Inflation is the topic du jour in global financial markets.

The parameters of the debate appear to be focussed on the likelihood of some persistent inflation, and potential financial stability concerns, in the absence of a timely withdrawal of the historically high levels of monetary accommodation currently being applied by central banks.

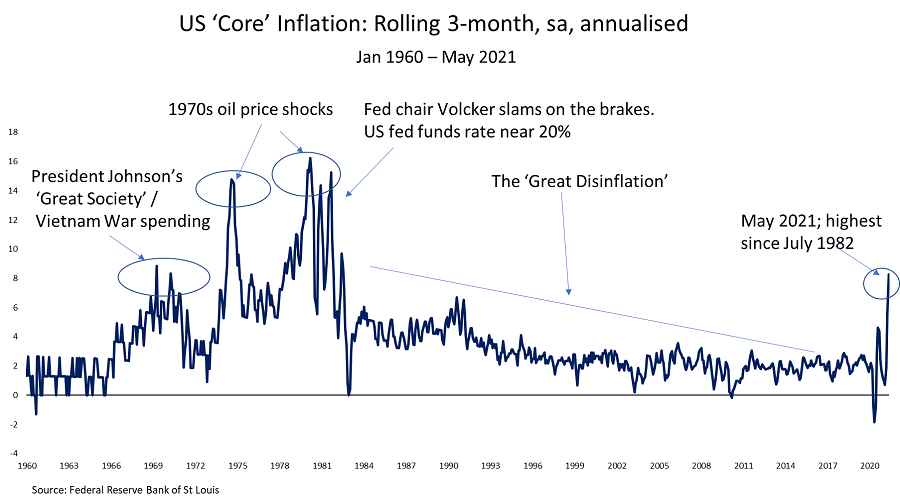

In the US the most recent May inflation report showed annual ‘core’ inflation at its highest level since 1992. In the past three months US inflation was running at an annual rate of 8.3%, the highest since 1982.

Plenty of inflation evidence

Moreover, the inflation pulse continues to beat rapidly. Purchasing managers report suppliers struggling to meet demand. Order backlogs are at their highest in 40 years, and commodity prices are surging.

In Warren Buffet's annual address to Berkshire Hathaway investors, he stated that he was seeing “very substantial inflation”.

Obama-era Treasury Secretary Larry Summers, former Pimco Head and Allianz adviser Mohamed El-Erian and BlackRock CEO Larry Fink, have all expressed concerns regarding inflation as well as some of the latent financial stability dangers.

They cite inflationary pressures mounting from:

- The boost in demand created by the $US2 trillion-plus in savings that Americans have accumulated during the pandemic

- Historically high levels of monetary accommodation including large-scale US Federal Reserve debt purchases and Fed forecasts of essentially zero interest rates into 2024

- $US3 trillion in fiscal stimulus passed by the US Congress

- Soaring stock and real estate prices.

Further, inflation may yet accelerate due to demand growth outstripping supply growth, rising materials costs and diminished inventories and the impact of inflation expectations on purchasing behaviour.

The Biden agenda, including higher minimum wages, strengthened unions, increased employee benefits and strengthened regulation - while replete with laudable intent - all push up business costs and prices.

The main argument - is it transitory?

However, US Federal Reserve Chair, Jerome Powell, continues to assert that any inflation will be “transitory” and reflect short-term supply imbalances as the economy recovers from the dislocation wrought by the COVID pandemic. Neither does the Fed Chair display any overt concern regarding financial market imbalances.

However, on occasion, unless addressed, 'transitory' inflation can take on an air of permanence. In the words of former Australian Prime Minister Keating “the inflation genie gets out of the bottle,” and once that occurs, it is a difficult process getting that genie back.

That is precisely what happened with the oil price shocks of the 1970s when policy generally ‘accommodated’ the increase in oil prices. Not that the current circumstance is entirely redolent of what took place back then.

For the time being the bond market has given the Fed the benefit of the doubt and has bought the ‘transitory’ narrative. Nevertheless, the time is fast approaching when the Fed needs to articulate an exit strategy from the historically high levels of monetary accommodation.

Were the Fed to indicate that it is 'thinking about thinking about' the retreat from current levels of monetary stimulus, that would be timely for the RBA.

Inflation less evident in Australia

Inflationary pressures are present but less visible in Australia. The fiscal boost was way less than that applied in the US and the prospective regulatory agenda less ambitious.

While base effects will see June quarter annual ‘headline’ inflation likely get close to 4%, the RBA’s preferred trimmed mean measure is forecast to be around 1.5%, still well south of the RBA’s 2-3% target. Indeed, the RBA forecasts only have inflation reaching the bottom of the 2-3% inflation target band in June 2023, and even then, wages are forecast to be running at a paltry 2.25%.

The RBA has achieved its stated objective in pursuing yield curve control and QE of “keeping the AUD lower than it otherwise would have been”. In my view, it will not wish to unwind those achievements by prematurely foreshadowing a significant retreat from the currently historically high levels of monetary accommodation.

Were the Fed to signal that it is reviewing or about to review its level of stimulus, the capacity for the RBA to signal its own (ever so slight) retreat is enhanced without exerting unwanted upward pressure on the AUD.

Given the RBA’s unequivocal commitment to full employment, and given that despite progress on the unemployment front, it is still some way north of the 4% or even “3 point something” previously cited by the Governor as getting close to capacity, the RBA is likely to implement only marginal adjustments to its QE programme. Changes will be implemented flexibly and with caution, perhaps by signalling a likely weekly run-rate of purchases of bonds say between $2.5-$4 billion a week, which would follow the expiration of the current six-monthly $100 billion programme in September.

Such measures are at this stage rather small in the scheme of things given the prevailing expectation of the RBA Board that a policy rate increase is “unlikely to be until 2024 at the earliest.”

It remains the case that while the economy’s performance has certainly exceeded expectations, recent price and wage growth remains at levels that are still uncomfortably low for the RBA and its inflation and employment objectives, and the economy is still some way from a level consistent with full capacity.

Whilever that remains, and while ever the Fed persists with current settings, and while ever there is no ‘lived experience’ of adequate wage and price inflation, we should expect the maintenance of the historically high accommodatory tack from the RBA.

A Fed retreat would give the RBA sufficient cover to commence a calibrated and marginal retreat.

But keep an eye out for that genie. If you see it, then it really might get interesting!

Stephen Miller is an Investment Strategist with GSFM, a sponsor of Firstlinks. He has previously worked in The Treasury and in the office of the then Treasurer, Paul Keating, from 1983-88. The views expressed are his own and do not consider the circumstances of any investor.

For more papers and articles from GSFM and partners, click here.