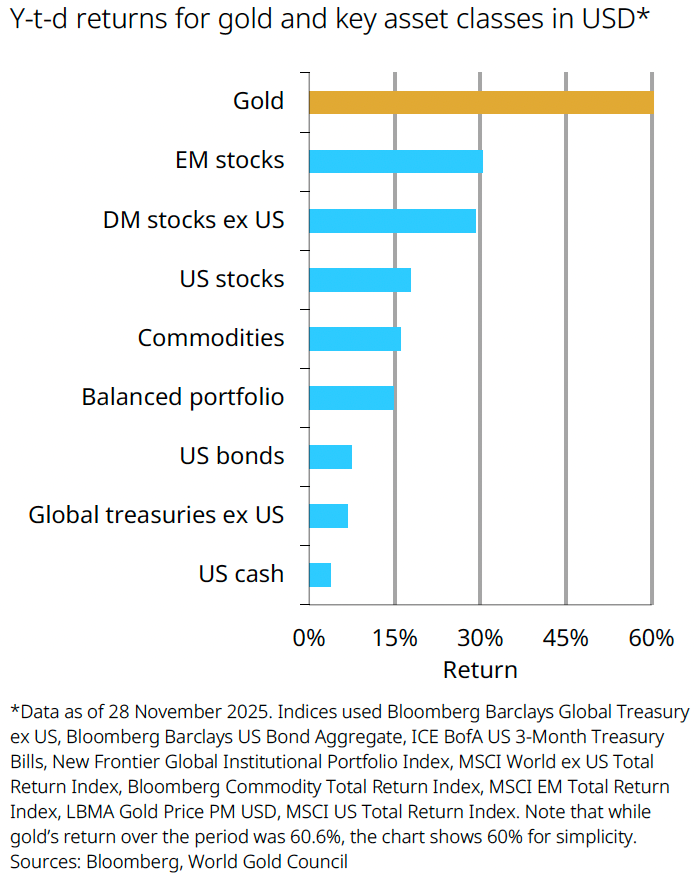

Heightened geopolitical and economic uncertainty combined with a weaker US dollar have driven investor demand for gold as investors seek hedges against volatility and inflation, creating significant price momentum in 2025. With bond markets lacklustre and equities highly concentrated, investors across all regions from West to East have been party to the rally.

Figure 1: Gold takes a place on the podium in 2025

Australian investors have not missed out. Inflows to Australian gold ETFs have netted almost A$1.5 billion (US$935 million) year-to-date as investors have turned to gold for its diversification benefits, stability and capital gains. The World Gold Council’s November ETF report shows total Assets Under Management (AUM) in Australian gold ETFs now sits at A$10.5 billion (US$6.9 billion) by the end of November [1].

So, what can we expect in 2026?

Concerns about a softening US labour market are mounting, while there is ongoing debate about inflation, as there is in Australia. Will inflation stay stubbornly high or even face renewed upward pressure?

Markets are largely pricing in a continuation of the status quo, but divergences in macro data and the ongoing geoeconomics volatility mean there will be nuances and no-one can discount the possibility of more extreme events.

So, the World Gold Council’s 2026 Gold Outlook has examined three potential scenarios other than the market consensus.

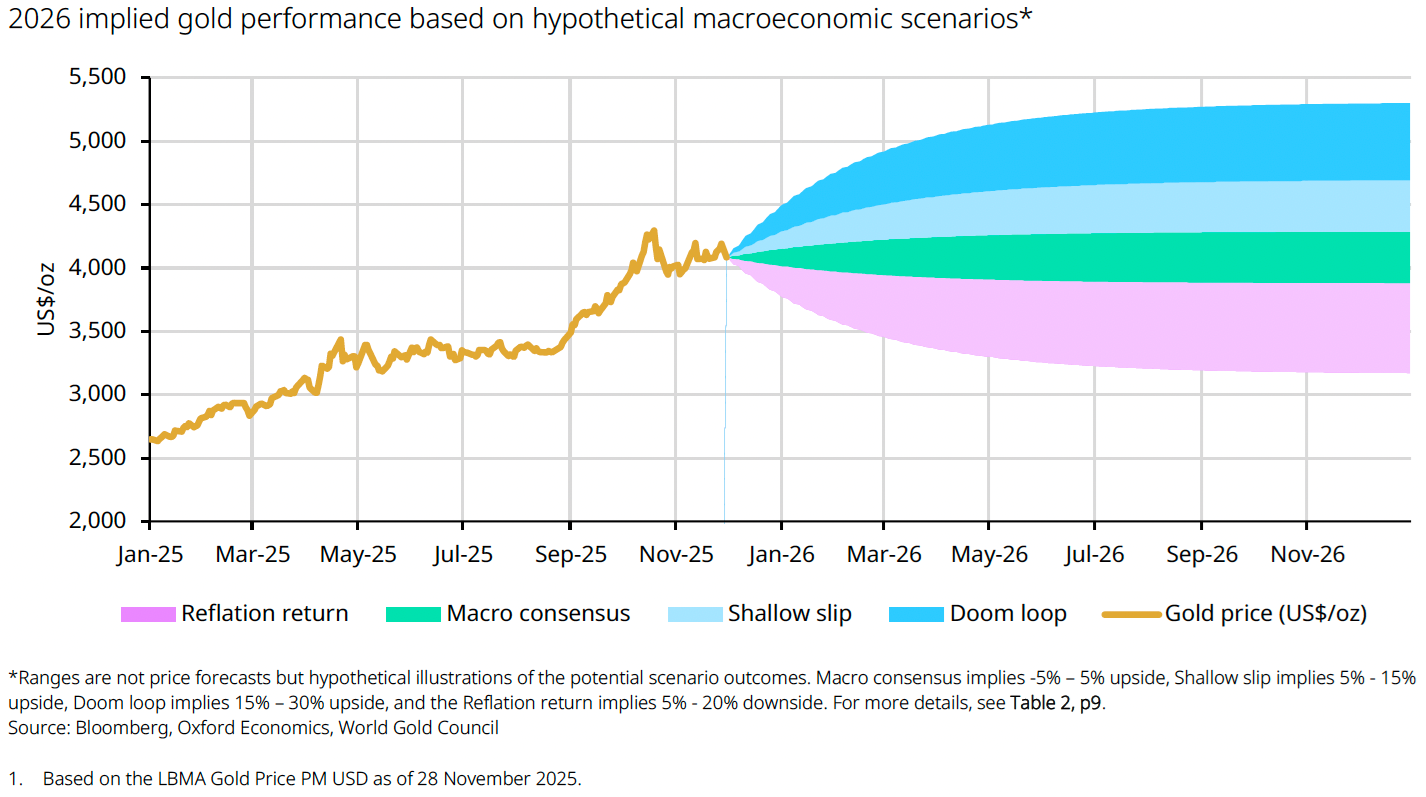

Figure 2: Continued market volatility and geoeconomic risk could push gold higher, but a reduction in risk premia could put pressure on its performance.

1. A shallow slip in macroeconomic conditions (moderately bullish)

This scenario sees a potential reset in the AI boom on equity markets acting as a drag on the wider market and the main indices. This would amplify market volatility and encourage further de-risking.

At the same time, the US labour market could track softer and consumer spending could weaken, creating a broader slowdown in global growth. If this occurs, the US Federal Reserve would likely cut rates faster and deeper than current expectations, responding to the economic uncertainty and expectations of cooler inflation.

The impact on gold in this scenario would be moderately bullish, creating a supportive environment for continued gold demand and a rise in the price. Our analysis – see notes under chart 2 – suggests that, in this environment, gold could rise between 5% and 15% on current levels, depending on the magnitude of the rate cuts and the severity of the economic slowdown.[2]

Central bank buying would continue, and there may be new entrants into investment markets, such as Chinese insurers or Indian pension funds.

A 5% to 15% rise in the gold price would represent a solid return and a normal year, but coming after the stellar performance of 2026 it would still be a noteworthy follow-up.

2. The doom loop (bullish)

This is the most bearish scenario for the economy but one that would have the most positive impact on the gold price. It reflects the chance that the global economy could move into a deeper and more synchronised slowdown.

Geopolitical risks could manifest larger as unresolved regional conflicts continue or even intensify, or a new flashpoint could emerge to further erode confidence.

This could occur alongside tensions around trade, fragmenting the market environment and impacting confidence and investment.

Business investment and consumer spending could be scaled back.

If the US growth was to weaken further and inflation fall below target, this ‘doom and gloom’ scenario could prompt some aggressive rate cutting from the Fed which would drive the US dollar lower and see long-term yields decline sharply.

A combination of these factors in the ‘doom loop’ would create exceptionally strong tailwinds for gold as investors sought out safety.

In this scenario gold could move sharply higher, and our analysis shows a potential surge of between 15% and 30% over 2026.

The main beneficiary of this would likely be gold ETFs, which have seen US$77 billion in inflows between January and November this year, and this would offset a potential weakness in demand for gold in other areas of the market, such as jewellery or technology.

3. Reflation Return

This is the most bearish scenario in terms of its impact on the gold price. In this environment, the Trump administration’s economic policies are successful, and the fiscal support delivers stronger than expected growth.

Reflation would take hold and lift global growth on a higher trajectory, forcing the Fed to hold or even hike rates in 2026. This would push long-term yields higher and strengthen the US dollar, increasing the opportunity cost of holding gold and forcing a re-allocation of capital back to US assets.

With economic sentiment improving, the environment would move to risk-on.

Gold ETFs would see sustained outflows as investors rotated back into equities and higher yielding assets.

All of this would have a negative impact on the gold price, resulting in a correction of between 5% to 20% on current levels.

Taken together, higher opportunity costs, risk-on sentiment and negative price momentum could create a challenging environment for gold if these reflation conditions are borne out.

Wildcards

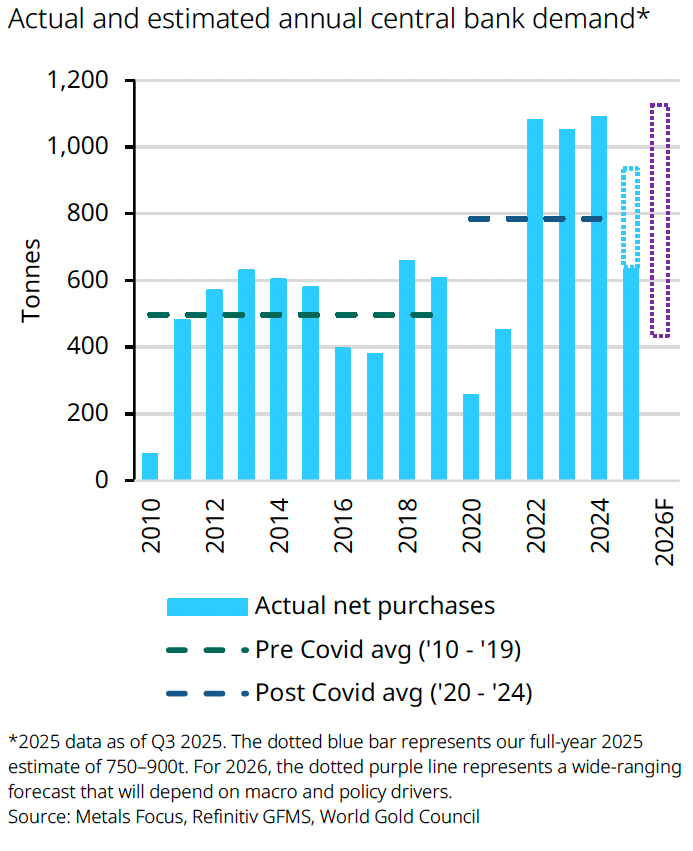

Beyond these scenarios, central bank demand – which was a significant driver of demand in 2025 - could become unpredictable. While there are good reasons to expect central bank buying to continue, the buying process is often dictated by policy rather than by market conditions alone.

If central banks pull back on buying, this could create additional headwinds for gold.

Figure 3: Central bank demand has been an important contributor to gold’s performance

Another wildcard could be recycling flows, where the gold used in jewellery and technology comes from repurposing rather than from mines.

Recycling was muted over 2025, a factor linked to a notable increase in the use of gold as collateral for loans.

In India, for example, consumers pledged more than 200 tonnes of jewellery through the formal sector, and anecdotal evidence suggests there is almost as much gold backing loans in the informal sector.

Subdued recycling would continue to provide support for the gold price, but an economic slowdown in India could force the liquidation of gold backed collateral and boost secondary supply.

This would ultimately work to undermine the gold price.

Final thoughts

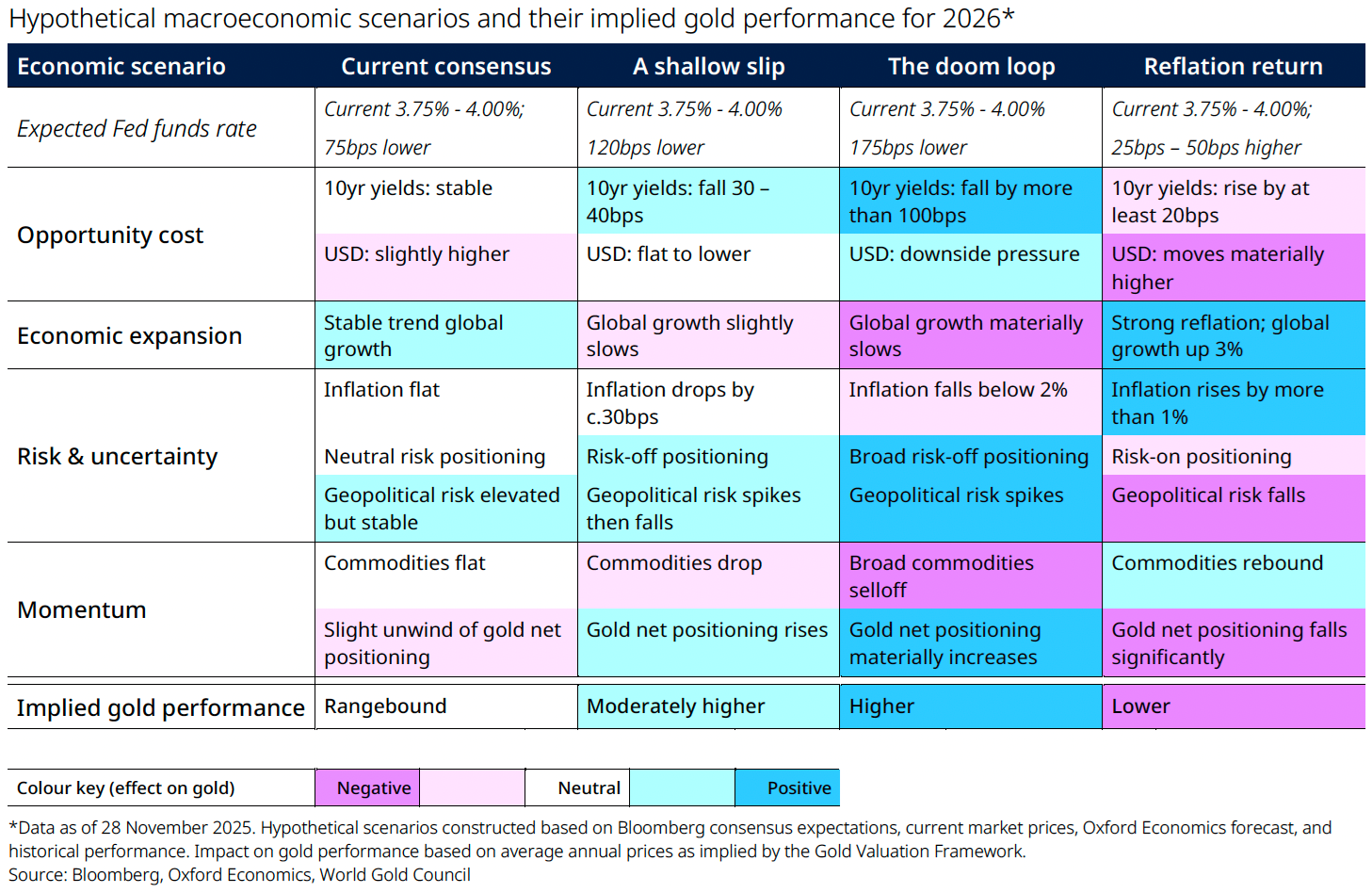

The gold outlook for 2026 is defined by the uncertainty of the economic environment.

Uncertainty is likely to continue in 2026, but what forms it may make and how severe it could be are unknowns as we move into the new year.

Investors will have their own views on the likely path of the global economy and the forces which may shape it in 2026.

Mapping those views against our three scenarios may clarify where gold might fit into assessments and forecasts for the year to come. Ultimately, the diversity of possible outcomes highlights the value of scenario-based planning.

In a world where shocks and surprises are increasingly the norm, gold’s capacity to provide diversification and downside protection remains as relevant as ever.

Figure 4: Gold responds to a combination of factors that influence its role as an asset

[1] Converted from USD to AUD using an exchange rate of 0.6536 (USD/AUD), 28 November 2025

[2] All hypothetical implied impact on gold from various macro scenarios are performances implied by our Gold Valuation Framework base on various inputs, see: Gold Outlook 2026: Push ahead or pull back | World Gold Council for more details.

Shaokai Fan is Head of Asia Pacific ex-China and Global Head of Central Banks, at World Gold Council, a sponsor of Firstlinks. This article is for general informational and educational purposes only and does not amount to direct or indirect investment advice or assistance. You should consult with your professional advisers regarding any such product or service, take into account your individual financial needs and circumstances and carefully consider the risks associated with any investment decision.

For more articles and papers from World Gold Council, please click here.