In 2023, I wrote an article that proved popular – ‘The challenges of building a lazy portfolio’. It was about how I had spare cash at the time and wanted to create a simple, long-term portfolio with exchange-traded funds (ETFs). The aim was to capture the performance of markets at low cost via such funds.

What I thought would be an easy task turned complicated and the article addressed the many issues I considered before finalising my portfolio. In the end, I opted for a three-ETF portfolio – 80% in equities with half in a US stock market ETF and the other half in a World ex-US ETF, and 20% in bonds via an Australian government bond ETF.

A lot has changed since I wrote that article. US stocks have skyrocketed, Australian shares have badly lagged, investors have lost faith in bonds after five years of poor performance, precious metals have become a trendy asset to own, and private assets have grabbed an increasing share of institutional and retail wallets.

It just so happens that I again have spare cash on hand and am considering how best to deploy it into a simple ETF portfolio for the long term. And I’ve tweaked my thoughts on the topic since last time around, which I’ll run through today.

The allocation to stocks in a lazy portfolio

The idea of a lazy portfolio is to keep it as simple and passive as possible. To keep biases and preferences to a minimum to benefit from the rise in markets over the long term. That’s easier said than done.

With the stock part of a portfolio, the simplest way to gain exposure to global markets is through investing in a global market ETF like the Vanguard MSCI Index International Shares ETF (ASX: VGS) or Betashares Global Shares ETF (ASX: BGBL).

So, is it best to invest in this ETF or a similar one and be done with the stock allocation part of the portfolio? I’d suggest not.

The reason is that if you look under the hood of VGS or BGBL, 73-74% of the portfolio is in US shares. That means by buying these ETFs, you’re essentially buying America.

That makes me nervous on few levels.

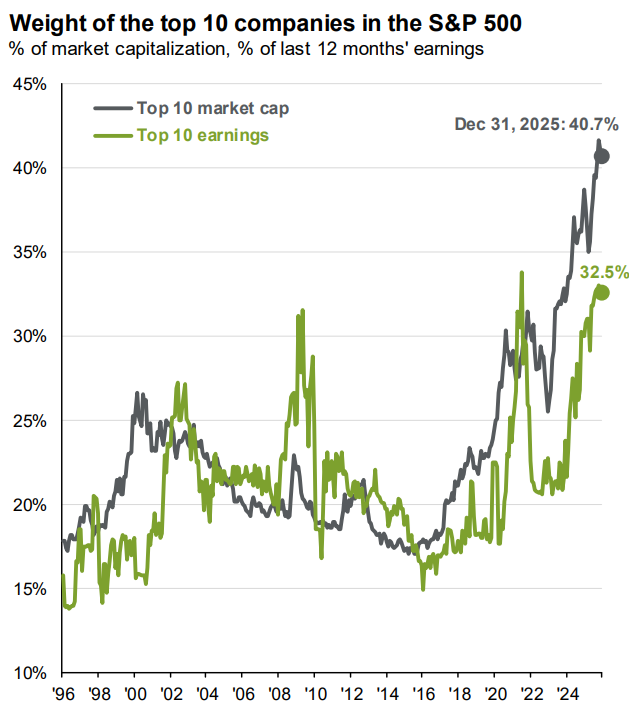

First, the US itself has become reliant on a handful of stocks. The top 10 stocks represent more than 35% of the index, far higher than even at the heights of the dot.com bubble.

Source: Factset, Standard & Poor’s, J.P. Morgan Asset Management.

Much of the concentration is in tech companies. Officially, the tech sector is 26% of the S&P 500 index. But that’s deceptive because the likes of Tesla and Amazon are classified as consumer discretionary stocks and Meta and Alphabet as communications services companies. The real weighting of the S&P 500 to technology is closer to 45% when these stocks are included.

This means that if you’re buying VGS or BGBL, not only are you taking a concentrated bet on America, but you’re also taking a concentrated bet on the handful of stocks which are driving US markets.

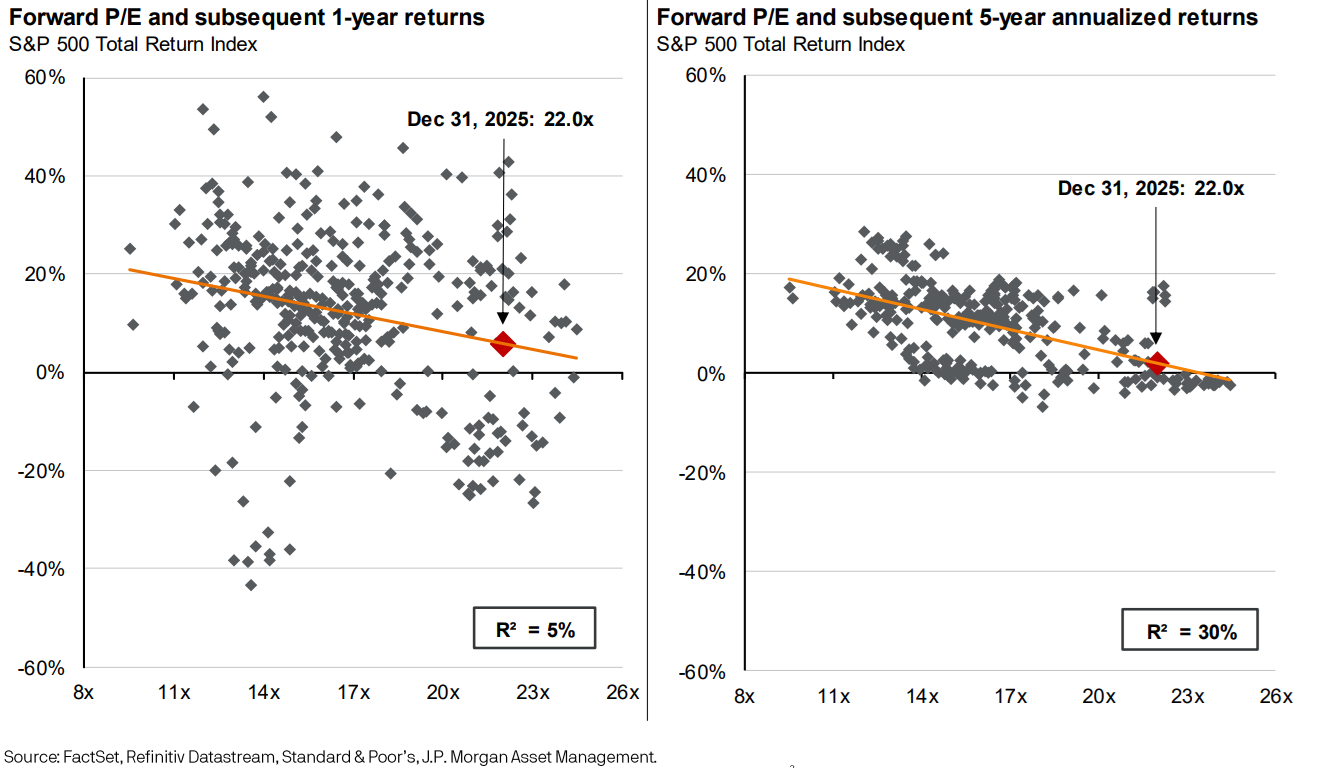

Second, US markets are expensive on every valuation metric. Whenever the US has been at current valuations, returns have been poor over the next decade on every single occasion in the past ie. flat to low single digit per annum returns.

These are worrying statistics if you’re trying to design a lazy portfolio for the next 10 or so years like I am.

Third, the US has had an almost 17 year bull market and bull markets in America have averaged 18 years through history. So, we may not be far from the end of this one.

These factors make me uncomfortable buying a global stock ETF for the stock portion of my portfolio.

Granted, I had similar concerns when doing this exercise in late 2023. Those concerns have only grown though.

What can we do with stocks for our portfolio, then? In my original article, I decided on a 50:50 allocation between a US stock ETF (main options include ASX: VTS and ASX: IVV) and a World ex-US ETF (main options are ASX: VEU, ASX: EXUS, ASX: ACWX). I’m now inclined to bring the US stock portion down and the international portion up, to make it a 40:60 split. That is, invest 40% of my lazy portfolio in US stocks and 60% in international ex-US stocks.

There’s no science to this breakdown and one possible issue is that I am using my judgement, and potentially my biases, to make this decision. In other words, I’m going from investing passively to investing actively.

I get the issue though I don’t think there’s a way around it. You either invest in an international stock ETF and make a big bet on America (which is an ‘active’ decision), or you can diversify your stock holdings as I suggest (which is also an active decision).

What about Australian stocks?

Why haven’t I included an Australia-specific allocation in the portfolio? Two reasons. First, Australia is about 4% of global ex-US stock ETFs so I can already get exposure there. Second, my preference is to go global with stock exposure rather than overweight my home country.

I know some of you may prefer more Australian exposure to access franking credits and regular income. That’s fair enough though an income-focused portfolio is different to the one that I’m trying to create here.

The allocation to bonds in a lazy portfolio

What about the bond portion of the portfolio? Last time, I opted for a plain vanilla Australian government bond ETF and I don’t see a good reason to change this option.

The idea for bonds in a portfolio is for them to function as a buffer to smooth out volatility over time. Put simply, when stocks have a large dip, as they invariably do at times, bonds can help to mitigate the fall in equities.

A government bond ETF like Vanguard’s Australian Government Bond ETF (ASX: VGB) is my preference. VGB offers triple-A rated securities, with a yield to maturity of 4.35%. It remains a solid offering.

What about corporate bonds? High-yield bonds? Floating-rate bonds? These are possibilities but you need to know what you’re doing. And while all of them offer more yield than government bonds, they also entail more risk. That’s a trade-off that I’m unwilling to take with the bond portion of my portfolio.

How about international bonds? Most of the research I’ve seen suggests that the risk-reward of investing in international government bonds versus Australian ones isn’t worth it. That’s especially when currency risk with international bonds is taken into account, or alternatively, the associated costs to hedge that risk.

The stock-bond split

In 2023, I went with an 80:20 stock-bond split for the portfolio. This may seem aggressive, though it reflects the long-term, hands-off intentions for the portfolio.

The split between stocks and bonds really depends on you and your circumstances. If you’re conservative and get anxious during market downturns, a higher bond portion may make sense. If you’re retiring or retired, larger bond exposure may also work better. If you’re young and have a high risk tolerance, more stocks may suit.

What about commodities?

Commodities are back in vogue as gold and silver hit new highs, and copper climbs on bullish data centre demand. Investment legend Ray Dalio is a big advocate of including commodities in a portfolio. For instance, his famed all-weather portfolio suggests a 7.5% allocation to commodities and a further 7.5% allocation to gold. He believes gold and commodities can protect portfolios during periods of high inflation, when stocks and bonds typically underperform.

Though Dalio’s idea has merit, I’m not convinced by his case. Gold has a mixed record during times of rising inflation. And though its returns have been inversely correlated to stocks (gold goes up when stocks go down) through much of the past 100 years, that hasn’t been the case lately with both reaching record highs.

Also, stocks typically hold up ok during inflationary periods. Certain types of stocks can do very well during inflation ie. for example, value stocks in the US outperformed commodities, including gold, during the 1970s.

For these reasons, I’ve opted to leave commodities out of my simple ETF portfolio.

What about adding more elements to the portfolio?

There are an infinite number of ways to build a portfolio. For stocks, there is the option of splitting the US and non-US exposure into further parts. For the US portion, you could put 50% in an S&P 500 ETF, and the rest split between value, quality, and small cap stocks. After all, research shows that value, quality, and small stocks have beaten the index over long periods. You could attempt similar splits with your international exposure.

There are two main disadvantages to doing this. First, it makes the portfolio more complex. Second, it can open the door to the portfolio reflecting more of your in-built biases. That can defeat the main objective of a lazy portfolio, which is to capture the performance of the overall market rather than second guess the future direction of markets.

What about hedging?

Can hedging international exposure help a portfolio? All the research says that while hedging can impact returns in the short term, it makes little difference in the long term. Additionally, there are increased costs associated with hedging.

Consequently, I’ve chosen not to hedge in my lazy portfolio.

Why not one ETF instead of three?

In sum, this time around I’ve chosen to go with a 3-ETF portfolio again, but with a slightly different mix: 80% in shares - 40% of that in a US total market ETF and 60% in an international ex-US ETF – and 20% in bonds via an Australian government bond ETF.

One question I got last time was whether it was simpler to invest in a ready made portfolio ETF like Vanguard Diversified High Growth Index ETF (ASX: VDHG). VDHG has 90% in stocks and 10% in bonds.

My advice would be to double check the fees and costs involved. For instance, VDHG has a management fee of 0.27% per annum. That compares to a potential three-ETF portfolio comprising VTS (US shares with a management fee of 0.03%), VEU (All World ex-US stocks with 0.04% management fee), and VGB (Australian government bonds with a management fee of 0.16%).

Disclosure: ETF providers Vanguard and VanEck are Firstlinks sponsors.

James Gruber is Editor at Firstlinks.