

The SKI phenomenon has been cited by airlines as a positive source of growth, particularly when it comes to the strong performance they have seen in their premium (premium economy/ business/first class) cabins. A recent survey of US retirees found that 63% of Americans nearing retirement saw travel as an important retirement goal. Another survey found that just 6% of retirees felt leaving a financial inheritance was more important than creating travel memories. The same survey found 68% of retirees don’t worry about spending their children’s inheritance when travelling.3

What are your spending priorities for retirement?

Survey of 2,000 Australians

Source: Equipsuper. Data as at July 2024.

At the opposite end of the age spectrum, we find that younger generations are prioritising travel more than ever before. A recent McKinsey report noted that 76% of Gen Zers agreed with the statement ‘I am more interested in travel than I used to be’. Even more surprisingly, just 15% said they were trying to save money by reducing the number of trips they go on.

The combined impacts of home ownership affordability challenges, climate anxiety and social media ‘travel influencers’ are all driving this shift. Leading the FOMO generation to live for today rather than save for tomorrow.

We see these two generational shifts as structural rather than cyclical drivers of traffic demand growth, helping to drive long-run traffic growth expectations higher. This is in turn creating a multi-year earnings and valuation uplift opportunity for the airport sector.

Indi-go global

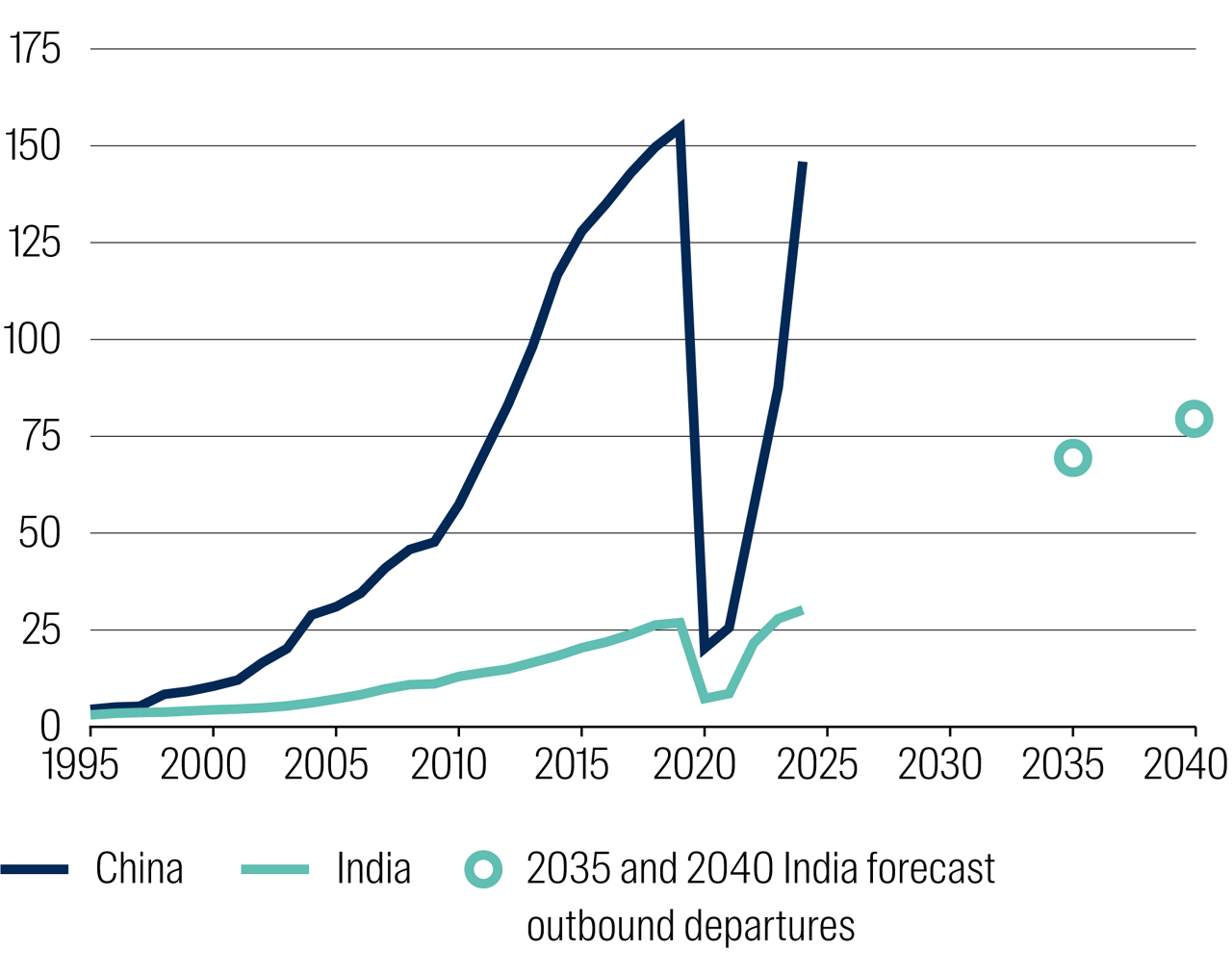

In the 1990s global tourism growth was fuelled by demand from Japanese tourists to see the world. Then we saw the rise of China’s middle class in the mid-2000s up until the pandemic.

Looking forward we believe the story will undoubtedly be outbound tourism growth from Indian travellers. At the same time, we believe that growth from China is far from over. We anticipate that China’s emerging middle class will once again support strong travel demand growth as the country’s domestic economic outlook improves. As a result, we expect dual tailwinds out of Asia as these two countries with a combined 2.8 billion people drive global tourism growth.

Back to the future

Outbound departures (millions)

Source: World Bank, CEIC, Travel China Guide, McKinsey, DFAT. Data as at 30 September 2025.

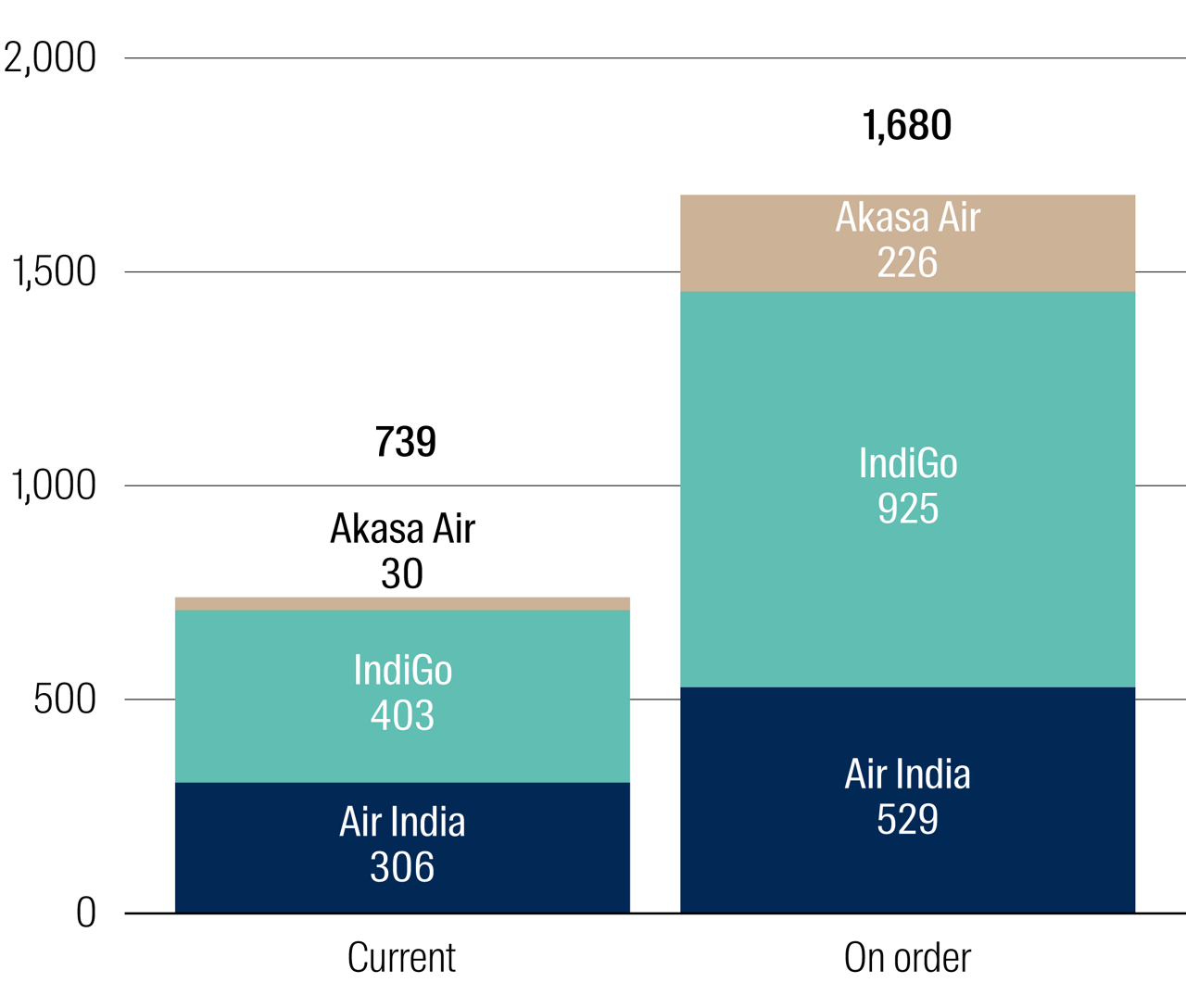

Indian airlines are ready to meet this demand as well. As highlighted below, the big three local airlines have a combined 1,680 new planes on order.4 This compares to a combined current fleet of 739 aircraft. A phenomenal increase in capacity even once you assume retirements of some of the existing fleet. As a result, once the aircraft manufacturer issues previously noted are resolved, this is the region where we expect to see the most significant further acceleration in traffic growth.

Growth in aircraft fleet in India

Source: FlightRadar24, Company reports. Data as at 30 September 2025.

This is one of the reasons we see significant valuation upside in portfolio companies Flughafen Zurich and Groupe ADP.

Flughafen Zurich, whose primary activity is the operation of Zurich Airport, recently completed the development of Delhi’s Noida International Airport. This airport is expected to have 8 million passengers in its first full year of operations, which we believe is an unprecedented level of growth for a new secondary airport. We expect Flughafen Zurich will be able to realise significant value from their investment in the near-term via a minority stake sale to an institutional investor looking for exposure to this significant growth in Indian tourism.

Groupe ADP is another portfolio company that identified India as a growth market early, acquiring a 49% interest in leading listed Indian airport operator GMR for €1.36 billion in February 2020. This stake today is worth over €4 billion based on market pricing,5 a 3x increase on their initial investment. We believe the market is placing very little value on this investment currently; something which we believe could shift as GMR management increasingly focuses on returning capital to shareholders via dividends as the company moves out of its capital-intensive investment phase.

Building for growth

We are seeing airport companies positioning for this growth, with increased investment in the infrastructure to accommodate the additional passengers they expect to serve. Within our universe, Auckland Airport, ADP’s Paris airports, Aena’s Spanish airports, Vinci’s Gatwick Airport, Vinci’s Lisbon Airport, Zurich Airport, and all of Mexico’s three main airport operators are entering large investment programs.

Portfolio company GAP is the operator of twelve airports in Mexico, including the high growth airports of Guadalajara, Tijuana and Los Cabos. In late 2024 they agreed with the regulator to a US$2.4 billion capex program. This will enable them to expand their airports to cater to the significant demand growth they are seeing. In exchange for this investment, the local aviation regulator approved a ~30% increase in the aeronautical fees they are allowed to charge to the airlines. This highlights the strong earnings growth we are seeing as airports look to expand capacity in order to serve this passenger demand growth.

Zurich Airport is in the early stage of planning the reconstruction and expansion of their Dock A terminal infrastructure and control tower, which is approaching the end of its useful life. The new CHF1 billion+ terminal infrastructure will allow Zurich Airport to more efficiently handle the processing of passengers. This should both lift the terminal’s passenger capacity and improve the overall customer experience and the retail offering being provided to travellers.

This highlights how the expansion benefits for airport companies are two-fold, providing upside to aeronautical charges as well as improving the quality of the retail offering. These commercial segment earnings largely fall outside the regulated operations of the airport, allowing airport operators to generate returns over and above their regulated return.

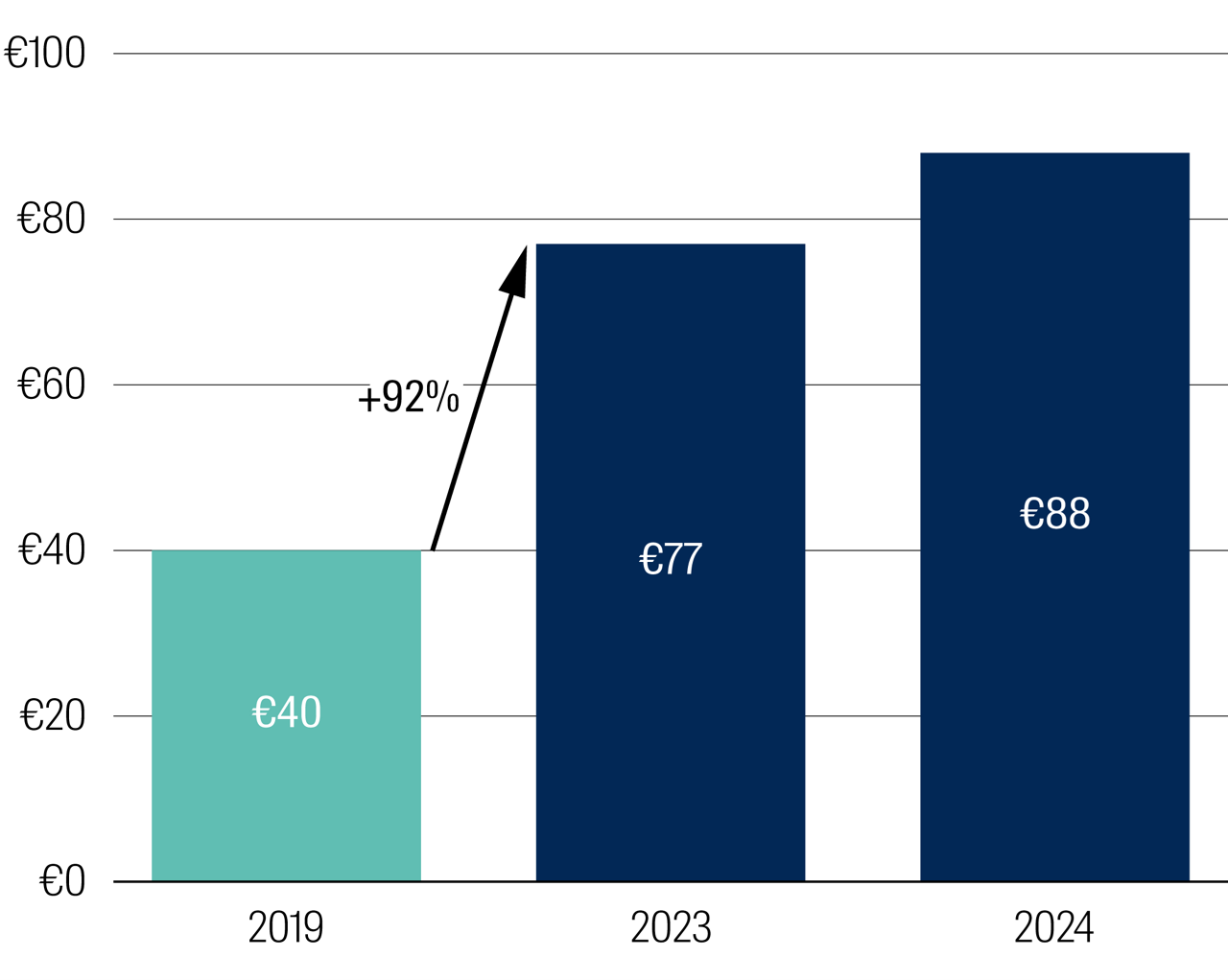

New or renovated terminals can lead to a meaningful step-change in commercial revenues, as a higher quality retail offering drives higher sales per passenger (SPP). Most recently we saw this with the Terminal 1 renovation at Groupe ADP’s Charles De Gaulle Airport. By the end of 2023, ADP had seen a 92% increase in the SPP for Terminal 1 following the opening of the refurbished terminal in 2022.

Paris CDG Terminal 1

Sales per passenger (€)

Source: Company reports; First Sentier Investors estimates. Data as at 30 September 2025.

This becomes an even more impressive figure when you factor in much lower contributions from high-spending Chinese passengers in 2023/2024, who in 2019 accounted for only 2.1% of the traffic but 15.4% of retail revenues.

Conclusion

In summary, we are seeing significant traffic momentum from generational trends such as SKI and FOMO that we believe are here to stay. This, coupled with growth in travel demand out of Asia, has led to a meaningful step-change in the long-run passenger traffic growth outlook for a number of airports.

While near-term traffic growth may be constrained by aircraft availability, the long-term nature of infrastructure means these companies are planning for long-term growth now. We believe this will be a positive multi-year earnings growth driver for the airports sector.

1 Company Reports

2 IATA

3 Grey Gap Year Report 2025, Australian Seniors

4 Boeing and Airbus company reports

5 Bloomberg; as at 3rd October 2025.

William Thackray is a Senior Analyst, Global Listed Infrastructure at First Sentier Investors (Australia) Ltd, a sponsor of Firstlinks. This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs.

For more articles and papers from First Sentier Investors, please click here.