Are today’s expensive AI stocks the next market leaders – or just another bubble waiting to burst?

History seems to be repeating itself and in relatively short order. The recent rally has led to a sharp increase in the number of companies valued at over 10 or 20 times their annual revenue.

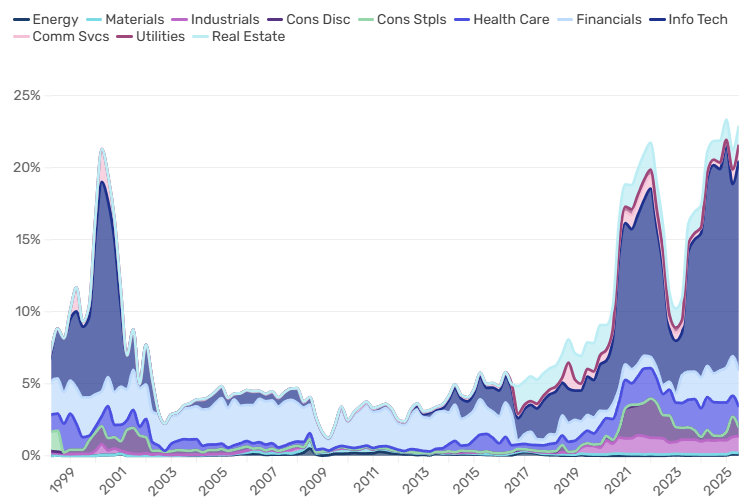

Companies with an enterprise value-to-sales ratio (EV/sales) greater than 10 now account for over 20% of the MSCI World index, levels not seen since the dotcom bubble. The question now is whether these inflated valuations can create lasting value or are destined to unravel under pressure.

We first looked at this in late 2020 as the FAANG1 stocks surged, warning that these kinds of stocks were likely to underperform. And for a while, that call was correct. From 2020 through 2022, this group of stocks lagged significantly.

Is the AI rally a new internet bubble?

But thanks in part to the AI revolution, the past two years have seen a dramatic reversal, with extreme valuations coming back. This comeback surprises us in today’s environment of normalised interest rates and persistent inflation. It’s one thing to justify these valuations when US 10-year Treasury yields are below 2% – when money is cheap, it’s easier to imagine a glorious growth-filled future. But with yields now around 4.5%, the justification becomes much harder to swallow.

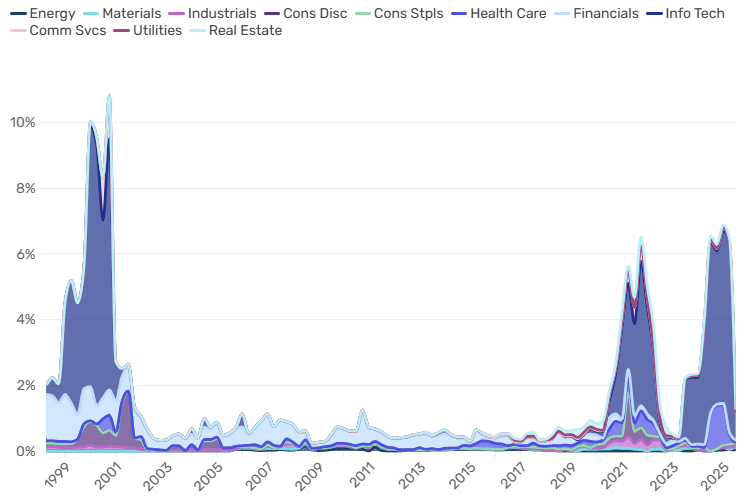

Our 2020 musings highlighted a persistent truth: stocks trading at extreme valuations (e.g., EV/sales > 10 or 20 times) rarely deliver the earnings needed to justify their price tags. Drawing on historical data, we showed that:

- For stocks with EV/sales above 10 times, the median underperformance was 65% over five years in the Russell 1000, and 33% in the MSCI World

- For stocks with EV/sales above 20 times, the story was even worse, with median underperformance of 73% in the Russell 1000 and 50% in the MSCI World

The reason? These companies typically fail to generate the returns on equity (ROE) or sustained growth required to justify such valuations. Our 2020 analysis showed that the median ROE for stocks with EV/sales above 10 times has been close to zero since 1999, and often negative for those above 20 times.

Figures 1 and 2 show today’s concentration of stocks trading at these multiples rivals the dotcom bubble, with the Information Technology sector driving much of the surge.

Figure 1: Return to dotcom heights: Share of MSCI World stocks trading above 10x EV/sales

Source: Man Numeric using MSCI World data as of 30 June 2025.

Figure 2: Share of MSCI World stocks trading above 20x EV/sales

Source: Man Numeric using MSCI World data as of 30 June 2025.

Are we closer to 1995 or 2000?

Of course, this brings us closer to the Internet bubble of the mid- to late 1990s where we also had a rather normal interest rate environment. And the key similarity is a once-in-a-generation technology advancement that is drawing immense sums of capital.

Another many-trillion-dollar question is where we are on this multi-year growth cycle. If the ChatGPT moment in late 2022 was the equivalent to the Netscape moment in 1995, are we in the equivalent of 1998? If so, equity beta is going to be fun over the next two years. But if we are closer to 2000… maybe not so much.

We’d also be remiss not to mention the possibility that the ever-increasing rise of passive investing may contribute to the lack of discipline in terms of valuing stocks. Passive flows inflate the largest companies without regard for valuation, making it easier for speculative bubbles to persist and grow.

Dispersion: signals of mispricing

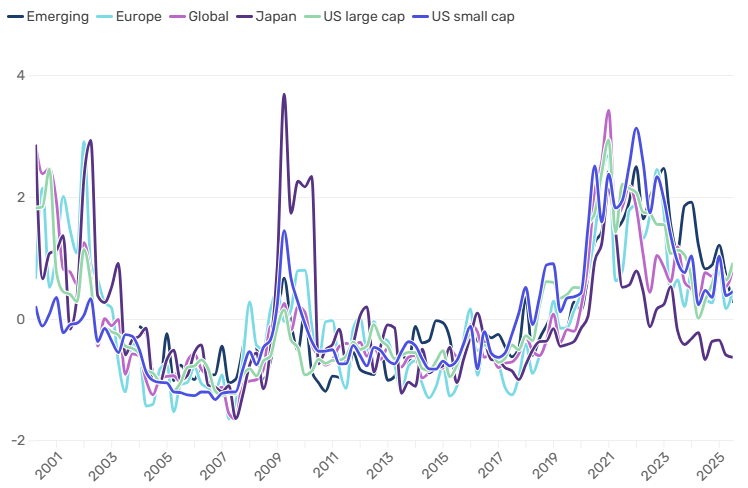

Regardless of whether parts of the market are overvalued, one thing we care about is valuation dispersion, which is the spread between the cheapest and most expensive stocks. Though not terribly useful as a short-term indicator, we believe that more dispersion signals better opportunities for Value investors.

This was true in the early 2000s after the Internet bubble burst, in 2009 after the Global Financial Crisis, and even in 2021-2022 after the COVID rally. Historically, wider dispersion has signalled greater opportunities for mispriced stocks, while narrower spreads suggest fewer inefficiencies to exploit.

Using forward earnings expectations, and neutralising for sectors and/or industries, dispersion across the global market looks relatively “normal.”

Japan has narrower dispersion than usual, while other regions are slightly wider than average. This means that although some parts of the market look excessively expensive, there are still opportunities for Value investors – particularly outside of Japan.

Figure 3: Valuation mispricing or opportunity? Dispersion in forward E/P across regions

Source: Man Numeric using MSCI World data as 30 June 2025.

Parting thoughts

While AI-driven enthusiasm has pushed valuations to extremes, history tells us that stocks trading at these multiples rarely deliver the returns needed to justify their price tags. Caution is warranted. Fundamentals still matter.

All data Bloomberg unless otherwise stated.

1. Facebook, Apple, Amazon, Netflix, Google

Daniel Taylor, CFA is CIO and Ben Zhao is a Portfolio Manager, Man Numeric. Man Group is a specialist investment manager partner of GSFM Funds Management, a sponsor of Firstlinks. GSFM represents Man AHL and Man GLG in Australia. The information included in this article is provided for informational purposes only. Man Numeric do not represent that this information is accurate and complete, and it should not be relied upon as such. Any opinions expressed in this material reflect our judgment at this date, are subject to change and should not be relied upon as the basis of your investment decisions.

For more articles and papers from GSFM and partners, click here.