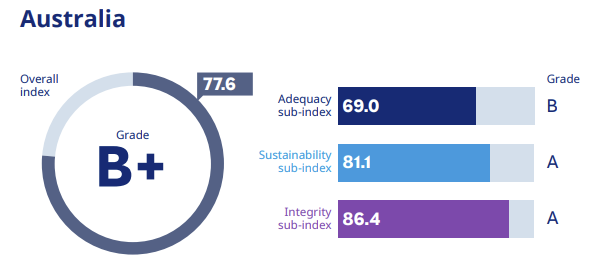

The 2025 Mercer CFA Institute Global Pension Index (MCGPI) showed that Australia’s Index score had improved to its highest level in 10 years but remained a B+ grade system. It ranked Australia 7th out of 52 pension systems around the world. While this result appears commendable, it represents Australia’s lowest ranking in the 17 years of the Index.

Indeed, in the last two years, both Singapore and Sweden have overtaken Australia.

Furthermore, if one considers the 17 years since the Index commenced, the average score for the pension systems that have been included throughout this period has increased by 9.9 whereas the Australian score has only increased by 3.6.

There is a similar trend, although not as dramatic, if we compare the five years since 2020. In this case, the average increase has been 4.8 compared to the increase in the Australian score of 3.4, thanks to the increase in the superannuation guarantee to 12% and the growing superannuation coverage of the working age population.

Since its beginning, the MCGPI has considered each pension system from three different perspectives, namely:

- Adequacy – what benefits are provided to retirees?

- Sustainability – can the system keep delivering benefits for decades to come?

- Integrity – does the system promote confidence through transparency and appropriate regulations?

The Australian system scores well in respect of sustainability and integrity with A grade ratings and placings of fifth and eighth respectively. However, when adequacy is considered, Australia is B grade and ranks 24th out of the 52 systems with a score that is 11.6 out of 100 below the average for the six systems above us (namely Netherlands, Iceland, Denmark, Singapore, Israel and Sweden). Clearly, we should do better.

Source: Mercer

Why are we slipping?

So why is the Australian score so poor when adequacy is considered? After all, the SG has now reached 12% and that should provide a reasonable retirement benefit for most workers. There are two main reasons.

The first is the impact of the assets test on the Age Pension for those who have had a career with median or above median earnings. The OECD, which calculates the net replacement rates used in the MCGPI, assumes that in the early years of retirement the impact of the asset tests means that many retirees will receive very limited, if any, Age Pension due to their superannuation. On the other hand, in the later years of retirement, the OECD reckons that some Age Pension will be received as the level of superannuation assets is assumed to decline. This means the relatively harsh assets test that currently applies, has a direct effect on our global ranking.

The second reason is more fundamental and reflects the current design of our superannuation system. We have developed a very good system that now covers all employees with a 12% contribution rate and that, in the vast majority of cases, is invested wisely producing a good long term return.

However, it is not a retirement income or pension system! There are no requirements for superannuation fund members to withdraw any part of their superannuation when they retire. This is in stark contrast to the best pension systems in the world which require most or all of the accumulated benefits to be withdrawn on a regular basis.

Even pension systems in countries which have a similar legislative background to Australia have introduced such requirements.

For example, in a Canadian defined contribution pension plan, pension payments must generally begin by the end of the calendar year in which an individual turns 71. In the UK, an individual can normally make withdrawals from their pension pot between the ages of 55 and 75. If no withdrawals are made by age 75, a “benefit crystallization event” occurs. The USA provides another example where there are required minimum distributions from age 73.

These requirements in other systems mean that the accumulated funds are used to provide retirement income and not for estate planning or intergenerational wealth transfers. This income-based approach would also limit the growth of superannuation balances during retirement.

We need a retirement income system

Of course, the Retirement Income Covenant and the follow-up actions by both APRA and ASIC are requiring superannuation fund trustees to have a much stronger commitment to developing appropriate strategies for members approaching and during retirement.

However, this pressure does not mean that accrued benefits will be converted into retirement income. Indeed, as at June 2025 there are more than 850,000 MySuper accounts for Australians aged 65 and over with an average balance of $116,000[i]. Of course, some of these individuals may still be in the workforce but most of them will have retired. By remaining in MySuper, their balances have not been moved to pension phase where there is a requirement for a minimum amount to be withdrawn every year.

Many of these MySuper members will have had very limited engagement with their superannuation. It has all happened automatically and that is a good outcome. However, at retirement, that automatic process stops and individuals must take action. The result is that many retirees are not a receiving an income from their superannuation account which could make a significant difference to their standard of living and help provide them with a dignified retirement.

Australia has a very good accumulation system for retirement, but we do not yet have a retirement income system. We should make it a requirement that from age 75, Australians must begin to withdraw their superannuation.

The introduction of an income requirement, together with a moderation of the assets test, would improve the retirement income for many older Australians and improve Australia’s ranking in the MCGPI. Without such a focus on retirement income, Australia cannot claim to have a world class retirement income system.

[i] APRA, Quarterly superannuation industry publication, June 2025, Table 7a

Tim Jenkins is a superannuation expert and actuary, and is a Partner at Mercer Australia. Dr David Knox is a global pension expert and actuary, who recently retired from being a Senior Partner at Mercer.