For generations, the US dollar has been regarded as the ultimate ‘safe haven’. In times of uncertainty, global investors instinctively seek the depth, liquidity, and unrivalled status of the world’s reserve currency. But what if that confidence is misplaced? What if the US dollar is actually the riskiest major currency to own today?

The dollar’s historical appeal is easy to understand. The US is home to efficient and liquid financial markets and numerous world-class companies, and its government debt is viewed as ‘risk free’ thanks to strong institutions that have treated foreign investors fairly. That trust has helped the US attract roughly $4.5 trillion of net capital inflows over the past five years.

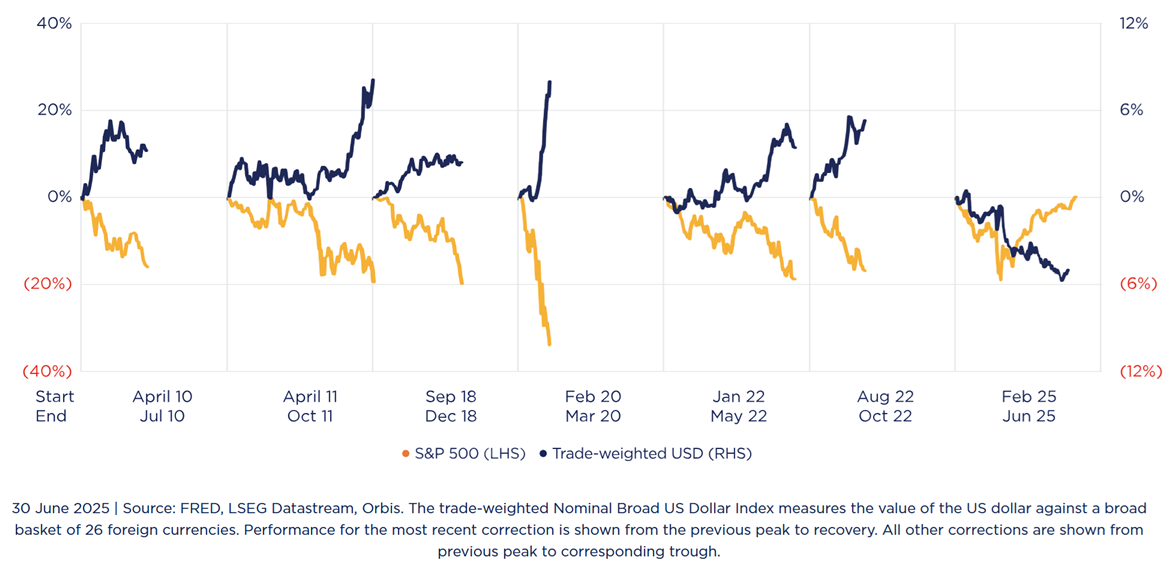

But the market turbulence of early 2025 was a wake-up call. The ‘Liberation Day’ sell-off was a reminder that American exceptionalism has limits. The dollar’s traditional role as a shock absorber began to break down, gold prices surged as investors looked for alternative stores of value, and several major currencies strengthened relative to the dollar. The dollar’s value ultimately rests on trust in US policy and institutions – and that assumption is being questioned.

The US dollar is no longer acting as a ‘shock absorber’

Figure 1: Trade-weighted US dollar performance during each S&P 500 correction of at least 15%, April 2010 to June 2025.

The first concern is fiscal policy. The US continues to spend far more than it raises in tax revenue, running a deficit of roughly 6% of GDP – a recession-like level of borrowing in an economy close to full employment. Even Elon Musk's DOGE (Department of Government Efficiency) initiative failed to make a dent. Each year of overspending adds to an already enormous debt pile. Were the US to experience a downturn, this leaves the government with fewer levers to pull.

A second concern is the current account deficit, which compounds the fiscal problem. The US spends more than it earns, importing far more goods and services than it exports. To plug the gap, it must rely on a continued stream of investment from abroad. Much of this capital has flowed into government debt and equities, concentrated in a handful of high-growth AI companies. If enthusiasm for US technology fades, or if investors start worrying about the sustainability of the government’s debt, those inflows could quickly dry up. What once looked like a position of strength now feels like dependence.

Uncertainty around monetary policy credibility adds further pressure. The Federal Reserve has a challenging job balancing the impact of tariffs against a backdrop of weakening employment. Doing this in the face of aggressive political pressure to lower rates only adds to the potential for a mistake. If the Federal Reserve yields to political pressure and cuts rates prematurely, the dollar could lose both its yield advantage and investors’ confidence.

Perhaps even more troubling is a gradual loss of confidence in US institutions. The Trump administration has taken a more adversarial stance towards some historical allies while also trying to assert greater influence over the judicial system – actions that may prompt some foreign investors to look for a new home for their capital.

From a valuation perspective, the dollar also looks vulnerable on a fundamental basis. On our valuation models, it has been expensive relative to other currencies for some time. To some extent, this could be justified by relatively high US interest rates, supported by robust growth, which offered a yield premium over most developed markets. But that foundation is now weakening while the concerns discussed above are intensifying.

Looking beyond the dollar

If the dollar is expensive and vulnerable, where might investors look instead? The problem is that there is still no realistic challenger to the dollar’s position as the global reserve currency. In our view, a better approach is to build a basket of alternative currency exposures that help to mitigate some of the risk that comes with excessive reliance on the dollar.

To name just a few current examples, the Norwegian krone, Australian dollar, and Japanese yen all offer compelling characteristics ranging from fiscal strength and external surpluses to deep undervaluation. The rise in the gold price also reflects a wider search for assets that can preserve value in a world of high debt and political uncertainty.

To be clear, exposure to the greenback is nearly impossible for global investors to avoid altogether. But we think it’s more important than ever to avoid being complacent and to challenge the conventional wisdom that the dollar is the only game in town. While none of the alternatives can individually replace the dollar, they collectively provide a valuable counterweight in a world where the traditional safe haven may no longer be as safe as it appears.

Key Takeaways

- Safe-haven question: The US dollar’s long-standing role as a ‘shock absorber’ during times of market stress is showing cracks. The ‘Liberation Day’ sell-off was a timely reminder that even American exceptionalism has limits, and the dollar’s defensive reputation can no longer be taken for granted.

- Mounting headwinds: The dollar’s yield advantage may fade if the US Federal Reserve cuts rates too soon or fiscal pressures lead to financial repression. Rising debt, persistent deficits, and a greater tolerance for inflation also point to a weaker long-term backdrop for the currency.

- Currency diversification: Investors may benefit from building a balanced basket of alternative currencies to reduce dollar dependence. In our view, the Japanese yen, Norwegian krone, and Australian dollar all offer compelling characteristics ranging from fiscal strength and external surpluses to deep undervaluation.

Nicholas Purser is responsible for currency management in the Orbis Global Equity Strategy at Orbis Investments, a sponsor of Firstlinks. This article contains general information at a point in time and not personal financial or investment advice. It should not be used as a guide to invest or trade and does not take into account the specific investment objectives or financial situation of any particular person. The Orbis Funds may take a different view depending on facts and circumstances.

For more articles and papers from Orbis, please click here.