Government investment is frequently derided as wasteful and ineffective. And definitely worse than private investment. But is this true? A new study shows that public investments on average are a remarkably effective way to boost the economy.

The authors of the study collected macro data for 18 developed economies between 1965 and 2019 and estimated the impact of an increase in public or private investment.

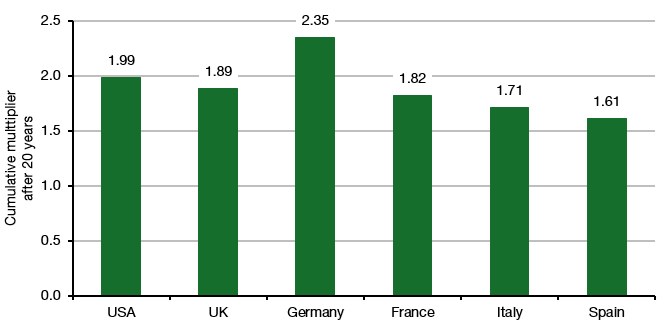

Let’s start with the private side because here the picture is unequivocally positive. After 20 years, every additional dollar, pound, euro, etc. invested by private companies increases the GDP by about two dollars. In the US, the exact ratio is 1.99 dollars for every dollar of additional private investment which equates to an annual return of around 3.5%. In the UK the multiplier is somewhat lower at 1.89x for an annual return of 3.2%.

Figure 1: Marginal productivity of total investment after private investment impulse

Source: Afonso et al. (2024)

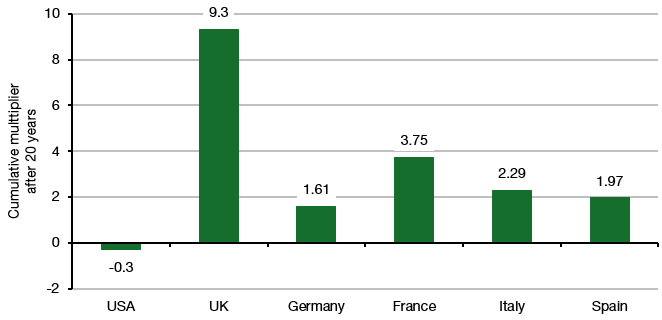

When it comes to public investments the picture becomes more complex. First, the direct return on additional public investment is more likely to be negative than in the case of private investments. This is because public investments are often made in unprofitable areas to attract private capital or boost nascent industries. In this instance, the government acts like an insurance company that takes the loss to provide a safety net for private investors to come in and boost the industry or region. The combined effect of private and public investments on economic output can then be positive even though the public investment itself had a negative return.

The second chart shows how good governments are in creating additional GDP from public investments and here I was surprised about two things.

First, I was surprised to see how diverse the outcomes are between the major economies shown. In the US, public investment really seems to be wasteful and destroy output. Or US public investment simply isn’t geared towards attracting private investments and boosting economic output because most of the economy is fully privatised leaving only areas that are intrinsically loss-making to the government. But outside the US, the multiplier is positive and higher than the multiplier for private investments (typically above 2x).

The second thing that surprised me was the tremendous multiplier of UK public investment on UK GDP. Every additional pound the government invests in the UK turns into 9.3 pounds of additional output after 20 years. That’s a return of 11.8% per year.

I really have no idea why the UK is such an outlier, but even if we ignore that, the results of this study are clear: Public investments work and are remarkably efficient in boosting long-term growth. In most countries more so than private investments. Now, all we need to do is convince the public that they should welcome additional government investment even if it means lower spending in other areas like welfare.

Figure 2: Marginal productivity of total investment after public investment impulse

Source: Afonso et al. (2024)

Joachim Klement is an investment strategist based in London. This article contains the opinion of the author. As such, it should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of the author’s employer. Republished with permission from Klement on Investing.