For two decades, the search box has been the undisputed gateway to the internet, a frictionless tool embedded in our daily lives. But this familiar landscape is undergoing a transformational change, driven by the rapid emergence of Generative AI (GenAI).

This evolution is forcing us to reconsider not just how we find information, but how the companies that provide it will create value in the coming years. The two leaders in consumer-facing GenAI1 tools are OpenAI (via ChatGPT) and Alphabet (via Gemini).

The new landscape of search

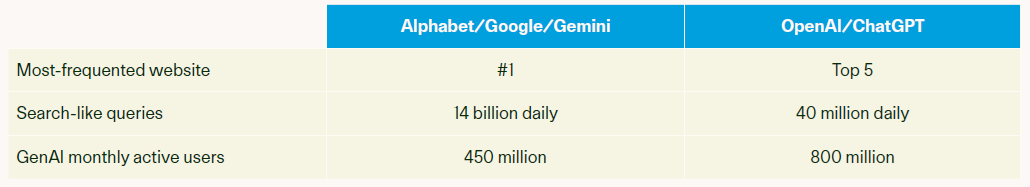

When ChatGPT launched in 2022, it acquired 100 million users in just two months, a pace unmatched by any prior consumer technology. Its first-to-market user-friendly GenAI tool has catapulted ChatGPT to the most-used app in the world, but still behind Google.com as the most frequented website. Current usage statistics include:

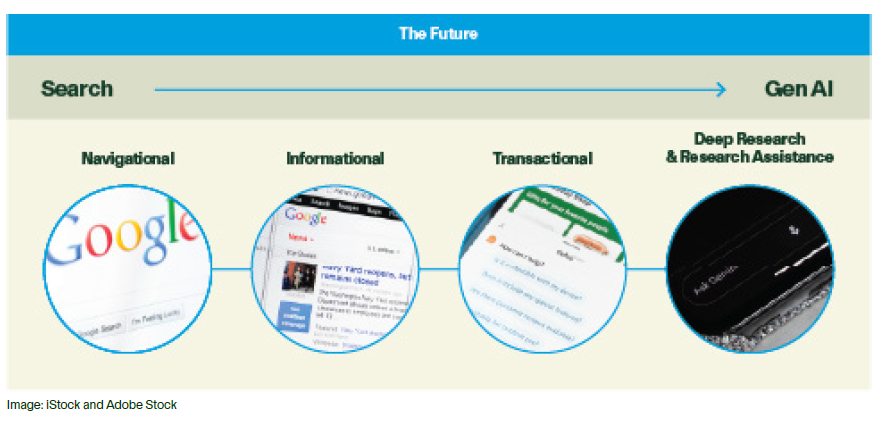

Currently, however, traditional search and GenAI serve distinct purposes. Google Search has long been the master of specific intent. Its usage is dominated by informational queries (e.g., “what is the weather in Brisbane?”) at ~55%, navigational queries (e.g., “Australian Museum website”) at ~30%, and commercial queries (e.g., “buy flights to Melbourne”) at ~15%. GenAI, on the other hand, excels at complexity. Around 70% of its use is for deep research and assistance, such as summarising reports or helping with homework. The remaining 30% comprises more search-like queries.

The who of the future of search

These two worlds of Search and GenAI, in our view, are rapidly converging. The future of Search isn’t a battle of one versus the other, but a synthesis of both. Magellan expect features and use cases to emerge that improve the experience for informational, navigational, commercial and deep research needs, as well as the emergence of agentic AI2 use cases.

At present, ChatGPT has the GenAI mindshare of the consumer given its first-mover advantage. Google has Search mindshare – and isn’t standing still on GenAI. Google, the pioneer of AI, is now integrating AI Overview into its core Search product, already reaching over 1.5 billion users of the tool, and over 450 million monthly active users (MAU) of the Gemini app. In addition, Alphabet’s scale and interconnected ecosystem are strategic advantages in driving future growth. Alphabet’s assets include YouTube (>2.7 billion MAU), Android (>3.5 billion users), Chrome (>3.5 billion users), Gmail (>1.8 billion MAU), Google Cloud, and Waymo. This powerful consumer base and diversified platform, combined with Alphabet’s GenAI capabilities, is a powerful platform to drive the adoption of GenAI and Agentic AI use cases. The breadth and depth of these services should enable Google to customise the AI experience for its users, which is hard to replicate.

Monetisation in the GenAI search era

The most critical question for investors is how this new technology will be monetised. Alphabet’s current model is a digital advertising fortress, with Search ad revenue representing a ~$200 billion annual revenue stream, and an estimated 90% market share in search. Impressively, this revenue is generated from ads being shown on only about 20% of searches. The future, however, points to a more diversified revenue stack, and more, albeit still concentrated, competition. For example, OpenAI currently generates US$12 billion in revenue and is aiming to grow 10x by 2029.

At Magellan, we see four key pillars emerging:

- Continued Google Search ad revenue: The foundational, highly profitable core business will remain, albeit it will likely be smaller over the medium to long term.

- GenAI subscription revenue: Premium tiers for advanced AI features are already being rolled out, creating a recurring revenue stream.

- GenAI ad revenue: As AI provides more comprehensive answers, new, native advertising formats will be integrated directly into the generated content.

- Agent revenue: This is the most transformative opportunity: an AI ‘agent’ that moves beyond providing information to completing tangible tasks. For example, users could engage an agent for booking an entire holiday, scheduling appointments or ordering products. The agent will be able to guide the consumer through the entire process from planning to discovery and purchase and is likely to take a small commission for the service. This moves GenAI players from an information provider to a commerce enabler.

In summary, the world of search is evolving, creating a powerful new monetisation model. Magellan view that Alphabet is far more than just a search engine; it’s a diversified ecosystem supercharged by AI and primed to lead in the future of search.

1 Generative AI or GenAI is a class of AI algorithm that can create new content such as text, images, audio and code based on learnings from existing data. GenAI responds to user prompts.

2 Agentic AI is an AI system that can autonomously and proactively act to achieve goals. Agentic AI can independently plan or make decisions to complete tasks.

From the Global Equities Team at Magellan Group, a sponsor of Firstlinks. This article has been issued by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 (‘Magellan’) and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs.

For more articles and papers from Magellan, please click here.