The Reserve Bank of Australia surprised markets by holding the official cash rate steady at 3.85% last month, marking its third consecutive pause despite growing expectations of an easing cycle.

With inflation now tracking comfortably within the RBA’s target band and consumer confidence weakening, many market participants had priced in a rate cut. The RBA’s decision, therefore, reinforced a broader theme playing out in global markets: central banks are proceeding cautiously.

Bonds are in better stead

After a relatively volatile period in fixed income markets, albeit one where returns from global bonds have been strong, especially credit, global bonds are entering the second half of 2025 in a stronger position. Amid an environment of softening global growth, evolving inflation dynamics, and heightened geopolitical and policy risks, global bond markets appear poised to deliver compelling income and relative stability.

US economic activity is moderating, with consumer spending and labour market strength slowly easing. This softening, combined with persistent uncertainty over tariffs, immigration policy, and geopolitics, has many investors reconsidering their portfolio allocations. In this setting, bonds are regaining their status as a core diversifier and income engine.

For bond portfolios, balancing return potential with downside protection is key. Many investors are tilting toward higher-quality credit across sectors and issuers, as the current market environment does not sufficiently reward taking on excessive credit risk.

Despite the recent pause by the US Federal Reserve, rate cuts remain possible. As of June 2025, the Fed kept its target range at 4.25% to 4.50%, but market expectations suggest modest easing by year-end. If growth data disappoints, intermediate-duration bonds could benefit meaningfully.

The steepening of the US yield curve has also drawn attention. While shorter-term yields have eased, the 10-year Treasury yield climbed to 4.39% in June. This signals the market’s acceptance of a higher long-term cost of capital and some lingering inflation concerns—but it also provides a more attractive income base for long-term investors.

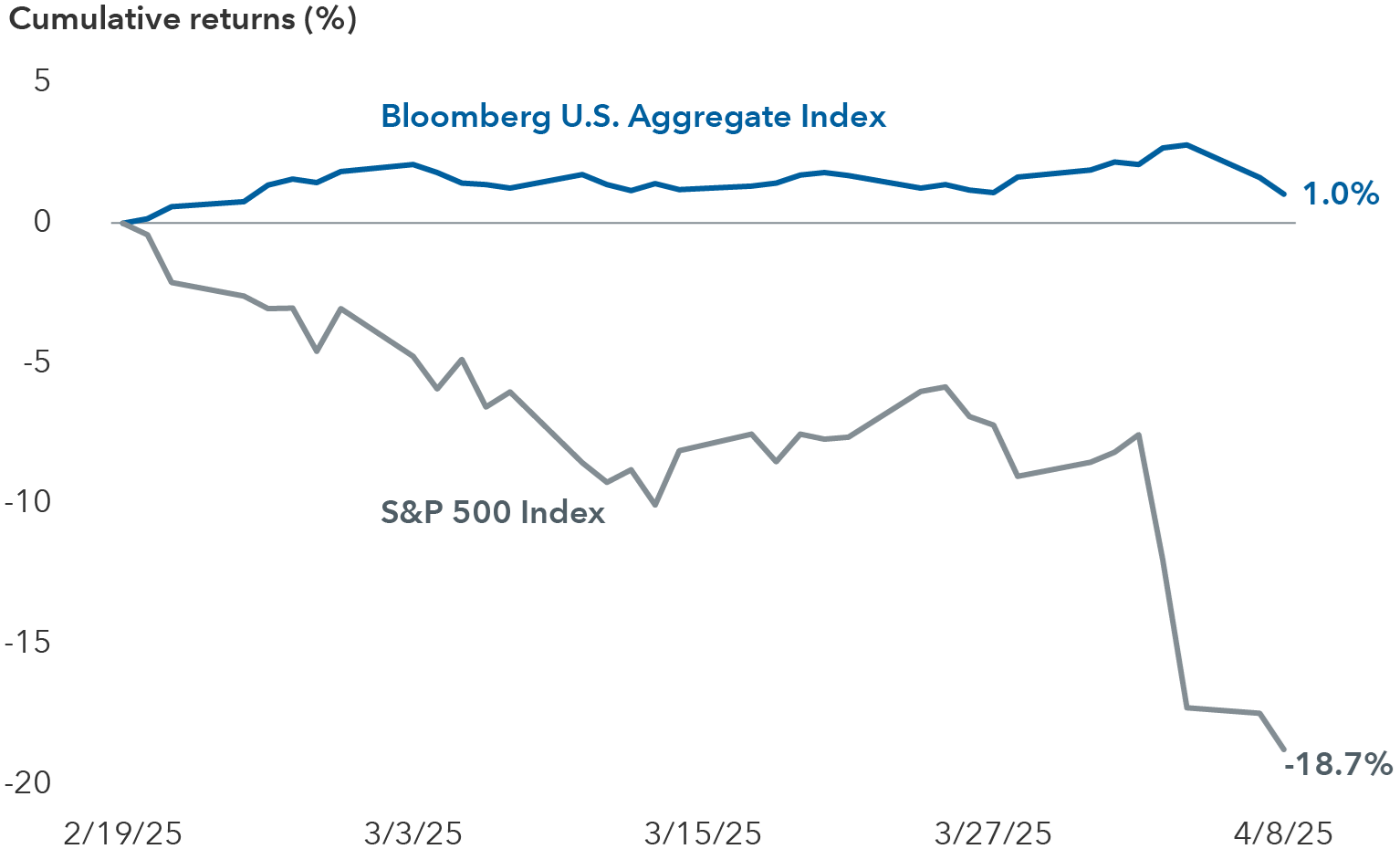

As equities entered a correction, bonds provided a buffer

Past results are not a guarantee of future results. Source: Bloomberg. As of 8 April 2025. A correction is defined as a price decline of 10% or more (without dividends reinvested) in the S&P 500 Index with at least 75% recovery.

One of the most promising developments is the re-emergence of the negative equity-bond correlation. Earlier this year, as the S&P 500 corrected by nearly 19% from its February peak to its April low, the Bloomberg US Aggregate Bond Index rose 1%. That traditional diversifying behaviour is particularly valuable in a period marked by policy and market unpredictability.

Globally, policy divergence is creating select opportunities. In Europe, Germany’s fiscal expansion and the stronger euro are helping suppress inflation, giving the ECB more scope to cut rates. In Japan, yield curve steepening caused by bond market dislocation may trigger a pause in further Bank of Japan tightening as they respond to supply-demand imbalances.

Within securitised markets, mortgage-backed securities (MBS) offer attractive risk-adjusted returns. Higher-coupon agency MBS provide competitive yields with lower duration risk. Their liquidity and resilience in past downturns make them particularly appealing in today’s environment. Value can also be found in certain subprime auto and commercial mortgage-backed securities that offer strong structural protections and income potential.

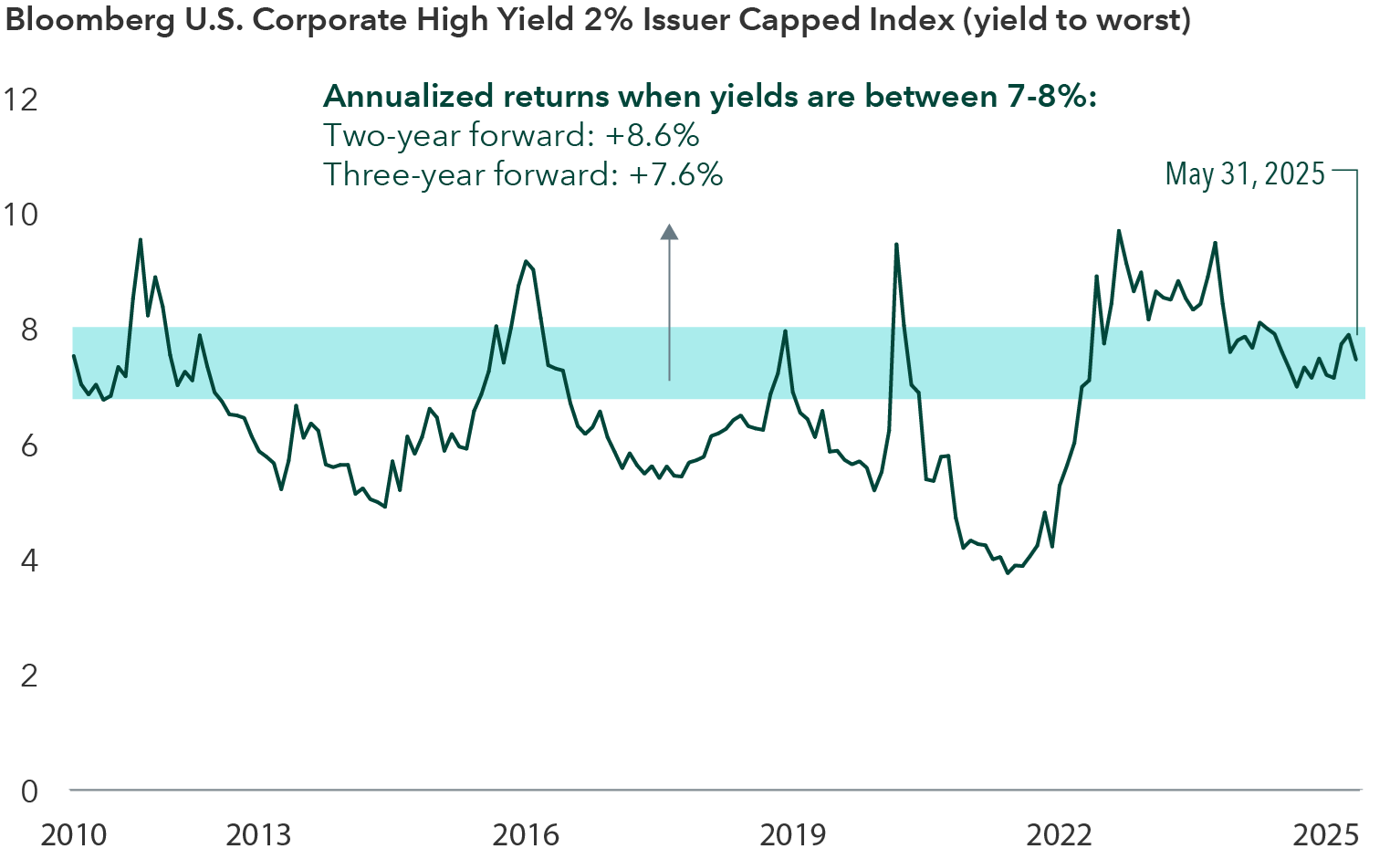

Corporate bond markets are holding up well. Investment-grade issuers continue to improve credit quality by reducing debt, and many high-yield companies have stable cash flows and reduced refinancing risk. In today’s market, yields between 4% and 8% across quality credit segments offer a strong starting point for long-term returns. Even if spreads widen, the elevated income helps cushion total returns.

High-yield bonds posted strong returns at current yields

Sources: Bloomberg Index Services Ltd. As of 31 May 2025. Average forward two-year and three-year returns are annualized.

Emerging markets are also worth watching closely. Declining energy prices, easing inflation, and weaker global growth have many EM central banks shifting toward looser policy. A reduced reliance on foreign capital, in favour of more stable domestic investor bases, makes these markets less prone to the shocks experienced in prior risk-off episodes.

The macro backdrop continues to favour bonds. Higher starting yields, better diversification properties, and potential for price appreciation if central banks ease more quickly than expected make a strong case for global fixed income.

This is the kind of environment where active management matters—navigating regional dispersion, credit selection, and curve positioning will be critical to capturing value while managing risk.

With all of these dynamics at play, the second half of 2025 may represent an ideal time to re-engage with global bonds—not as a defensive afterthought, but as a core source of durable income and strategic value.

Haran Karunakaran is an Investment Director at Capital Group (Australia), a sponsor of Firstlinks. This article contains general information only and does not consider the circumstances of any investor. Please seek financial advice before acting on any investment as market circumstances can change.

For more articles and papers from Capital Group, click here.