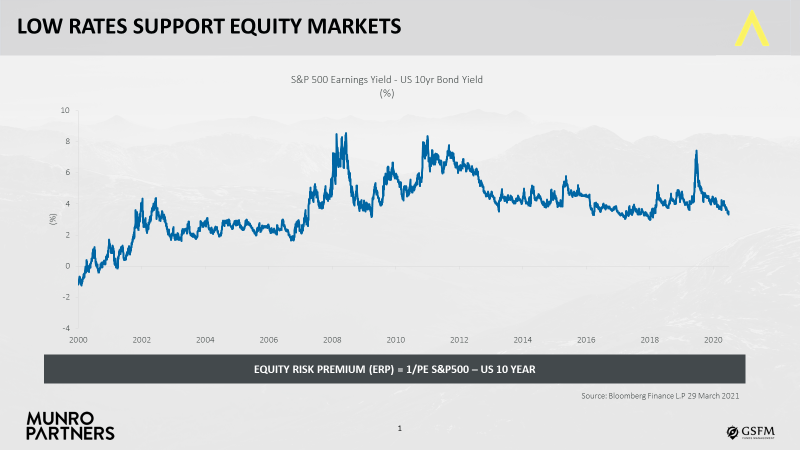

Global equity markets had a volatile start to 2021 as US long-term interest rates, represented by the nominal yield on the benchmark 10-year Treasury, rose on the back of expectations of a vaccine-led recovery.

This has compressed the equity risk premium – the premium that equities offer investors over interest rates – and made markets look less attractive. It has made longer duration equities, like growth equities, look even less attractive still. The chart below shows the contraction in spreads between the US S&P 500 earnings yield minus the benchmark US bond.

Interest rate rises versus earnings growth

The outlook for markets therefore depends on how high interest rates will rise as we move through this economic recovery. Prior to the pandemic, interest rates had been held very low globally for some time, which suggests that while there is some room for rising rates, it is unlikely they can rise much above 2-2.5%.

The vaccine rollout around the world, combined with political stability in the US, means that more likely than not, we will see a broadening in the recovery in global markets and earnings continuing to grow.

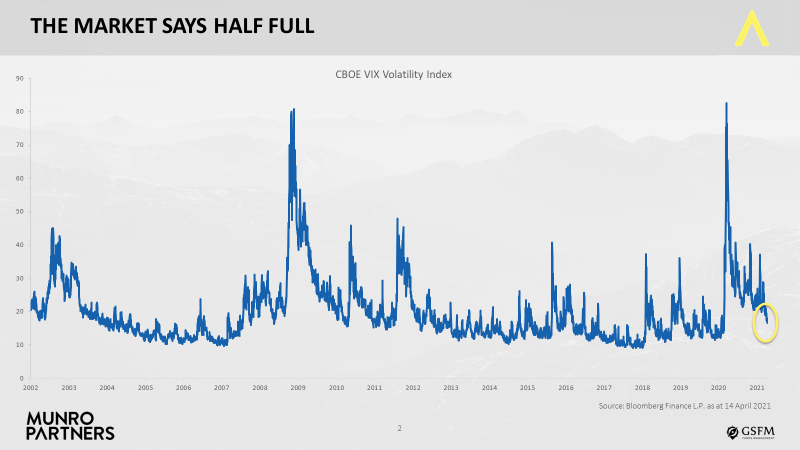

The volatility index, or VIX, also offers clues to the outlook for equity markets. During difficult periods, such as the GFC and more recently 2020, the VIX rises and then gradually moves into a lower volatility band. We are already seeing signs of this with the VIX dropping below 20 in the past few months (from a high of 66 in March 2020). This further supports the argument for a broad-based recovery and buoyant equity markets over the months and years ahead.

Structural ideas for the long term

Despite the massive disruptions that economies and markets have experienced over the past 12 months, there are themes and investment ideas that will always prevail.

One structural theme occurring in the world today, which will ultimately drive earnings growth, is that of the ‘emerging consumer’.

The emerging consumer is one of our particular areas of interest (AOI) and it is all about the rising wealth effect in emerging economies, particularly China, and how, as income levels rise in those countries, consumption habits and patterns change.

Sub-sectors under this theme include Luxury, Cosmetics, Travel and Global Brands.

Growth in spending on luxury goods pre-pandemic could be observed in the prevalence of luxury brands or goods in any airport or any major city.

Alcohol is another example, as an economy develops its consumers are also more likely to shift to consuming more high-end liquor.

These trends all target the higher growth rates that will result from rapidly modernising emerging economies as they move from low rates of GDP to high rates of GDP. Companies linked to these trends – such as Louis Vuitton in luxury goods, Airbus and Boeing in aerospace, and Diageo or Pernod in drinks - are beginning to look attractive again as travel and spending starts to pick up.

Aerospace

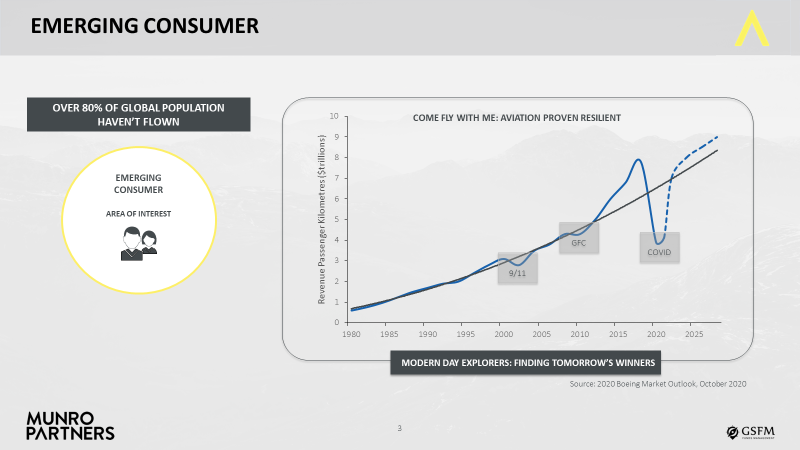

Aerospace is a good example of an emerging consumer industry starting to come out of the pandemic. Even though there has been a reduction in the number of international travellers as many countries remain locked down, 80% of people in the world today have never boarded an aeroplane.

Even prior to the pandemic, when more than 3 billion were travelling every year - the equivalent of just under half the world’s population - it was actually the same people, mostly in developing countries, travelling numerous times a year.

A large proportion of people in the developing world who have never travelled by air would like to, and there is no doubt they will as their income allows it. The emerging world is where the majority of growth in aerospace is likely to come from in the years ahead.

In South East Asia, Africa and China, travel growth is expected to grow in excess of GDP over the next two decades. And even if international travel continues to be off limits, people will want to travel by air in their own countries. The number of airports in China, for example, is forecast to double to 450 airports in 2035. Boeing’s commercial market outlook for 2020-2039 forecasts that Chinese airlines will need nearly 8,240 new passenger aircraft deliveries over the next 20 years. The majority - 6,450 – will be single-aisle aircraft.

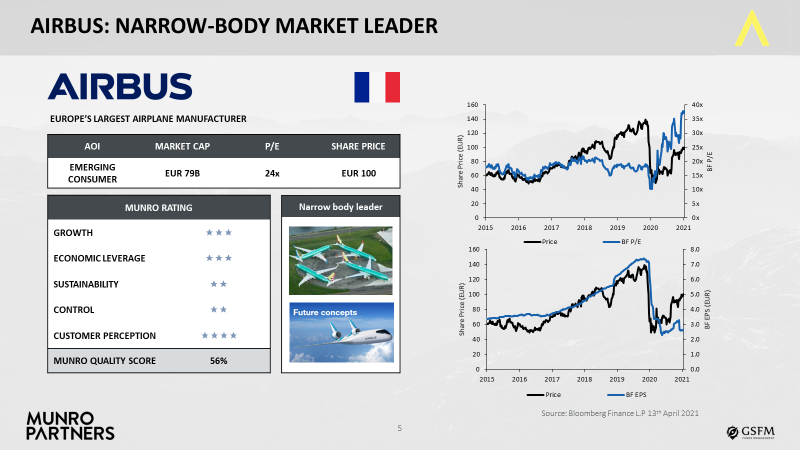

Airbus

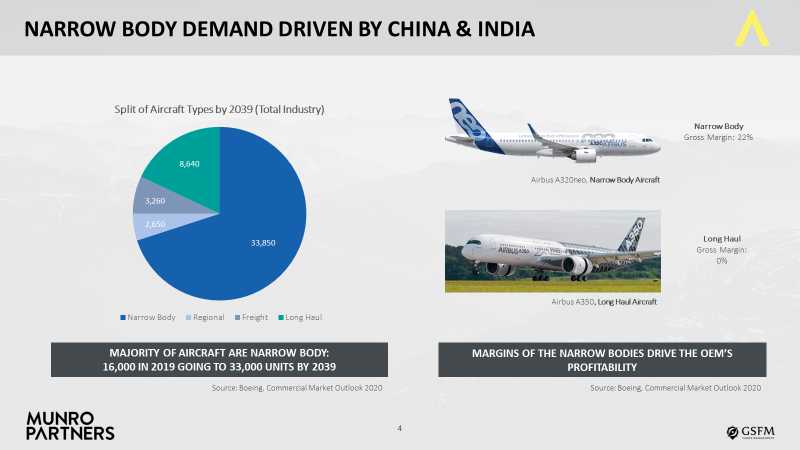

Airbus* is a key player that will benefit from this change in travel habits and patterns. Narrow body, or single aisle, aeroplanes used for shorter domestic flights are more profitable than the wider body aeroplanes used for long-haul flights.

Both Boeing and Airbus have been very profitable in the narrow body space, to the point where they could potentially become more profitable companies overall without the wider body aircraft. Boeing estimates the gross margin on narrow body aircraft at 22% compared to 0% for the larger long-haul aircraft.

Boeing also estimates that most aircraft are expected to be narrow body by 2039 - at 33,850, compared to 8,640 long haul aircraft. This trend is already starting.

In the first quarter of 2021, Airbus reported that of the 39 aircraft ordered, 38 were for single aisle aircraft. That overall number for the quarter was significantly down on the 356 ordered in Q1 2020 but the number of commercial aircraft Airbus delivered in Q1 2021 - at 125, was slightly up on the 122 delivered in the same quarter last year.

Boeing and Airbus combined have an effective monopoly on the narrow body aircraft space which makes them very attractive investment prospects.

Where to from here? Watch the emerging consumer

Digital might have been a key thematic winner from the pandemic, with the share prices of the likes of Zoom and Amazon skyrocketing, but it is not the only beneficiary. A broader economic and market recovery unlocks opportunities in other areas such as supercomputing and the manufacture of semiconductors and semiconductor equipment. It can assist growth in climate-related stocks in clean energy and solar batteries as well.

These are all areas of interest for us.

Broader economic and market recovery will also support further growth in spending by the emerging consumer. Aerospace may be an early leader in the emerging consumer space, but due to its relatively quick recovery from Covid, China is already experiencing growth in consumer spending on luxury goods. Listed Italian high-end outerwear manufacturer Moncler**, for instance, reported their Chinese mainland revenues more than doubled in the first quarter of 2021.

As these companies’ earnings outlooks improve, their stock prices should follow. In the long run, it is always earnings that drive stock prices.

*At the time of writing, Munro Partners holds Airbus in its Munro Global Growth Fund and Munro Concentrated Global Growth Fund.

**At the time of writing, Munro Partners holds Moncler in its Munro Global Growth Fund.

Nick Griffin is a Founding Partner and Chief Investment Officer at Munro Partners, a specialist investment manager partner of GSFM, a sponsor of Firstlinks.

For more articles and papers from GSFM and partners, click here.