The Reserve Bank of Australia (RBA) Board surprised the markets at its August meeting by continuing with the scheduled reduction in bond purchases announced in July. It had been thought that the COVID-induced lockdowns and inflation outlook would push the Board into formalising a delay. The relative sanguinity of the RBA Board can be attributed to a number of factors.

First, as the RBA Governor noted in his statement “the experience to date has been that once virus outbreaks are contained, the economy bounces back quickly”. Additionally, the recovery from the pandemic has to date exceeded expectations.

Second, in the context of what looks to be an interruption to growth from current lockdowns, it is not going to be meaningfully attenuated by delaying for a month or two a decision to taper bond purchases by $1 billion a week from September. Other approaches are more effective.

Third, the Governor noted, the “recent fiscal responses by the Australian Government and the state and territory governments are also providing welcome support to the economy at a time of significant short-term disruption.” Of course, one hopes that such measures are intelligently crafted and targeted. Regrettably that hasn’t always been the case.

Flexibility the key differentiator

Most important is the emphasis given by the RBA to its 'flexibility'. This flexibility is a key differentiator between the RBA and some other central banks who have appeared to foreshadow policy rate increases in 2022. Given the uncertainties ahead, the RBA has done well to avoid any such undertaking, even if it has been of a conditional nature in other jurisdictions.

In other words, if the situation deteriorates the RBA has already communicated that its process allows it to quickly flick the switch and increase bond purchases.

For this reason, it would be a mistake to see the August RBA Board meeting as an indication that the RBA was following the lead of other commodity-intensive economy central banks such as the Bank of Canada, the Norges Bank and RBNZ or even the Fed ‘dot plot’ in indicating a significant retreat from historically high levels of monetary accommodation, including policy rate increases in 2022.

The RBA’s expects that the condition (or ‘outcome’) for any increase in the policy rate “will not be met before 2024".

In this context, the RBA is best viewed as a ‘caged dove’ (a 'dove' is defined as a central banker who generally favours easy monetary policy).

That will likely persist, at least until the RBA gets some clarity on the US Federal Reserve’s (the Fed’s) approach. It is the Fed’s approach to inflation that looms large as a challenge for investors.

Certainly the Fed has commenced “talking about talking about” tapering, and strong economic data and clear inflation pressures are likely to escalate that chatter turning the Fed into a ‘reluctant hawk’ (and 'hawks' generally favour tighter monetary policy).

Investment portfolio diversification

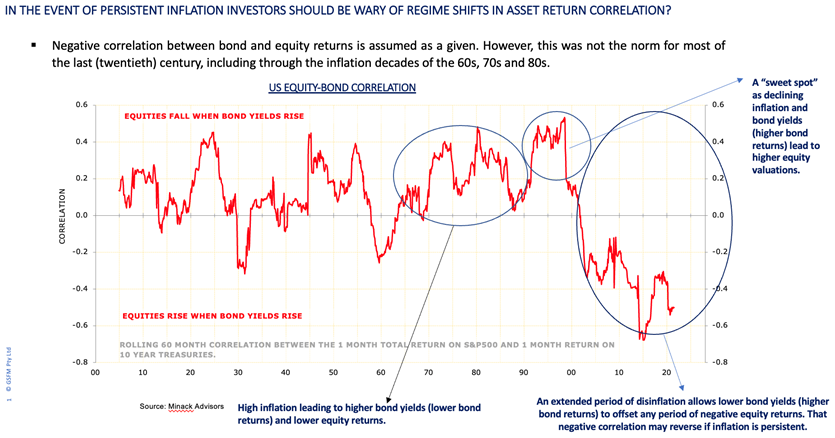

It may be for investors that any escalation of tapering talk, particularly given clear and present inflation danger, necessitates a questioning of portfolio diversification practice, including the assumed negative return correlation between bonds and equities.

As the chart below shows, in the period beginning with the ‘tech wreck’ at the turn of this century, bond and equity returns have been negatively correlated. In essence, once inflation had been purged, any periods of stress in the outlook for economic growth and associated downdraft in equity markets could be quickly addressed by easier monetary policy (lower interest rates and lower bond yields).

However, with bond yields at historic lows, and policy rates approaching the ‘zero-bound’, it is reasonable to question whether yields can go meaningfully lower, particularly given inflation pressures, and what that might imply for the diversification properties of high credit quality nominal government bonds, particularly as long-dormant inflation pressures emerge.

If, in the wake of persistence in inflation, the Fed has to jam down hard on the monetary brakes, leading to sharp upward movements in bond yields, there may well be a significant correction in equity and bond markets.

Multi-asset investing implications

Such a scenario looms as a major challenge for investors, including how multi-asset investors react to a potential reversal of long-held assumptions regarding asset return correlation. That is equity returns and bond returns become positively correlated in the worst possible way - in extremis, both deliver negative returns.

Clearly the search for differentiated portfolio exposures uncorrelated with conventional equity or bond returns looms as a particular challenge.

In the defensive space, inflation-linked bonds or absolute return or ‘unconstrained’ bond funds are worth consideration. Gold may also be a candidate but its traditional role as an inflation hedge is undermined somewhat by rising bond yields increasing the opportunity cost of holding gold.

If the RBA lags the Fed, which seems likely, then the Australian dollar (AUD) is likely to come under some pressure which may ameliorate any negative performance of unhedged global exposures.

One thing is clear, even if the RBA remains a ‘caged dove’, emerging inflation may cast the Fed as a ‘reluctant hawk’, heralding a requirement for investors to think more imaginatively about portfolio diversification.

Stephen Miller is an Investment Strategist with GSFM, a sponsor of Firstlinks. He has previously worked in The Treasury and in the office of the then Treasurer, Paul Keating, from 1983-88. The views expressed are his own and do not consider the circumstances of any investor.

For more papers and articles from GSFM and partners, click here.