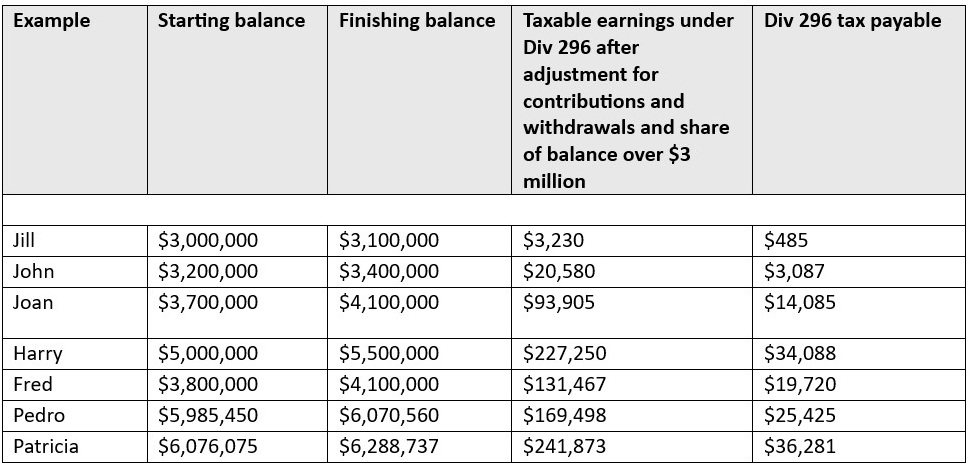

The Federal Government has proposed reducing the concession paid on earnings in superannuation accounts holding more than $3 million dollars. The worked examples below show how the tax is calculated for a range of different superannuation account holders.

The examples below are for illustration purposes only and based on current information about the proposed tax as at 5 June 2025. The table below summarises the figures in the examples.

Joan, a retiree with account-based pensions

In the 2025–26 income year Joan received benefit payments of $250,000 combined from her two pension accounts and made a $300,000 downsizer contribution. On 30 June 2025 Joan’s Total Superannuation Balance (TSB) was $3.7 million and $4.1 million on 30 June 2026.

Joan’s adjusted TSB at the end of the year is calculated to be $4.05 million by adding her total withdrawals of $250,000 and deducting her total contributions of $300,000 from her 2025–26 TSB of $4.1 million. Her superannuation earnings for the year are $350,000 (the difference between $4.05 million and $3.7 million).

The percentage of taxable earnings over $3 million is calculated by subtracting $3 million from $4.1 million and then dividing it by $4.1 million, resulting in a percentage of earnings attributable to the balance over $3 million of 26.83%.

The Division 296 tax amount is calculated by first multiplying the superannuation earnings of $350,000 by 26.83%, which is $93,905. That amount is then multiplied by the 15% tax rate, leading to a Division 296 tax amount of $14,085.75. This is a relatively small proportion – approximately 4% – of the overall superannuation earnings of $350,000.

Jill, not currently working, aged 55

On 30 June 2025 Jill’s Total Superannuation Balance (TSB) was $3.0 million and $3.1 million on 30 June 2026.

Her superannuation earnings for the year are $100,000 (the difference between $3.1 million and $3.0 million).

The percentage of taxable earnings over $3 million is calculated by subtracting $3 million from $3.1 million and then dividing it by $3.1 million, resulting in a percentage of earnings attributable to the balance over $3 million of 3.23%.

The Division 296 tax amount is calculated by first multiplying the superannuation earnings of $100,000 by 3.236%, which is $3,230. That amount is then multiplied by the 15% tax rate, leading to a Division 296 tax amount of $485.

John, an employee who has not retired

In the 2025–26 income year John had total employer contributions totalling $25,000 after deduction of the 15% contribution tax. On 30 June 2025 John’s Total Superannuation Balance (TSB) was $3.2 million and $3.4 million on 30 June 2026.

John’s adjusted TSB at the end of the year is calculated to be $3.375 million by deducting his total contributions of $25,000 from his 30 June 2026 TSB of $3.4 million. His superannuation earnings for the year are $175,000 (the difference between $3.375 million and $3.2 million).

The percentage of taxable earnings over $3 million is calculated by subtracting $3 million from $3.4 million and then dividing it by $3.4 million, resulting in a percentage of earnings attributable to the balance over $3 million of 11.76%.

The Division 296 tax amount is calculated by first multiplying the superannuation earnings of $175,000 by 11.76%, which is $20,580. That amount is then multiplied by the 15% tax rate, leading to a Division 296 tax amount of $3,087. This is a relatively small proportion – less than 2% – of the overall superannuation earnings of $175,000.

Harry, self-employed and not retired

On 30 June 2025 Harry’s Total Superannuation Balance (TSB) was $5 million and $5.5 million on 30 June 2026.

Harry made no contributions and had no withdrawals from his super, so the superannuation earnings for the purpose of the tax are $500,000, the difference between the two figures.

The percentage of taxable earnings over $3 million is calculated by subtracting $3 million from $5.5 million and then dividing it by $5.5 million, resulting in a percentage of earnings attributable to the balance over $3 million of 45.45%.

The Division 296 tax amount is calculated by first multiplying the superannuation earnings of $500,000 by 45.45%, which is $227,250. That amount is then multiplied by the 15% tax rate, leading to a Division 296 tax amount of $34,088.

Fred the retired farmer

Fred has retired from farming. His children continue the farming business, paying rent to the Self-Managed Super Fund (SMSF) which holds the property as an investment asset.

Fred’s account in the SMSF has an investment portfolio represented by the $3 million value of the farm, together with shares and bank deposits. His total superannuation balance as at 30 June 2025 is $3.8 million. The fund receives rent in 2025–26 at a yield of 4% on the opening value of the land, which equates to $120,000. The SMSF is required to charge a commercial rent for the farming land. Rent is a set amount and does not vary with the profitability (up or down) of the farming business.

Interest and dividends amount to $60,000 a year. Fred draws down at the minimum required rate for his age (70), so his benefit payment is $190,000 in 2025–26. Even in the absence of any Division 296 tax the fund needs to have access to cash to pay the minimum required drawdown.

At 30 June 2026 the value of his interest in the farm has increased by 10% to $3.3 million. The total value of his interest in the SMSF is $4.1 million.

Fred’s adjusted TSB at the end of the year is calculated to be $4.29 million by adding his total withdrawals of $190,000. His superannuation earnings for the year are $490,000 (the difference between $4.29 million and $3.8 million).

The percentage of taxable earnings over $3 million is calculated by subtracting $3 million from $4.1 million and then dividing it by $4.1 million, resulting in a percentage of earnings attributable to the balance over $3 million of 26.83%.

The Division 296 tax amount is calculated by first multiplying the superannuation earnings of $490,000 by 26.83%, which is $131,467. That amount is then multiplied by the 15% tax rate, leading to a Division 296 tax amount of $19,720. This is approximately 4% of the overall superannuation earnings of $490,000 and around 10% of the otherwise tax-free payment he received from superannuation.

Pedro, retired male MP

Pedro retired from Parliament in May 2025 after many years of service, including as a Minister and Shadow Minister. Due to his date of entry to Parliament he qualifies for a defined benefit pension which he started to receive from May 2025. He has informed the fund trustee that he has a spouse. He is aged 55 as at 30 June 2025.

In the 2025–26 income year Pedro received benefit payments of $250,000.

The trustee of the fund has used the Family Law valuation method to determine a Total Superannuation Balance (TSB) of $5,985,450 on 30 June 2025 and a closing balance of $6,070,560 as at 30 June 2026. The closing balance reflects a lower valuation factor due to the member being one year older but there is also an increase in the benefit paid, which for the purpose of this illustration is indexed by growth in average earnings of 3.5%.

Pedro’s adjusted TSB at the end of the year is calculated to be $6,320,560 by adding his total withdrawals of $250,000. His calculated superannuation earnings for the year are $335,110 (the difference between $6,320,560 and $5,985,450).

The percentage of taxable earnings over $3 million is calculated by subtracting $3 million from $6,070,560 and then dividing it by $6,070,560, resulting in a percentage of earnings attributable to the balance over $3 million of 50.58%.

The Division 296 tax amount is calculated by first multiplying the superannuation earnings of $335,110 by 50.58%, which is $169,498. That amount is then multiplied by the 15% tax rate, leading to a Division 296 tax amount of $25,425 from $335,110 in earnings.

Patricia, retired female MP

Patricia also retired from Parliament in May 2025 after many years of service, including as a Minister, Shadow Minister and Committee Chair. Due to her date of entry to Parliament she qualifies for a defined benefit pension which she started to receive from May 2025. She has informed the fund trustee that she has a same-sex spouse. She is aged 55 at 30 June 2025.In the 2025–26 income year Patricia received benefit payments of $250,000.

The trustee of the fund has used the Family Law valuation method to determine a Total Superannuation Balance (TSB) of $6,076,075 on 30 June 2025 and a closing balance of $6,288,737 as at 30 June 2026. The closing balance reflects both a lower valuation factor due to the member being one year older and also an increase in the benefit paid (to $258,750), which for the purpose of this illustration is indexed by growth in average earnings of 3.5%.

The Family Law valuations use gender-based factors, reflecting longer life expectancy for women. A higher valuation also applies when there is a spouse, because of the reversionary pension paid on the death of the primary recipient. The valuation factors assume a spouse is of the opposite gender. It is also not clear whether the factors apply to a person based on their gender at birth or the gender they currently identify with.

Patricia’s adjusted TSB at the end of the year is calculated to be $6,538,737 by adding her total withdrawals of $250,000 to the closing balance. Her calculated superannuation earnings for the year are $462,562 (the difference between $6,538,737 and $6,076,075).

The percentage of taxable earnings over $3 million is calculated by subtracting $3 million from $6,288,737 and then dividing it by $6,288,737, resulting in a percentage of earnings attributable to the balance over $3 million of 52.29%.

The Division 296 tax amount is calculated by first multiplying the superannuation earnings of $462,562 by 52.29%, which is $241,873. That amount is then multiplied by the 15% tax rate, leading to a Division 296 tax amount of $36,281 – around 14% of the pension received.

The Division 296 tax payable by Patricia is about 45% more than the tax payable by Pedro, even though they receive the same pension payment. This is due to the use of gender-based valuation factors. The calculated investment earnings are higher and a greater amount of the account balance is over $3 million. In submissions on the valuation methods ASFA has advocated for the same valuation factors to apply to males and females for both the primary and reversionary beneficiaries.

ASFA represents the APRA regulated superannuation industry with over 100 organisations as members from corporate, industry, retail and public sector funds, and service providers. We develop policy positions through collaboration with our diverse membership base and use our deep technical expertise and research capabilities to assist in advancing outcomes for Australians.