Legendary Vanguard founder John Bogle was famous for advocating that US-based investors need just two funds in their portfolio: a total US stock market index fund and a total US bond market index fund. And that they could split those funds according to how much risk they were willing to take. Bogle’s theory was that investors could capture the performance of both markets at low cost via such funds.

Recently, I’ve tried to create a Bogle-like portfolio with exchange-traded funds (ETFs) and found that what it seems like a simple task can quickly turn complicated. Should I have just Australian stocks or go global? If I go global, how much do I want of US stocks versus non-US? Do I want exposure to emerging markets, and with that, China? For bonds, do I take on non-government bonds to potentially increase returns?

Beyond these questions, I’ve discovered that ETF labels sometimes don’t reflect the portfolios underlying them. That makes me suspect that other investors may not fully understand what they’re invested in when they buy ETFs.

The following is my journey for building an ETF-based portfolio and the lessons learned.

Full disclosure: I’ll be discussing several ETF providers and three of them, Vanguard, Blackrock (iShares) and VanEck, are Firstlinks’ sponsors. Also, this article is based on my views and shouldn’t be taken as personal financial advice.

The equities conundrum

Recently, I built up excess savings and set out on a mission: to create a simple, low-cost ETF-based portfolio for the long term. My preference was for a mix of 80% equities and 20% bonds. The equities portion principally in global stocks. I figured that Australia is a relative minnow – with 0.33% of the world’s population and 1.9% of global stock market capitalization – and my portfolio should reflect that.

Getting a global equities ETF is easy enough. For instance, Betashares has recently released a global stocks ETF (ASX:BGBL) with management costs of just 0.08% a year. On the face of it, that seems attractive.

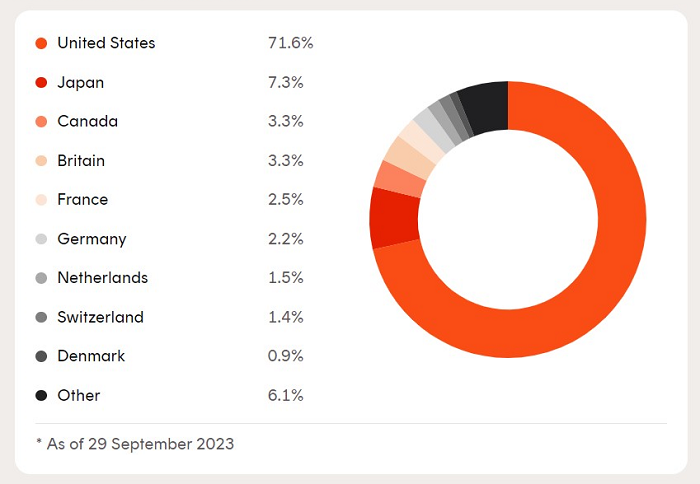

Yet, there’s a wrinkle: with any global stock ETF, it’s mostly buying America. With the Betashares ETF, US stocks are 71% of the total portfolio and the top 10 holdings are all American.

Betashares Global Shares ETF - country allocation

Source: Betashares

My problem with this is that the US market looks expensive compared to the rest of the world. And I’m not sure that the US will command such a large share of world equities in the long term.

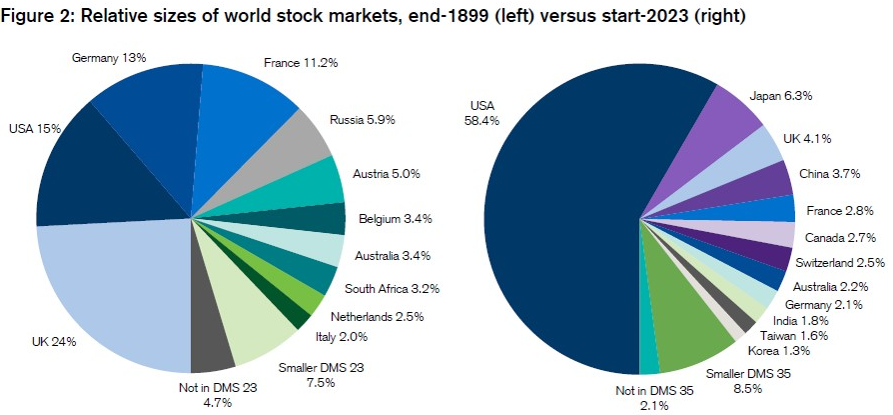

Source: Credit Suisse

This chart above shows how dramatically a country’s share of world stock markets can change over time. At the start of the 20th century, the US was just 15% of global stocks. Now, it’s 58%, reflecting its rise as a world superpower over the past 123 years. Meanwhile, the UK has gone from superpower to a middling country over that same period, and its share of world stock markets has shrunk from 24% to 4%. This chart is in the back of my mind when I look at a global stock ETF with overwhelming US exposure.

How to work around this issue, then? The simplest solution is to split a US stock ETF and a world ex-US stock ETF. It could be a 50/50 split or even 25/75. Either way, it’d have the globe covered, hopefully at minimal cost.

Getting a US stock ETF at low cost is straightforward. Vanguard offers a US total market shares index ETF (ASX:VTS) at 0.03% annual fees, and iShares has an S&P 500 ETF (ASX:IVV) at 0.04% annual fees. Note that one covers the whole US market while the other has the top 500 stocks.

An alternative is to look at an equal weighted US stock ETF, like the Betashares S&P 500 Equal Weight ETF (ASX: QUS). Equal weighted means that the stocks are weighted equally rather than by their size. If you’re concerned about tech valuations and tech stocks being a large part of the index, then an equal weighted ETF can address that risk. There are also several studies suggesting that equal weighted indexes can outperform weighted ones over the long term.

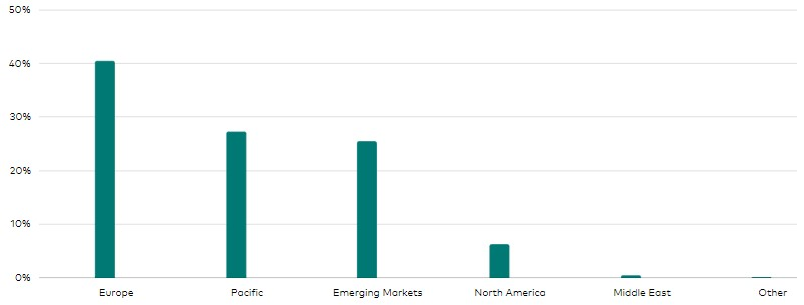

For a non-US stock ETF, Vanguard offers the All-World ex-US Shares Index ETF (ASX:VEU) with investment management costs of 0.08% per annum. One thing to be aware of is that any ex-US stock ETF has large exposure to Europe. For instance, European markets are more than 40% of Vanguard’s product. Some people are comfortable with this, while others may not be.

VEU region allocation

Source: Vanguard

Wanting less European stock exposure and perhaps more emerging stock holdings comes with complications and increased costs. Vanguard and iShares have emerging market ETFs with management costs of 0.56% and 0.68% per annum respectively. Note that Chinese stocks make up around 30% of these ETFs. I know that institutions in the US are now offering emerging market ex-China stock products, though I’m not aware of any available in Australia.

For more Australian exposure than a world ex-US stock ETF can give, there are a lot of options. An ASX 200 ETF is the go-to for many investors. Note that the ASX is banks and commodities-heavy, with these two sectors making up almost 60% of the ASX 200 index.

I looked at the different options, weighing up a lot of factors, but I opted for the simplest equities portfolio for my needs: 50% in a US stock ETF and the other 50% in a non-US stock ETF.

Bonds: the ballast of a portfolio

I confess that I am an equities guy and bonds are not my specialty. That said, my view is that bonds can serve as a ballast to an investment portfolio. When stocks take a large tumble, as they invariably do at times, bonds can help to mitigate the fall in equities. That didn’t happen last year when both equities and bonds fell, and the 60/40 stock/bonds portfolio has been questioned ever since. The questioning seems exaggerated to me given bonds before 2022 were priced at ludicrous levels rarely seen in history. That’s not the case now, and I’m comfortable with bonds being part of my portfolio.

I found that it’s easy to get bond exposure through ETFs by buying an Australian government bond ETF or a composite bond ETF. The former is essentially medium-term loans to governments, while the latter involves medium-term loans to governments as well as some to corporates. Lending to governments comes with limited credit risk as governments tend to repay their loans. And medium-term loans reduce exposure to movements to interest rates. These ETFs are low-risk bond options. Some products on offer include Vanguard’s Australian Government Bond ETF (VGB) and iShares Core Composite Bond ETF (IAF).

A few options crossed my mind. Should I explore corporate bonds? I dismissed this because I didn’t think it’d offer enough diversification from the equities portion of my portfolio.

What about high yield bonds? I am zero expertise in this area and quickly banished this idea.

The other question was whether it would be worth getting a mix of short and long duration bonds for diversification purposes? For instance, I looked at the new VanEck ETF, the 1-5 year Australian Government Bond ETF (ASX:1GOV). I didn’t think it was worth complicating the portfolio and rejected this option.

The last question was whether I needed to venture overseas to get bond exposure. For instance, I looked at Vanguard’s Global Aggregate Bond Index (Hedged) ETF (ASX:VBND). Unlike with equities, I didn’t think global bonds would provide enough reward versus risk, compared to Australian bonds.

In the end, I went with an Australian government bond ETF.

Moving beyond stocks and bonds

I did explore whether it was worth buying other assets besides stocks and bonds to diversify the risks of the portfolio.

I have some sympathy for investment titan Ray Dalio’s view that an investment portfolio should include a small percentage in commodities. There are several things to be aware of with commodities. First, they are cyclical and volatile. Second, you can buy physical commodities or commodity stocks. With physical commodities, many ETFs track the so-called CRB Index, which has 39% exposure to energy and 41% exposure to agriculture. It has much less allocated to industrial and precious metal commodities. It’s also worth noting that the performance of commodity stocks can diverge from the commodities themselves, sometimes by a wide margin. I seriously considered adding commodities to the mix, though chose not to as I didn’t want to complicate the portfolio.

I also looked at real estate as another option to diversify the portfolio. I thought that there could be a contrarian opportunity in property stocks given the poor recent performance of many A-REITs. Caveat emptor though: I found the A-REIT index is dominated by one stock – Goodman Group (ASX:GMG). Goodman comprises more than 30% of the A-REIT 300 index. You might be surprised to learn that despite the carnage in property, the A-REIT 300 index is largely flat over the past year, and that’s thanks to the 23% rise in Goodman’s share price over the period.

Source: Morningstar

I chose not to include real estate, primarily because I wasn’t convinced that it would do enough to diversify the risks of my portfolio.

The final decision

In the end, I’ve opted for a 3-ETF portfolio: 80% in equities with 50% of that in a US stock ETF and the other 50% in a world ex-US stock ETF, and 20% in an Australian government bond ETF. It suits my needs for a core portfolio.

One of the biggest lessons that I’ve taken away from this exercise is that it's difficult to resist the allure of adding more to an investment portfolio. There’s almost a deep psychological need to add complexity.

I’m no investing saint though. My next project is to consolidate my stock portfolio into a smaller, ‘satellite’ equities portfolio to hold alongside this core portfolio.

John Bogle would rightly be rolling his eyes.

James Gruber is an assistant editor at Firstlinks and Morningstar.com.au