A million people generate a lot of demand for things. Hospitals included. In Australia, we need on average 1 hospital bed for every 270 people, so that’s 3,703 beds for 1 million people. Based on a large hospital of say 500 beds, that’s roughly 7.5 hospitals for 1 million people.

Why is this of interest? Because we are about to add another million people to cities like Brisbane (by 2045), Sydney (by 2040) and Melbourne (by 2038). So, just to tread water, we should have the equivalent of around 7.5 new hospitals planned for each, otherwise we go backwards.

For some more context, an average new hospital bed in Australia costs around $1.5 million to $2 million. So those 3,703 extra beds for each major city are going to need something like $5.5 billion to $7.5 billion in new capital invested. That’s at today’s dollars.

We could ask the same for schools: roughly how many do we have for every 1 million people? The answer is somewhere between around 360 (250 of which are government schools and 110 non government). If we are to maintain schooling with the same range of choice and sized schools, and to maintain class sizes as they broadly are now, that’s a lot of schools.

At policy adviser, Suburban Futures, we recently modelled a number of options for new school designs in urban infill locations (even including a repurposed Bunnings style shed). The cost for a full P-12 school of 1,000 students was in all cases over $100 million. Not all schools are full P-12 formats with 1000 students, but even on conservative guesstimating, we are looking at maybe $5+ billion for 50 x P-12 size schools, plus just as much again for the remaining 300 schools of smaller size. Combined that’s another $10 billion, per city region, by 2040. A lot of money, let alone the challenge of finding the sites for them.

How will the extra 1 million people get around? If the current ratio of private cars to people doesn’t change, each city region will have another 600,000 cars on the roads. Plus, another 200,000 or so commercial vehicles doing commercial things. Should we put them underground with more road tunnels? A good idea, which costs roughly $1billion per kilometre (depending on in-ground conditions and surface portals). OK, let’s build more commuter rail track so that we won’t notice the traffic impacts of an additional million people. That’s also now around $1 billion per kilometre but will likely move fewer people than a road tunnel, so is arguably not going to have as much impact.

Need something to drink, flush the toilet, wash the car or do the laundry? There’s another 200 million litres per day for 1 million people, or 73 gigalitres per year. For context, that’s roughly 30,000 Olympic swimming pools worth of extra water, each year, for each city.

Been naughty? That will mean another 1,600 to 2,000 prison cells per million people. A prison cell isn’t cheap either – around $700,000 per cell not including the operational costs. There’s at least another $1.2 billion to house the criminal element that another 1 million population will generate.

We will also need another 4,000 police officers, 12,000 nurses, 1,000 firefighters and the workplace buildings to accommodate them.

Sadly, another 1 million people will also mean another 48 people will die on the roads. Promises to lower the road toll mean that, mathematically, none of the extra 1 million will die on our roads and the toll for the existing population will fall. A noble and worthy ambition, but the maths is sadly challenging.

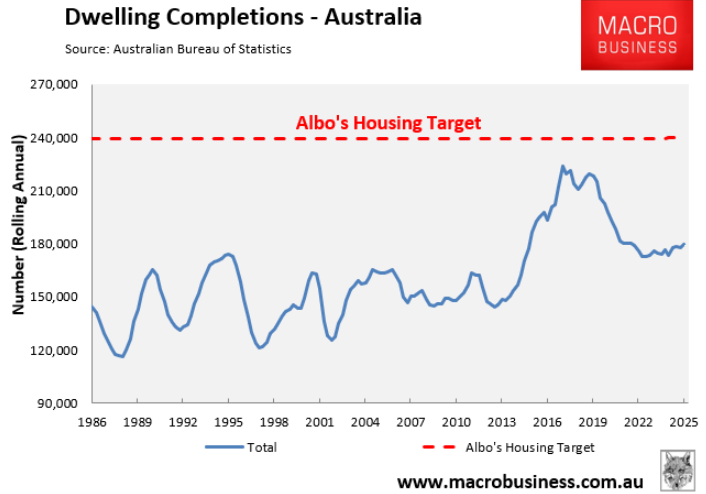

In amongst this are our housing targets. I’ve long maintained that housing should be the easiest types of structures to deliver. But we have made even that difficult. The plethora of codes and regulatory and planning approvals now needed are reflected in our worsening ability to match demand with supply.

It now takes longer and costs more doing the very same thing than just 20 years ago. The Federal Government’s target of building 1.2 million homes over 5 years could most kindly be described as an aspirational target. At worst a lie. Either way, even when it comes to the simplest form on construction, our supply response is clearly lagging, and slowing.

It's going to be interesting to watch how this growth challenge pans out. Much of our national dialogue is focused simply on population and housing. There’s quite a bit of attention also on the increasing traffic congestion experienced in our major centres. If we start to add to that obvious short falls in hospitals, schools, drinking water, corrections and any number of other things that are the direct consequence of growth, the debate could quickly go febrile.

Ross Elliot is an experienced strategist and advisor with over 35 years in urban development, infrastructure, and public policy. He currently chairs the Brisbane Lord Mayor’s Better Suburbs Initiative, is Director of not-for-profit urban research and policy organisation Suburban Futures, and takes on a number of industry engagements. This article was first published on Ross’s blog, The Pulse, and is reproduced with permission.