Apple was a serial winner over the past 15 years as personal computing transitioned from desktops to smartphones. In the 2010s, the iPhone built a large user base through the seamless integration of iOS with great hardware design to offer users unique, intuitive and arguably superior computing experiences. Examples included:

- first to market with multi-touch input on large capacitive touch screens

- in-sourcing chip design to deliver best-in-class performance and battery life

- seamless cross device compatibility through features such as Handoff and AirPlay, and peripherals like the Watch and AirPods.

For much of the past decade, the iPhone was synonymous with the marketing tagline “it just works”.

In the past five years the smartphone market matured, phone designs converged and competitors arguably surpassed the iPhone’s hardware. As these dynamics changed, Apple increasingly relied on the iOS platform to extract value from their business in a similar fashion to many of the demand side aggregation businesses we've written about.

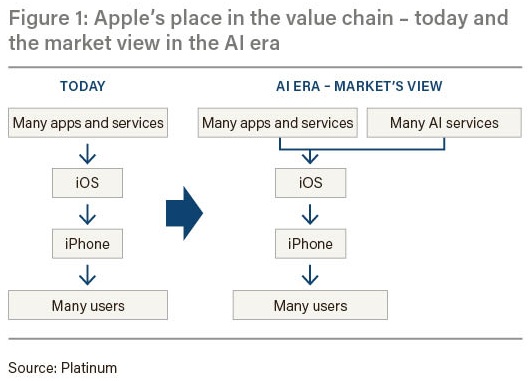

On the users’ side, iOS is the main way Apple lock in their one billion+ user base. Users are reluctant to switch due to inertia, the need to repurchase apps and port across contacts, photos and personal data. Apple monetises these high value users by being the ‘toll road’ for apps and service providers (see Figure 1). Google paying Apple $20 billion a year to be the default search engine exemplified Apple’s market power.

With the rise of ChatGPT and other AI services, the prevailing market narrative assumes the status quo - AI will be another category of apps and services. Apple will be an ‘AI winner’ as the iOS platform remains the primary toll road for AI services to access high value users (see Figure 1). This view is the one likely held at Apple’s Cupertino headquarters. Apple has under-invested in Apple Intelligence and is increasingly reliant on external partnerships like ChatGPT for AI functionality.

Although we remain cautious about the AI promise, ‘AI agents’ - where AI interprets and executes tasks autonomously for a user - could be the next evolution in device interactions. Rather than relying on touchscreen inputs, the interactions happen through the AI agent autonomously or via voice. Today, this could be simple tasks such as drafting emails or scheduling meetings. But in five years’ time, AI agents could book our hotel or buy toilet paper every two weeks.

In this scenario Apple’s market power could weaken materially over the medium term. On the users’ side, iOS’ lock-in effects could weaken as agentic AI interactions increase, and touchscreen inputs decrease. There will be a tipping point.

Users will accept the high switching costs of changing their operating system in pursuit of a superior and capable agentic AI experience as the value of the latter meaningfully outweighs the costs of the former.

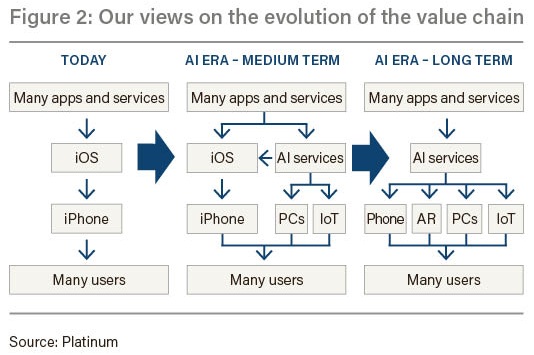

On the apps and services side, it’s likely native integration between them and AI services is on the roadmap. There’s strong incentive to do so, firstly, to create a seamless and integrated agentic AI experience for users, and secondly, to create new hardware-agnostic distribution channels, bypassing the iOS toll road (see middle column in Figure 2).

The existential risk for Apple is that agentic AI evolves into the new operating system for the next generation of hardware which do not require touchscreens (e.g. Meta’s Orion or Xiaomi’s AI glasses). If this happens, the iOS and iPhone will be suddenly obsolete and Apple another commoditised tech hardware provider.

One only needs to remember Blackberry clinging on to the superiority of their keyboards at the beginning of the touchscreen era to see the disintermediating effects of interface changes. The right column in Figure 2 shows how the value chain could evolve long term.

Given these potential outcomes, Apple’s relationship with ChatGPT could be them welcoming a large wooden horse through the gates of Troy.

We think Apple must develop and control their own leading edge agentic AI models, deploy them in iOS and natively integrate them with apps and services providers as quickly as possible. Doing so is expensive - xAI is reportedly burning $1 billion a month and Meta is spending $72 billion this year on capex. Yet Apple, which generates around $100 billion annually in free cash flow, is one of the few companies with the resources to do it.

The next platform shift?

Computing witnessed three major platform shifts in the past 50 years.

- In the 1980s from mainframes to desktop PCs.

- In the 2000s from desktop PCs to desktop internet.

- In the 2010s from desktop internet to smartphones – a platform shift which Apple led.

Each transition reshaped the industry and redistributed profit pools. Leadership in the sector changed as incumbents were slow to adapt. The question becomes: Is Apple ready for the next great platform shift?

Jimmy Su is Portfolio Manager of Platinum’s International Technology Fund. Platinum Asset Management is a sponsor of Firstlinks. The Platinum International Technology Fund currently does not have long or short positions in Apple.

The above information is commentary only (i.e. our general thoughts). It is not intended to be, nor should it be construed as, investment advice. To the extent permitted by law, no liability is accepted for any loss or damage as a result of any reliance on this information. Before making any investment decision you need to consider (with your financial adviser) your particular investment needs, objectives and circumstances.

For more articles and papers by Platinum click here.