The Weekend Edition includes a market update plus Morningstar adds free links to two of its most popular articles from the week, including stock-specific ideas. You can check previous editions here and contributors are here.

Weekend market update

From AAP Netdesk: Shares in Australia had their fifth consecutive week of gains - the best run this year - and ended the week at a record closing high.

Information technology shares gained most, 3.5%, on Friday as investors rebounded from Thursday's US rate rise concerns. The benchmark S&P/ASX200 index closed higher by 10 points to 7,369. The prospect of higher US rates kept investors moving the US dollar higher. The Aussie dollar was buying about 75 US cents.

From Shane Oliver, AMP Capital: US shares fell sharply on Friday dragging them down 1.9% for the week as a whole as the Fed’s hawkish surprise earlier in the week weighed on cyclical reflation trades and inflation hedges. This also saw Eurozone shares fall 1.2% for the week. Chinese shares also fell 2.4% but Japanese shares rose 0.1% having missed Friday’s decline in the US share market. Bond yields fell slightly in the US but rose elsewhere reversing some of their recent decline. Oil prices rose but metal, iron ore and gold prices fell not helped by a rebound in the US dollar and the rotation out of cyclical stocks. The rebound in the US dollar also weighed on the $A.

The drumbeat of central banks looking to start slowing monetary stimulus continued over the last week with the Fed surprisingly hawkish and the RBA heading in that direction albeit slowly. But while this could drive a correction in share markets its way too early to get bearish in a cyclical sense. Our view is that formal taper talk is likely to start at next month’s Fed meeting with actual tapering likely to start late this year or early next and that 2023 for the first Fed hike is a reasonable expectation.

***

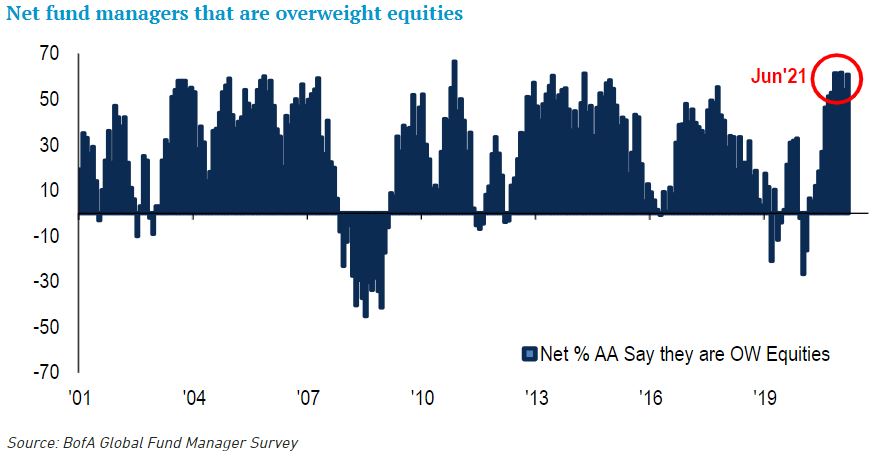

Despite lofty valuations, a higher than expected 5% annual inflation rate published last week in the US and new strains of the virus, fund managers and financial advisers are increasingly weighting portfolios to equities. Each month, Bank of America publishes a Global Fund Manager Survey, and for June 2021, BofA found asset allocators (AA) are:

" ... bullishly positioned for permanent growth, transitory inflation and a peaceful Fed taper via longs in commodities, cyclicals and financials”.

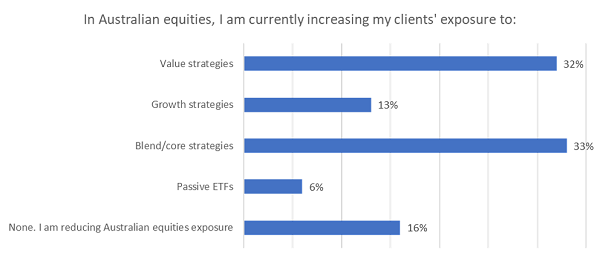

At the Morningstar Investor Conference (MIC) last week, mainly comprising over 500 financial advisers, only 16% were reducing their clients' exposure to Australian equities, while many were increasing in value and core strategies.

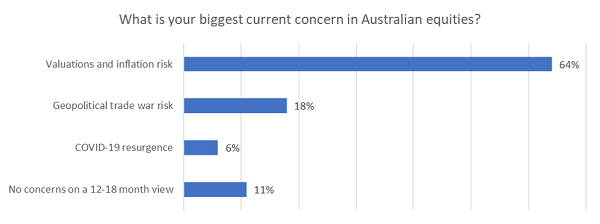

When asked at MIC about their biggest concerns, most cited valuations and inflation risk, with few worried about COVID. How quickly we move on.

It was the same in the BofA fund manager survey, with 66% nominating their biggest tail risk as either inflation or a taper tantrum (that is, the market reacting badly to central banks withdrawing support).

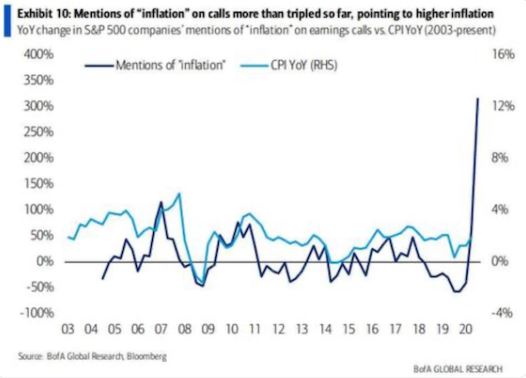

It's an unusual combination of allocating more to equities amid high concerns about inflation and rising rates. A record number of companies are mentioning inflation in the market updates they give during their earnings outlooks.

A good example of rapidly rising costs is container shipping spot rates. The vital trade route from Shanghai to New York shows supply chain disruptions and an accelerating upward trend in shipping costs. As trade reopens, higher demand for oil will be another factor which tests whether inflation is really 'transitory'.

While on inflation, we should acknowledge a moment in history which shows the merit of government spending on productive assets at the moment. For the first time ever, the Australian Government paid a negative interest rate of minus 0.01% on part of $1 billion borrowed from institutions last week. At some point, debt needs to either rollover or be paid back, but it's certainly cheap while it's out there.

Damien Klassen recently published an exhaustive 7,000-word, four-part review on his inflation expectations which he has summarised into a shorter article for our purposes. He concludes that the investments that might protect a portfolio from inflation have already had their run and current high inflation is supply-chain based and temporary.

In this week's lead, Dawn Kanelleas identifies five companies in her portfolio that she holds based on the outlook over the next five years, not because she is jumping aboard some prediction about a COVID recovery.

Then Greg Lander checks the performance of a wide range of LICs and LITs between the previous peak in January 2020 and the end of March 2021. How well did they manage the rapid fall and recovery in a sector that has some strong results despite the recent criticisms?

Rudi Filapek-Vandyck identifies a stock market segment that has delivered excellent results recently, away from the headlines. He says it would be front page news if achieved in other parts of the market.

Then two articles on important subjects not receiving enough attention. Bill Pridham highlights the terrible impact of single-use plastics on our environment, and how regulations will hit some companies. He has invested in one business that is confronting the issues. And Will Baylis defends the rights of fund managers to use the research of proxy advisers and he argues the Government's desire to stamp out their influence is going too far.

Finally, like the market, we can't leave the inflation genie in the bottle. Stephen Miller asks what it will take for the RBA to change its highly accommodative stance on bond purchases, interest rates and lending to banks.

The White Paper from Perth Mint is a detailed review by Jordan Eliseo on the role gold can play in diversified superannuation strategies based on market data and super funds across the risk spectrum for almost 30 years.

Two bonus articles from Morningstar for the weekend as selected by Editorial Manager Emma Rapaport.

Woolworths pubs and liquor stores business Endeavour will debut on the ASX this week. Lewis Jackson spoke to Morningstar's Johannes Faul about whether the demerger will pay dividends. Meanwhile, Emma weighs the pros and cons of active ETFs. Accessibility, price transparency and no ongoing platform fees are some of the advantages over conventional managed funds.

We had a lively debate (36 comments so far) on Emma Davidson's article about declining fertility but our favourite Comment of the Week came from Simon (Luke Skywalker) Samuel who joined in the spirit of our comparison of LICs and ETFs with Marvel and Star Wars, writing:

Graham Hand, Managing Editor

A full PDF version of this week’s newsletter articles will be loaded into this editorial on our website by midday.

Latest updates

PDF version of Firstlinks Newsletter

Australian ETF Review from BetaShares and / or Bell Potter

ASX Listed Bond and Hybrid rate sheet from NAB/nabtrade

Monthly market update on listed bonds and hybrids from ASX

Indicative Listed Investment Company (LIC) NTA Report from Bell Potter

Latest LIC (LMI) Monthly Review from Independent Investment Research

Monthly Investment Products update from ASX

Plus updates and announcements on the Sponsor Noticeboard on our website