A pop quiz: What percentage of migrants to Australia last year were skilled workers? I asked this question to a work colleague and her answer was 50%. I think that would be about ball-park consensus.

The actual number: 13%. And that’s split between skilled workers on permanent visas (6%) and skilled workers on temporary visas (7%).

There’s a widespread perception that the bulk of migrants to Australia are skilled workers, yet these numbers show it’s anything but. It’s one of many myths built around the issue of migration.

I’m going to explore these myths as well as why both sides of politics have been big boosters of a ‘Big Australia’ policy that’s helped kill economic productivity and put unprecedented pressures on our housing market. It’s time we followed Canada and reduced migration to more manageable levels.

Until recently, migration had been a major net-positive

This article isn’t about politics. It’s not about being left-wing or right-wing. And it’s certainly not about being anti-immigration.

Migrants have helped build modern Australia. The initial convicts who came here were young and hardworking and quickly turned the country into a thriving colony. The 1850s gold rush saw a further surge in migrants, many of whom were looking to get rich, and even if they didn’t, ending up staying anyway.

Post World War Two, we had the rush of European migrants who started with little and yet helped turn Australia into a prosperous economy. This was helped by the influx of Asian migrants from the 1970s, who now make up a considerable portion of our population.

Migration has been a major net-positive for Australia.

That is … until now.

What’s changed?

Over the past 20 years, both major political parties have advocated a ‘Big Australia’ policy that’s seen an unprecedented surge in our population.

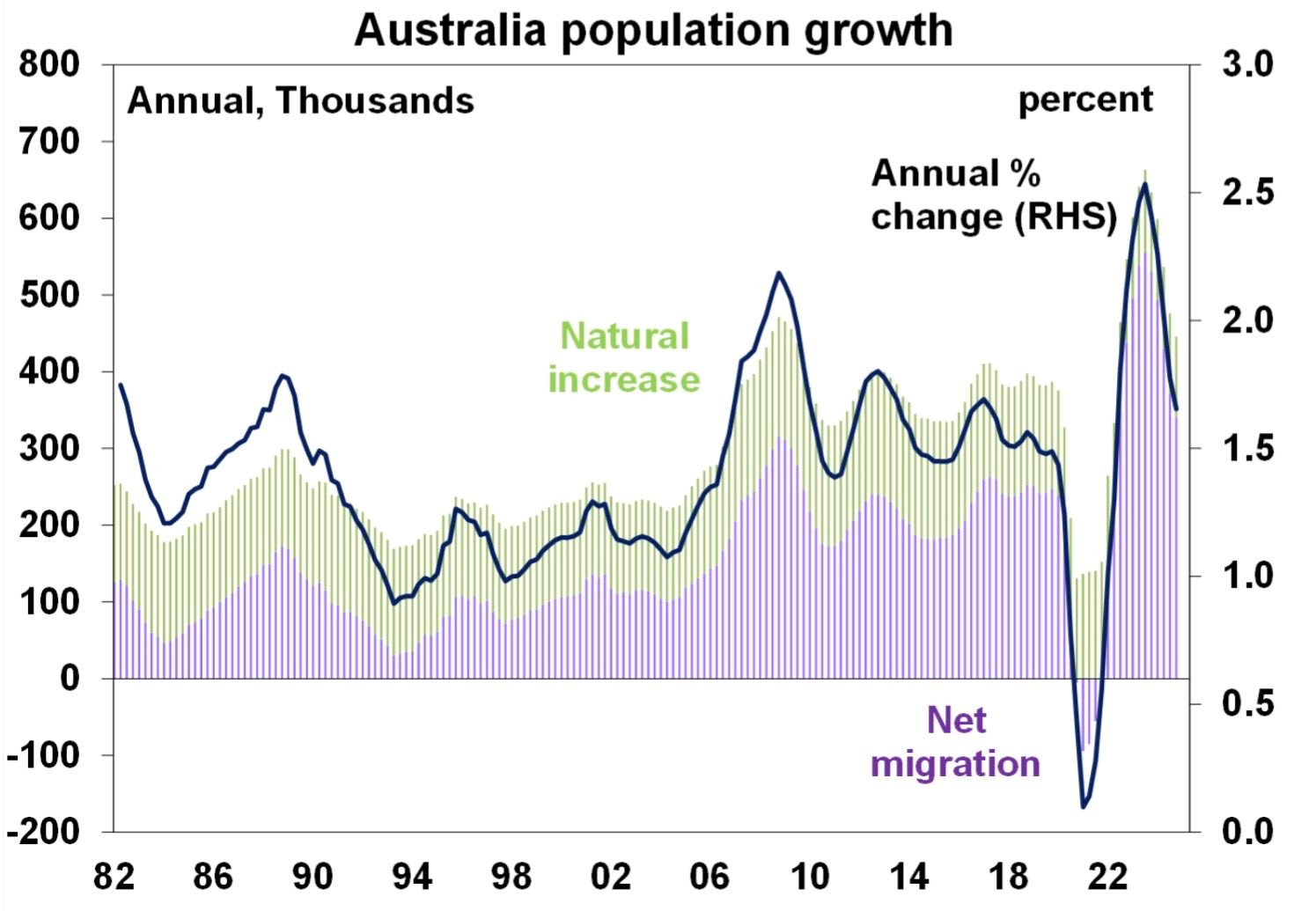

From 1980 to the mid-2000s, population growth in Australia averaged 1% to 1.5% each year. From the mid-2000s, that stepped up to 1.5% to 2%. In recent years, population growth has been even higher.

For instance, population growth was 1.13% in 1984, 1.0% in 1994, a little higher at 1.32% in 2004, a lot higher at 1.75% in 2014, and 1.7% last year.

The 2024 figure was a decrease on the 2023 growth number of 2.5%, which was the highest in more than a century.

As the chart shows, a significant increase in the number of migrants to Australia has accompanied the step-change in our population growth.

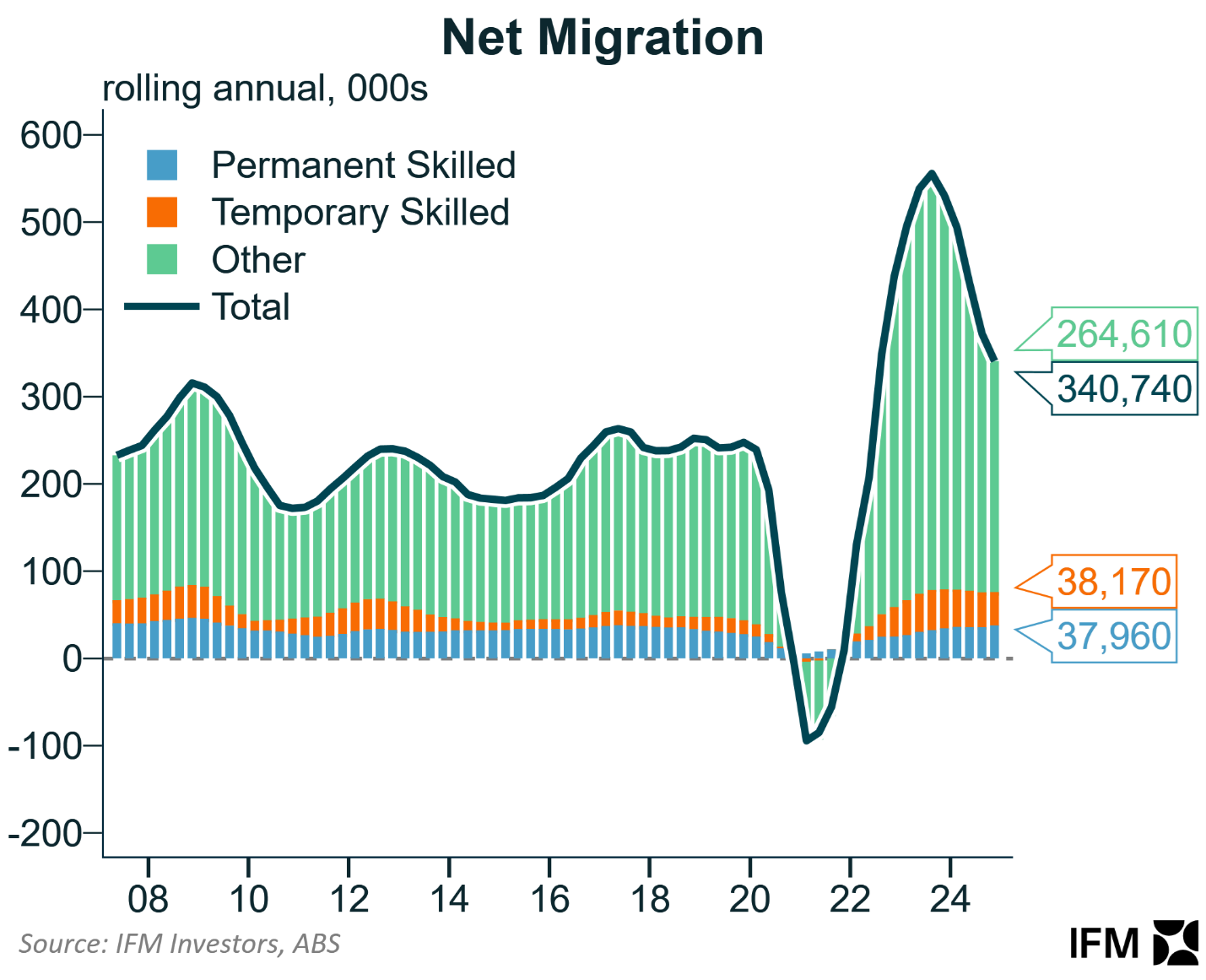

Last year, net overseas migration was 341,000, 87% higher than the 182,000 of a decade earlier.

Who are these new migrants?

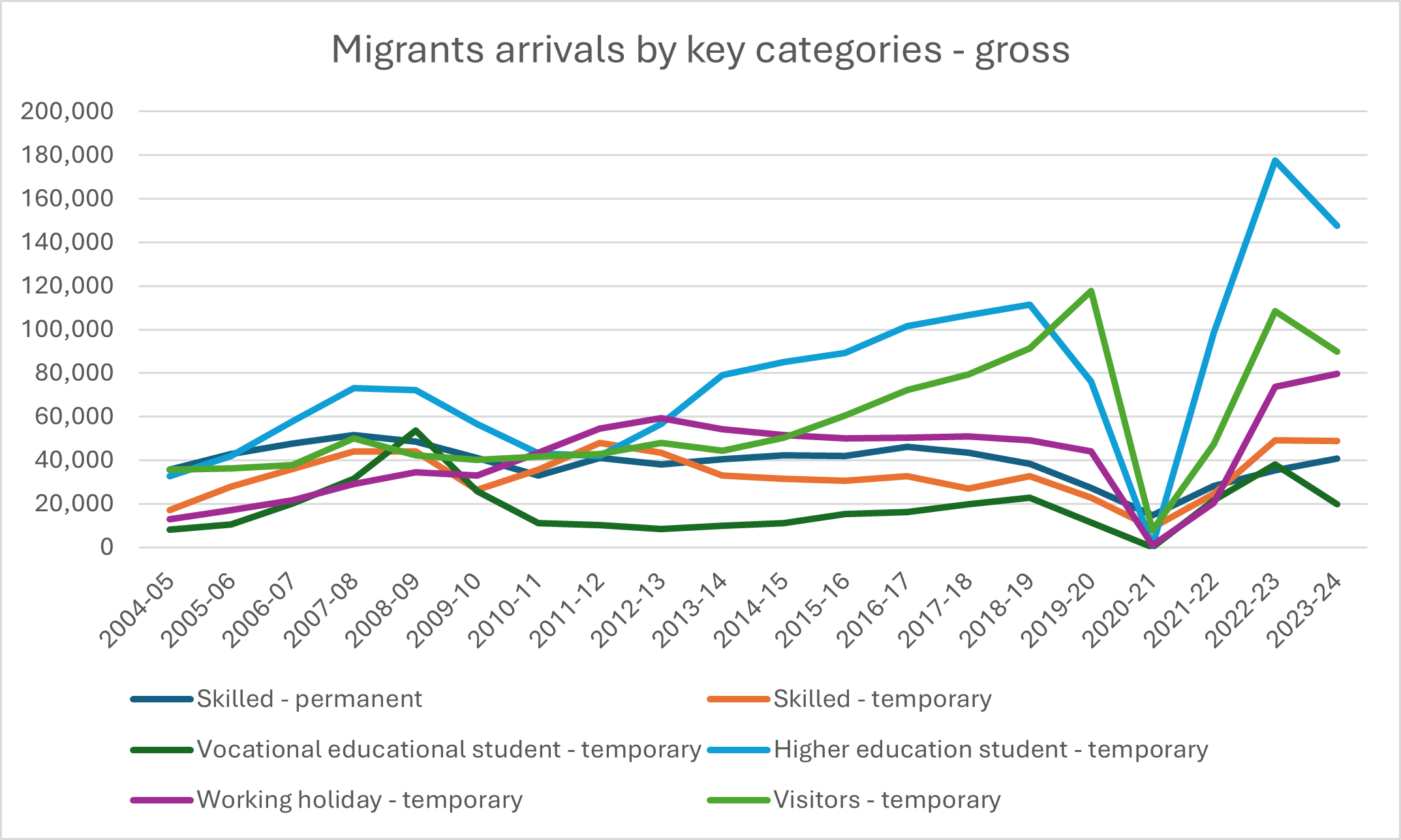

As alluded to earlier, few of them are skilled workers. The number of skill workers on permanent visas hasn’t moved much over the past 20 years.

However, there has been a gradual increase in skilled workers on temporary visas. These visas are given so people can temporarily live and work here to fill specific skill shortages or gain work experience, often with a pathway to permanent residency for some categories. They’re often sponsored by a local employer.

Yet, the biggest driver for increased net migration has come from those on working holiday and student visas.

The number of working holiday visas has risen from around 13,000 in 2004-2005 to 80,000 in 2023-2024. These visas now outnumber those given to permanent and temporary skilled workers.

Working holiday visas are for young people to come here and work for up to a year, often in seasonal industries like agriculture and hospitality.

Student visas are the other driver behind the surge in net migration. In 2004-2005, 33,000 students on higher education visas came to Australia. By the last financial year, that had increased to almost 148,000, a 4.5x increase. And last year’s figure was down from 177,000 in 2022-2023. Universities have had a good time of it!

Source: ABS, Firstlinks

It’s now estimated that there are around a million international students in Australia. About half of them are at universities and the other half are studying at non-degree institutions like language and hospitality schools.

It’s impacting our economic fortunes

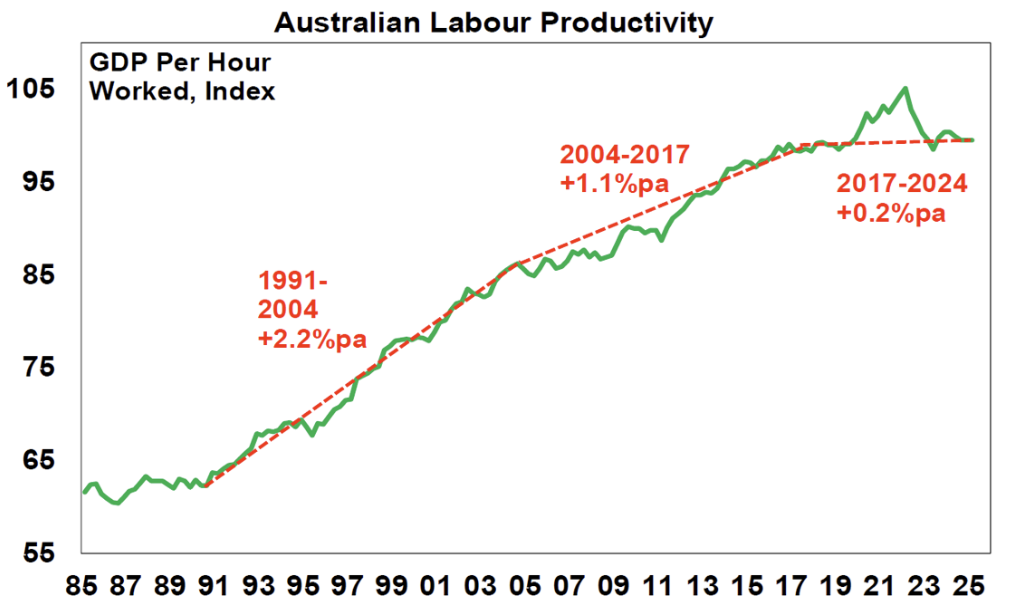

The surge in migration numbers has coincided with a flatlining in economic productivity and per capita GDP over the past decade. Is it just a coincidence? I don’t think it is.

That’s because students and those on working holiday visas make up about 10% of Australia’s labor force today. According to a recent study, they’re mostly in low-skilled jobs, such as food delivery, cafes, hotels, removals, and construction.

The increase in the pool of workers has undoubtedly depressed wage growth and hit productivity.

Source: Shane Oliver, AMP

It’s impacting housing too

It’s unlikely that the increase in low-cost labor has impacted house prices much. Though, it’s almost certainly had a larger effect on rental housing.

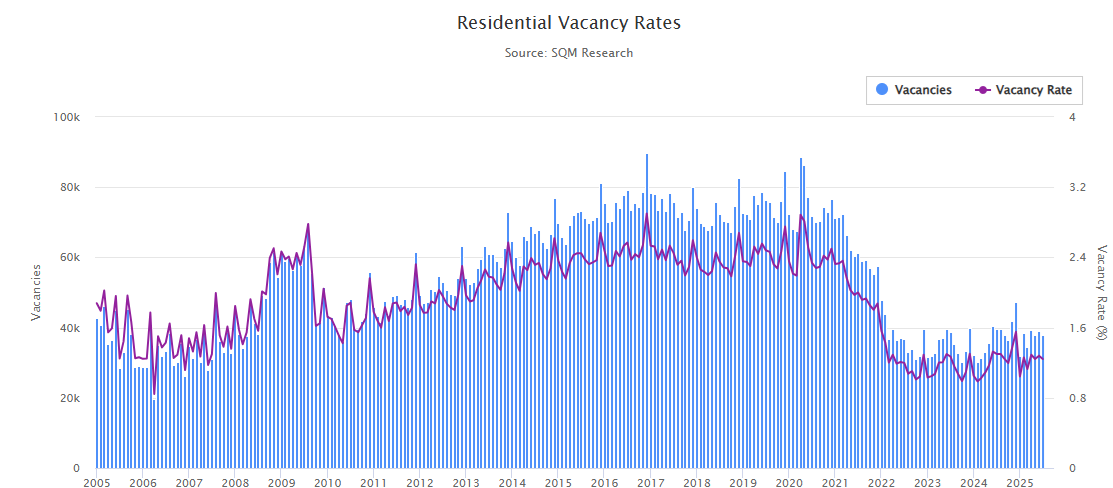

The national rental vacancy rate was just 1.2% in July this year. Currently, it’s extremely difficult to find rentals in Perth, Adelaide and Brisbane – all with vacancy rates under 1%. The situation is slightly better in Sydney and Melbourne, with rates of 1.5% and 1.8% respectively.

The national vacancy rate peaked above 3.2% during Covid and periods in the decade before, though now languishes at near record lows.

Canada shows Australia the way

Canada may offer a path forward to boost Australia’s economic fortunes and ease the pressures on our housing market.

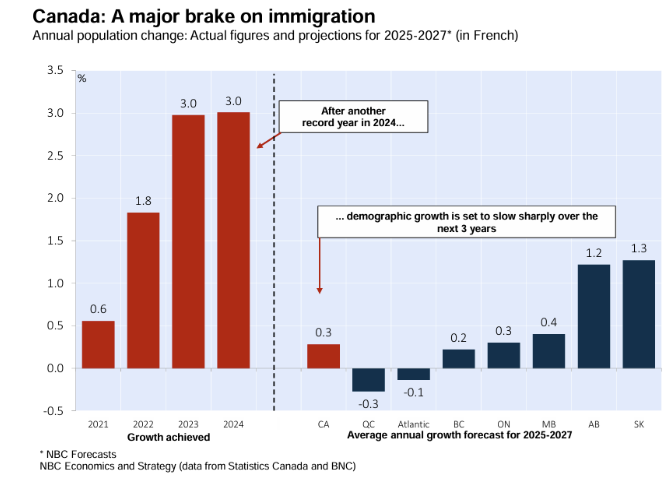

Until last year, Canada had run the largest migration program in the developed world. In 2024, population growth peaked at almost 3%.

This led to plummeting per capita GDP and a record housing shortage that caused a rental crisis.

After a backlash, the then Prime Minister, Justin Trudeau changed course. In a video address in November last year, he outlined a plan to drastically cut migration over the next three years:

“In the last two years, our population has grown really fast, like baby boom fast.

So we’re doing something major. We’re reducing the number of immigrants that will come to Canada for the next three years.

Bad actors, like fake colleges and big chain corporates, have been exploiting our immigration system for their own interests”.

Trudeau’s aim was to stabilize the population at 2024 levels out to 2027. The new government has followed through with his plan.

Consequently, Canada’s quarterly population growth plunged to 20,100 in the second quarter of this year, down from more than 400,000 per quarter seen at the peak in 2023.

Canada has kept their flow of permanent residents relatively steady; the cuts have come from temporary migrants. In 2023, temporary net migration numbers were above 300,000 per quarter, and they’ve now turned negative.

Overall population growth has eased to 1.24% in the most recent quarter, down from the 3% levels of 2023.

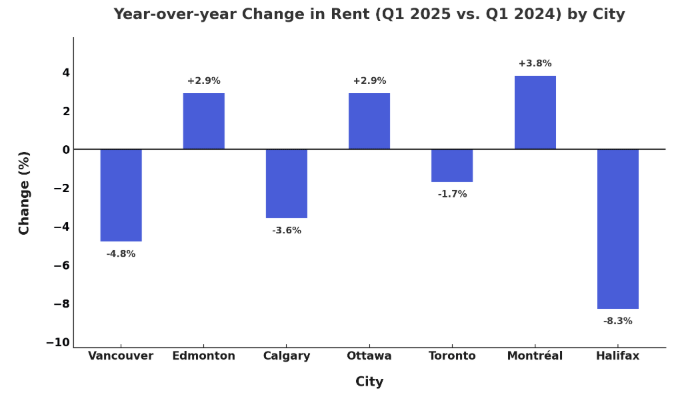

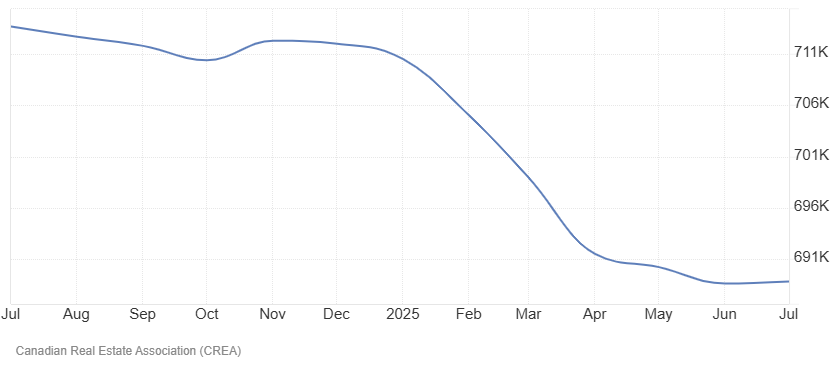

The migration cuts have had an immediate impact on the housing market. Asking rents across Canada have fallen for eight straight months. And house prices have declined by close to 3% this year.

Source: Canada Mortgage and Housing Corporation

Canada average house prices

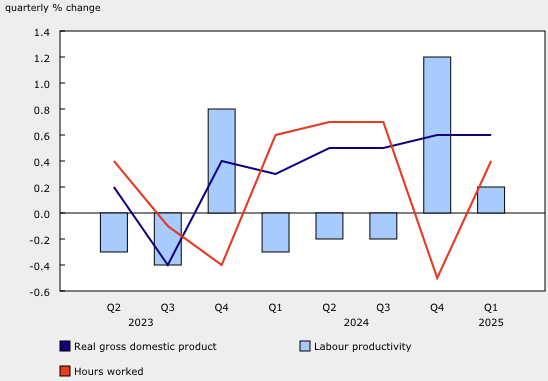

Productivity growth has also perked up after being in the doldrums during the previous two years.

Canada productivity growth

Source: Statistics Canada

Why the Labor Government doesn’t utter the ‘M’ word

At the government’s recent productivity summit, migration didn’t get a mention. Why the reticence?

Over the past two decades, both parties have wholeheartedly endorsed increased migration. In my view, they have done it principally for cynical reasons.

First, boosting migration lifts headline GDP numbers. This gives governments the opportunity to market themselves as having ‘grown the economy’.

GDP comprises population growth plus productivity growth. The surge in our population has more than offset the stagnation in productivity growth.

But while headline numbers have been positive, they’ve largely been a mirage. Per capita has flatlined for many years. In other words, at an individual level, GDP hasn't gone anywhere.

Second, migration also lifts housing demand and house prices. As mentioned previously, it’s likely a minor driver, though it’s there, nonetheless. And the government loves anything that drives house prices higher!

A caveat

I’m not suggesting that cutting migration is the sole answer to our economic and housing woes. Though it’s a piece of the puzzle that’s worth more thoughtful discussion.

James Gruber is Editor of Firstlinks.