We have had our fair share of bubble talk in the AI space over the last six months. So many people argue that AI stocks are in a bubble and that bubble may lead to a crash soon. But while we can debate the former, I think the latter is the wrong conclusion.

It is extremely hard, if not impossible, to identify a bubble in real time. Still, even if you can identify a bubble with certainty, you shouldn’t expect the affected stocks to see a drastic decline in prices anytime soon. That is one of the lessons I take away from reading a new paper by Christian Stolborg and Robin Greenwood.

They looked at all the boom-bust stocks in the US since 1980. Boom-bust stocks meet the following criteria: (i) they have had >100% return in the last 12 months and the last 6 months, (ii) a positive return in the current month, (iii) a price-to-book or a price-to-sales ratio of more than 5x, and (iv) a drawdown of at least 50% in the next 24 months.

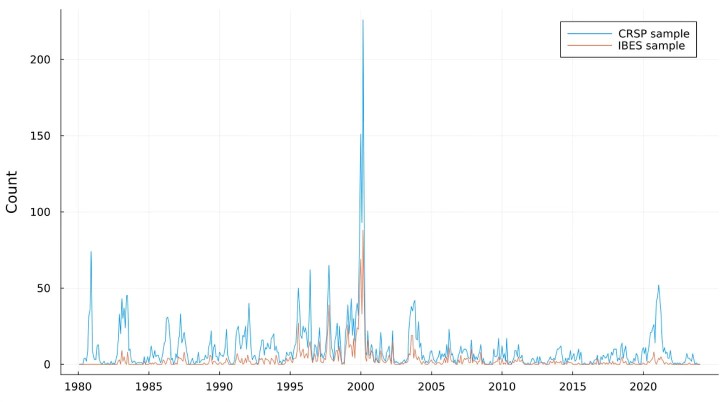

As you can see in the chart below, there have been quite a few of these boom-bust stocks, not just in 2000 but throughout the period from 1980 to 2023 covered in the study.

Figure 1: Boom-bust stocks since 1980

Source: Stolborg and Greenwood (2025)

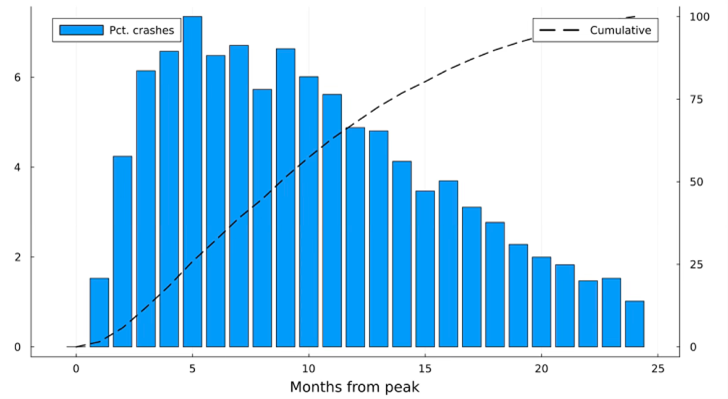

In hindsight, we can identify these stocks and know precisely when their share prices peaked. But when did they crash? The second chart today shows that it can take more than a year before even these extreme bubble stocks face a significant drawdown. About 75% of bubble stocks are down by 50% within a year after they have reached their peak, but 25% of stocks continue to drift along for more than a year before they crash.

And because boom stocks are defined as having at least 100% return in the six months before they peak, a 50% drawdown only means that investors have lost six months’ worth of gains by then. Often, the drawdowns continue from there until most of the gains from the bubble phase are lost again.

Figure 2: Months until boom stocks meet the bust criteria of 50% drawdown

Source: Stolborg and Greenwood (2025)

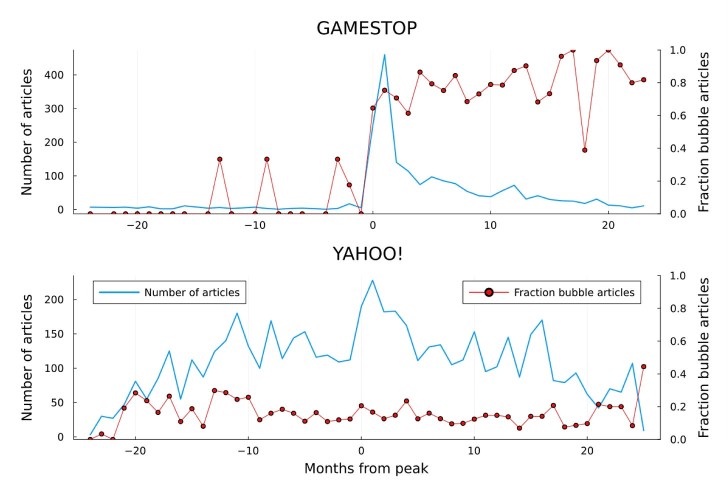

So even if you know you are in a bubble, share prices can linger near the bubble peak for quite some time. But do people at least talk about the stocks being in a bubble during that time? It turns out no. There are two types of media coverage of boom-bust stocks, as exemplified by Gamestop in 2021 and Yahoo in 1999. Gamestop was immediately identified as a bubble stock, and the media talked a lot about the bubble in Gamestop as it unfolded and before the stock crashed. But this is the exception rather than the rule.

According to the authors of the study, most media coverage resembles that of Yahoo in 1999 much more closely. The media coverage of a potential bubble in Yahoo intensified about one year before the shares actually hit their all-time high and then collapsed. Once the bubble actually burst, the share of media articles covering Yahoo as a bubble stock was about half of that in 1997 and 1998. Only when the crash had fully unfolded in 2003 did the media characterise Yahoo shares again as a bubble stock because by then, it was clear to everyone that the shares had gone through a boom-and-bust cycle.

Figure 3: Gamestop 2021 vs. Yahoo 1999

Source: Stolborg and Greenwood (2025)

The lessons I learn from the paper are that it is (i) incredibly difficult to identify a bubble in real time, (ii) you cannot trust media or investor worries about a potential bubble as a signal to identify crash risk, (iii) even if you are in a bubble, many stocks can linger for a long time near their all-time highs giving investors hope and short-sellers seemingly endless pain before the share price collapses.

But just to be sure that you don’t blame me for being a booster to AI stocks. Even though the media typically misses a bubble, it sometimes catches it in time. Maybe AI stocks follow the path of Gamestop, perhaps they follow the path of Yahoo. I don’t know. We will find out in due course.

There are some other interesting results in the paper about which metrics to use to get some indication that a stock may be in a bubble, but I leave you to read the paper and find out about them yourself.

Joachim Klement is an investment strategist based in London. This article contains the opinion of the author. As such, it should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of the author’s employer. Republished with permission from Klement on Investing.