Phoenix has long discussed the importance of assessing governance in its investment process. The much-repeated Charlie Munger quote “show me the incentives and I will show you the outcome,” rings as true today as when he first said it. As such, we have maintained a preference for internally managed vehicles over those managed externally by fund managers focused on growing their funds under management. In June, BWP Trust (BWP) announced a major transaction, comprising the internalisation of management, along with a lease reset for many of the Bunnings tenanted properties owned by the trust. These interlinked transactions removed two of the key “snags” that were holding back our investment in the stock.

Snapshot

In June, BWP Trust announced two major changes:

- Internalisation of management – Ending its external management by Wesfarmers, BWP paid $142.6 million (10.6x FY26 EBIT) to take control.

- Lease reset – Extended lease terms on 62 Bunnings properties, increasing the WALE from 4.6 to 9.5 years, boosting property value by an estimated $50 million.

Why it matters

- Better alignment: Internal management means decisions now serve unitholders directly, as opposed to serving the dual interests of unitholders and the external manager.

- Cost savings: Expected to save over $5 million annually, with 2% dividend accretion in FY26.

- Improved asset quality: Longer leases make properties more attractive and saleable.

- Capital investment: $86 million committed to property upgrades, with $56 million rentalised and $30 million co-funded with Bunnings.

Valuation and outlook

- BWP now trades at $3.60/unit, a 5% discount to its pro-forma NTA of $3.79/unit.

- Historically traded at a premium due to strong tenant (Bunnings) and reliable dividends.

- Due to the above changes, Phoenix has started buying BWP units again.

A brief history

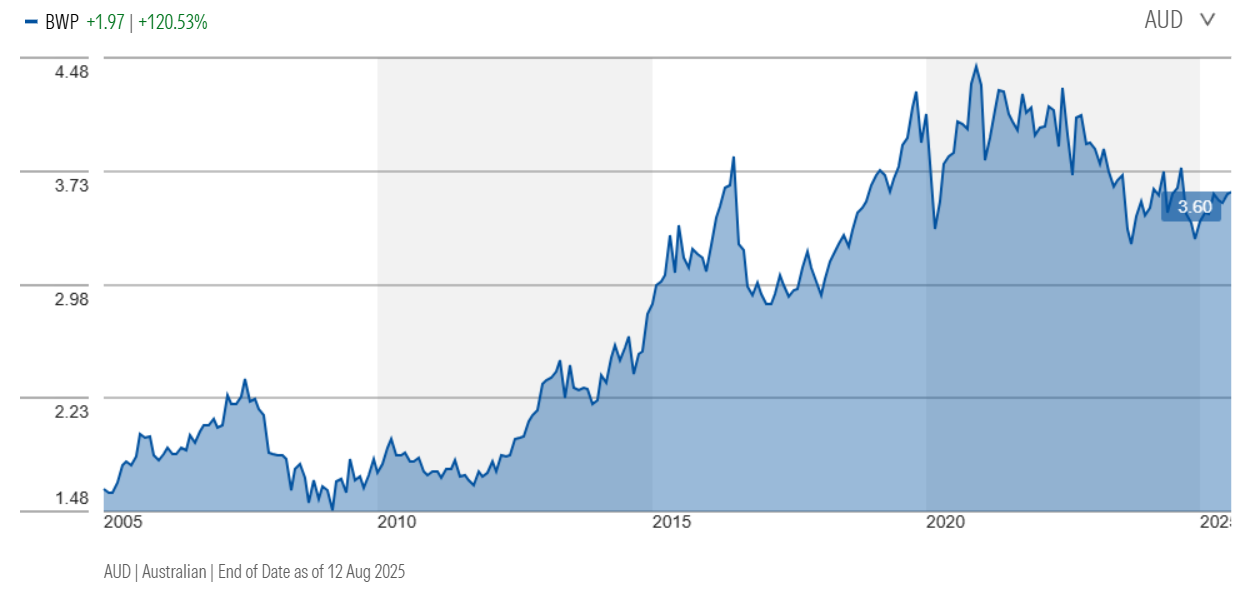

BWP conducted an initial public offering (IPO) in 1998, initially comprising 16 hardware retail properties tenanted by Bunnings Warehouse and 4 properties under development, to be tenanted by Bunnings. These properties were vended into the trust by Wesfarmers, the owner of the Bunnings Warehouse business. 99 million units were to be issued to public shareholders, with 33 million units subscribed to by Wesfarmers, all at an offer price of $1.00 per unit. Of the 20 initial properties, 15 are still owned by BWP. Their valuation has increased from $133.1 million to $644 million today, representing growth of 6% per annum. The IPO portfolio was vended to BWP at an initial yield of ~9.0%, whilst the most recent valuation showed a capitalisation rate of 5.4%. Despite this, much of the value appreciation has been driven by rent growth, with increases in rental payments growing 4.3% per annum for the properties held since IPO. Returns to shareholders have also been solid, with BWP producing a total return of 11.8% per annum since IPO.

Source: Morningstar.com.au

It is not only per share metrics that have grown. The units on issue have grown to 713.5 million, increasing more than 4x when compared to 1998. Much of this equity issuance did occur in capital raises above, or near net tangible asset backing. This growth may well have served BWP unitholders well, diversifying the portfolio and creating a more relevant entity, but it is worth acknowledging that on a per share basis, unitholders would have done perfectly well merely holding onto the initial portfolio. It is not questionable that the external manager of BWP, Wesfarmers, has very clearly benefited from this growth, as the recent transaction proves.

Coming to today

How much has Wesfarmers benefitted from BWP’s growth? In June, BWP announced it would internalise management of the company, paying Wesfarmers $142.6 million, representing 10.6x the management company’s estimated 2026 Financial Year (FY26) earnings before interest and tax (EBIT). In FY26 this will produce cost savings to BWP of more than $5 million, however this likely understates the true savings, as this includes transaction costs (associated with this deal) and does not include benefits of additional scale. The deal is also 2% accretive to the FY26 dividend. As fees are charged as a percentage of assets under management, growth under the old structure would naturally lead to an increase in management costs. Adding an additional Bunnings property to an internally managed vehicle, however, should barely make a difference to administration costs. This creates a better alignment of interests, meaning any decision to grow is more likely to be solely in the interests of unitholders, as opposed to serving the dual interests of unitholders and the external manager.

Connected to this deal is the announcement of an extension and reset of the lease terms of 62 Bunnings leases. This increases the weighted average lease expiry (WALE) of Bunnings tenanted properties owned by BWP from 4.6 years to 9.5 years. An independent expert has assessed that this is likely to increase the value of the properties owned by BWP by ~$50 million. This may understate the true value uplift as it does not directly consider the optionality inherent in the leases. Bunnings tend to have options embedded in their leases to extend the lease. The options have a cap and collar of 10%, meaning the rent can only increase or decrease as much as 10% upon option exercise. As Bunnings controls the option, they will likely exercise it on any strongly performing stores and likely won’t on any underperforming stores, which are more likely to be in inferior locations. With the WALE having decreased to 4.6 years this was a key concern. The lease extension does not extinguish this concern, however, it does push it out 5 years. Additionally, Bunnings properties with longer WALEs are meaningfully more saleable, with recent transactions very supportive of independent valuations.

The final element of the transaction is a commitment to capital expenditure by BWP. $56 million of this is to be rentalised at a fair rate, whilst an additional $30 million will be equally and jointly funded by BWP and Bunnings to improve some older properties. This amount won’t be rentalised, however should support asset values and prove a commitment by Bunnings to stay in that space.

What to do about it?

For much of its history, BWP has traded at a premium to its net tangible asset backing. A strong, prominent covenant and steadily growing dividends attracted a large retail shareholder base to the stock, supporting valuation over time. Given elevated share prices, along with an awareness of negative optionality and an external management structure with poor incentives, Phoenix has very rarely held any position in BWP1. At the time of writing, BWP traded at $3.60 per unit, approximately a 5% discount to the pro-forma net tangible asset backing of $3.79 per unit. The capitalisation rate used to deduce this value compares favourably to recent transactions. All told, this transaction removes two “snags” with investing in BWP. Namely, a relatively short WALE, creating a large degree of uncertainty in the short to medium term and perhaps more importantly, aligns incentives between BWP’s management and those of independent unitholders2. Phoenix has also been impressed with the quality of BWP management and board members and the transactions they have undertaken.

Given this and the stock’s reasonable valuation, the portfolio has begun purchasing BWP units for the first time in a long time. Owning a rock-solid portfolio of properties leased to one of the strongest tenants in Australia, with a strong, efficient and aligned management team, at a discount to somewhat conservative independent valuations, seems like a worthy investment.

1 Phoenix has briefly held positions in BWP in times of temporary weakness, but quickly reduced the position as it returned to fair value.

2 The proposed remuneration framework laid out in the meeting booklet is top quartile for property companies under coverage, with remuneration outcomes closely linked to shareholder returns.

Stuart Cartledge is Managing Director of Phoenix Portfolios, a boutique investment manager partly owned by staff and partly owned by ASX-listed Cromwell Property Group. Cromwell Funds Management is a sponsor of Firstlinks. This article is not intended to provide investment or financial advice or to act as any sort of offer or disclosure document. It has been prepared without taking into account any investor’s objectives, financial situation or needs. Any potential investor should make their own independent enquiries, and talk to their professional advisers, before making investment decisions.

For more articles and papers from Cromwell, please click here.