Google became the gateway to the internet because it got users the information they wanted as quickly as possible. Initially, the best way to do this was sending the user to an external website, minimising time on google.com. Google’s original model centred around “10 blue links” to external sites, but developed to improve query responses, offering Maps, Images, YouTube, Shopping, as well as "featured snippets".

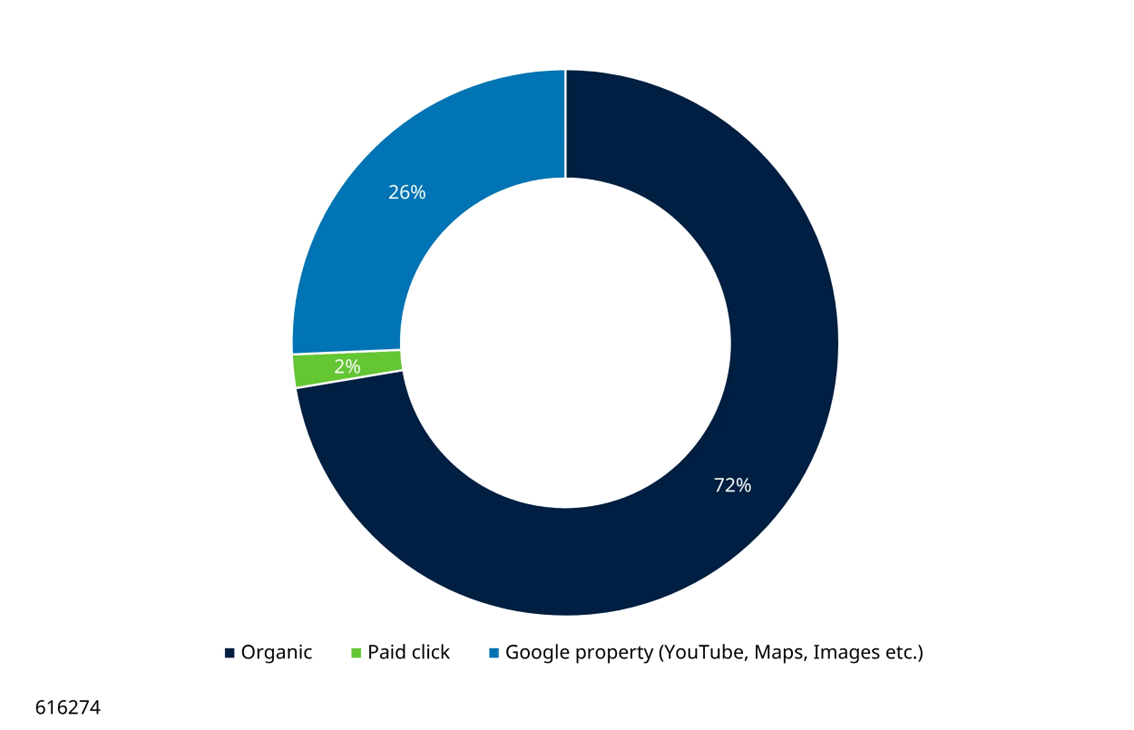

The latest additions to Google’s armoury are AI Overviews and AI Mode (more on these later). Google’s model has moved far from its 10 blue link origins. Now, 27% of searches result in no clicks whatsoever. This means fewer people are being sent outside of google.com. Just 56% of searches result in a click, which often includes Google's own tabs such as Images, YouTube or Shopping.

How traditional search supports the open web

By connecting browsers with external sites, Google supports the open web. Website owners can sell something (a product, service, subscription) or show advertising. Traffic can arrive organically to websites, or via paid search.

For paid search, the site will bid an amount to show up at the top of the results page for a certain query. Google finds a balance between the bid and how relevant the site is; taking the highest bid but showing a result that doesn’t help the user is not a winning solution long-term. If the link is deemed relevant, the link will be shown, and the site will pay Google if the user clicks the link. Paid searches skew heavily to commercial queries, because these are more likely to generate a return on the spend through selling a product.

The beauty of the paid search business model is that it’s likely that when a user searches for a specific item, the seller of that item will have both the highest bid and be the most relevant query. In this way, paid search is more like a commission model than traditional advertising, capitalising on an existing intent to purchase, whereas many other forms of advertising are designed to generate intent.

For organic search, a company will create and maintain the content on its website to maximise exposure to Google’s algorithm. If the content is deemed relevant to a particular query, then the link will be shown, and the site will not have to pay Google for the click.

Query results skew heavily towards organic (see chart below). This reflects the fact that many users search Google for information, not to buy something, and hence the incentive for a site to bid and pay for that query is low.

US desktop Google click breakdown, 2025

Source: Semrush

How ChatGPT is closing the open web

ChatGPT is challenging this model. Users are spending more time engaging directly with ChatGPT with less exposure to external links.

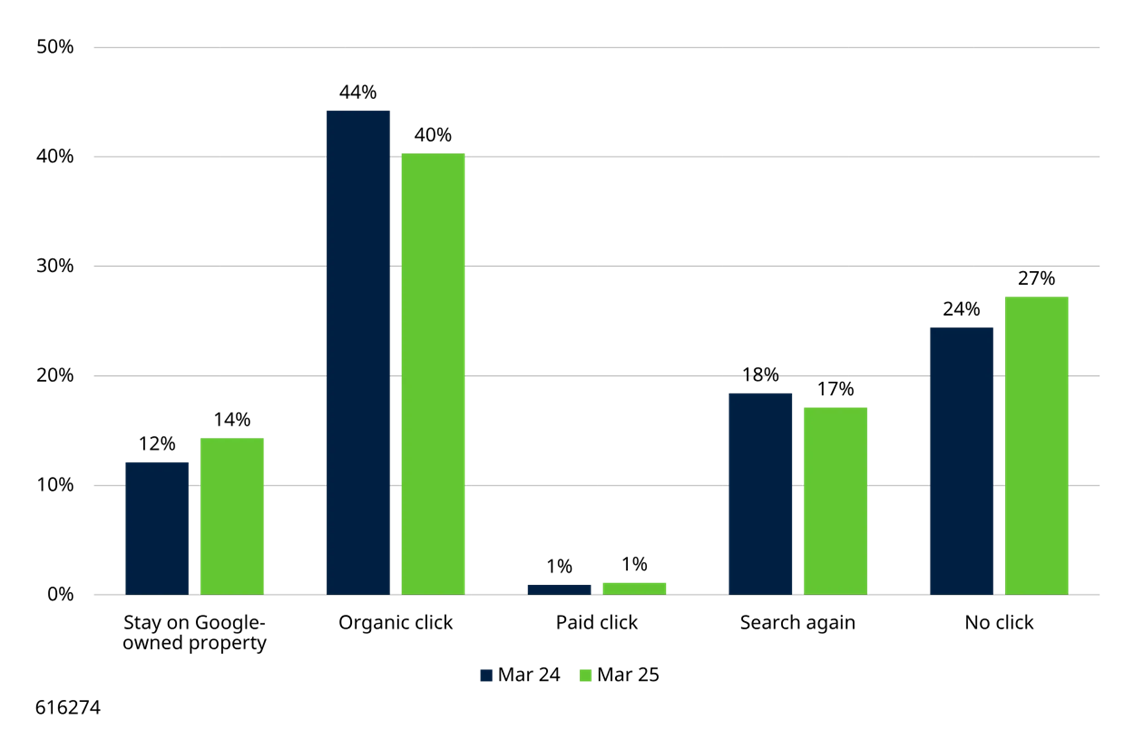

Google's response to ChatGPT - AI Mode and AI Overviews - shows how AI responses have accelerated this trend. The next chart shows how in the period March 2024 to March 2025, where AI answers have become increasingly prevalent in Google's results, the percentage of searches that result in "no clicks" has increased at the detriment of "organic clicks" to external sites. Google is keeping users within Google more.

Changing Google search habits in 12 months, US desktop searches

Source: Semrush

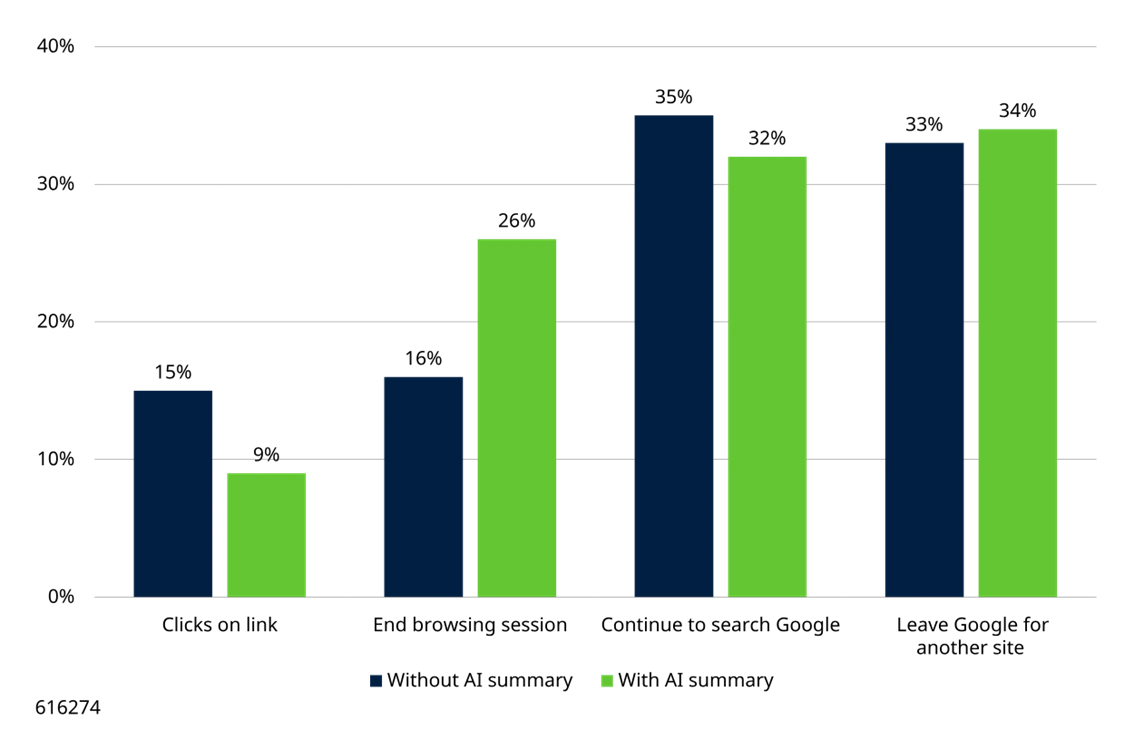

Results of a separate study that observed that when an AI summary is shown, users click fewer links.

Different clicking habits when AI summary shown or not, US desktop and mobile, 2025

Source: Pew Research Center

The result is that the open web is becoming closed. An increasing proportion of activity sits within the gateways to the internet, whether that is Google or ChatGPT.

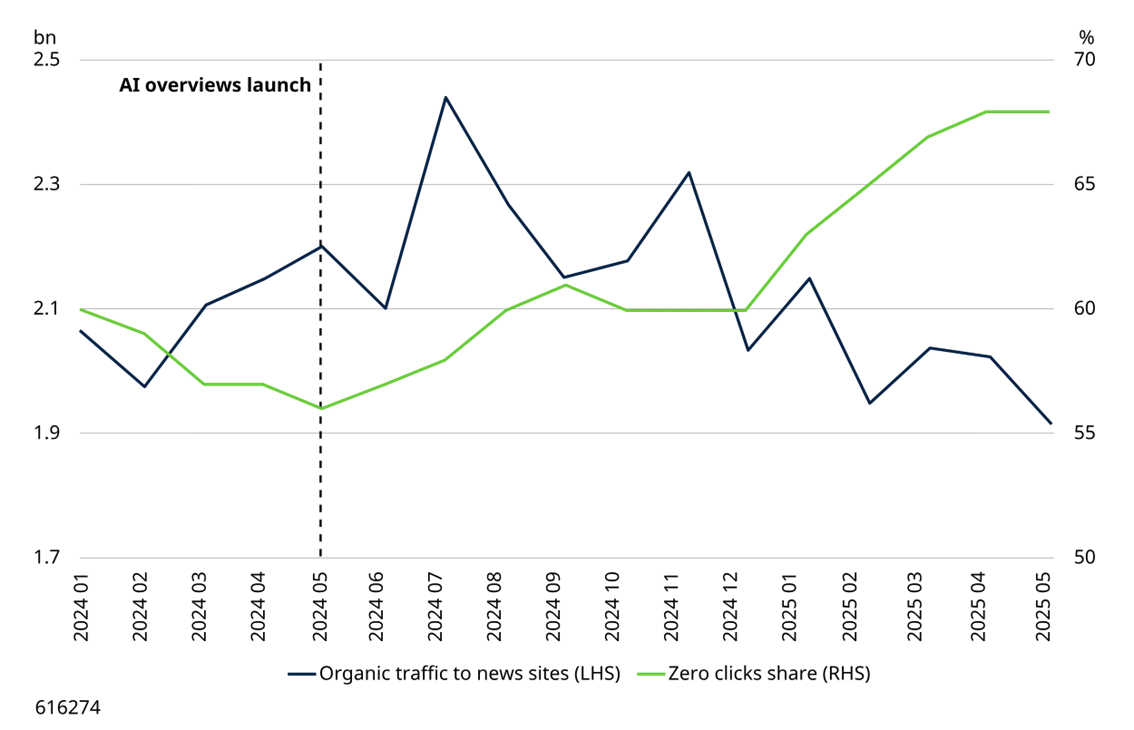

This is impacting business models. News sites, for example, require time spent on page to monetise content via advertising, as opposed to selling goods. If gateways provide news summaries, there is less need to visit news sites. We can see this in the data - organic traffic has declined to news sites as the percentage of searches that have no click-through increases.

This has led to multiple news outlets suing ChatGPT and Google to protect their existing monetisation model. However, it may prove too late for these business models as consumer has already made its choice on how it now wants information to be presented.

Organic traffic to news sites vs. zero-clicks search share US, desktop and mobile web, Jan 2024 - May 2025

Source: Similarweb

Less click-through, but more searches for ChatGPT and Google

ChatGPT, by its conversational nature, encourages queries that would never be ‘Googled’. ChatGPT users still seek information, as one would on Google, but also query in new categories such as image or video creation, technical help or writing skills, few of which consumers would have Googled pre-ChatGPT.

This change in behaviour is flowing through to Google too, with Google commenting in September 2024 that searches with more than five words are growing at 1.5x the rate of shorter queries.

Despite the surge in usage of ChatGPT, the pie for what search can do for the user has likely expanded significantly, providing plenty of queries for both. Recent comments from Google would support this:

“Overall queries and commercial queries on Search continued to grow year-over-year. And our new AI experiences significantly contributed to this increase in usage. We are also seeing that our AI features cause users to search more as they learn that search can meet more of their needs. That's especially true for younger users.” From Q2 2025 earnings call.

From a search monetisation perspective, many of these new categories do not result in a sale to the user, so the incentive to pay Google or ChatGPT to appear in results is low.

However, there will be some new queries that may be monetisable. For example, many of the more detailed "how to" questions can be addressed within an AI Overview response, whilst showing ads for the products that enable the fulfilment of that task. It seems reasonable to assume that where the overall query pool increases, the opportunity for commercial queries will expand.

How the monetisation opportunity may develop – “agentic commerce”

To date, most of the changes outlined have been made in areas where revenues for Google are not at risk. Google is indifferent between an organic click to a third-party website and an AI type response, given neither generates revenue. Users increasingly want the answer immediately, avoiding clicking through to another site, hence the increasing prevalence of AI responses to informational queries.

Currently, AI responses do not typically offer satisfactory answers to commercial queries. Users would be unlikely to ask ChatGPT for clothing options over Google for example, as the presentation of products, prices and reviews is lacking compared to "ordinary" search. Unlike informational queries, you can't complete the transaction without leaving the gateway. This situation is developing though, and it seems clear that commercial transactions within the gateway is a goal for both Google and ChatGPT. ChatGPT is now collaborating with Shopify and Walmart to enable users to purchase from merchants directly on the gateway.

This is a step towards “Agentic Commerce”, where an AI agent can fulfil some or all of a transaction on behalf of users. For example, could ChatGPT or Google send you a shortlist of family activities over certain dates, providing one-click payment links to significantly speed up the process of research and booking? In this scenario, you never leave the gateway. The difficulty of integrating across the open web cannot be understated, but both companies seem intent on improving the user experience in this way.

Predicting consumer habits is difficult, but for certain transactions where the user might benefit from a “conversation”, the experience could be enhanced.

If this works, the revenue potential is in the hundreds of billions of dollars

If agentic commerce improves the shopping experience, then users are more likely to follow through on a purchase that otherwise might not have been made. It could even operate in the background when a user's search for a product hits a dead end (i.e. auto-purchasing out-of-stock items)

Agentic commerce could also reduce the power of external websites compared to a gateway - fewer shoppers would go direct-to-source, and less of the transaction would be fulfilled by those sites. In theory, over time, more of the value of an online transaction shifts to Google or ChatGPT, in a similar manner to news or content.

How ChatGPT or Google monetise enabling transactions at the gateway is unclear. The existing paid search model would suggest external sites bid for placement, paying if clicked on, but a new model may emerge where there is no bidding for placement, but the site pays the gateway if a transaction is completed. As discussed, though, the search market to date is essentially a commission model so the result may be the same – if the gateway is fulfilling more of the task then its share of the transaction will increase.

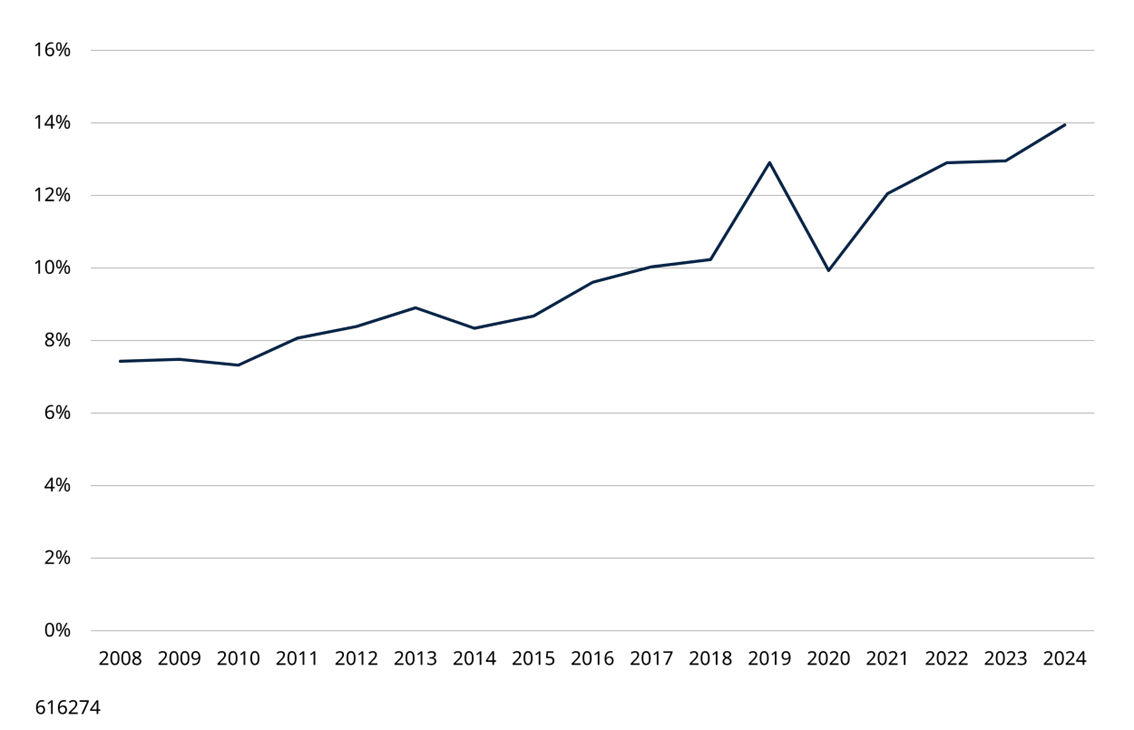

This phenomenon has been present for many years, where the Search ‘advertising’ market has consistently increased as a percentage of ecommerce, reflecting a higher commission on transactions. It is our view that agentic commerce is set to continue that trend.

The scale of this market is huge - the global ex-China search market is approaching $300bn in 2025, of a global ex-China ecommerce market of ~$3tn - what is the ceiling for this ratio?

US search market as a % of US Ecommerce market

Who will emerge as the winner?

Which of the gateways comes out on top is unclear as of today. For many people ChatGPT is AI and therefore it will capture a lot of this activity, Google however has superior reach and is already plugged into many businesses wanting to sell products and services.

In our view the opportunity is so significant that both can benefit.

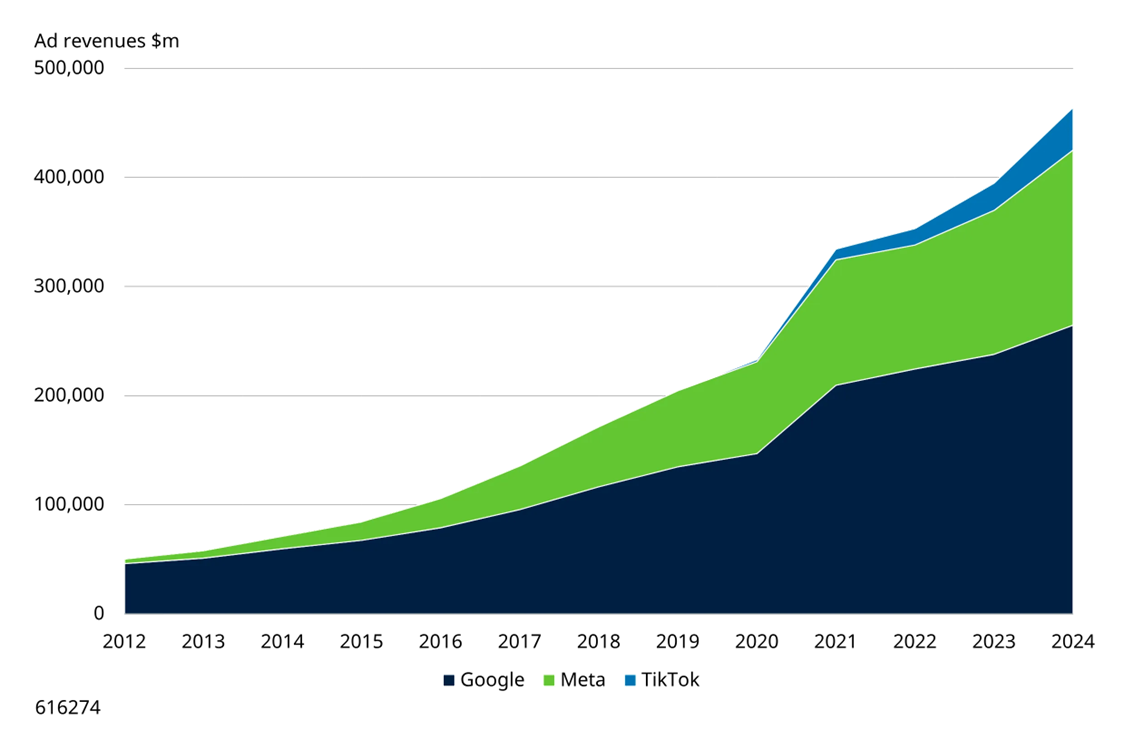

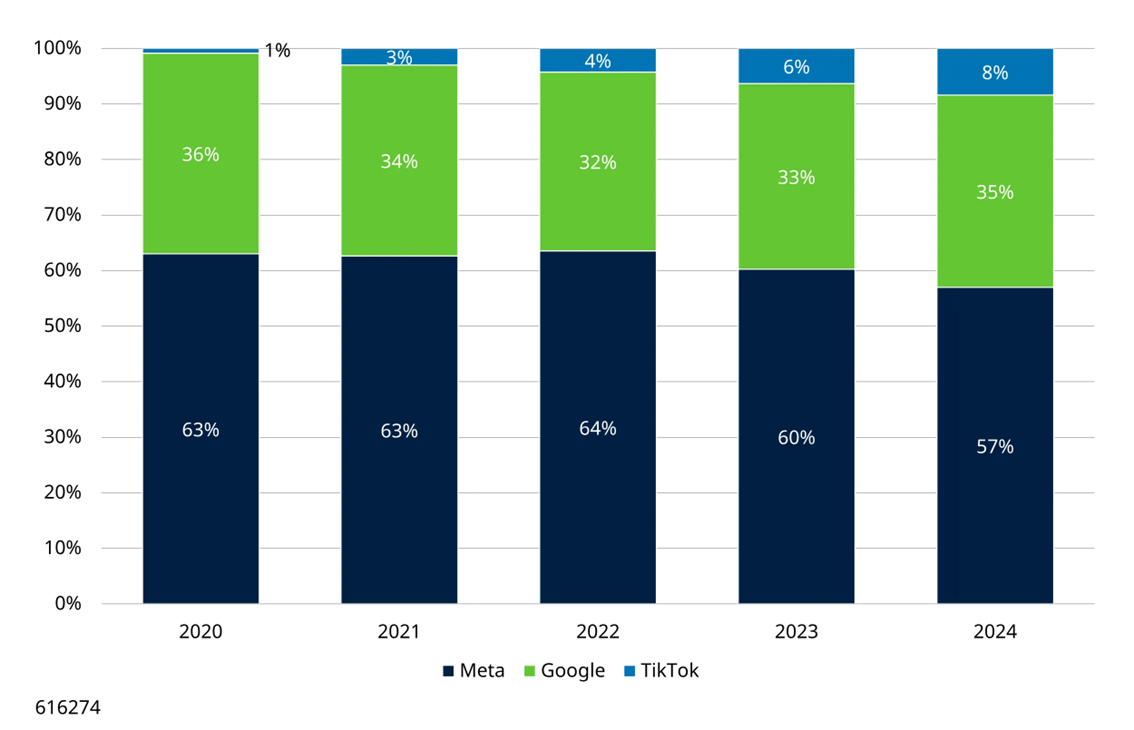

We have seen this previously in new markets - Google and Meta Platforms were often seen as competing against one another for budgets. Both significantly expanded the digital advertising market and took share from traditional advertising budgets, creating sizeable growth in earnings and shareholder value. Similarly, TikTok has outgrown Meta in recent years, but the addition of short-form video on Meta has ended up being a material tailwind for the business, as it continued to be a draw of budgets into the digital ad market.

All have shown significant growth

Even though Meta and Google have lost share

Both Meta and Google’s parent company Alphabet are part of the “Magnificent Seven” group of companies whose performance has dominated markets in recent years. Any threats to their market leading positions understandably cause concern. However, in these instances, disruption from challengers such as ChatGPT, or TikTok, can result in the overall market opportunity growing, even if Google or Meta’s absolute market share falls.

Careful analysis is needed to distinguish between disruption that may prove damaging, and disruption that creates new opportunities. Every case is different. Actively managed global approaches are needed to capture the nuance and the opportunity, wherever these may emerge.

For third-party sites there are some difficult choices to be made - do you pivot early and support ChatGPT/Google gaining more power? Or do you hold out to slow the speed of adoption, but potentially lose out when other competitors follow the consumer?

The open web appears set to change, and the gateway might soon become the destination.

Michael White is a Global Sector Specialist at Schroder Investment Management Australia (ABN 22 000 443 274, AFSL 226473). This material is general information only and does not take into account your objectives, financial situation or needs. Schroders does not give any warranty as to the accuracy, reliability or completeness of information which is contained in this material. Read the full report and important disclaimers here.

For more articles and papers from Schroders, click here.