We’re living in a time of paradoxes.

As we explore the consumer landscape, we see it shaped by both innovation and change and timeless human needs. In this tension lies a powerful story: of consumers seeking both speed and meaning, digital convenience and personal connection, individual empowerment and community belonging.

There are the trends like the rise of Artificial Intelligence (AI) and automation to demographic shifts, global connectivity, and sustainability demands are rewriting the rules of engagement. Yet amid this flux, timeless human drivers remain, such as trust, authenticity, and purpose. These are not just buzzwords but benchmarks for brands seeking relevance. The paradoxes are stark. Consumers crave simplicity in an age of abundance. They demand transparency in a world of curated realities. They are globally minded but hyper-local in values. These juxtapositions don’t signal confusion, they reveal a complex, evolving consumer shaped by layered expectations.

To navigate this terrain, organisations must become both agile and anchored, embracing change while staying grounded in human-centric drivers. In decoding these paradoxes, we explore the roadmap to meaningful connection in a rapidly transforming world. Here are the megatrends shaping the consumer landscape.

1. Living longer, spending later

As we look across the operating environment today, the purchasing lifecycle is no longer linear, or age bound. Wealth is held by older generations who are living and spending longer, while younger generations, often without buying power yet, hold cultural and household influence. We see that the intergenerational commerce landscape is shifting.

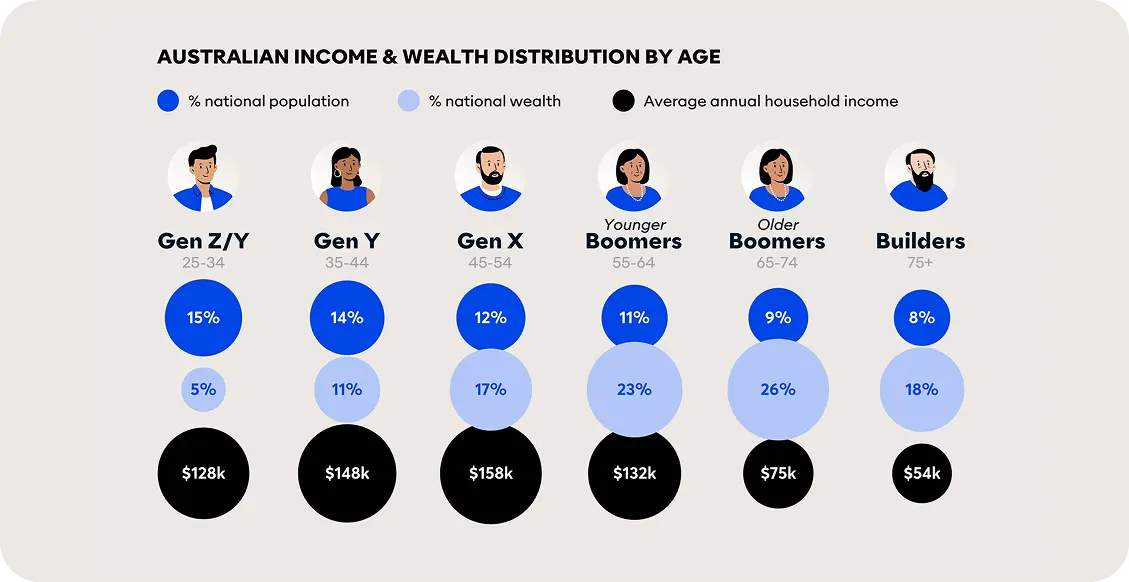

Older Baby Boomers (aged 65-74), comprise 9% of the Australian population, yet hold 26% of national wealth and continue to spend despite their lower relative income. While Gen Xs (aged 45-54), who comprise 12% of the population, have just 17% of national wealth despite being the highest income earners. With an average annual household income of 158k.

By comparison Gen Z/Y in their early earning years comprise 15% of the population and hold just 5% of national wealth. And have an average household income of 128k.

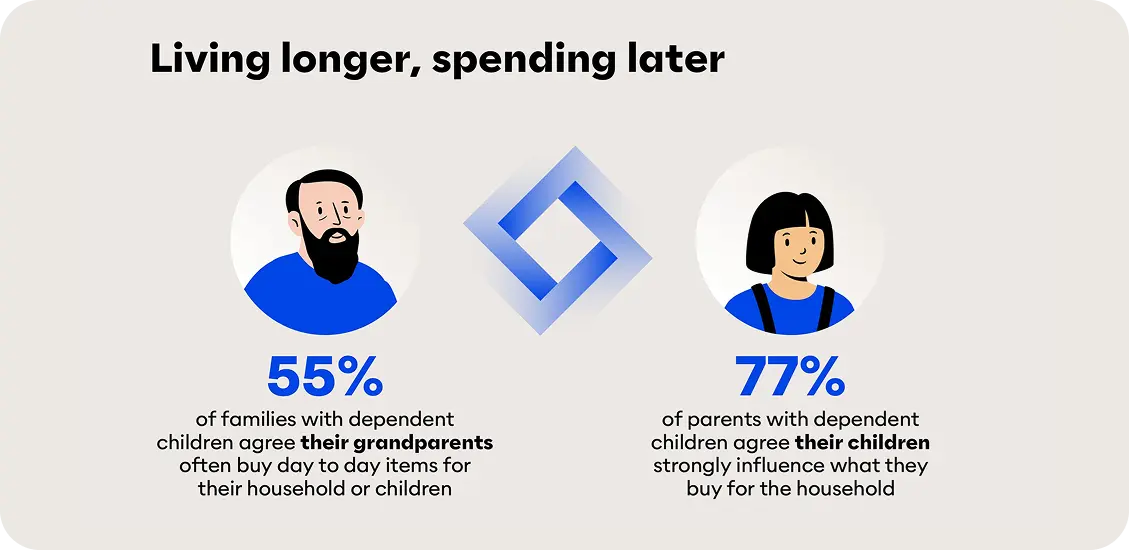

Historically financial power was directly linked to consumer decision making power. Today, however, people are spending throughout the lifecycle. There is a young, empowered generation coming through and purchasing decisions are no longer siloed by age. We even see that older generations are spending longer, and not even necessarily on themselves and today’s Gen Alpha children, yet to enter their earning years, are influencing household spend and purchasing decisions.

55% of families with dependent children agree their grandparents often buy day to day items for their household or children. Therefore Older people aren’t retiring from consumer culture but many are purchasing for self but also for others, which is fuelling the rise in the Grandparent economy.

2. Hyper-global and reengaging locally

Brands today are expected to have the systems, reach and convenience of a global organisation but the authenticity, and identity of a local organisation. Online marketplaces have been growing, while so too has the support of local businesses. When we asked why do you choose to purchase from an offshore retailer we can see that price is a key motivator, followed by availability. For 34% the convenience aspect comes into play as does access to a wide range of products or brands, leaning more into the convenience factor is international shipping offers or free delivery.

On the flip side the number one driver for supporting a local business is to support the local economy or community, followed by a desire to see or try the product in person. For two in five they see local providing better customer service or a more personalised experience. There is also greater trust in product quality or authenticity. Similar to global purchasing the convenience aspect comes into play with faster delivery or same day pickup.

3. Private by principle, public by practice

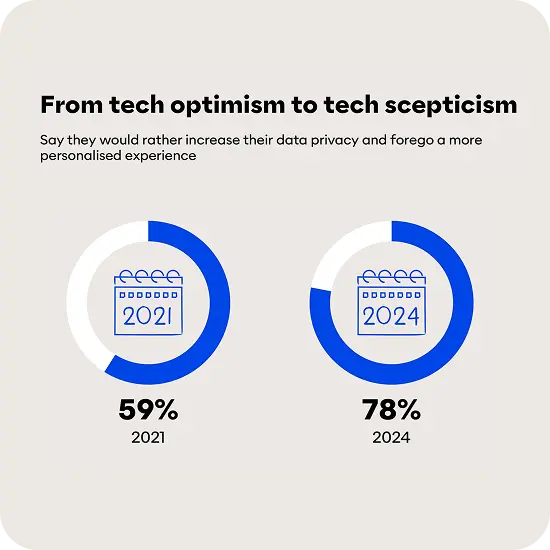

Today’s customers are empowered and want to take their data back. Over the past few years there has been a shift from tech optimism to tech scepticism.

In 2021 the percentage who would rather increase their data privacy and forego a more personalized experience was 59%, today that is 78%. What is interesting though is that this is not limited to older generations with Gen Z 1.8 times more likely to value data privacy today than they were in 2021 (79% 2024 cf. 44% Gen Z). This tech scepticism is influencing behaviour with more people valuing their data privacy and foregoing a more personalised experience.

However, many are still engaged in social commerce. This is buying and selling goods alongside referring friends and influencing spend through social media platforms, which by nature are platforms designed to harvest data. We are seeing that social commerce is blurring the lines between privacy and experience.

4. Outsourced ownership

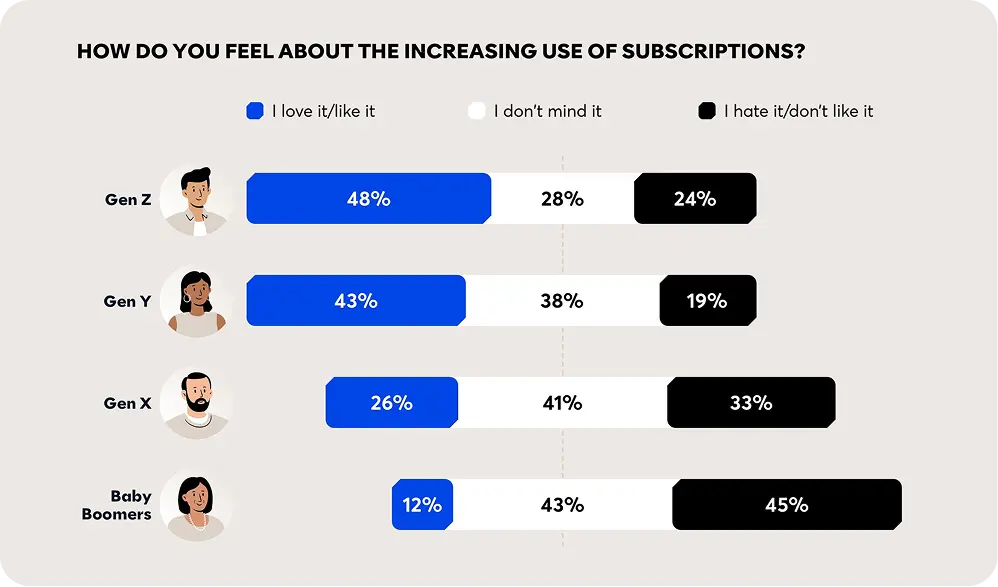

Twenty years ago, music was owned, today it is streamed; cars were owned, now many are leased. A trade off with this ongoing accessibility is a loss of permanence. Today, people may pay less upfront, but they are paying always. When considering generational attitudes towards these subscriptions, it became clear that Gen Z and Gen Y are more likely than their older counterparts to love or like subscriptions, with as the emerging generation of consumers is seeing the rise in the subscription economy.

Established generations, however, are more likely to hate it or not like it. Generational use of subscriptions is reflective of their sentiment. Gen Z who are most positive towards subscriptions are also the highest users of subscriptions. Convenience, followed by value for money, access to exclusive content. For three in ten they identified that sometimes subscriptions are the only option, and for a quarter they found that regular payments make it easier to budget.

5. Cutting back, yet also premiumisation

We’re in a cost-of-living crisis. You probably hear it everywhere. People are cutting back because of this. Yet, we are also seeing premiumisation which is when people spend on luxuries.

Interestingly this isn’t a new phenomenon. Back in the early 2000s, Estée Lauder noticed an odd trend: when recessions hit, lipstick sales spiked. Economist Juliet Schor had already put words to it – the Lipstick Effect.

Our research shows that almost 77% of Australians are extremely or very concerned over the rising cost of living. But, a similar proportion 69%, agree that even when tightening spending in some areas, they choose to splurge on little luxuries that make them feel good. What this shows, is that even during economic strain, consumption decisions are entwined with identity. Buying things can make us feel good, meet our needs or even display status to those around us.

6. Environmental concern amidst consumer pragmatism

Today’s consumers are more environmentally conscious than ever, yet they also face real world constraints like time, money and convenience. 57% of consumers say they have had to compromise their social responsibility values to purchase a cheaper product. However people are also willing to invest in quality pieces that last a long time.

In an interesting twist, younger generations are more likely than their older counterparts to purchase something cheap even though they know it’s bad for the environment. Although younger generations are often the most vocal about environmental sustainability, we’ve seen them be pretty impacted by the rising cost of living, and therefore the least able to financially support their consumer values. Customers have their values. But they are also seeking value.

7. Post-materialism in a hyper material world

For many, material wealth is increasing, but at the same time, overall satisfaction is decreasing. 52% agree that the more they own, the less satisfaction they seem to get from new purchases. People are making room for meaning, with 77% of consumers agreeing they are more interested in experiences and meaning than accumulating material possessions.

People have a void which material possessions are not satisfying in the way they used to. There is still a desire, however, to use purchases to communicate identity and values. As the focus shifts to investing in community and meaning, there is an opportunity for organisations here to provide brand experiences that create belonging and identity expression to combat isolation and loneliness.

Despite the tides of change and these paradoxes, some timeless human needs have remained the same, and they are worth exploring when thinking about consumer behaviour and decisions.

Mark McCrindle is a social analyst, demographer, author, and Founder of McCrindle Research. Mark has presented keynotes and workshops in all major industries including finance, technology, health, mining, energy and education.