The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

Michael Burry, the investor who famously predicted the subprime mortgage bubble bursting in 2008 and was a central character in Michael Lewis’ book The Big Short, recently revealed that he is shorting more than a billion dollars of shares in tech high-fliers Palantir and Nvidia. Both stocks tanked on the news, though they have recovered some since, and it initially brought jitters to the broader market.

Palantir’s CEO Alex Karp has called Burry “batsh*t crazy” for betting against his company and accused him of market manipulation.

Nonetheless, Burry’s short selling has fuelled concerns about whether markets are overvalued, if not bubbly, and whether they may be on the precipice of a correction or crash.

Downplaying Burry

Before getting to that, it’s worth putting Burry’s latest moves into context. It’s fair to say that Burry is an eccentric character. He went from being a medical student to writing about stocks for a website, to attracting money from big-hitting fund managers, to making huge bets against US subprime mortgages that turned spectacularly right in 2008. His eccentricity made him a captivating character both in Michael Lewis’s book and the subsequent movie.

However, his market moves since the GFC have been a mixed bag. But he can afford to get it wrong given the riches he’s previously made.

While his shorts of Palantir and Nvidia are large, Burry has probably hedged them in a way so he’s not betting the farm on them ie. he won’t go broke if they turn awry.

And it’s worth noting that he has made specific shorts against two tech companies. He hasn’t shorted the entire US tech sector or the broader stock market.

Burry has since explained that he thinks the AI capex boom is inflated and tech companies aren’t accounting for them correctly, as they are overstating the useful life of chips, thereby understating depreciation charges and boosting short-term profits. He thinks the returns on AI will disappoint and future accounting adjustments will hurt long-run profits.

That said, Burry is a smart guy and his latest investments have added to concerns that we may be witnessing a historic market bubble that won’t end well.

[A day after this editorial was written, there is news out that Burry is shutting down his fund.]

He’s not the only bear

Burry is far from the only bear.

Even Jerome Powell, the US Federal Reserve Chair, has said that he thinks stocks are “fairly highly valued.”

Aswath Damodaran, an NYU Professor and valuation expert, followed up on Powell’s remarks with work of this own, and concluded that: “It is undeniable that this market [the US] is richly priced on every metric.”

Jeremy Grantham, who correctly called the 2000 and 2008 downturns, is similarly sceptical about today’s market: “This is the highest-priced market in the history of the stock market in the US.”

Wall street legend Ray Dalio is concerned about recent US central bank indications that it will start buying bonds again. If that develops into full-blown quantitative easing, against a backdrop of a still strong economy, markets will be vulnerable:

“It would be reasonable to expect that, like late 1999 or 2010-11, there would be a strong liquidity melt-up that will eventually become too risky and will have to be restrained. During the melt-up, and just before the tightening that is enough to rein in inflation that will pop the bubble, is classically the ideal time to sell.”

Markets do look toppy

These experts have a point – markets do look frothy.

First, the S&P 500 has returned 16.2% per annum (p.a.) since it bottomed in March 2009. It’s been a glorious run, far exceeding the long-term index average return of 10% p.a.

The ASX 200 returns pale in comparison yet have still been healthy, up 10.7% p.a. over the same period, above its long-term average of close to 10% p.a.

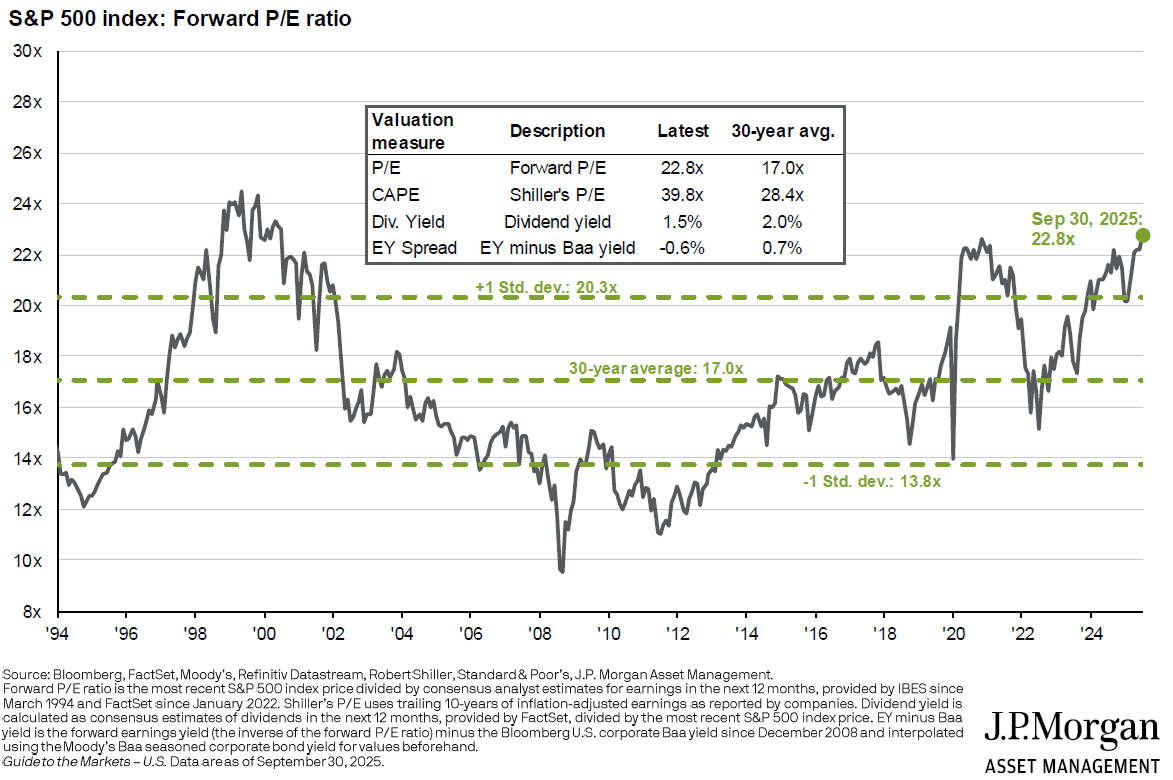

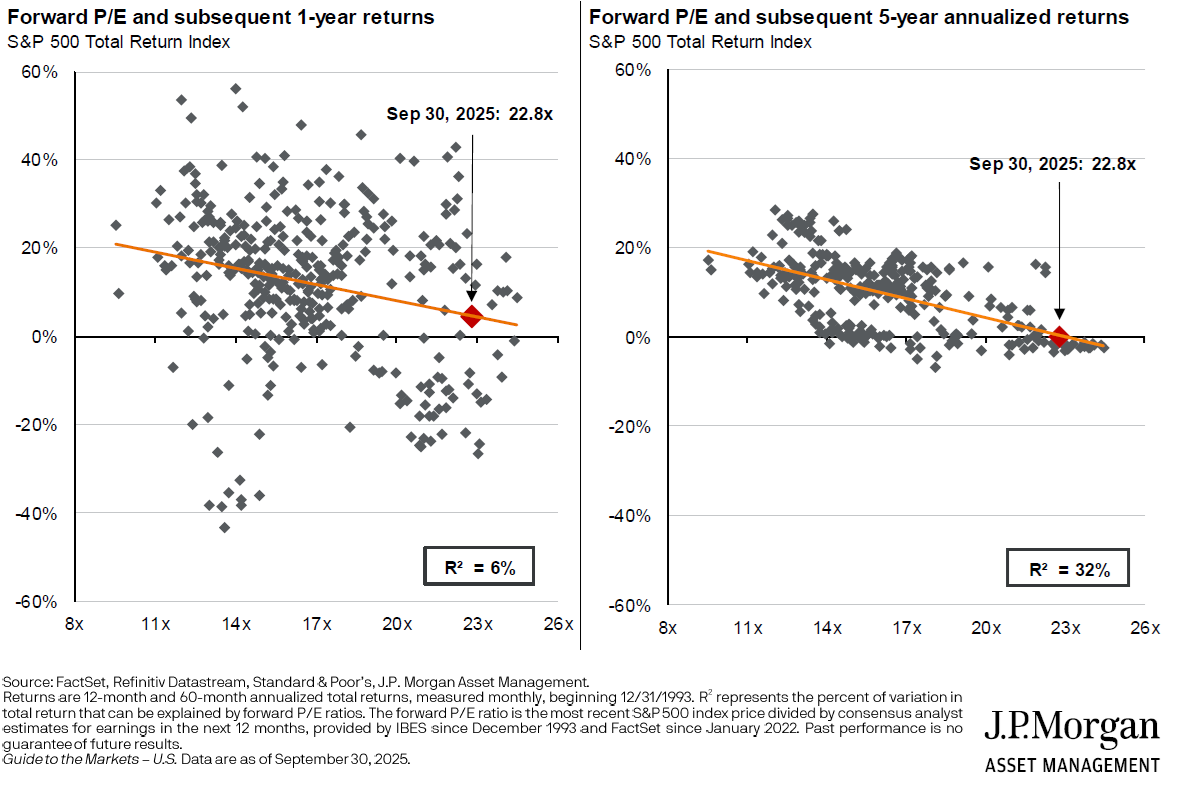

Second, valuation metrics, as Professor Damodaran mentions, are high. The S&P 500 is trading at a forward P/E multiple of 23x, versus the long-run average of 17x. It’s above levels prior to the 2022 highs, and only a little below those of 2000.

These P/E levels don’t augur well for future US market returns.

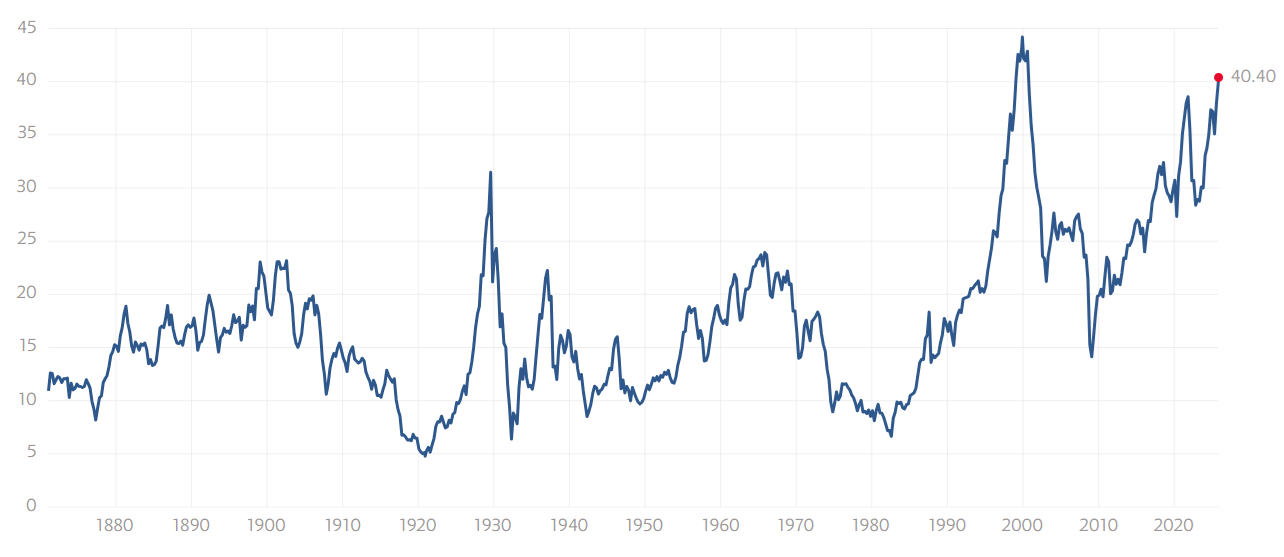

Meanwhile, the cyclically adjusted P/E ratio (CAPE) indicates the S&P 500 is now more expensive than it was in 1929, and a touch below levels reached in 2000, before the market fell 60%.

Shiller P/E ratio

Source: Robert Shiller

While ASX valuations aren’t as high, the ASX 200 is trading at 20x forward P/E, well above its historical average of 16x.

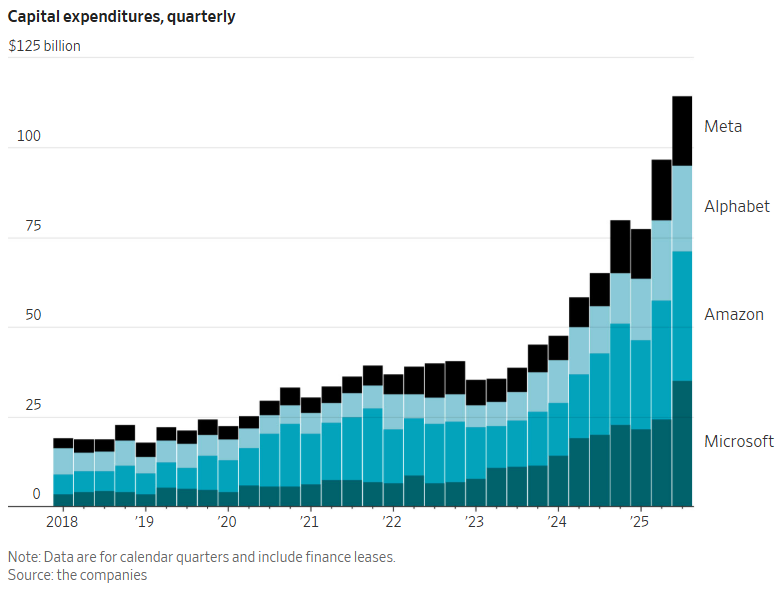

Third, the extraordinary spending on AI by the tech giants looks eerily like the telecoms capex of the late 1990s and railroad investment bonanza of the 19th century – both of which didn’t end well.

Microsoft, Amazon, Google & Meta will pour US$400 billion into capital expenditure this year and J.P. Morgan forecasts US$6-7 trillion in AI capex by 2030, which will require about US$650 billion in perpetual annual revenue to make a 10% return.

Four, there’s been the launch of a host of leveraged ETF products this year, offering up to 5x leverage on daily returns.

Five, meme stocks are back. There have been a lot of crazy moves in US stocks recently – Krispy Kreme, GoPro, Beyond Meat, Kohl’s - driven by retail investors and fuelled through social media.

Six, there have been many head-scratching, large deals in public and private markets. The circular deals among AI giants – where they essentially invest in each other’s chips, capital and compute power – harks back to pre-2000 when internet companies did similar types of deals.

And in private markets, the money flowing into anything AI has been extraordinary. Thinking Machine Labs, launched by a former OpenAI executive, received a US$12 billion valuation via raising US$2 billion in seeding funding, even though it doesn’t have a product and few know what it is building.

Timing markets is hard

Despite the obvious froth, it doesn’t mean markets will correct or crash any time soon.

It’s worth recalling that Jeremy Grantham started calling out a bubble in internet stocks in 1997, but it was three years before markets crashed and, in the meantime, stocks more than doubled.

During that same period, hedge fund legend Julian Robertson made larger and larger bets against tech stocks and yet they continued to go up. He had to close his fund in March 2000, just before the bubble collapsed.

Put simply, bubbles are easier to detect than to time.

What should the average investor do?

So if you do believe that markets are getting toppy, what should you do about it?

Rather than predict what the market is going to do, which is nearly impossible, it’s better to prepare for what’s ahead. To do that, here are three tips:

- If you are a long-term investor with a timeframe of 10+ years, it may be best to do nothing – or at least – very little.

- If you need to soon make a withdrawal - possibly a large one - from your shares, dialling back risk would make sense.

- Imagine a scenario where stock markets fall 50% and consider how you’d react. If you’d be inclined to sell stocks, then perhaps you hold too many stocks to begin with. If you’d want to buy more stocks when they’re down, then maybe you need more liquidity, aka cash, in your portfolio to take advantage of future opportunities.

****

We feature several related articles this week. Owen Lamont of Acadian Asset Management says retail investors are winning big right now, and this case of 'dumb money triumphant' bears similarities to 1929 and 1999 - both of which didn't have a happy ending.

There are also two pieces on the rise of AI. Michael White from Schroders explores how AI will impact search and Google, while Rob Almeida of MFS suggests transformative technologies often create massive societal value but leave producers with thinner profits. As AI accelerates, he says understanding this dynamic is key for savvy investors.

****

In my article, I reflect on Warren Buffett's last letter to Berkshire Hathaway shareholders, and how my view of him - as a genius investor though flawed man - has changed over time.

James Gruber

Also in this week's edition...

Noel Whittaker delivers a warning on housing: the market is heading into choppy waters as lending standards loosen, and that means borrowers should be on guard and not let clever marketing cloud their judgment.

We’d love to get to know more about our readers, hear your thoughts on Firstlinks and see how we can make it better for you. So please complete this short survey, and have your say.

UniSuper's Annika Bradley explains how a string of negative investment returns early in retirement can drastically reduce how long your super lasts. She says understanding sequencing risk is crucial to planning for a secure retirement.

According to Mark McCrindle, today's consumers are walking contradictions: they crave simplicity in a complex world, transparency in curated realities, and global access with local authenticity. Mark thinks understanding these paradoxes is important for both investors and businesses.

The RBA is shrinking its balance sheet, and thus tightening money supply, while also cutting interest rates, which loosens supply. Getting that balance right will determine the fate of our economy and markets, Tony Dillion believes.

Two extra articles from Morningstar this weekend. Nathan Zaia says competitive pressures highlight the need for ANZ to lower costs, while Angus Hewitt looks at Aristocrat's positive results.

Lastly, in this week's whitepaper, Capital Group interviews investors to get their views on ESG topics such as the energy transition and the impact of AI on the environment.

***

Weekend market update

Stocks managed to swiftly recoup early 1% losses on the S&P 500, but that was it for the bulls as the blue-chip gauge marked time from there to settle unchanged. Treasurys came under pressure with yields rising three to four basis points across the curve, while WTI crude climbed back to US$60 a barrel and gold sank to US$4,081 per ounce. Bitcoin reversed a mid-morning rebound back to US$94,500 while the VIX wrapped up the week just below 20

From AAP:

The Australian share market closed at an almost four-month low after suffering its worst day in 10 weeks amid a global pullback in risk assets. The benchmark S&P/ASX200 index on Friday dropped 1.36% to 8,634.5. It was the fourth day of declines in a row for the ASX200, as well as its third straight week of losses. It dropped 1.54% for the week.

Nine of the ASX's 11 sectors finished lower on Friday, with energy and consumer staples up marginally.

The tech sector was by far the biggest loser, losing 4.4% in its worst day in seven months. Megaport fell 9.6%, Hub 24 retreated 8% and Life360 fell 6.7%, taking its losses for the week to more than 20%.

The big four banks finished deep in the red, with CBA dropping 1.8% to a seven-month low of $157.30, ANZ falling 2.6% to $35.99, Westpac subtracting 1.6% to $38.81, and NAB losing 1.7% to $41.48.

Commonwealth Bank shares are down 18% from their record high of $192 in June, leaving them up just 2.6% for 2025.

The heavyweight mining sector also lost ground, with BHP falling 1.3% to $42.75, Fortescue dropping 1% to $20.23, and Rio Tinto subtracting 1.4% to $13.85.

Goldminers did not do any better. Northern Star dropped 1.9%, Evolution retreated 2.4% and Westgold fell 4.9%.

A handful of names finished in the green, including lithium miners Pilbara and Liontown, which climbed 1.1% and 1%, respectively, and Santos, which added 1.2%.

The ASX200 has fallen more than 5% in the three-and-a-half weeks since it hit a record high of 9,094 on October 21. It is still up 5.8% since the start of 2025.

From Shane Oliver, AMP:

Global shares mostly rose over the last week but had a messy ride. While US shares initially rose strongly on the back of the end of the Government shutdown the gain for the week was erased to just 0.1% as hawkish commentary by some Fed officials saw market expectations for the probability of a December rate cut fall back to around 45% and as valuation concerns weighed on tech/AI related stocks. Eurozone shares rose 2.2% and Japanese shares rose 0.2%, but both also saw gains curtailed later in the week following the US lead. Chinese shares fell 1.1% not helped by weak economic data. Australian shares fell for the third week in a row with a fall of 1.5% as expectations for RBA rate cuts were further curtailed following stronger than expected jobs data and as the fall in US shares later in the week weighed. Falls for the week were led by IT, financial, property, telcos and retail shares. Bond yields rose, particularly in Australia as RBA rate cut expectations were further wound back.

Trump now cutting tariffs! Trump won the 2024 election largely on the back of dissatisfaction with “cost of living” increases under Biden, but recent Democrat election victories indicate that swing voters are now deserting him because he has only added to the cost of living. So to avoid a disaster in next year’s mid-terms he is swinging back to measures to reduce the cost of living. This was already evident in talk of tariff rebates and a 50-year mortgage but is now in full swing with cuts to tariffs on imports of food items – like beef, tomatoes, bananas and coffee - directly and in trade deals with various South American countries. In some cases, this involves cutting tariffs on items that were only imposed earlier this year, like beef! So much for his argument that foreigners pay the tariffs and there is no impact on prices for Americans!

Australian economic data released over the last week has likely reinforced the RBA’s caution on rates. RBA Deputy Governor Hauser reiterated the RBA’s cautious stance on interest rates on the back of concerns that capacity constraints – not helped by poor productivity growth – are limiting how fast the economy can grow without leading to excessive inflation. While he didn’t rule out further rate cuts if the September quarter inflation spike proves to be temporary and the jobs market turns out to be weaker than the RBA thinks, the RBA’s hurdle to further cuts is clearly now high. And most of the data released over the last week support a rates on hold scenario for now - with jobs growth up and unemployment down in October, a strong rise in consumer confidence, solid business conditions and confidence readings and very strong growth in housing finance in the September quarter reinforcing that RBA rate cuts have got traction.

However, while the RBA’s hurdle for another rate cut is high we remain of the view that the RBA will need to cut again next year as the September quarter spike in underlying inflation is likely to prove largely temporary with business surveys pointing to a still falling trend in price pressure and unemployment is likely to remain in a rising trend likely taking it just above the RBA’s 4.5% forecast as the private sector will be slow to fill the gap left by slowing “care economy” jobs growth. But barring a very low reading for December quarter trimmed mean inflation and a quick spike higher again in unemployment we don’t expect the next rate cut until May and we are now allowing for just one more rate cut next year. That said money market pricing suggesting just a 50% chance of another rate cut looks a bit too low.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

LIC (LMI) Monthly Review from Independent Investment Research

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website