The Weekend Edition includes a market update plus Morningstar adds links to two additional articles.

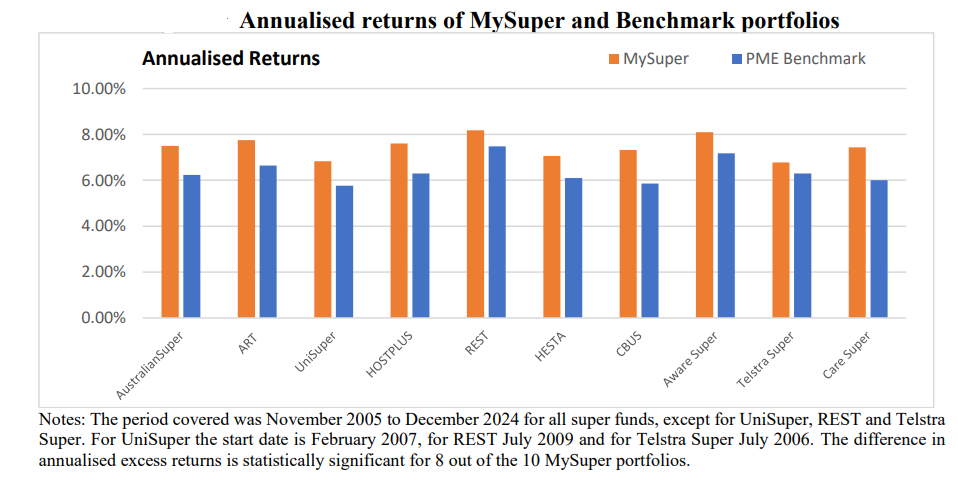

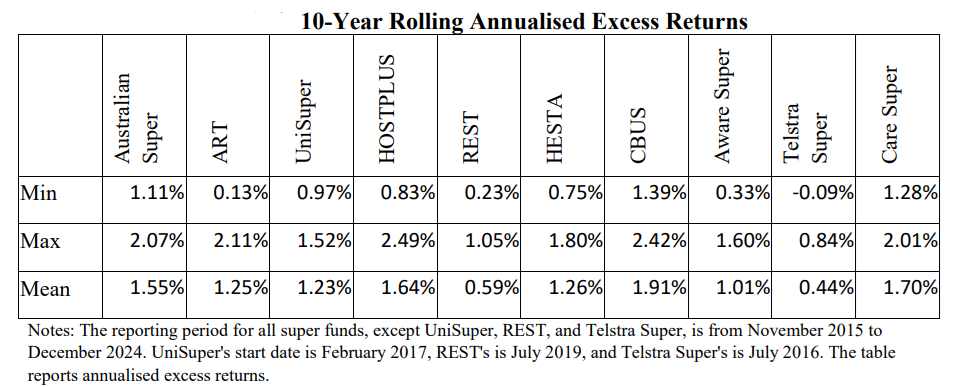

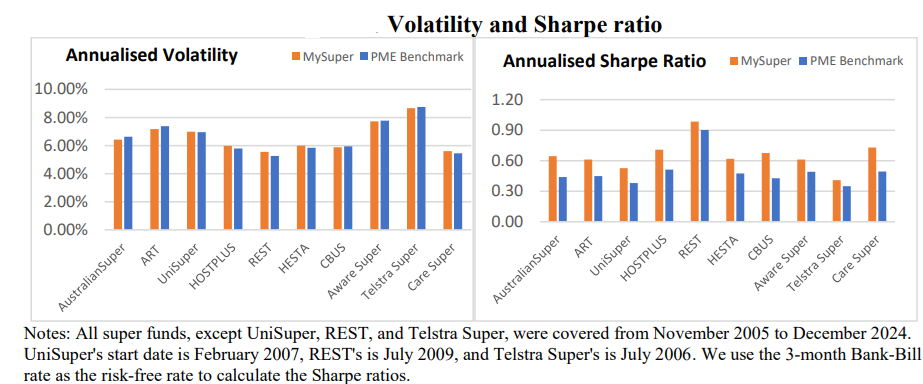

A recent study from the Monash Centre for Financial Studies gave our super funds a big thumbs up. The study showed that unlike its US counterparts, Australian super funds had consistently outperformed market benchmarks over the past 20 years.

It revealed that 10 of the largest Australian funds produced an annual outperformance versus benchmarks ranging from 0.57% to 1.53%, with an overall average of 1.11%.

Cbus and Hostplus topped the group, followed by AustralianSuper and Care Super, while TelstraSuper and Rest lagged.

The study found that the super funds performed well during good and bad times and delivered impressive risk-adjusted returns.

The study attributed the outperformance to the funds investing in alternative assets and using active management. Yet, curiously, it didn’t explain or quantify how much these factors contributed to returns.

The rise (and fall?) of alternative investments

There’s no doubt that the super funds have been enthusiastic supporters of alternative, or unlisted, investments and it has helped boost their returns.

Hostplus has been at the forefront of it. Its growth fund, for instance, has 29% of its assets in unlisted assets, split between property, infrastructure, private equity, credit, and alternatives.

The largest super fund, AustralianSuper, is also a large investor in alternatives. Its balanced fund has more than 25% of its portfolio in unlisted assets.

As with many trends, our super funds have followed the Americans.

Former CIO of Yale University, David Swenson, pioneered the so-called endowment model in the 1990s and changed the way institutions invest, moving them from a narrow focus on marketable securities to an extended diversification across a variety of other assets, including unlisted ones such as private equity and venture capital.

After Swenson achieved top tier returns, other universities jumped on board.

A number of academic studies seem to confirm that unlisted assets can deliver better risk-adjusted returns than public equities over the long-term.

Yet, questions are emerging about the sustainability of Swenson’s model. Over the past 12 months, sentiment has soured on the likes of private equity and venture capital.

There’s been a snowball effect as deals in the sector stall. Private equity funds can’t sell assets, so they can’t distribute cash to their clients, and many of those same clients are less willing to finance future deals, and that’s resulting in fewer fees and profits for the funds. A not-so-virtuous circle.

Topping it off, there are forced sellers in the market. Yale University is looking to sell US$6 billion in private equity assets, representing 15% of its total portfolio, and 30% of its private equity assets.

It’s doing this to raise cash. The university is being crunched by slowing tuition revenues and federal funding cuts enacted by Donald Trump.

Faced with similar pressures, Harvard University is also looking to offload US$1 billion in private equity assets.

These are big sales. Last year, Evercore says endowments and foundations sold just under $9 billion in the secondary market.

Yale and Harvard are likely to take hits on the portfolios as the average discount for buyout portfolios was 10% last year.

The depressed environment has impacted the share prices of the large players in unlisted assets, with KKR and Blackstone down 31% and 26% respectively over the past three months.

Source: Morningstar

Source: Morningstar

The big question is whether super funds have been late to the alternative asset party, and a comeuppance awaits.

It’s interesting that Swenson wrote in his seminal book, Pioneering Portfolio Management, that because “market players routinely overpay for liquidity, serious investors benefit by avoiding overpriced liquid securities, and by embracing less liquid alternatives.”

Could it be that the tables have turned and investors including super funds have been too willing to overpay for illiquid assets versus more liquid ones of late?

Trumped

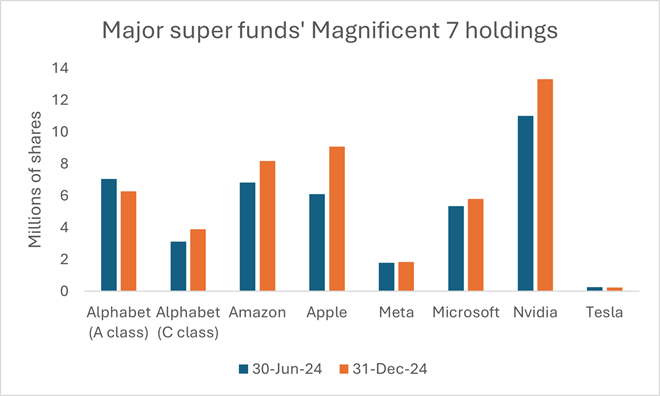

The other watch is on the super funds’ US tech holdings. Following the election of Trump in November, there seemed to be a consensus view among the big super funds that the US market would continue to outperform the rest of the world, and US tech would be at the forefront of that. To be fair, almost every other global fund manager shared that view.

Most of the major super funds increased their exposure to US tech stocks in the second half of last year.

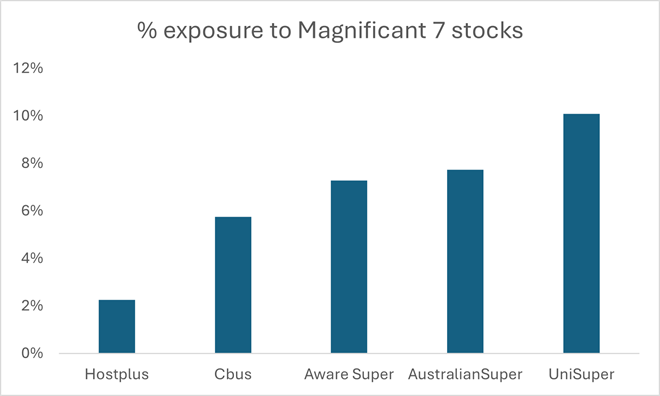

Source: AustralianSuper balanced fund, Aware Super balanced fund, Cbus growth fund, Hostplus growth fund, UniSuper growth fund.

The Magnificent Seven stocks were meaningful parts of portfolios at the big super funds as we entered 2025.

Source: AustralianSuper balanced fund, Aware Super balanced fund, Cbus growth fund, Hostplus growth fund, UniSuper growth fund. As of Dec 31, 2024.

The positivity of some super funds to US stocks has diminished in the wake of Trump’s tariff policies and subsequent market correction. John Pearce, CIO at UniSuper – a Firstlinks sponsor - has said that he’ll look to decrease US holdings over time.

Will the performance of super funds be impacted if non-US stocks continue to outperform US ones and unlisted asset valuations come under pressure?

Time will tell.

****

In my article this week, active funds have copped a lot of flak of late, yet there are still plenty of good fund managers in Australia that can deliver outperformance in the long-term. I look at how to identify the best active funds for your portfolio.

James Gruber

Also in this week's edition...

Our undersupply of housing has been well documented, but Michael Matusik looks at some of the key drivers, and how to fix the problem. He also offers a warning that the next generation won't forgive us for our current ineptitude.

There's been a lot of talk about the cost of living crisis, and energy is a big part of that. Electricity transmission has been less spoken of, yet it looms as a huge issue going forward, according to Peter Warnes. He suggests the energy transition depends on transmission capacity being added and we're way behind the eight ball on this.

Lawyer, Greg Russo, is back, this time with a guide to family trusts and relationship breakdowns. Greg says preserving trust benefits in family law disputes can be tricky, though he offers some pointers to help with the process.

Recent changes to property taxes in Victoria have had some property holders questioning whether to maintain a holiday home. With the potential for other states to also play with property taxes, UniSuper's Brooke Logan says it's timely to consider the implications and opportunities individuals may have if they're looking to sell their holiday home.

Stocks outside the US have been getting some love after 15 years of relative neglect. Lucas Klein believes this can continue as when outperformance between regions flips, it tends to persist for a long period of time.

Dimitri Burshtein thinks Australia's Future Fund offers a cautionary tale for Donald Trump's plans for a sovereign wealth fund. He urges Trump to bin the idea.

Two extra articles from Morningstar this weekend. Joseph Taylor highlights 3 cheap ASX stocks with sound balance sheets, while Shane Ponraj explains why ResMed could continue to prove the doubters wrong.

Lastly, in this week's whitepaper, we have Neuberger Berman's latest Asset Allocation Committee Outlook exploring if financial markets are experiencing the storm before the calm.

****

Weekend market update

In the US on Friday, a stronger-than-expected payrolls print paved the way for yet another stock market updraft, as the S&P 500 advanced 1.5% to complete a swift retracement of the early April rout. Treasurys reacted poorly to that sturdy data, with 2-year yields vaulting a further 13 basis points to 3.83% following Thursday’s 10 basis point leap, while the long bond accelerated to 4.79% from 4.74% yesterday. WTI crude ebbed back below US$59 a barrel, gold bounced to US$3,239 per ounce, bitcoin consolidated recent gains at US$97,000 and the VIX notched fresh one-month lows south of 23.

From AAP:

The Australian share market has closed at two-month highs, as a sustained rally helped the bourse to its best week since 2023. The S&P/ASX200 rose 1.13% to 8,238, as the broader All Ordinaries gained 1.08% to 8,456. Australia's top 200 public stocks were up 3.26% since Monday, its best weekly performance since December 2023.

Ten of 11 sectors rose on Friday, led by a 2% bounce in energy stocks, after the US threatened sanctions on buyers of Iranian oil, boosting crude prices.

The Commonwealth Bank has surged to a new all-time peak of $169.66, less than three months since underwhelming earnings sparked fears Australian banks were overpriced.

The financial sector rose 1.3% on Friday and was up more than 3% for the week, but the other three big banks are still a long way from their own record highs. Westpac and NAB will post half-year earnings next week.

Materials stocks rose 0.9% on Friday and finished the week 0.5% higher after tanking mid-week on lower commodity prices after disappointing manufacturing data from China.

Interestingly, three of the best-performing sectors were the traditionally defensive consumer staples (1.7%), utilities (1.6%) and health care stocks, which jumped 1.9%.

Curated by James Gruber and Leisa Bell

Latest updates

PDF version of Firstlinks Newsletter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Listed Investment Company (LIC) Indicative NTA Report from Bell Potter

Plus updates and announcements on the Sponsor Noticeboard on our website