In December 2023, I made a bold prediction: returns from Australian shares would handily beat those from residential property over the next 10 years.

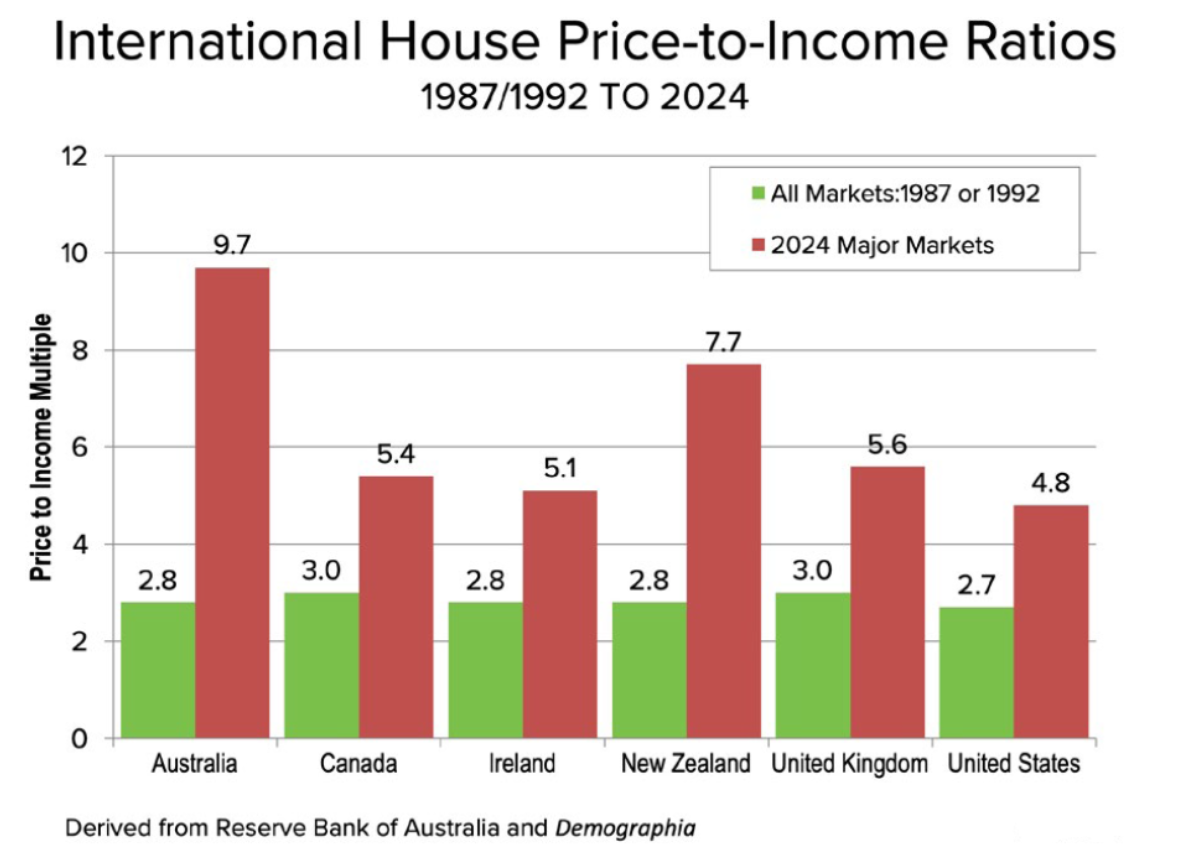

In that article, I explained how Australian housing was ludicrously priced, up to 40% overvalued. And that property was far more expensive than the ‘Magnificent Seven’ US tech stocks, which were richly valued yet had infinitely better growth prospects.

I went into detail on why I thought future housing performance would disappoint, with forecast 2-5% annual returns over the coming decade (ending November 2033). I said the bottom end of those return estimates was the most likely scenario and, if right, it meant property gains would struggle to keep pace with inflation.

Meanwhile, Australian stocks were much more reasonably priced then, trading at price-to-earnings multiples in line with history. I surmised that ASX share returns were likely to be far superior to those of housing, in the range of 6.5-10% over the subsequent 10 year period. I suggested the middle of that range was most probable, though that depended on whether company earnings picked up.

Where we stand today

How is it played out to date? If I took a poll of readers, the majority might suggest that property has outperformed shares over the past 24 months. After all, there’s been breathless commentary on the latest “property boom” and equally breathless press on Australian stocks being ho-hum.

If you guessed that property has had superior returns, you’d be wrong.

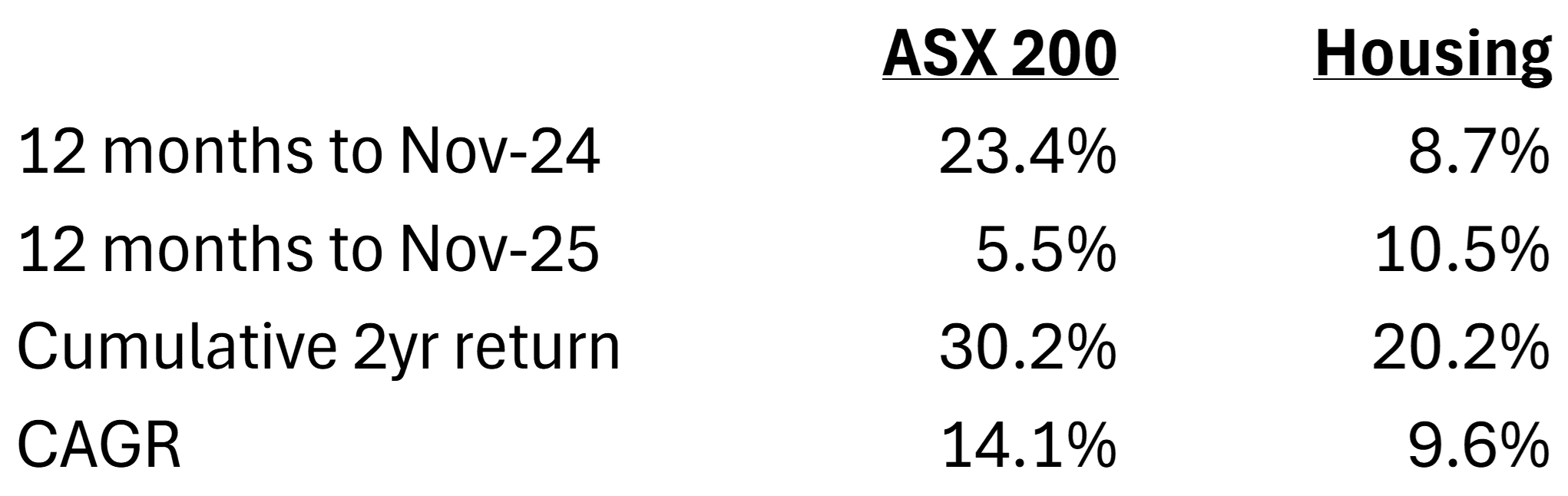

Over the past 12 months, property has done better. Housing in the capital cities has risen 10.6% (including gross rent) compared to ASX 200 returns of 5.5% (including dividends).

Over the past two years, it’s a different story. The ASX 200 is up a cumulative 30.2%, at a compound annual growth rate (CAGR) of 14.1%. That compares to housing where prices have increased by a total of 20.2%, or 9.6% CAGR.

Shares versus property returns

Note: ASX 200 returns include dividends. Housing = capital city returns. Sources: Morningstar, Cotality, Firstlinks

Thus far, my forecast of shares handily beating property is working out. However, it’s worth noting that the annual returns for both shares and property are well above my initial estimates made in December 2023.

What’s driven share gains?

The past year hasn’t been great for ASX shares, though it hasn’t been a disaster. Total 12 month returns of 5.47%, including dividends, are well below historical average returns of close to 10% per annum (p.a.). And they’ve badly trailed other developed markets, including the US, where the S&P 500 has returned 15% including dividends over the past year.

Why has the ASX lagged? A few reasons.

First, bank share prices have pulled back after a huge, and largely unwarranted, run up. For instance, CBA shares peaked at $192 in late June and have since tanked 21%.

Second, other index heavyweights haven’t picked up the slack. Despite a market rotation away from banks, BHP was only up 3% over the past year. CSL has also continued to disappoint, down 34% over the 12 months as turnaround efforts failed to gain traction with investors.

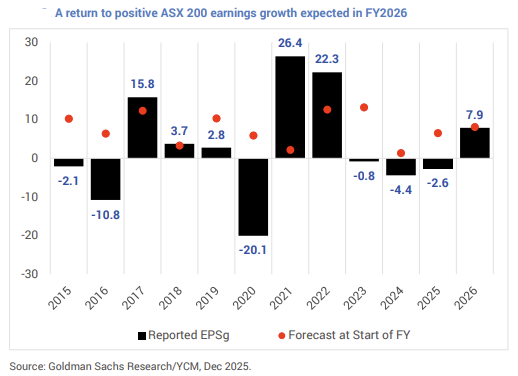

Third, the bigger picture is that company earnings haven’t met market forecasts. In fact, earnings growth has been negative for three consecutive years.

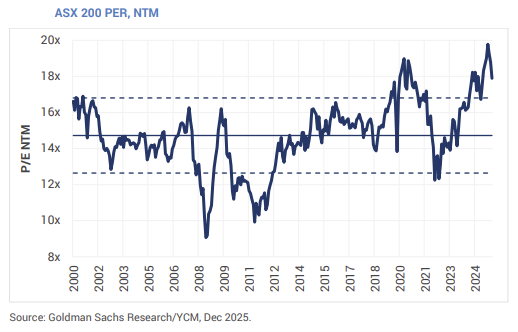

With earnings having gone nowhere, valuation expansion has driven the 30% increase in the ASX 200 since my initial article in 2023. In simple terms, that means investors have been willing to pay a higher price for company earnings.

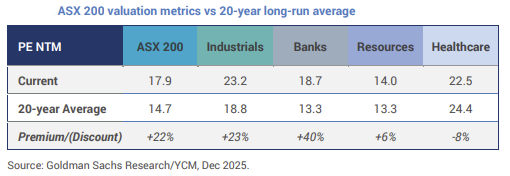

The ASX 200 is now trading at a price-to-earnings (P/E) ratio of 17.9x, well above its 20-year average of 14.7x.

Despite the recent drop in CBA shares, bank valuations remain 40% above their long run average. Meanwhile, resource and health stocks appear reasonably priced.

A property bounce

Two factors are behind property price increases over the past few years.

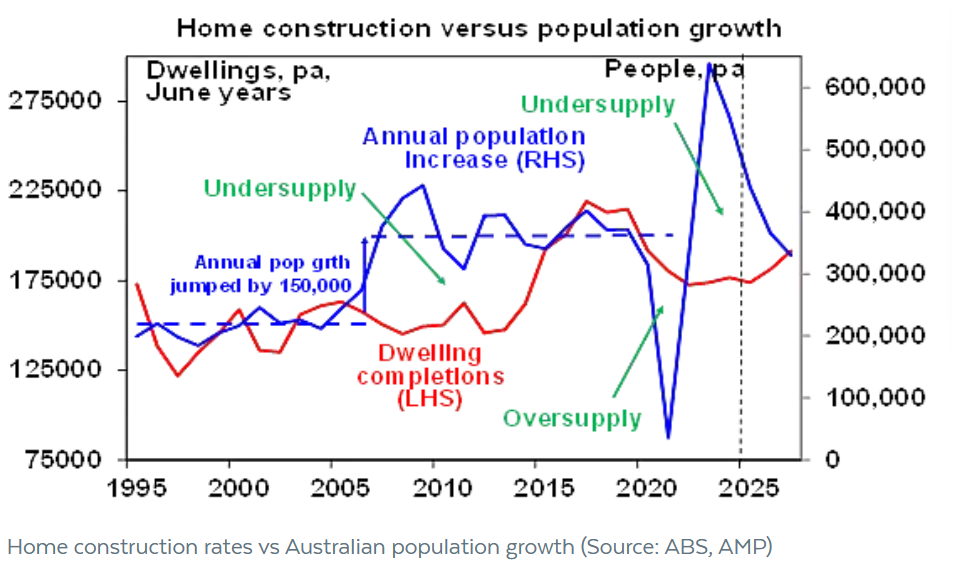

First, there’s been muted supply of new housing. Construction firms have struggled with high costs, making building homes largely unviable. Federal Government commitments to boost supply haven’t worked either. The government pledged to build 1.2 million homes over five years, yet one year on, they’ve only completed 174,000 homes, well below their 240,000 annual target. Red tape and struggles to get qualified tradies have restricted supply.

Second, housing demand has picked up. RBA interest rate cuts starting in February this year have played their part. Lower rates boost the relative appeal of housing as an investment and they allow home buyers to borrow more.

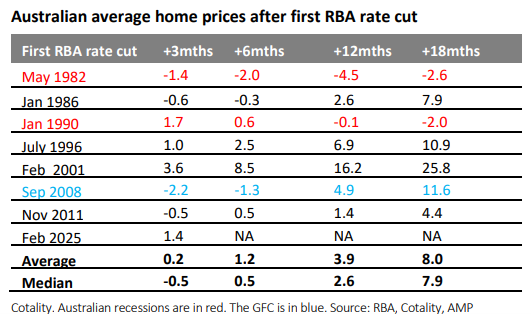

Over the past 45 years, five of the last seven rate cutting cycles have led to property price rises. The only exceptions were those that began during the recessions of the 1980s and 1990s. And the average gain in housing prices after the first RBA rate cut is 4% over 12 months and 8% over 18 months.

The property price rises this year following the first RBA cut are in line with these historical averages.

Government policies to help first home buyers have also stoked demand. The government’s low deposit guarantee scheme allowing first home buyers to access loans with a 5% deposit was brought forward to October 1 this year. Recently, the government’s Help to Buy Scheme started, provided 10,000 places a year where the government will take a 30-40% equity stake in the purchase price of a property for an owner occupier.

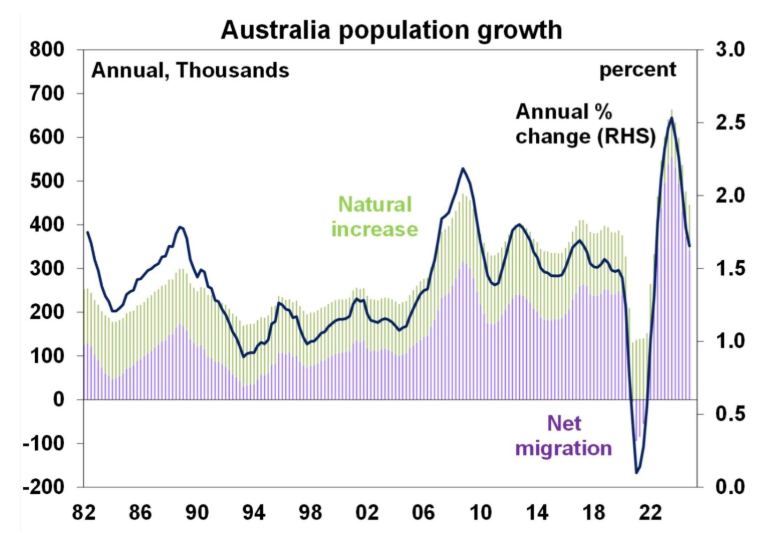

Strong population growth has also fuelled demand for housing. Yes, that growth has slowed since last year, but it remains well above historical levels.

Source: AMP

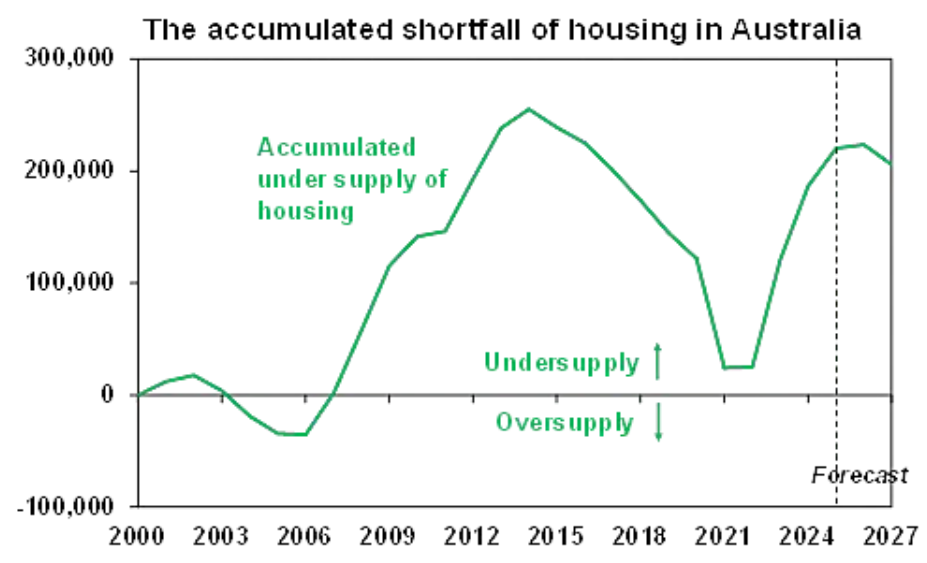

AMP chief economist Shane Oliver estimates that the supply-demand imbalance has led to a cumulative shortage of at least 220,000 homes:

“Up until 2005 the housing market was in rough balance. It then went into a massive shortfall of about 250,000 dwellings by 2014 as underlying demand surged with booming immigration. This shortfall was then cut into by the 2015-20 unit building boom and the pandemic induced hit to immigration.

But it’s since rebounded again to around 220,000 dwellings, or possibly as high as 300,000 if the pandemic induced fall in household size is allowed for. The shortfall is confirmed by low rental vacancy rates.”

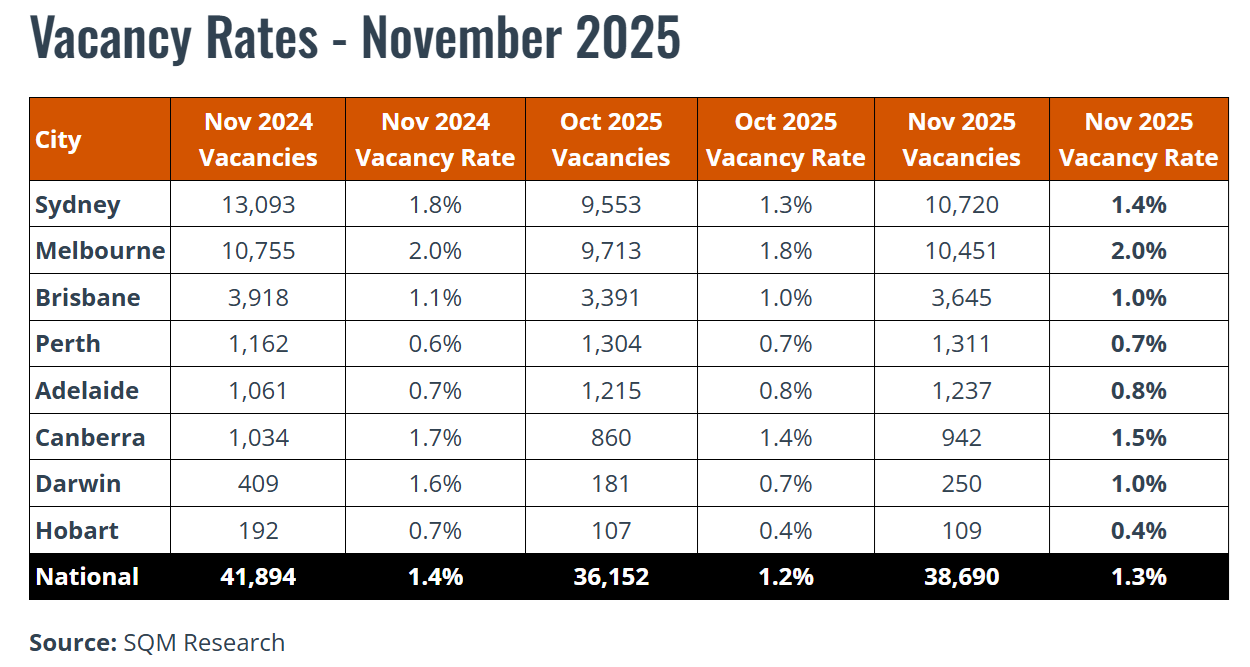

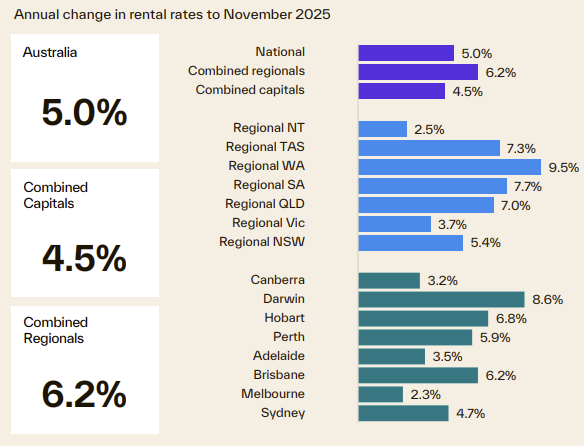

On those rental vacancies, the latest figures confirm a still tight rental market, despite a minor tick up in vacancy rates in November. Over the past year, Sydney has been the largest driver for falling vacancy rates.

Falling vacancies have led to continued growth in rents.

Source: Cotality

Where to from here?

I remain comfortable with my initial forecasts for decade-long stock and property returns.

It wouldn’t be a surprise to see a pullback in stocks in the short term given excessive market valuations compared to history.

The medium term outlook for shares will depend on earnings growth coming through. The good news is that we are starting to see better company profits. The market now expects ASX 200 earnings growth of 7.9% in the 2026 financial year.

For property, the sugar rush for demand from RBA cuts is over, with the next move in rates likely to be up.

That said, housing supply will still struggle to keep up with demand in the near term. Migration levels remain too high and government policies to help first home buyers only fuels purchases and higher prices (and sadly, the government knows this).

Affordability is the biggest handbrake on higher property prices. Nationwide, the house price to income ratio is 9.7x, up from just 2.8x almost 40 years ago.

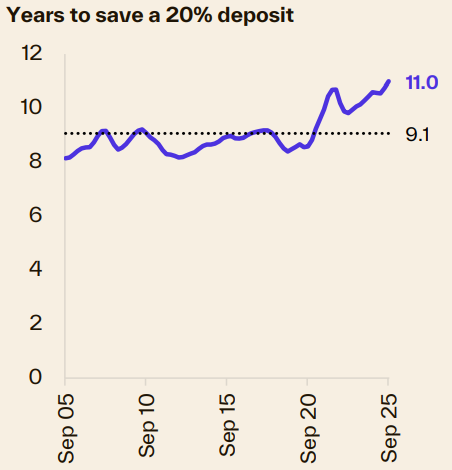

A 20% deposit now takes a record 11.0 years to save, up from 10.6 a year prior, and a 20-year average of 9.1 years.

Note: Assumes a 15% per annum household savings rates. Source: Cotality

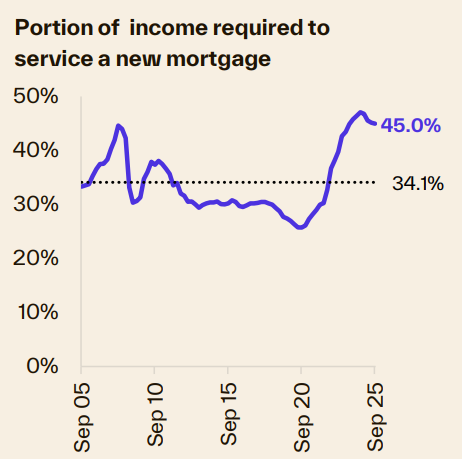

And the portion of income required to service a mortgage is 45%. That’s down from 47.1% a year ago, though it is well above the 20-year average of 34%.

Source: Cotality

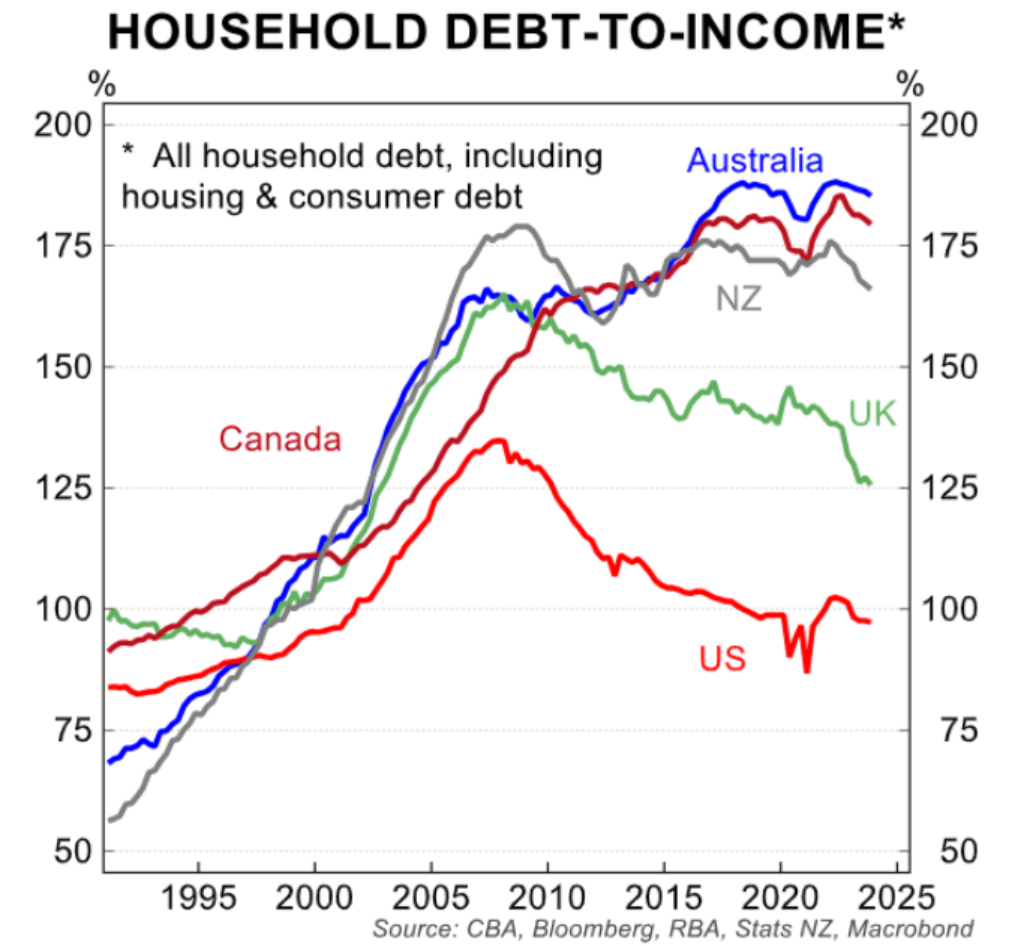

Meanwhile, Australians are swimming in debt, with household debt to income ratios of 182%, among the highest in the developed world.

Affordability is likely to put a cap on house prices. Put simply, property price growth can’t continue to exceed income growth as it will result in ever more unaffordable home prices, and given our debt levels, there’s a limit to how long that can go on.

Politics is the biggest long-term wildcard for property. It’s becoming clear that younger generations are getting fed up with rising house prices, and government policies that stoke demand and further increase prices. Their anger is finding its way to the ballot box as record numbers move away voting for the major political parties.

As the young increase in numbers in future elections, this may increase pressure on the government to use blunter tools to cap house prices.

James Gruber is Editor at Firstlinks.